Suryoday Small Finance Bank IPO- Is It Worth Investing?

More on IPO

Even before the buzz of one IPO gets over, another one starts gaining the interest of the investor. There is no need to mention how the month of March has brought a lot of IPOs. Suryoday Small Finance Bank IPO is soon going to join the list.

Launching on the 17th of March, this leading small finance bank is ready to grab the attention.

If you are curious to know whether you should invest in the IPO or not, then you have reached the right place.

In this article, we will help you to know everything about the IPO and then make a profitable decision about Should You Subscribe Suryoday Small Finance Bank IPO?

Suryoday Small Finance Bank IPO Details

The Suryoday small finance bank has carved a niche in its industry. If you are planning and sleeping over the thought Should You Subscribe Suryoday Small Finance Bank IPO then you must know the primary details.

The leading small finance bank is all set to launch its IPO on the 17th of March and go on until the 19th of March.

It aims to see a sale of 1,90,93,070 Equity Shares aggregating up to Rs.582.34 Cr.

The face value of the IPO is Rs.10 per equity share. Further, Suryoday Small Finance Bank IPO price band is set at Rs.303 to Rs.305 per equity share.

Ready to be listed in BSE and NSE, the market lot size of the Suryoday Small Finance Bank is 49 shares.

Suryoday Small Finance Bank Company Details

When we talk about the Suryoday Small Finance Bank, it wouldn’t be wrong to say that it is one of the leading Small Finance Banks in the country.

The bank was incorporated in 2008, and it began offering its SFB services in the year 2017.

They have their services in both the banked and the unbanked segments. Before beginning its journey in the SFB department, it worked as NBFC.

The growth of the bank is evident by the fact that as 482 banking outlets as of 31st July 2020.

The geographical reach of the company is based around the urban and semi-urban areas.

The company details play an essential role in deciding Should You Subscribe Suryoday Small Finance Bank IPO.

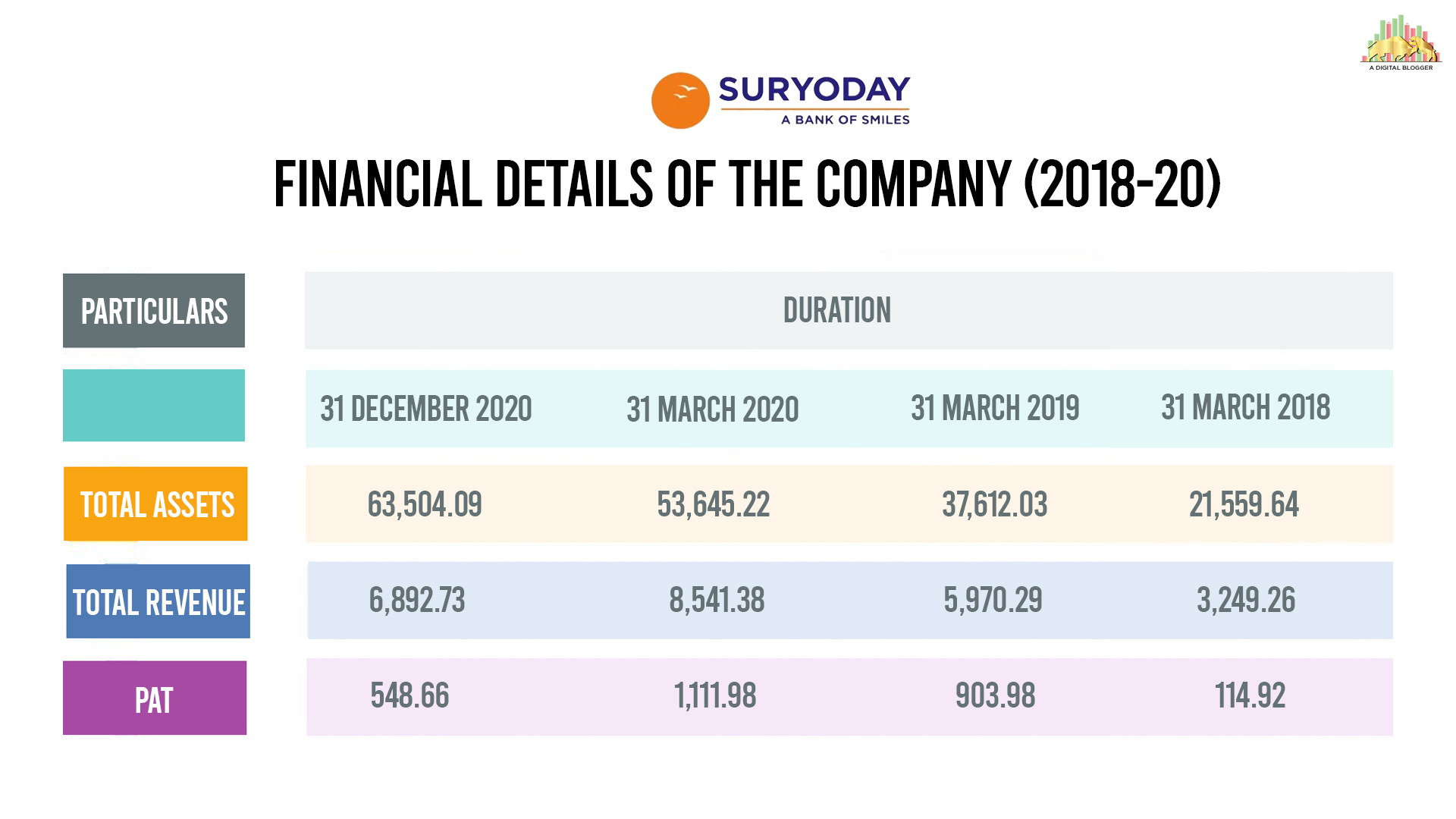

Company Finances

When we plan to invest the money in any company’s IPO, it is essential to check the financials of the company. It tells the growth of the company and also gives an idea of whether or not you should invest in the company’s IPO.

Given below are the financial details of the past three years of the company.

(All the values are in crores)

Promoters

In any company, it is essential to see who forms the back. Promoters are often linked directly with the company and are a part of every significant happening of the company.

The promoters of Suryoday Small Finance Bank are as follows:

▶️ Baskar Babu Ramachandran

▶️ P. S. Jagdish

▶️ P. Surendra Pai

▶️ G. V. Alankara

Objectives

It is evident that every company comes with its IPO due to specific reasons and objectives. You must be wondering if it is necessary to know the objectives of the IPO. the answer is yes.

The decision of Should You Subscribe Suryoday Small Finance Bank IPO highly depends on this factor.

Whenever you are giving or putting your resources into something, it is your right and duty to understand where it will be used.

The objectives with which the Suryoday Small Finance Bank IPO is set to grace the market are listed below:

➡️ The bank aims to utilize the gains from the fresh issue to augment the Tier-1 capital of their bank.

➡️ This will help in fulfilling the future capital requirements of the bank.

Competitive Strengths

Let us make the decision of Should You Subscribe Suryoday Small Finance Bank IPO, a little easier for you.

