Varroc Engineering IPO

Check All IPO Reviews

Varroc Engineering Background

Varroc Engineering Limited is a global tier-1 automotive component company.

The company is into designing, manufacturing and supplying exterior lighting systems, plastic and polymer components, electrical-electronics components and metallic components to passenger cars, commercial vehicles, two-wheelers, three-wheelers and off-highway vehicles.

It is the second largest Indian auto component group.

Varroc Engineering was incorporated in 1997 and now has 36 manufacturing facilities across seven countries. The business can be segregated into the Global Lighting Business, India Business and Other Business.

For the Global Lighting Business, Varroc has manufacturing facilities located in Mexico, the Czech Republic, China and India, and is in the process of setting up a plant in Brazil and one in Morocco. The Global Lighting Business has 900 engineers in nine R&D centres and has 184 patents.

The India Business has 25 manufacturing facilities and 5 R&D centres across India with 452 engineers, and are strategically located across Indian automotive hubs. The Indian Business is headquartered in Aurangabad, Maharashtra and has offices in Pune, Gurgaon and Japan.

Varroc Engineering is a strong company with a strong competitive position, long-standing customer relationships, comprehensive product portfolio, low cost and strategic manufacturing units, robust in-house technology and innovative R&D capabilities and consistent track record of growth and financial efficiency.

Varroc Engineering IPO Data Points

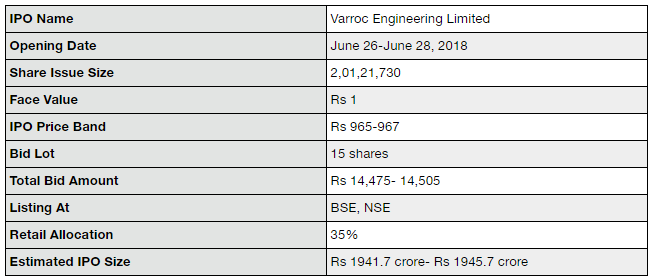

The Varroc Engineering IPO is set to open on June 26, 2018 and will remain open till June 28, 2018. The issue size is 20.1 million shares, which constitute about 13.7% of the total shares outstanding.

The selling shareholders are Tarang Jain who is offering 1.75 million shares for sale, Omega TC Holdings Pte. Ltd. offering 15.37 million shares and Tata Capital Financial Services Limited offering 1.41 million shares up for sale.

The face value of each share is ₹1 and the IPO price band is in the range of ₹965-967 per share, making the issue size between ₹1,941 crore and ₹1,945 crore.

The investment in the IPO needs to be done in lots of 15 shares each, thus the minimum bid value is between ₹14,475 and ₹14,505.

Varroc Engineering Financial Performance

Varroc Engineering has demonstrated strong financial performance and takes all required actions to reduce potential adverse effects on its financial performance.

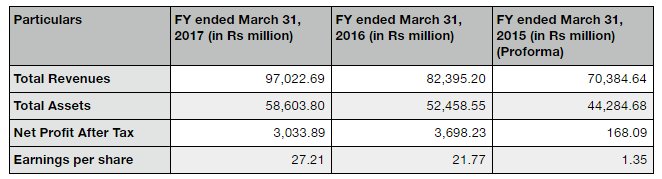

The company reported total revenues of ₹9702.2 crore, total assets of ₹5860.3 crore and net profit after tax of ₹303.3 crore for the financial year ended March 31, 2017.

The financials of the company have been dependable and growing since the very beginning. Revenues have grown at a much higher rate than the competitors and the overall leverage has been very low.

However, the company is now facing strong competition from cheaper Chinese and better quality Japanese products. It is still holding its ground.

Varroc Engineering IPO Objective

The proceeds of the sale of the shares will be directly received by the selling shareholders. The company will not receive any proceeds from the offer. The selling shareholders are looking to raise about ₹2000 crores via this secondary issue of shares.

The objective of the offer is to achieve the benefits of listing the equity shares on the stock exchanges and to provide liquidity to the shareholders. Tata Opportunity Fund is looking to exit its holdings in Varroc Engineering as part of the IPO.

The offer will also enhance the visibility and the brand image of Varroc Engineering Limited.

Varroc Engineering IPO Events

Varroc Engineering Limited filed the Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India in the month of March 2018.

The IPO will open for bidding on June 26, 2018 and will remain open till June 28, 2018.

The remaining sequence of events like the listing date is yet to be announced.

