Rites Limited IPO Review

Check All IPO Reviews

Rites Limited IPO Introduction

An upcoming IPO is going to be launched next week that comes from the house of Rites Limited. This mid-sized IPO is estimated to be worth ₹450 Crore plus. The IPO price band is kept at ₹180 to ₹185 with a bid lot of 80 shares.

In this detailed review, we will talk about different aspects related to this IPO including company background, management, financials, IPO data points before we finally provide our recommendation on whether to go ahead with the IPO investment or not.

Rites Limited Background

Rites Limited is a wholly-owned enterprise of the Government of India. It was incorporated in 1974 and is a consultancy company. The company is a private company under the name of “Rail India Technical and Economic Services Limited”. Rites Limited provides consultancy in the field of transport, infrastructure and related technology.

The company is ISO 9001:2008 certified and provides an array of high-quality services. It has an experience of about 44 years and has undertaken projects in about 55 countries. It is the only export arm of the Indian Railways, which provides rolling stock overseas.

Rites Limited has expertise in design, engineering and consultancy with reference to railways, roads and highways, ports, waterways, airways, ropeways and urban transport. It also understates turnkey projects of construction of railway lines, tracks and the entire transportation systems in various countries.

‘Rites’ is also into leasing, export and maintenance of rolling stock and into wagon manufacturing and power procurement for Indian Railways.

The clients of Rites Limited in India include government ministries of centre and state, and other local government bodies, including Indian Railways, NTPC, DMRC, Steel Authority of India Limited, Public Works Department, Hindustan Petroleum Corporation Limited and Airport Authority of India, to name a few.

Rites Limited Management

The management team of Rites Limited consists of the Board of Directors which is headed by an Executive Director and has 10 Directors. Of the Directors, four are Functional Directors, four are Independent Directors and two are Government Nominee Directors. The Directors are appointed by the President of India.

The Director of Projects is Mr Arbind Kumar, Director of Finance is Mr Ajay Kumar Gaur, Technical Director is Mr Mukesh Rathore, Government Nominee Directors are Mr A.P. Dwivedi and Mr Bhupendra Kumar Agrawal and the Independent Directors are Dr Vidya Rajiv Yeravdekar, Mr Satish Sareen, Mr Anil Kumar Goel and Dr Pramod Kumar Anand.

The Board of Directors is headed by Mr Rajeev Mehrotra.

He is the Chairman and Managing Director of Rites Limited. Mr Mehrotra has been associated with Rites since 2007 and has a total of 34 years of experience with big names like Power Finance Corporation Limited.

Mr Rajeev Mehrotra has a Bachelor’s degree in Accountancy and Business Statistics from Rajasthan University and is qualified as a member of the Institute of Cost Accountants of India.

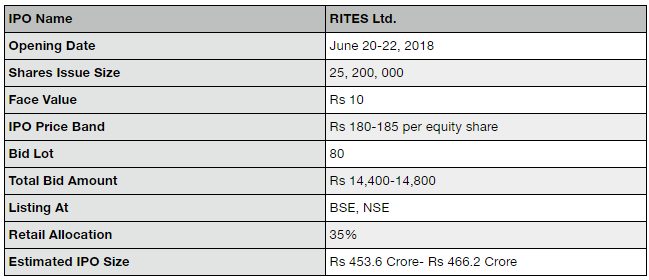

Rites Limited IPO Data Points

The IPO of Rites Limited is set to open on June 20, 2018, and will close on June 22, 2018. The issue size is 24 million shares, which is 12% of the total shares outstanding of 200 million.

The selling shareholder is the President of India, who is acting through the Ministry of Railways, Government of India. All the pre-offer shares are, directly or indirectly, held by the President of India. Rites Limited will be the second public sector unit to be listed on the exchanges, after Container Corporation of India.

The face value of each share is ₹10 and the IPO price band is in the range of ₹180 – ₹185, making the issue size between ₹453.6 crore and ₹466.2 crore. A discount of ₹6 per share will be offered to the issue price to the retail investors and the eligible employees.

The investment in the IPO needs to be done in lots of 80 shares each, thus the minimum bid value is between ₹14,400 and ₹14,800.