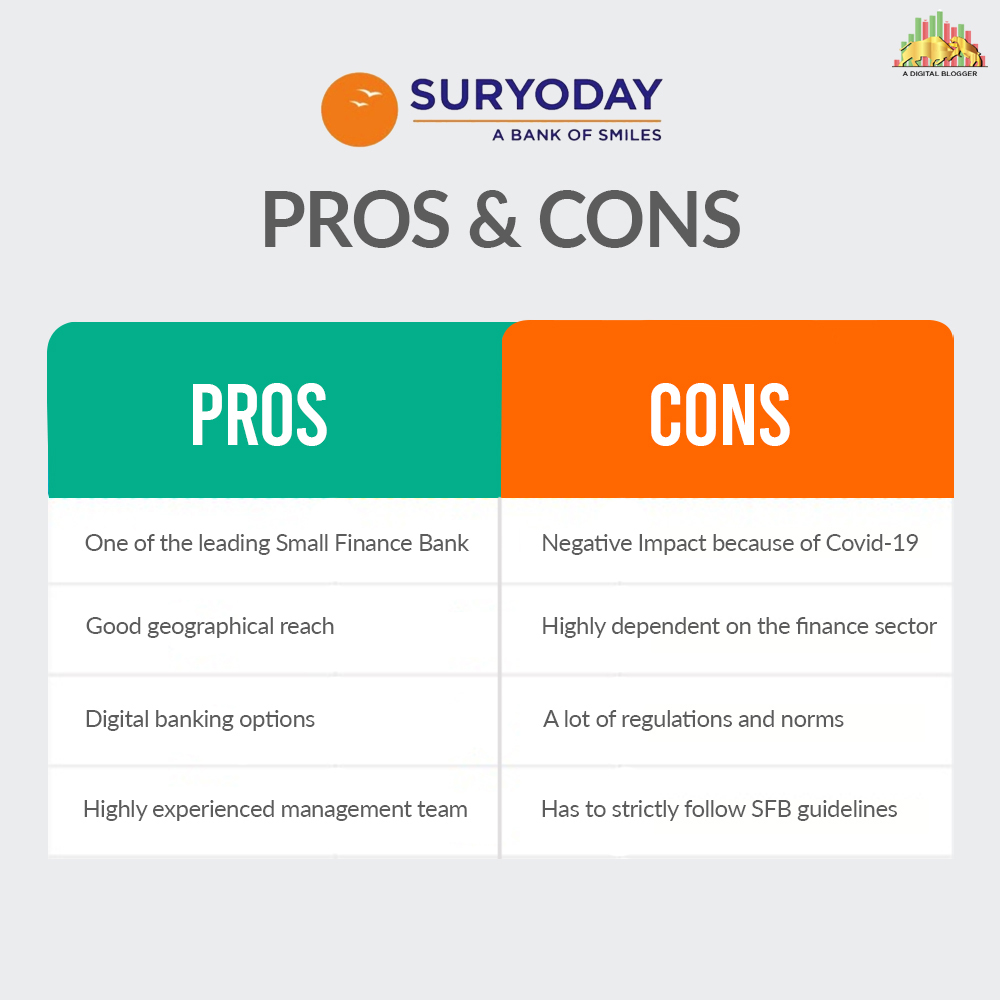

Given below is a list of all the advantages, or you can say the strengths of the Suryoday Small Finance Bank IPO.

- They have a well-proven and good track record in the industry that makes them a prominent player.

- A very diverse product portfolio with an added focus on retail operations.

- In the world of digitalization, it offers all kinds of online services. This includes online banking, mobile banking, and NPCI payment services.

- Because of their widespread branches and digital banking options, they have a very strong customer base.

- They have strong backing from good institutional investors.

- Their management team is experienced and capable of showcasing good leadership.

- They have a very customer-centric approach to their business.

Risks Associated

Even though there are a lot of advantages associated with the Suryoday Small Finance Bank IPO, there are some risks associated with it as well.

Let us look at both sides of the coin to reach an unbiased decision regarding Should You Subscribe Suryoday Small Finance Bank IPO.

- The ongoing pandemic has affected the working and growth of the bank. There are chances that this can continue in the future as well.

- The bank has to work on some strict laws and norms failing to which it can see an impact on its financial performance.

- The bank is in constant monitoring of the SFB guidelines. If not followed correctly, it can see significant penalties from the Reserve Bank of India.

- The bank does not have a very long operating history. It becomes challenging to judge the performance through fewer data.

Should you Invest in Suryoday Small Finance Bank IPO?

The discussion comes down to one point, Should You Subscribe Suryoday Small Finance Bank IPO or not?

Suryoday is one of the leading small finance banks in India. Its revenue has been in a positive movement for more than three years now.

Although, there are some regulations and risks that need to be kept in mind.

We suggest that you do a complete analysis before investing in the IPO. A well-thought decision will most probably reap profitable results.

Want to invest in this IPO? Refer to the form below

Know more on How to apply for Upcoming IPO 2021