Zerodha Option Selling Margin

Margin

It is never enough to emphasize the fact that options trading is going to gain great popularity in the coming times. If you have a Zerodha demat account, you must be wondering about the Zerodha option selling margin.

Now in options trading, buyers have to pay option premium in Zerodha on the other hand, the sellers have to maintain a minimum margin balance in their trading account.

Well for both the positions, Zerodha options charges are same but due to maintaining margin option selling is considered to be an expensive run when we look at options trading. But what is the margin requirement and how one can know this range in Zerodha.

Does Zerodha provide Margin for Options Selling?

If you are also looking for an answer to the question, does Zerodha provide a margin for options, then the answer is YES!

Zerodha provides a margin for options. This is the leverage that is provided by the broker. Zerodha gives 2X leverage on exposure margin to the traders. In this way, the traders can use it and sell options to make better profits.

This is the leverage that is provided by the broker to the traders, but when you are doing option selling, there has to be a minimum margin that a trader must hold in his account. Let us now have a look at that.

How much Margin Required for Option Selling in Zerodha?

Whenever you are doing option selling, you have to keep some amount in your trading account to move further with the order. But what is the mindset of an option seller?

- An option seller in the case of a call option is bearish.

- In the case of a put option, the option seller has bullish sentiment.

- Option sellers enter the market with an objective to earn benefits from the market.

Now, there are certain conditions when the margin required for option selling can differ in Zerodha. The first thing that a trader should keep in mind is that, when using the margin calculator, the total margin that is displayed is the margin including the premium that you will receive.

- The more you move away from the strike price, the less your margin becomes. This means that you require less margin for ‘out of the money options.

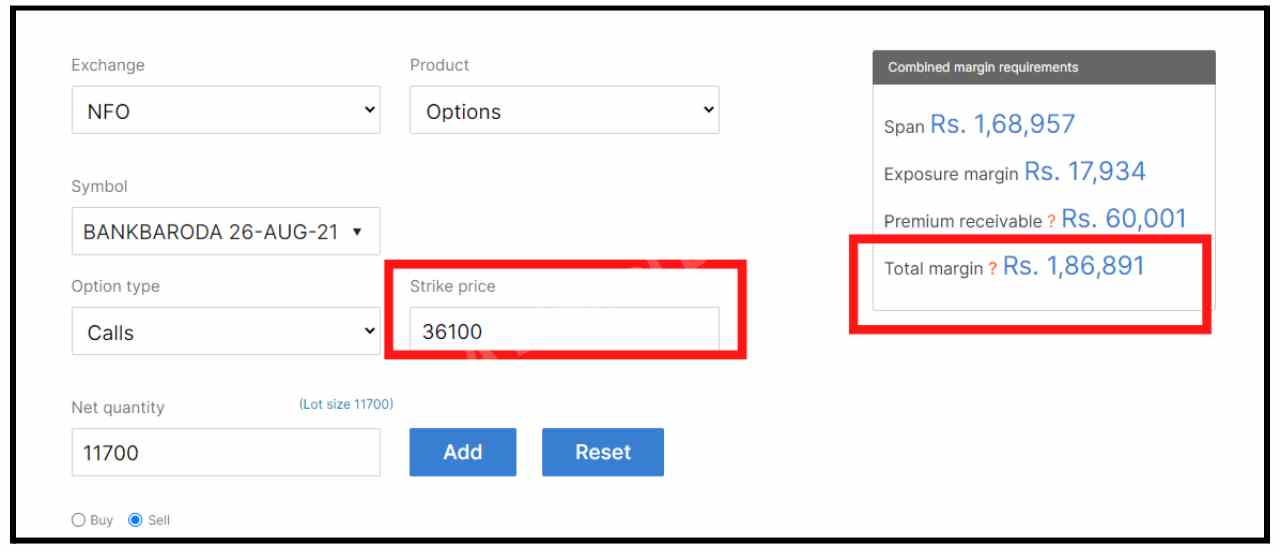

Let us take an example of the bank nifty. If we are selling the call option of bank nifty at a strike price of ₹36,100, when its current market price is around ₹36,000, then the total margin required is ₹1,86,891.

