How to do Option Trading in Zerodha?

Options trading can often leave the traders in speculation and worrying about how to carry it forward. There are a lot of stockbrokers that provide the facility of trading in the derivatives segment. So, if you have an account with Zerodha, let us find out how to do option trading in Zerodha.

Options trading is no rocket science if you understand the basics properly. Just like the engine of a car needs to be running, it is important that you understand the basics of options trading, before diving deep into the trading.

Wouldn’t it be better if we quickly summarised option trading in some pointers?

- Option trading is a contract between traders of different sentiments in the market that is executed at a fixed price on a fixed day.

- The two types are the call option and the buy option.

- The execution of an option contract is a right and not an obligation with the right with the one who pays the premium (non-refundable upfront cost)

Now that the basics are clear, let us see how you can easily trade options in Zerodha.

Well for that the broker offers the best app for option trading, Zerodha Kite.

So, let’s begin and learn how you can trade options using Zerodha Kite app.

How to Activate Option Trading in Zerodha?

We are well aware that there are a lot of stockbrokers available for equity trading in the market, but how do you trade in options? Are a separate trading and demat account required?

In Zerodha, you don’t need a different Demat and trading accounta for option trading. The one you have for equity serves as a multi-bagger deal for the other segments as well.

All you have to do is to activate the derivatives segment active in your Zerodha account.

Once you have activated the segment, you can easily start trading.

Wondering how to activate option trading in Zerodha? Don’t worry, we have got you covered!

- You first have to log in using the credentials to Zerodha Console.

- Now from the top right corner, open the drop-down menu and then select My profile.

- Now, you will be redirected to a new page.

- Now click on the ‘Activate Segment’ option.

- Select the segment you want to start your trading.

- Now enter the gross income.

- Upload an income proof (latest salary slip, bank account statement for last 6 months, net worth statement, etc)

- Click on submit and you will be sent a confirmation mail of your request.

The process is easy and usually requires 48 hours for successful activation. Once you have activated the account, it is accessible for option trading.

How to do Option Trading in Zerodha Kite?

Zerodha, technology-wise, is one of the best discount stockbrokers and has varied trading platforms as well.

In the times when mobile apps have gained an accelerated pace, Zerodha Kite is also ahead in the game. It provides best indicator for option trading that helps you in analyzing index and stocks for options trade.

Zerodha gives you the option to buy and sell options through its Zerodha Kite app.

It makes it easier to trade options and the experience seamless. Now as we know that there are two types of options, i.e, call option and put option.

Therefore in the upcoming segment, we will cover,

- How to buy and sell call option

- How to buy and sell put option

So, let’s begin.

How to Buy Call Options in Zerodha?

Call option is where the buyer has a bullish sentiment regarding the market. The buyer in this case gives the premium as he/she is sure that the market is going to soar in the upcoming times.

Therefore, he/she has the right to exit the market at any point in time.

Let us now have a look at the step-by-step procedure of how to buy a call option in Zerodha.

- Log in using your login credentials and password.

- Once you successfully login into your account, you will get your dashboard.

