Zomato IPO

More on IPO

With the long list of IPOs,’ the mark of the upcoming IPO is growing in numbers. Here comes the next IPO from the list, i.e. Zomato IPO. For helping you take the hard decision, here is the detailed Zomato IPO Review.

One of the most awaited IPOs by investors is now all set to start dealing with Public Offering. Zomato has stepped forward toward Public Listing by filing in DRHP (Draft Red Herring Prospectus) with a plan to raise around ₹9375 crores.

By studying the above-mentioned IPO let’s not make a quick decision, as we will go through with the first main aspect i.e. “ ABOUT THE COMPANY”.

Zomato initially started as a private company in 2008 with the name of Foodiebay and is now the biggest food aggregator and delivery service company serving. The current valuation of the company stands at $5.4 billion.

The company also has a subsidiary known as Hyper pure – which is in the business of supplying raw materials to restaurants.

The company’s competitive supplier UBEREATS was also later acquired through a whopping all-stock deal of 350 Million USD in lieu of 9.99% shares in Zomato and now holding nearly 55% of its market shares.

Other than this let’s look at the major investors of the company before diving into the details of the Zomato IPO review.

Zomato IPO Details 2021

The Zomato IPO review covers all the essential information like IPO date, issue size, price band, etc. So if you are planning for the investment then here is all the related information:

Zomato IPO Date

It is necessary to keep in mind the dates of the IPO before applying for it. The Zomato IPO review covers all the associated dates.

- Dates when the IPO will be opened.

- Dates when the IPO will be closed.

- IPO allotment date, when you can check whether the shares are allotted to you or not.

- Date when the funds will be initiated.

- Date when he shares will be transferred to the Demat Account.

- Date when the shares will be listed in the stock market.

Zomato IPO Price

The fundamental principle of IPO consists of Issue Price and Listing Price. Zomato IPO carries 65 lakh equity shares with a value of Rs.9,375 crores for public investors.

- Fresh Issue of Rs 9000 crore.

- Whereas Offer For Sale (OFS) value Rs 375 crore by existing shareholder Info Edge.

Apart from this, the Price Band of the IPO is Rs. 72-76 per share for the bid size of a minimum 1 lot (195 shares) and it’s multiple thereafter. You should also be aware of the Zomato IPO GMP as well to take a call for investment.

*The maximum investment for the IPO is limited to ₹2 lakhs.

These are all the details covered in the Zomato IPO review. Now let’s jump to another important aspect, how to apply for the IPO.

Zomato IPO Apply

If you are a first-time investor and have never before participated in markets and are wondering how to apply for the Zomato IPO, then head over to the steps to open a Demat account. For existing stock market investors, the simplest way to apply for Zomato IPO is through their Demat Accounts.

Not having a Demat account, do not fret! Just reach us by filling in the basic details in the form below and get your account opened in no time.

Once you open a Demat account you need to select the mode through which you can apply in IPO. there are two methods for doing this:

- online method

- offline method

Both online and offline method uses the ASBA method. The only difference is the offline method is a little complex and time-consuming as compared to the online method.

To apply online via the ASBA method just follow few steps:

- Log in to the trading platform.

- Click on IPO.

- Select the IPO in which you want to invest, here Zomato IPO.

- Enter the bid price and lot size.

- Click on Submit button.

- The amount corresponding gets blocked in your bank account.

On the other hand, to apply for the Zomato IPO using the offline method requires downloading the form, filling in details, and submitting it along with the cheque.

Should You Invest in Zomato IPO?

The complete information of the Zomato IPO review might seem to be attractive, but what most of the investors skip is considering the company’s fundamentals and growth potential.

So, before planning your investment in the initial public offerings here is a few basic financials and other data of the company.

If you are in deep thought as to whether to apply in this IPO or not, then this section will clear all your queries.

The food delivery giant has grown at least 3 times over in the last four years. Revenue at the end of December 2020, for the preceding 9 months, was ₹13,013 million, compared to ₹4,660 million for the fiscal year ending March 2018.

What’s the catch? In the first three-quarters, Zomato clocked almost Rs. 1,367 crore in revenue, even after the loss of a certain amount, revenue was raised from Rs.1,398 to Rs.2,743.

Zomato’s IPO comes in the middle of a grueling second wave of the COVID-19 pandemic in India and as said by Zomato that the COVID-19 pandemic had pushed it closer to profitability.

Lastly, Zomato has used tech extensively in operations, sales, marketing, and automation, which has excellent operational leverage in the longer term, which aligns with the global trend.