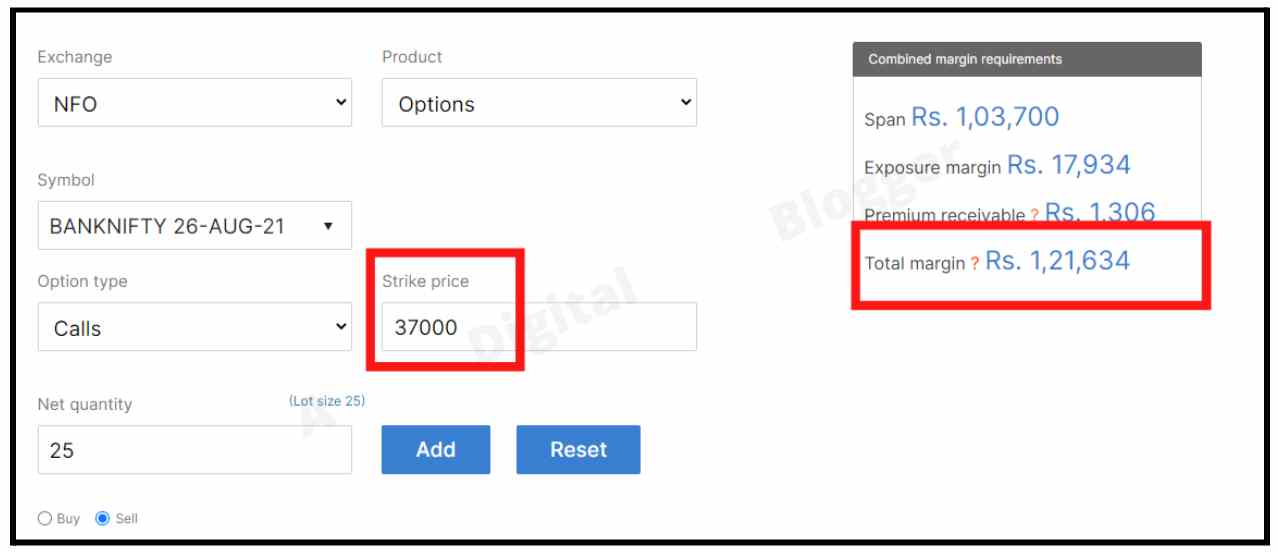

But when we sell the same call option for a strike price of ₹37,000, then the required margin in your account should be ₹1,21,634.

So the farther you go from the current market price, the lesser margin you need. Since the loss in the F&O market is settled daily, due to which Zerodha show negative balance.

Here the trader has to add funds to meet the minimum margin requirement in T+1 day to avoid Zerodha penalty charges.

- The second thing that should be kept in mind is that the exposure margin remains the same in all cases, be it the strike price of ₹36,100 or ₹37,000. Like in both of the above cases, the exposure margin is ₹17,934.

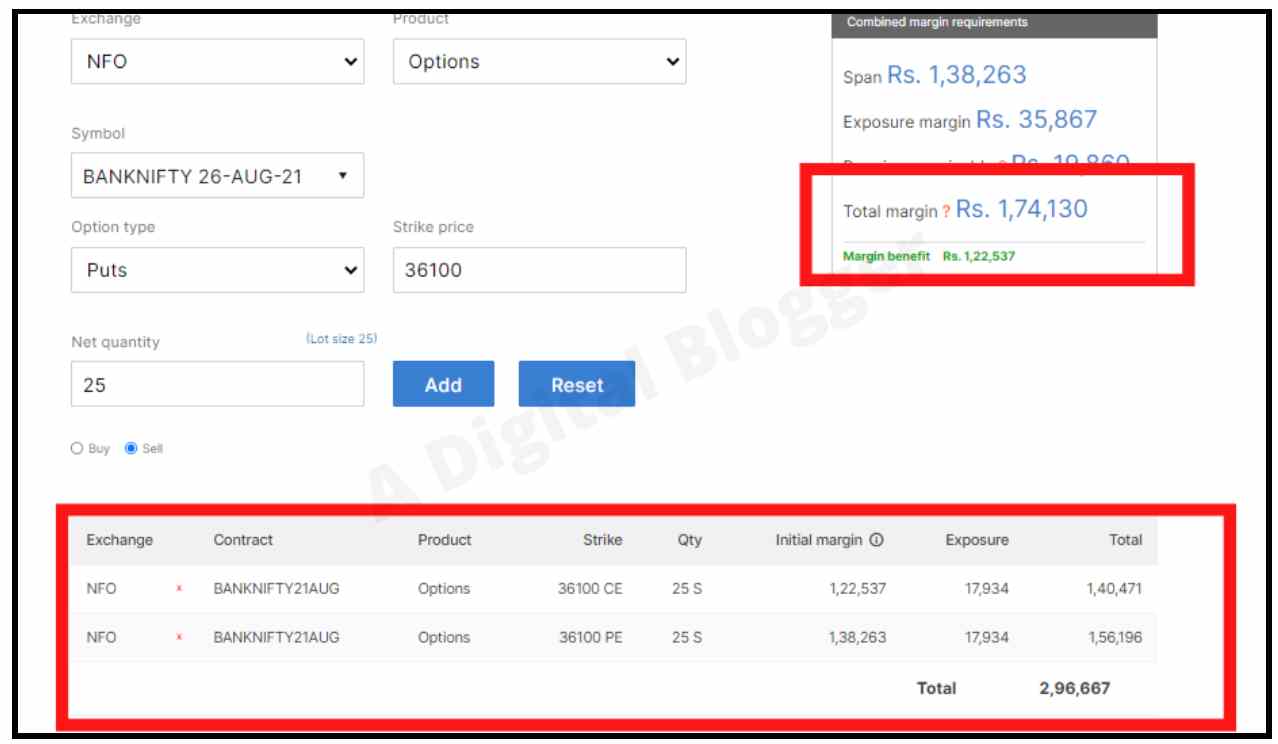

- If you want to sell options with less margin and also want to cap your losses, then you can hedge your options. It means that you can sell a call option and simultaneously sell a put option as well.

This is beneficial because if you sell both of them separately, you will be required the margin twice the time, but when you sell them simultaneously, then the margin will be less.

For example, if you sell a put option for the strike price of ₹36,100 and sell a call option for the same strike price, the collective margin required will be 1,74,130, giving you a margin benefit of ₹1,22, 537.

Also, to reduce the margin cost when using any option strategy, then you can make use of the basket order in Zerodha, where you can place multiple trades and execute all of them together.

How to Sell Option in Zerodha?

Once you have activated option trading in Zerodha, you can easily do option selling in Zerodha.

- Log in to your account using your login credentials.

- Now on the dashboard, search the scrip that you want to sell.

- On the Zerodha option chain, you will see the call option on the left and the put option on the right. Select the desired strike price.

- A window will pop up, click on the sell option.

- Now add the lot size, price, and your order type and click on ‘place order’.

In these simple steps, you can easily sell your options in Zerodha.

Conclusion

Option selling can be lucrative when done with the right strategies. The margin required in Zerodha depends on various factors, and therefore you can easily calculate and then decide.

If you are also willing to do option selling, then open your demat account today and reap the benefits!