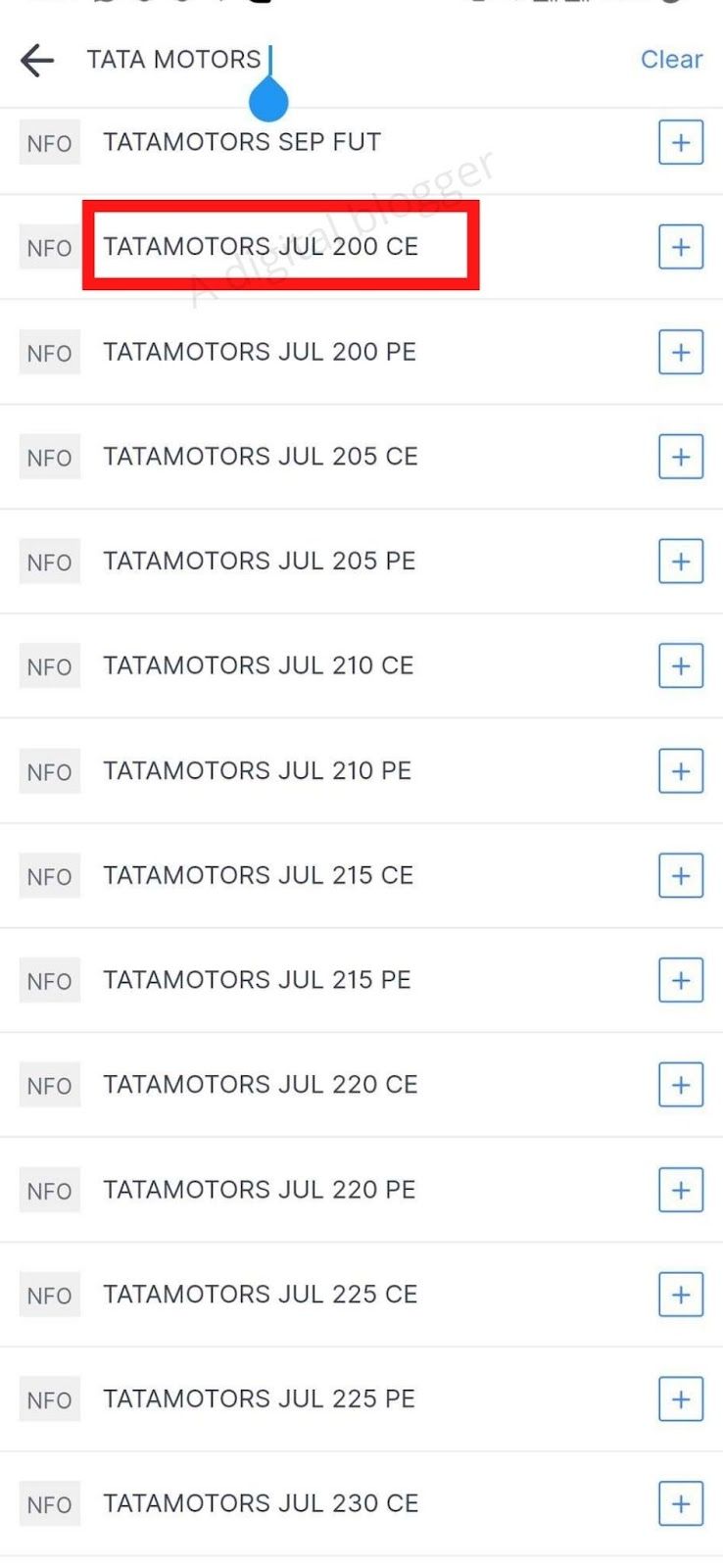

- On the search bar, search the scrip that you want to trade in. Here, for example, we looked for Tata Motors. You will see a lot of different strike price options available.