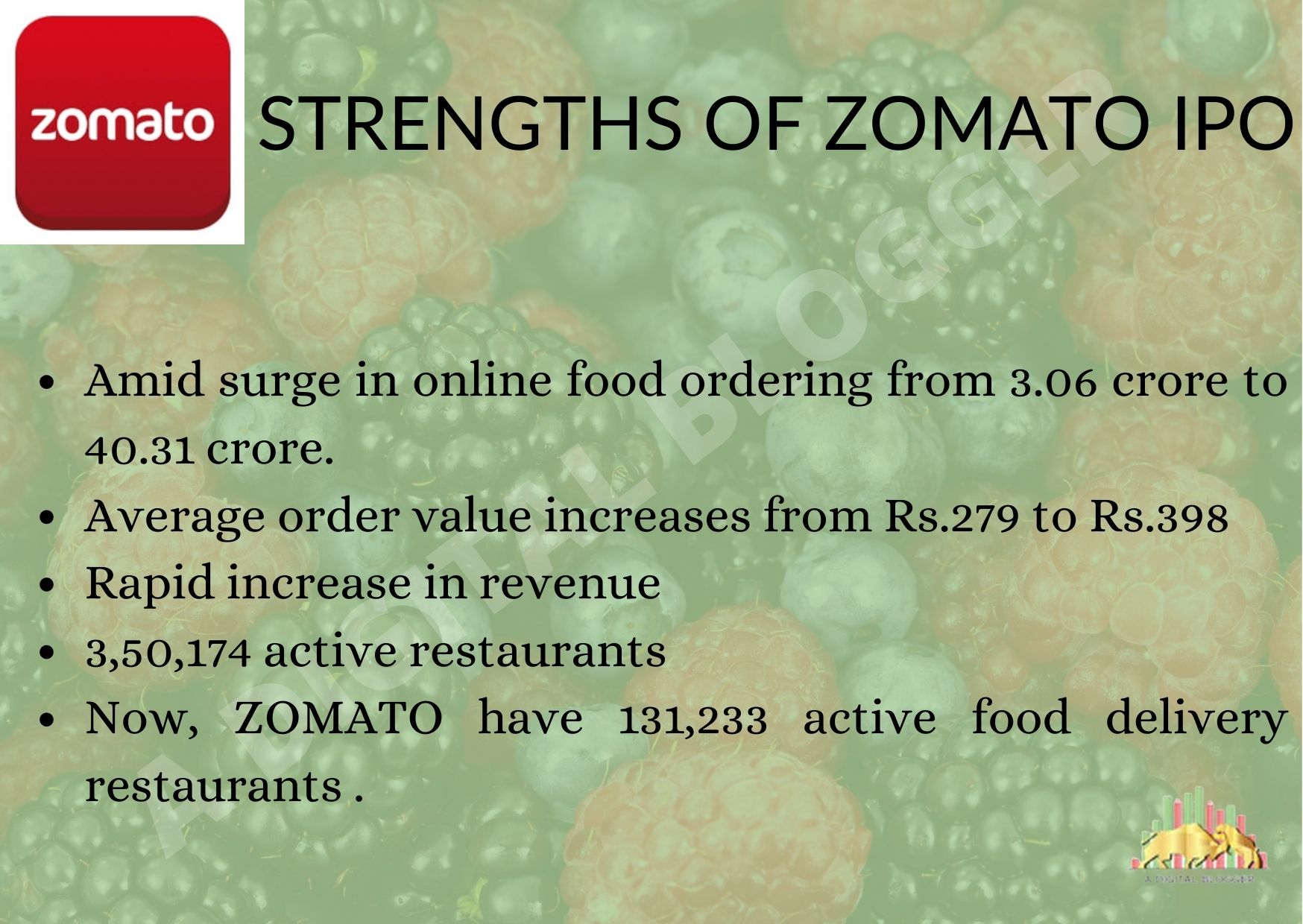

Strengths of Zomato IPO

It is human nature to check the assets provided by the product before buying, the same is in the case of an IPO, smart investors look for the strengths and weaknesses of the IPO.

The following infographic displays the strengths of the Zomato IPO. Zomato follows SWOT criteria to inform all its users as well as its future investors.