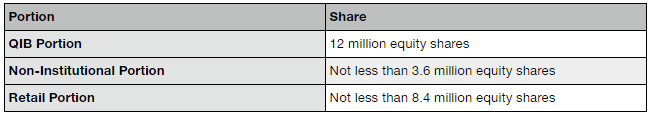

The offer is divided into the following portions:

Rites Limited Financial Performance

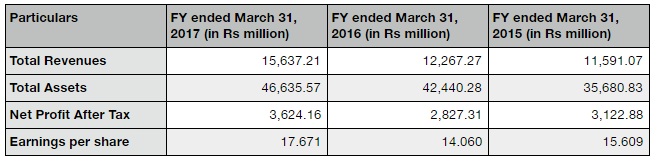

Rites Limited has had strong and consistent financial performance in the past years. The company reported total revenues of ₹1,563.7 crore, total assets of ₹4,663.5 crore and net profit after tax of ₹362.4 crore for the financial year 2016-17.

The revenues have increased at the rate of 15.62% from the year 2015 to 2017 and the net profit after tax has shown a remarkable increase of 7.73% from 2015 to 2017.

The financials of Rites Limited show to be very promising and strong. The company has always held strong grounds and is expected to continue to do so.

There are no comparable listed companies in India in the same line of business as Rites Limited, therefore, comparison with industry peers is not applicable. The competition for the company is mostly from competitors outside India. The competition also depends on various other factors like type of project, the total value of the contract, margins and location of the project.

Rites Limited IPO Objective

The net proceeds of the offer will not be received by the company. They will be directly received by the selling shareholder.

The President, or the Government of India, intends to disinvest its 24 million shares in Rites Limited, which is equal to 12% of the issued share capital. The selling shareholder intends to achieve the benefits of listing the shares on the stock exchanges.

The objective of the offer is also to increase the visibility and the brand image of Rites Limited, and also to provide liquidity to the shareholders.

Rites Limited IPO Events

Rites Limited filed the Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India in the month of January 2018.

The IPO will open for bidding on June 20, 2018, and will remain open till June 22, 2018.

The remaining sequence of events like the listing date is yet to be announced.

Rites Limited IPO Advisors Information

For the IPO of Rites Limited, the book running lead managers or the merchant bankers are Elara Capital (India) Private Limited, IDBI Capital Markets & Securities Limited, IDFC Bank Limited and SBI Capital Markets Limited. The Registrar to the offer is Link Intime India Private Limited. The statutory auditor of the company is M/s Agiwal & Associates.

DSK Legal is the Indian legal advisor and Riker Danzig Scherer Hyland & Perretti LLP is the international legal advisor to Rites Limited and the selling shareholder. J. Sagar Associates has been hired as the legal advisor to the merchant bankers of the offer.

Rites Limited Contact Information

In case you are looking for more information regarding the IPO or need more details about Rites Limited, following are the contact details for your reference:

RITES Limited

Scope Minar

Laxmi Nagar

New Delhi- 110092

India

Telephone Numer: +91-11-2202 4610

Fax Number: +91-11-2202 4660

Rites Limited IPO Recommendation

Rites Limited has a strong financial background, excellent credibility with the President of India being the promoter, and very positive future prospects.

In terms of performance, Rites has shown consistent performance and achievement of the targets set by the Ministry of Railways. It was rated as “Excellent” with a score of 90.09 by the Government of India, for the financial year 2016-17. It has also been rated “Excellent” consistently for the five consecutive years from 2012 to 2016.

Rites Limited has also been debt free for about a decade and has shown a high percentage increase in the revenues, net profit and earnings per share.

The company has strict internal control systems and audit systems and also has a currency risk management policy for hedging and risk management.

The company is also certified with ISO 9001: 2008, which certifies its high standards of quality. It has also been certified as ISO/IEC 17020:2012 compliant by the National Accreditation Board for Inspection Bodies. This establishes the credibility of the quality of the company.

Rites Limited has certain unique strengths and a strong and diversified client base across different sectors. It is the only export arm of the Indian Railways in rolling stock.

The management of the company is highly experienced and well-qualified and forms excellent strategies, procedures and policies. The company has an in-house team of expert engineers in all departments like civil, mechanical, electrical, telecom, quality assurance and information technology.

Based on the above-mentioned reasons and observations, the company RITES Limited holds a strong potential. Therefore, in spite of the fact that the proceeds of the offer will not be used by the company for development, the offer is a perfect opportunity to BUY and become a shareholder in India’s second-ever listed public service unit.

It is ideal to hold the investment for a longer duration of time as the returns are expected to be long-term.

In case you are looking to invest in this upcoming IPO, just fill in some basic details in the form below and a callback will be arranged for you: