India Pesticides IPO Review

More on IPO

With the long list of IPOs, the index of the upcoming IPO is increasing in numbers. Here comes the next IPO from the list, i.e. India Pesticides IPO Review. For helping you in taking the firm decision, here is the detailed India Pesticides IPO Review.

India Pesticides Limited is an Agrochemical Company that has entered the IPO race to boost up Rs.800 crore with its IPO which has been listed in a Draft Red Herring Prospectus (DRHP).

After understanding the IPO value, let’s not make a decision because we will cover the first main factor that is “About the Company”.

Since around September 30, 2020, the business’s yearly income was Rs 3,291.34 million. Although since its inception in 1984, the firm has expanded its product line to include herbicide and fungicide technicals, and also Active Pharmaceutical Ingredients (APIs).

The company is a competitive supplier because of its wide range of high-quality goods plus value-added facilities.

Apart from this, a devoted R&D team, consisting of PhDs, Masters Graduates in Chemistry, plus Biotechnological Engineers, leads the company’s efforts.

After getting the gist about the company, now head towards the IPO that is going to be launched by the same firm, i.e. India Pesticides Limited.

India Pesticides IPO Details 2021

To have a piece of detailed information about the India Pesticides IPO below is the table that presents the all necessary information as required.

| India Pesticides IPO Details 2021 | |

| IPO Date | Opening Date: 23 June, 2021 |

| Closing Date: 25 June, 2021 | |

| Issue Size | Rs. 800 crores |

| Fresh Issue | Rs. 100 crore |

| Offer for Sale | Rs. 700 Crores |

| IPO Price Band | ₹290-₹296 per share |

| Market Lot | Minimum Lot: 50 shares |

India Pesticides Limited IPO Date

It is meant to be considered if you check the dates of the IPO before applying for it.

The India Pesticides IPO date covers the specific information about:

- The date when the IPO will be opened.

- The date when the IPO will be closed.

- The final date when the shares will be allotted to the investors.

- The date when the funds will be initiated.

- The date when the shares will be transferred to the demat account.

- The date when the shares will get listed in the stock exchanges.

To cover such dates the table has been created to provide the specific data.

| India Pesticides IPO Date | |

| India Pesticides IPO Opening Date | 23 June, 2021 |

| India Pesticides IPO Closing Date | 25 June, 2021 |

| Finalization of Allotment of Shares | 30 June, 2021 |

| Initiation of Refunds | 01 July, 2021 |

| Credited to Demat Account | 02 July, 2021 |

| India Pesticides IPO Date Shares Listing Date | 05 July, 2021 |

India Pesticides IPO Price

Basically, the IPO price consists of the Issue Price and the Listing Price. The India Pesticides IPO carries the (●) equity shares with the value of Rs. (●) for the public investors.

Here, the issue size further includes:

- Fresh Issue of ₹100 Crores.

- Whereas the Offer for Sale (OFS) of the value of ₹700 Crores.

Apart from this, the Price Band of the IPO is Rs. 290- Rs. 296.

India Pesticides IPO GMP

Discovering the GMP of an IPO will discuss the premium amount on which the particular IPOs shares are traded.

With the confusing concept, the GMP became complex for the people to understand. But in simpler terms, the premium amount that is basically offered to the person who has applied for the IPO and on which the shares of the IPO are traded is known as Grey Market Premium.

The GMP is the activity that is done before the shares of the IPO gets listed in the share market

Note: These shares are not meant to made available in the share exchanges for trading.

The below-mentioned table is made to make it understand or to have a look at the GMP and Kostak of the IPO at the same time.

| India Pesticides IPO GMP | ||

| Date | GMP (in INR) | Kostak (in INR) |

| 23 June 2021 | ₹70-₹80 | (●) |

| (●) 2021 | (●) | (●) |

| (●) 2021 | (●) | (●) |

| (●) 2021 | (●) | (●) |

| (●) 2021 | (●) | (●) |

India Pesticides IPO Promoters

You might be curious to know the names who are connected to the company and IPO as promoters. Isn’t it?

The promoters of the company are Anand Swarup Agarwal and ASA Family Trust. While on the date of the DRHP, the promoters in total carry 52,506,967 equity shares which 46.97% of the pre-offer in total.

To know the information about the numbers of equity shares and the percentage of the pre-offer equity share capital, refer to the following table.

| Name of the Promoter | Number of Equity Shares | Percentage of the pre-Offer Equity Share Capital (%) |

| Anand Swarup Agarwal | 44,789,850 | 40.07 |

| ASA Family Trust | 7,717,117 | 6.90 |

| Total | 52,506,967 | 46.97 |

In the past year preceding the date of DRHP, the weighted average price on which the given securities were obtained by the promoters of the company are mentioned in the following table.

| Name of the Promoter | Number of Equity Shares | Weighted average price of acquisition per Equity Share (in ₹) |

| Anand Swarup Agarwal | 31,992,750 | Nil |

| ASA Family Trust | 7,717,117 | Nil |

How to Apply for India Pesticides IPO

After getting the information on the India Pesticides IPO, now you might be looking for information on how to apply for IPO. Isn’t it? If yes, then stay connected to the segment till last to get detailed information.