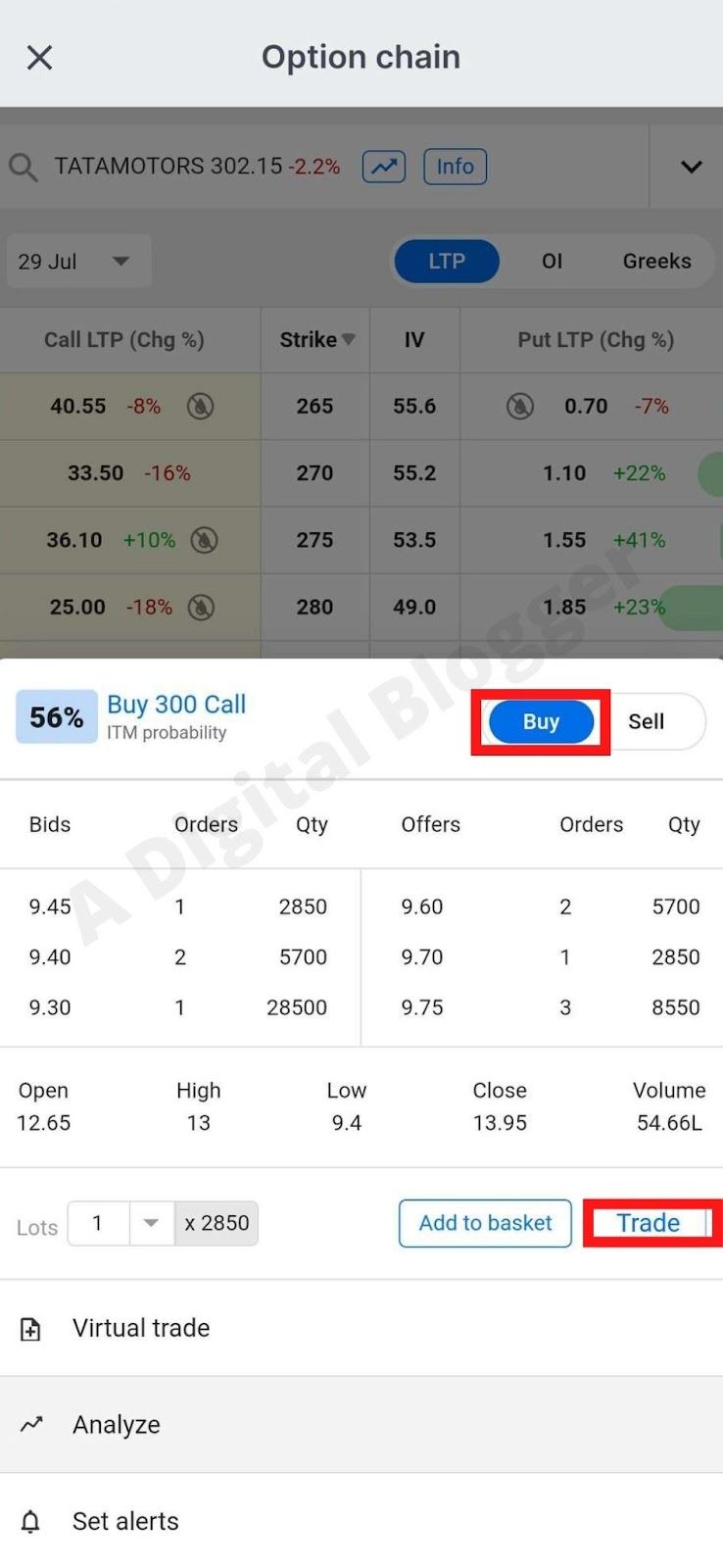

- You can now scroll down and open the option chain to have a better idea. On the left-hand side, you can see the Call LTP and in the center, you can see different strike prices.

- Click on the one that you want to choose.

- Now a window will pop up. Select the buy option and then click on Trade.

