Policy Bazaar IPO Apply

More on IPO

Whenever a new IPO comes into the market, you might feel excited and really wish to try your luck in that. Well, the same can happen with our upcoming IPO– Policybazaar and you might be curious to know how to apply for Policy Bazaar IPO?

If that’s really what you wish to know, then all your queries will be solved on this lucky day!

Let’s get started!

How to Apply for Policy Bazaar IPO Online?

In this digitalized world, everyone wants to perform tasks on their own. Using the online method, one can quickly apply for the Policy Bazaar IPO through their smartphones.

Perhaps, there are two different ways to apply in this IPO, namely-

- ASBA Method

- UPI Gateway Method

Both are simple and straightforward to do and without any guidance, you can apply for any IPO by following their vital steps.

Let’s discuss each one of them!

How to Apply for Policy Bazaar IPO Using ASBA

ASBA stands for Application Supported by Blocked Amount and is generally used by various banks. If you plan to apply through this method, make sure that your bank is registered with SEBI.

Though a majority of the banks are approved under the ASBA category, yet you can find a complete list of the banks by clicking here.

Let’s talk about the ASBA method-

- ASBA method is used through the net banking facility of your registered bank so if you have the net banking service then you can go ahead with this process.

- Here, the bid amount of the IPO is held or blocked on your behalf by the bank and once the shares are allocated to you, the blocked amount is deducted instantly.

- But if the shares are not allotted, then the money will be unblocked and you can use it for your purposes.

Here’s the complete process of ASBA:

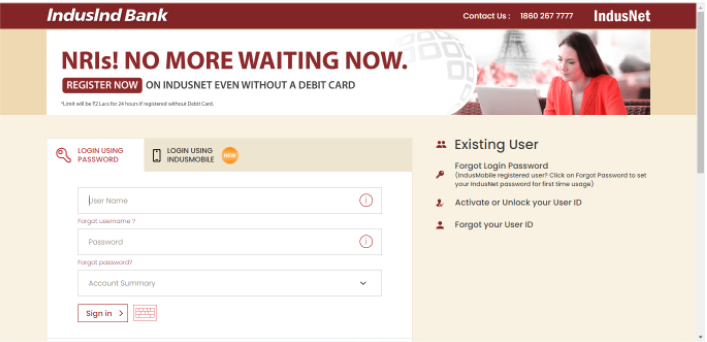

- Open your bank net banking facility by entering your username and password. (taking an example of IndusInd Bank)

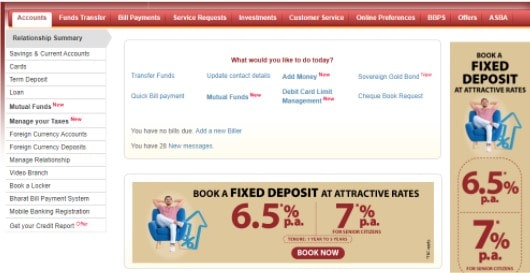

- Find ASBA in the Main Menu Bar or under the services category(depending on your bank)

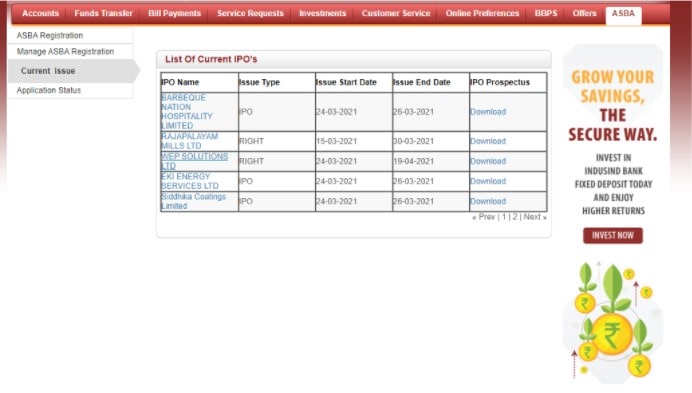

- Under the “Current Issue,” you can view the latest IPO’s in the market and can choose the ideal one.

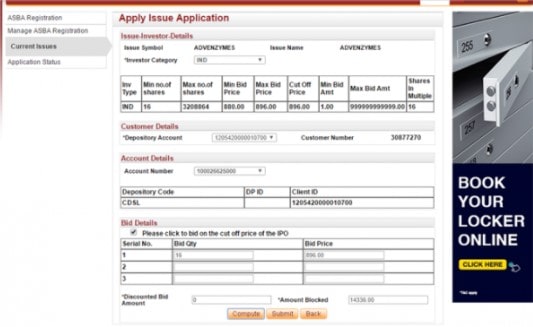

- Click on the Download button and here you will be required to enter the details related to the specific IPO such as quantity, price, demat account number, PAN number, etc.

- Submit the form after verifying the details and shortly the bank will block your amount.

So, this was how you can apply for Policy Bazaar IPO through ASBA, however, before moving ahead with this process, you are mandatorily required to fulfill the below requirements:

- The respective bank must be under the approved list of SEBI.