The foremost step to apply for the IPO is to open a demat account with a reputed stockbroker or you can say a depository participant.

In case you don’t have a demat account, refer to the form below and proper guidance will be provided to you:

Once the demat account is opened, you will be required to select the method through which you can apply for the IPO comfortably. Those methods are:

- Online method

- Offline method

Let’s head forward by discussing each method one after another.

So, let’s proceed with the flow by discussing the online method which continues with the two procedures, i.e.,

- UPI (Unified Payment Interface) or

- ASBA (Application Supported by Blocked Account)

Through the trading platform of the stockbroker, the application for the IPO can be filled and the payment can be possible with the UPI procedures.

Applying for the IPO through the offline mode will be time-consuming as the investor will be required to visit the local branch of the bank with whom they are registered and then he had to apply personally.

If you are applying for the IPO offline, so here the mode of payment will be cheques.

India Pesticides Company Details

The R&D-driven agro-chemical manufacturer of technicals, India Pesticides is a rising formulation business.

According to the F&S Report, taking the volume in FY2 into consideration, India Pesticides was the fastest-growing agro-chemical company.

India Pesticides owns and maintains two production plants one in Lucknow and the other in Hardoi, Uttar Pradesh, with a total capacity of 19,500 MT for technicals and 6500 MT for formulations.

Currently, the firm has the licenses and registrations for the 124 formulations and 22 agro-chemical technicals for the sale. Whereas, 34 formulations and 27 agro-chemical technicals are for the purpose of export.

It is also the only Indian producer of many technicals, including Folpet and Thiocarbamate Herbicide, and ranks within the best five manufacturers worldwide.

India Pesticides’ technicals are mainly exported, with export value accounting for 62.12 percent of the money from operations in FY20 as well as 65.73 percent throughout the six months expired September 2020, respectively.

In fiscal 2018, operational sales grew from Rs. 2,532 to Rs 4,796.27 million in the fiscal year 2020, but in six months ended September 30, 2020, Rs 3,338.44 million were achieved.

The firm is financially stable which makes it a reputed name in the industry and earns reliability among the customers.

Should You Invest In India Pesticides IPO?

If you are confused as to either to apply in this IPO or not, then this segment will clear the queries among the investors.

The main objective of the India Pesticides IPO is that the company will use the net fresh issue to fund the working capital requirements as well as the common corporate purposes.

As a result, companies like India Pesticides Limited are believed to enhance their product portfolio’s emphasis on herbicides and fungicides, which aligns with global trends.

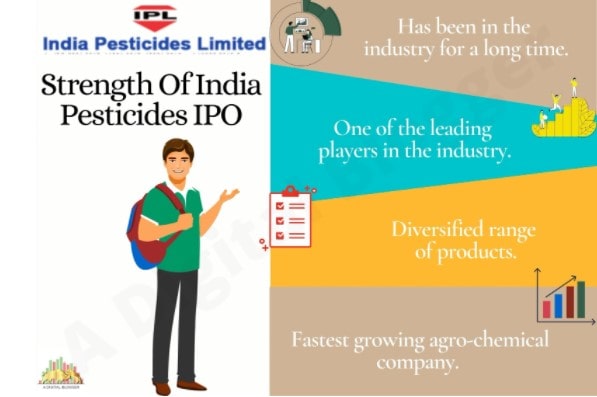

Strength Of India Pesticides IPO

It is human nature to check the pros of the product before buying it. The same is in the case of the IPOs. smart investors always check the strengths of the IPO.

so if you want to know the strength of India Pesticides IPO, refer to the following infographic.

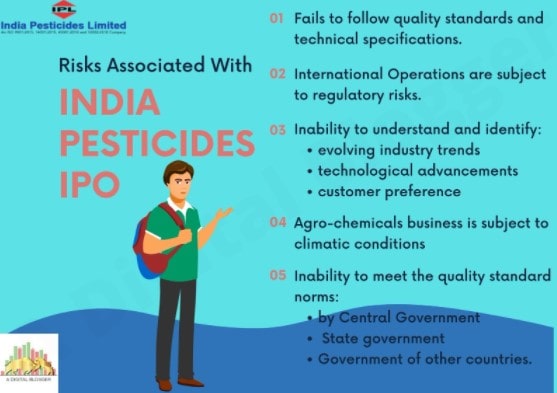

Risks Associated With India Pesticides IPO

The product always comes with flaws so does the IPOs come with risks. To know about the risks associated with India Pesticides IPO, check the following infographic.

The above infographic describes the risks that the IPO consists of. It is necessary to go with the flow. If you are examining the strength, it is also essential to examine the risks too.

Before applying for the IPO, go through the company’s background and examine the necessary information and data about the same.

It is the right time to research, compare and invest!

After going through the India Pesticides IPO Review, you might think of investing in this IPO? Refer to the form below and open a demat account.