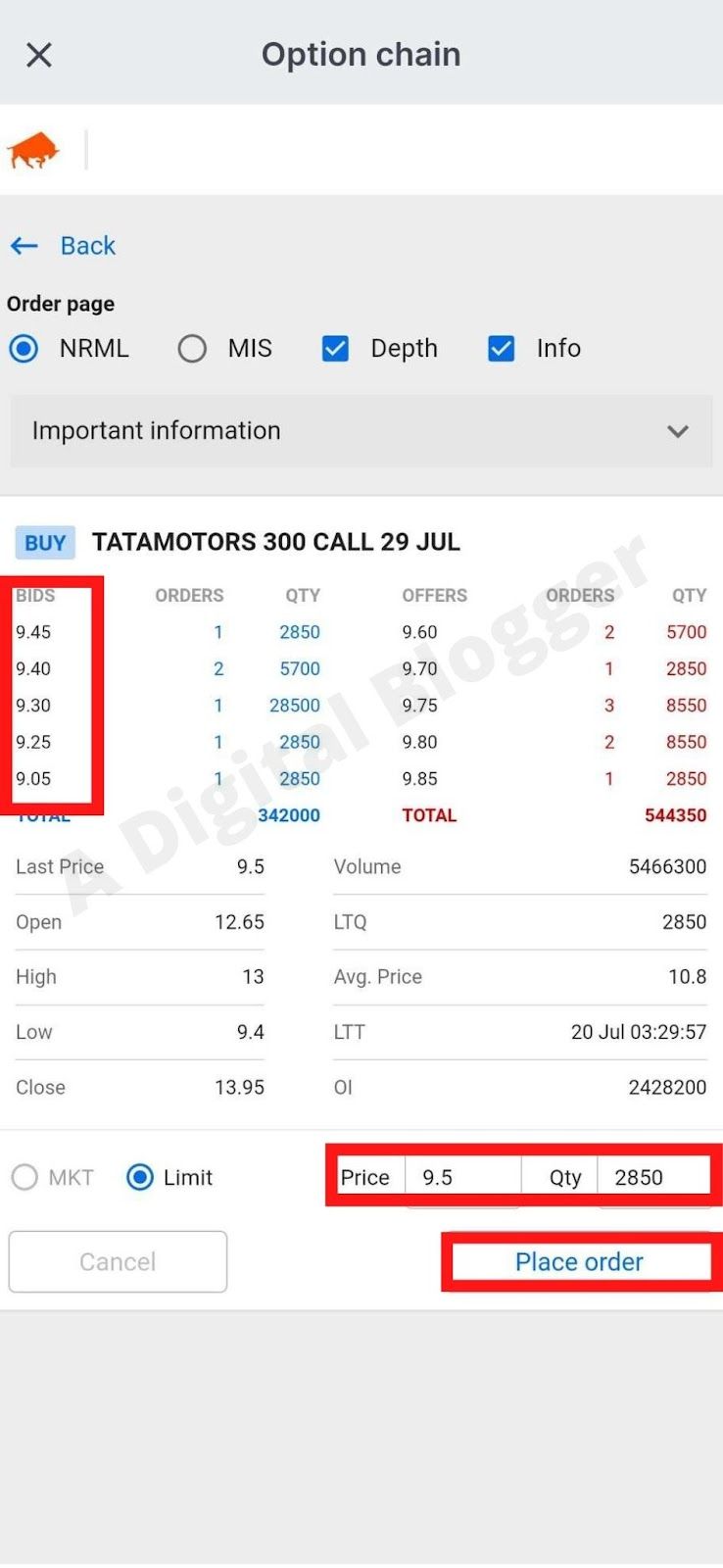

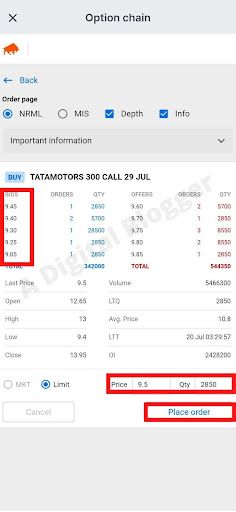

- Here you will see the bids, which is the premium which you will have to pay on the purchase of this option.

- You can choose between the market order and limit order. Enter the price and quantity and click on place order.

In this simple way, you can buy a call option in Zerodha.

How to Sell Call Options in Zerodha?

Now similar to the buying, you can also sell the call option. In this quick section, we will learn how to sell option in Zerodha, including both call and put versions.

The call option seller, also known as an option writer, is the one who will receive the premium.

So, he/she doesn’t have the right to leave the trade. So he/she will have to be a part of the execution even when the conditions are not favorable.

- Login using your credentials.

