Blue Chip Stocks

Check All Investment Services

Blue Chip stocks are basically the shares of renowned organizations that have a good and stable financial history. These kinds of stocks are well known to be able to handle the challenging market conditions and know how to give high returns in severe market trends.

The cost of Blue-chip stocks is always high as their reputation in the market is very strong and is usually act as the market leaders in their particular markets.

Blue Chip Stocks Meaning

In 1923, Oliver Gingold, who operated at Dow Jones, invented the term ‘Blue Chip.’

Gingold was standing near a stock ticker in a brokerage firm when this term came to the fore. Noticing that many stocks were trading at $200 as well as more for every share. He termed them’ Blue Chip Stocks’ and published an article about them.

Ever since the term has been used to refer to high-priced stocks, and now it is more generally used to refer to heavy-quality stocks. Blue Chip Stocks are the stocks that yield typically superior long-term returns.

Most of the people often correlate the blue-chip stocks as the blue betting hard drives with the poker game. Here the blue disk has the maximum value on the contrary the white one had the minimum value.

But in reality, blue-chip stocks are nowhere close to the ones in the poker game. The former ones are seen as the most dependable ones while the latter has a fair bit of risk involved with them.

Nonetheless, let’s find out the kinds of returns you can expect from this kind of stocks.

Blue Chip stocks Returns

It is essential to know as to why Blue Chip stocks yield better returns making an investment.

Blue-Chip stocks are widely accepted and these are almost taken as given. Practically every company, marked as a blue-chip stock in the market, has grown with time and retained a good reputation in the market over the years.

Blue-chip stocks document a consistent performance across a period with either a secure debt-to-equity ratio, median price-to-earnings percentage, as well as interest coverage proportion.

They are constant as they have an excellent financial position, outstanding management staff, steady growth rate, brand appreciation, and goodwill via a demanding business cycle with different market trends.

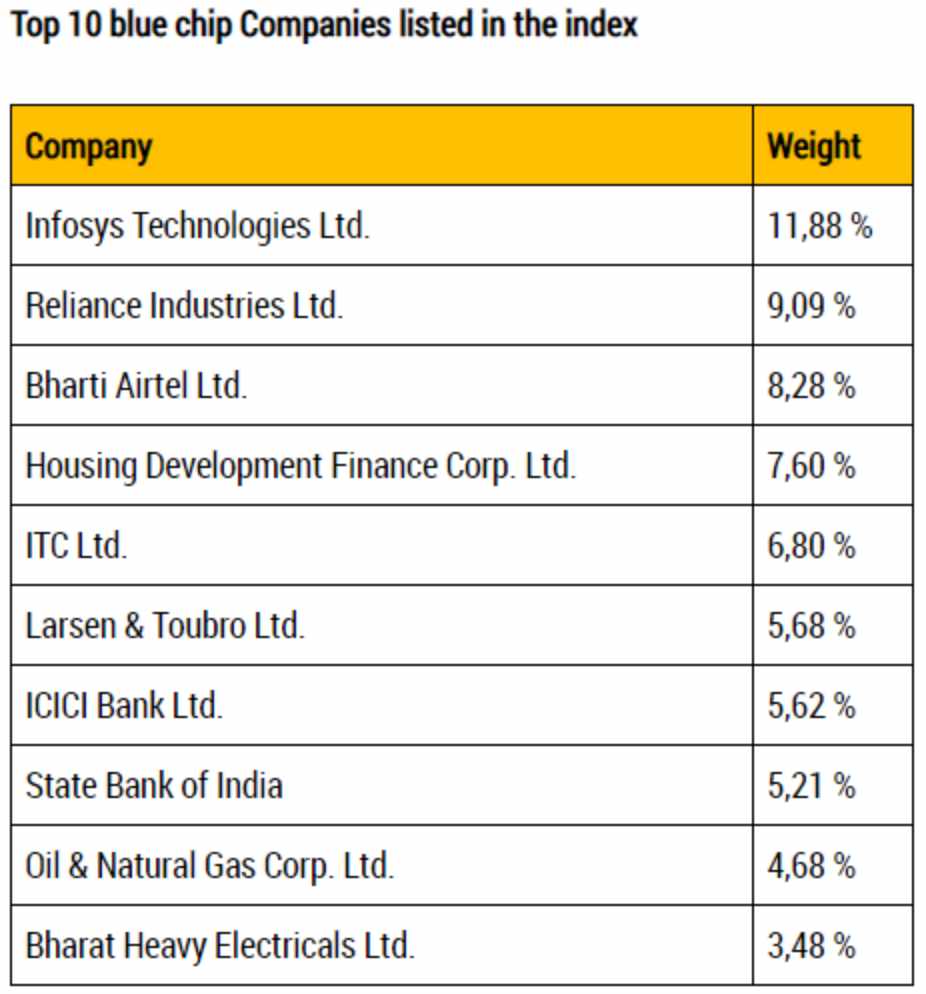

Here is a quick look at some of the Indian companies that are entitled to be running blue-chip stocks in the stock market:

Blue Chip Stocks Pros and Cons

There are different opinions of experts about Blue chip stocks benefits and disadvantages. Although you might get more persuaded of the profits than the problems, let us discuss each aspect of this story.

| Pros | Cons |

| Great financial performance | Poor returns |

| The steady long-term return | Bad dividend yield |

| Well regulated & governed | Cannot beat a benchmark as well as index returns |

| Less volatile | Slow capital appreciation |

| Potential for the regular dividend | Cannot be a multi-bagger (basically speaking) |

| Lower downside risk | Could be conservative of finding new opportunities (but this is debatable as well as varies from case to case) |

Once you look up the points, you will analyze that most of the drawbacks are just for the sake of counterarguments next to benefits.

Why are you supposed to invest in Blue Chip stocks?

The question will be answered to an extent behind where the additional benefits are evident, but just let us offer you a few further points or ‘ Friendly advice ‘ to inform you virtually why blue-chip stocks were better than the tinier peers like mall caps mid-cap stocks, penny stocks, and so on.

Blue-chip stocks Benefits

Let’s find out some of the benefits of blue-chip stocks you can avail in your investments:

1. Earnings are stable

The primary goal of every investor would be to get an excellent return on their money, and with investing in blue-chip stock, you will be highly benefited.

Blue-chip stocks companies have constant earnings within a specified period, to become reliable as well as earning their stakeholders’ confidence. During an economic downturn, they will do anything to stay intact in the market.

No matter what, one should not worry regarding their expenditure in blue-chip equities.

2. Regular dividend payouts

Blue-chip stocks are well known for paying timely dividends to their shareholders. They might not show a steady price increase. However, they cover up to undisturbed dividend payments.

Not only will it offer the best long-run gain of capital growth, but it also behaves as an extra cherry on the top in terms of earnings as well as inflation-protection.

3. Strength in the Financial Base

Generally, a typical blue-chip stocks company was not under a huge debt burden.

However, it stands strong with the evenly effective operating cycles. We have also discussed how blue-chip stocks do not undergo fluctuations, thus holding minimal shareholder risk. Besides, they support all financial aspects that contribute to business growth, including cashflows and balance sheets.

Expenditure in blue-chip equities is seen as safe and steady, particularly due to a firm’s strong basic base. These firms are rarely involved in scams as well as fraud.

They get an understanding of the business they were in and have a quite convincing vision of the future of a company.

4. Great Brands

Most of the product which we buy in our daily routine, you can find dozens of brands. There will be shampoo brands including, Clinic All Clear (HUL), Pantene (P&G) Fiama, and so on.

The same applies to noodle products, e.g., Top Ramen (Nissin Foods), Maggie (Nestle), Yippie Noodles (ITC), and so on.

Those are brands value hundreds or thousands for crores or even drive its company of revenues and profits. Most of the products sold at times, regardless as to whether the market is positive or negative.

5. Flexibility to the Economic Downturn

This feature could only be exhibited by those blue chips of defensive industries (pharma, FMCG, health care, and so on.).

Why is that so? Those are the sectors that serve the economy’s basic usage needs, that may not slow it down substantially also in crises.

During much of the Lehman Brothers crisis at just the end of 2008, for example, most FMCG equities (that initially fell) gradually began heading north against all the market.

Why?

The reason is that analysts & investors have confidence in pharmaceutical & FMCG stocks.

6. Low Debt with Leverage

Leverage was the strategy of using that borrowed money to produce higher company returns.

Is that good?

Yes, given business yields were significantly higher than the borrowing costs. And if it is, the company pays a high debt provider than its earnings and erodes its assets and liabilities.

Simply put, it’s like having to borrow too much on your credit or debit card to explore that your credit card payments surpass your earnings. Even though the debt is essential for any business, so much debt may erode profits or even make a company bankrupt

In cases in which they involve debt, they can raise funds via debenture as well as asset sales or borrow from the banks.

The main benefit of Blue-chip stocks is that it can be borrowed at lower prices as compared to other new companies. Financial institutions or banks are more likely and comfortable to offer blue chips.

Conclusion

Thus, blue-chip stocks are one of the best ones out there to invest. Most of the Blue chip companies have such a powerful management team with a solid understanding of both the business and also a commitment to advance the firm to achieve the vision.

If talking about firms, then Infosys has become a stalwart as well as a role model for most IT firms to India. The high management talent makes them go for the succession plan from the Narayana Moorthy of S.Gopalakrishnan to Nandan Nilekani.

In case you are looking to get started with stock market trading or investments, let us assist you in taking the next steps ahead.

Just fill in a few basic details to get started: