Stoxkart Margin

Margin

Different Stockbrokers offer different margins in the stock market, and there are many brokers who provide the highest Margin, and one such is Stoxkart. In this article, we will share complete information regarding the Stoxkart Margin.

These days offering leverage to the traders and investors by the stockbrokers has become quite a bit normal.

Also, read Stoxkart App

Stoxkart is one of the most trusted and reliable brokers in terms of Margin in the Indian Stock Market. This clearly explains that being a Stoxkart customer can quickly avail Margin to expand the quantity.

Stoxkart Margin Review

If you seasonally trade or actively buy or sell stocks, then the concept of Margin must be understandable to you. However, to understand the Margin, you can visit our detailed article by clicking here.

It is accessible for different trading and investment segments such as equity, commodity, currency, etc.

The margin plays a vital role in defining the success of the broker and traders, but with SEBI new margin rules, the brokers will now limit the margin funding up to 5x which will hamper the growth and profit potential of traders in the market.

You can effortlessly avail the margin in the following products:

- Delivery Intraday

- Commodity

- Currency

- Futures and Options (F&O)

- BO (Bracket Order) and CO (Cover Order)

If you are having a trading account with the broker you can easily avail the margin facility to trade in different segments. Each product offers a different margin for the customer that depends on the quantity of the scripts.

In simple words, the margin money or percentage of margin amount differs from segment to segment and also from a script to another.

It is believed the higher the risk associated with stock or script, the higher will be the margin amount.

Unlike Stockart Margin, many stockbrokers ask for the initial Margin from its customers before they can proceed with their trading.

Moving ahead, let us discuss the various products and segments in which one can avail of a benefit of margin funding.

For more information, review Stoxkart commodity margin in detail.

Before choosing the Stoxkart Margin facility, you must be aware of the following necessary details and information:

- The margin limit is available for each trading and investment segment except IPO or Initial Public Offering.

- Before taking the benefit of margin trading from the broker, it is vital to understand and analyse the market.

- It is also important to know that Stoxkart does not provide margin facility in some scrips, so as a client, you must make sure whether the particular scrip or stock is available for margin facility or not.

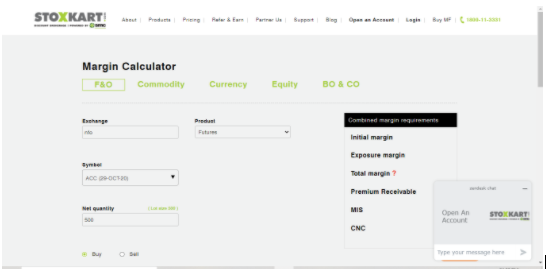

Stoxkart Margin Calculator

You can easily calculate the margin in a particular scrip only

As the name suggests, it’s an online tool that helps traders and investors to calculate exposure or Margin offered by Stoxkart for multiple products or segments.

With the help of this amazing online tool, a trader or an investor can calculate or determine the Stoxkart Margin.

In addition to this, one can also calculate the complete value of extra shares or stocks that can be easily brought with the extra leverage allowed by the Stoxkart.

Stoxkart Margin Calculator can be easily accessed through their official website.

All you need is, Simply navigate to the website and click on the “Margin Calculator” in the lowest section of the page.

Here, a screen will be displayed before you, just like the above one. Click the segment in which you want to do Stoxkart margin trading such as F&O, Commodity, Currency, Equity, and BO & CO.

Next, enter the details asked in the Stoxkart Margin Calculator feature after selecting one of the segments.

For each segment, different details of the script are asked from the traders and investors.

Stoxkart Margin List

The Stoxkart Margin list shares complete information on the Stoxkart Margin facility.

So either you want to buy or sell stocks in currency, commodity, or maybe in equity, simply refer to the table below and avail a full information on the margin facility of broker.

Stoxkart Intraday Margin

You can easily choose the Stoxkart Intraday Margin facility if you want to trade in the Equity segment. The Stoxkart Equity Margin is also high in this case.

Along with this, if you opt for buying or selling stock or shares on the same day before the closing of the Stock Market, which is also known as Intraday Trading, then you can choose this margin segment.

The below table gives correct and quick information on Stoxkart Intraday Margin:

Along these lines, we can plainly sum up that Stoxkart offers Margin or leverage up to 25 times on the Intraday exchanging on stocks (MIS).

The Brokerage Charges on Stoxkart Intraday are only applied if you earn a certain amount of profit on this trade.

Stoxkart Delivery Margin

When you hold the stock for at least one trading session then it is known as Delivery Trading and if you are also one such trader or investor who prefer this kind of trading, then you can avail Stoxkart Delivery Margin facility.

On Delivery trading, there are no brokerage charges with Stoxkart.

Details related to Stoxkart Delivery Margin are as follows

Margin offered in Stoxkart Delivery is only 1 time of the amount available in your trading account.

Stoxkart Option Margin

If you choose Derivatives specifically Option Trading, then you can read this section on Stoxkart Option Margin to have complete information on the same.

Around 50% Stoxkart Margin is offered to the investors trading in the options contract.

Options have a specific expiry date and can also be traded on an Intraday or Delivery basis, depending on your requirements.

Stoxkart Futures Margin

If you choose futures trading with Stoxkart and looking for Margin then you can quickly avail of Stoxkart Futures Margin.

Stoxkart Futures Margin of around 26% of the total value is offered by this broker to its customers.

Around 2x of Intraday exposure, 1x of CNC exposure, and BO exposure of nearly 5x is provided by the Stoxkart.

Stoxkart BO & CO Margin

If you opt for BO & CO (Bracket Order and Cover Order, respectively) then read the below information covering all the details about Stoxkart BO & CO Margin.

Just like other segments, Stoxkart also deals in Bracket Order and Cover Order facility.

Through Stoxkart Bracket order and Cover order, traders and investors can make the trading simplified and easy by defining the entry price, stop-loss, and target points.

Hence, the trader prevents himself from loss by enabling these necessary points.

Undoubtedly, the lesser or lower is the stop-loss, the higher exposure of around 25 times will be received to the trader or investor.

Similarly, the loss will be pre-defined by the trader, so up to 25 times, the exposure on the Bracket order and cover order can be availed on multiple kinds of stocks, shares, or securities.

Closing Thoughts

Stoxkart is a new name in the Indian Stock Market industry and is showing incredible performance in meeting its customers’ needs. One such requirement is the Margin.

Indeed, Stoxkart is believed to offer the highest Margin in the industry. So, if you are also one of their customers or want to join them, then you can avail Margin in various trading and investment segments such as equity, commodity, currency, futures, and options.

To calculate Margin, simply navigate to their site and choose your desired segment and enter the details like script quantity, exchange, order type, etc. and know the leverage that will be offered by Stoxkart.

Want to open a Demat Account? Please refer to the below form

Know more about Stoxkart