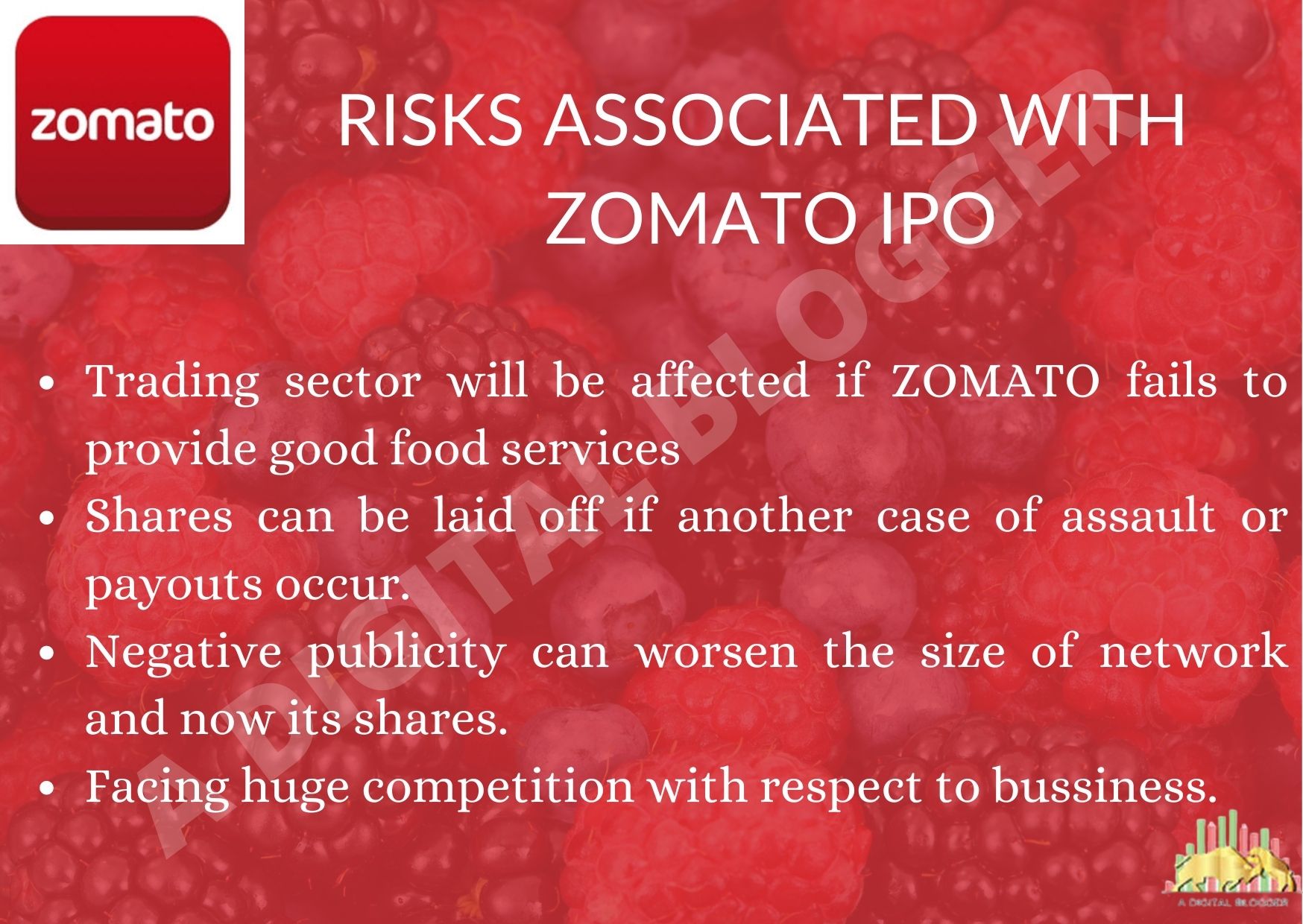

Risks Associated with Zomato IPO

Any details of the IPO are incomplete without considering the risks associated with the investment. Zomato IPO review covers all the details of risks that could affect your investment in these public offerings.

We all know that The only way to find true happiness is to risk being completely cut open and the same is in the case of an IPO there are also some flaws associated with it.

The above image represents the risks associated with an IPO. It’s better to go with the flow. If you pore over the strengths, it is important to analyze risks too.

Conclusion

From the above data, it is quite clear that although the company shows good growth over the past few years and even during the pandemic condition, but considering some of the future aspects and the risk is equally important before you decide to invest in this public offerings.

So, if you have made up your mind to initiate your journey in the stock market through IPO investment, then choose the stockbroker to open a Demat account and apply online.

Now you can apply for any IPO seamlessly by opening a Demat account online for FREE. Just fill in the details in the form below:

More on IPO