Varroc Engineering IPO Advisors Information

In order to process the IPO of Varroc Engineering, Link Intime India Private Limited is the Registrar to the Offer and the book running lead managers to the offer are Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, Credit Suisse Securities (India) Private Limited and IIFL Holdings Limited.

The legal advisor for the company and the promoter is Khaitan & Co and the legal counsel to the investor selling shareholders is AZB & Partners. Shardul Amarchand Mangaldas & Co is the Indian legal counsel to the book running lead managers and Clifford Chance is the international legal counsel.

The auditors to Varroc Engineering are Price Waterhouse & Co Chartered Accountants LLP.

Varroc Engineering Management

The Board of Directors of Varroc Engineering consists of eight Directors, of whom four are Independent Directors. Of the Independent Directors, one is a woman Director.

On the Board, Naresh Chandra is the Chairman and Non-Executive Director, Tarang Jain is the Managing Director, Ashwani Maheshwari is the whole-time Director and Padmanabh Sinha is the Investor Nominee Director. The Independent Directors are Gautam P. Khandelwal, Vijaya Sampath, Marc Szulewicz and Vinish Kathuria.

Naresh Chandra

Chairman and Non-Executive Director

Mr Naresh Chandra has been associated with the company since its incorporation and became the Chairman in 1997. He has over 50 years of experience, with 35 years of experience in the automobile industry.

Mr Chandra holds a bachelor’s degree in Economics and a master’s degree in history from the University of Delhi. He also has a diploma in business administration from the City of Birmingham College of Commerce, United Kingdom.

Tarang Jain

Managing Director

Mr Tarang Jain has also been associated with the company since its incorporation and was appointed as the Managing Director in 2001. He has about 30 years of experience in the automotive industry. He is also a promoter of the company.

Mr Jain holds a bachelor’s degree in commerce from the University of Bombay and a diploma in business administration from University of Lausanne, Switzerland.

Varroc Engineering Contact Information

If you require more information regarding the IPO or need to get in touch with Varroc Engineering for more information about their business, following are the contact details:

Varroc Engineering Limited

L-4, MIDC Area

Waluj

Aurangabad 431136

Telephone Number: +91 240 6653 700, +91 240 6653 699

Fax Number: +91 240 2564 540

E-mail: investors@varroc.com

Varroc Engineering IPO Recommendation

Varroc Engineering is a rapidly growing company in a rapidly growing sector. Globally, the exterior lighting business for passenger vehicles has grown at a rate of 4.5% between 2011 and 2016 in terms of revenue.

Let’s quickly check how the IPO works in favour of the investors:

- Varroc Engineering holds a strong and competitive position in this growing market. It has outgrown the overall market at a rate of 18.02% in terms of revenue.

- In terms of customer relationships as well, the company has shown outstanding performance. Varroc has long-standing relationships with international clients as well as Indian clients like Bajaj and continues to add new customers like Renault-Nissan-Mitsubishi and Volvo.

- The global business caters to premium manufacturers like Ford, Jaguar Land Rover and the Indian business caters mainly to two-wheelers and three-wheelers like Yamaha, Honda, Hero, Royal Enfield and Harley Davidson.

- The product portfolio is broad and comprehensive, including Halogen, LED, Flex LED and high definition MEMS. The width of the product portfolio is proved by the fact that Varroc Engineering has a second largest share in the global lighting business and has customers across various verticals in India.

- Varroc Engineering also holds strong potential for growth due to the innovative R&D capabilities. The company is highly innovation-driven and is focused on development and adoption of new technology. It seeks to capitalise on the emerging trends and following them.

Most importantly, Varroc Engineering has shown a consistent track record in terms of growth and financial performance. The company has grown its presence by investing in nine manufacturing plants in India and has grown through international acquisitions and joint ventures.

The revenues of the global lighting business have grown at a rate of 18% compared to the 10% growth of the competitors. The EBITDA margins have grown by 30.09% since 2014. The leverage of Varroc Engineering is very low with debt to equity ratio of 0.54 as on December 31, 2017.

For all the reasons mentioned above, Varroc Engineering stands strong in terms of current position and scope of growth. It is an excellent performer in its segment and promises to continue doing so. Therefore, the IPO is a good opportunity to become a shareholder in the growing company.

The recommendation is to BUY the shares offered through the IPO.

In case you are looking to apply in an IPO, just fill in some basic details in the form below.