- Per account, only five applications per issue are allowed.

- On the last day of the bid, if the ASBA process is followed after the closing time of bids acceptance, then the application will not be accepted.

- One must have an active demat account.

- The maximum investment of Rs. 2 lakh can be made through one pan card.

- The application must be filed under the “General Category”.

How to Apply for Policy Bazaar IPO Through UPI

Applying for Policy Bazaar IPO through UPI gateway is super fast and easy. Without the role of a Bank working on your behalf, all the process is done by you through your smartphone!

Hence the basic condition to apply for an IPO through UPI is to have a-

- Smartphone

- UPI Gateway- Google Pay, Bhim Pay, Phone Pe, or Paytm.

Below are the steps to follow in order to apply for an IPO through the UPI method:

- Install a UPI gateway app from your App Store or Google Play Store. To make your search easy, click here and you will be landed on UPI Gateway App on the google play store.

- Now, create a UPI ID on the app such as xyz@okhdfcbank or any other. In most cases, it is automatically generated for the user however you will be required to activate it.

- Next, open the trading platform, either mobile or web, of your stockbroker by entering the username and password. (Here we are taking an example of Zerodha Kite)

- Now, from the dashboard tap on your account and further click on IPO under the “Console” category.

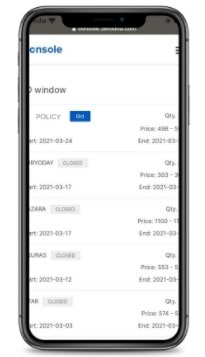

- A new window will appear where the latest or ongoing IPO details will be presented.

- From this window, you can click on the “BID” button and enter the details in the IPO such as UPI ID, investor type, quantity (number of lots to tend to buy), price, etc., and then click on the “Submit” button.

- Your IPO application will be submitted and the bank will block your amount after you accept the request from your Google Pay!

Make sure that a maximum of upto 3 bids is submitted by you. Not more than three bids will be accepted. However, you can apply for less than 3 as well!

To make changes in your current application, you can visit the IPO window and modify as desired.

How to Apply for PolicyBazaar IPO Offline?

If you are not tech-savvy, then you can opt for the traditional method. Here you simply need to visit the nearest branch of your Bank or your full service stockbroker’s branch, and after filling the IPO application form, your amount will be kept on hold by the bank till the shares are allotted to you.

You will be required to mention the following details in the application form:

- Quantity of the shares

- Cut off price

- Demat account number

- PAN number

- Name of the IPO

Within a short time, your application for PolicyBazaar IPO will be accepted!

Policy Bazaar IPO Date

Now, you might know the different processes of how to apply for Policy Bazaar IPO. Before applying for an IPO, make sure you also have a clear picture of their date so that delay in the bid is avoided.

The issue period of an IPO is between 12 PM to 5 PM so all the modifications and applications are allowed to be made between these hours.

The date of Policy Bazaar IPO is as follows:

Policy Bazaar IPO Price

The other important detail regarding an IPO is its Price because it will determine the cost at which you will be bidding.

PolicyBazaar IPO Price details are as below:

Should I Apply in Policy Bazaar IPO?

As a new and prominent company’s IPO arrives, the majority of the investors get interested to invest in such an IPO. and they make this decision not on the basis of fundamental analysis, rather just on the popularity of the company.

So, don’t make that mistake!

Perhaps, it’s vital to determine whether you should invest in Policy Bazaar IPO or not and it can only be known through the company’s financials.

The Paiza Bazaar company is a registered Insurance Broker and is widely famous in financial markets but in the year 2020, the firm experienced a drastic loss, and advertisement losses reached a mark of more than 30%.

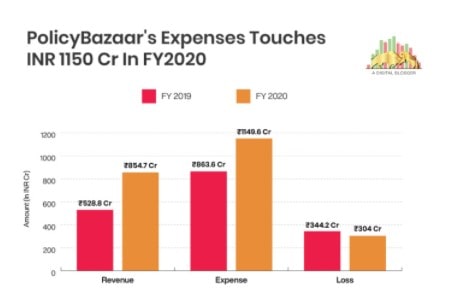

Besides this, here are some of the other financial details of Policy Bazaar IPO:

- From 2019 to 2020, the firm has experienced an increase of 66% in its revenue i.e. from Rs. 310.3 Cr in 2019 to Rs. 515 Cr in 2020.

- On a combined basis, Policy Bazaar expenses have touched Rs. 1150 Cr including advertising total value addition of 38% in it.

- The company accounts for around 25% of India’s life insurance sold online to customers.

With such a growth rate, the firm is expected to make a profit in the coming periods. There is another reason for its growth i.e. by end of 2021, online insurance companies’ penetration in India has been proposed to increase at an outstanding range.

Besides its progressiveness, the firm has also expensed losses due to advertising and promotions.

Before making a decision, conduct a fundamental analysis of the company with its peers and then make an investment plan in Policy Bazaar!

Want to invest in IPO and still not having a Demat Account? Do Not Fret! Fill the form below and open a demat account for free without delay.