- Now you can easily search the scrip which you want to trade-in.

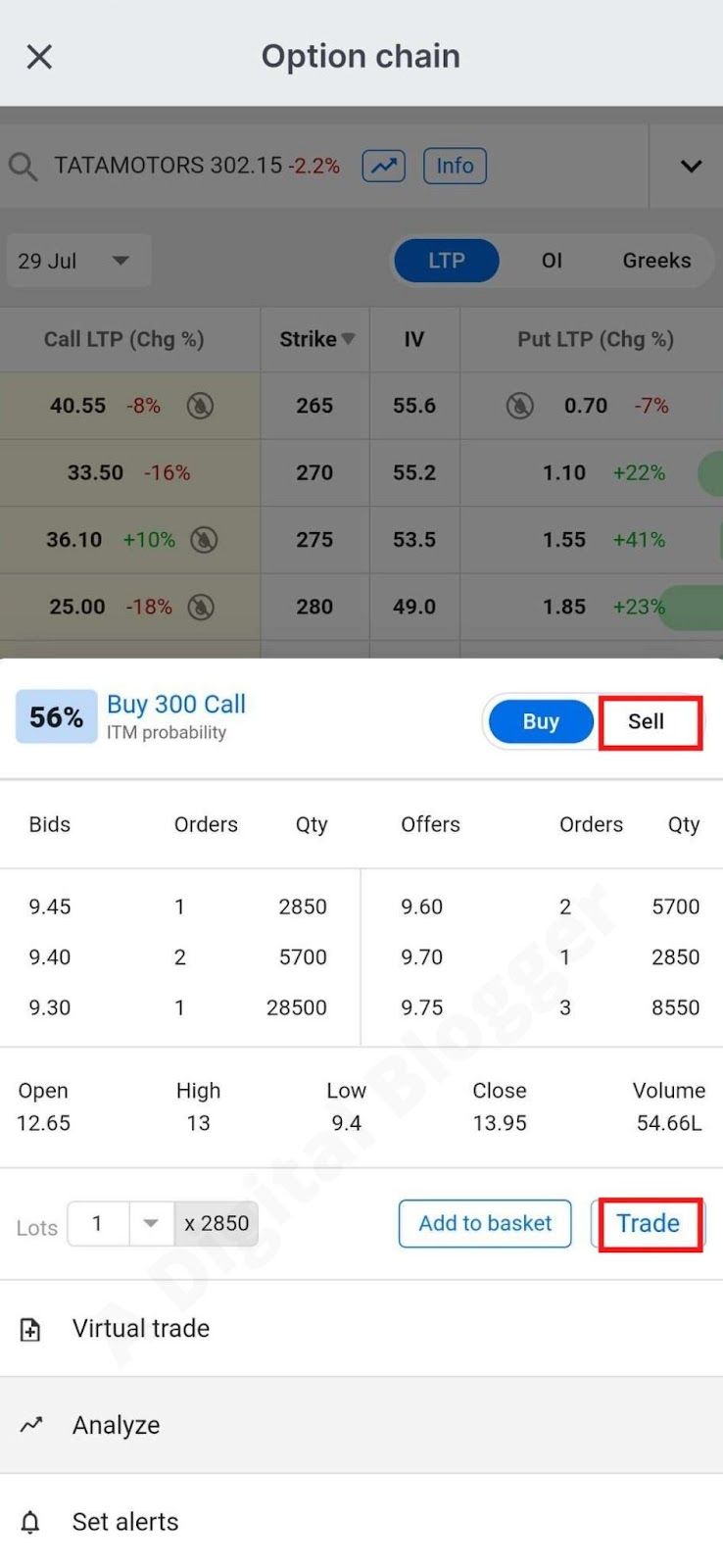

- Look at the option chain and analyze it properly and choose the strike price that suits you the best.

- A window will pop up, choose the sell option and click on trade.

- Now, in the new window, enter the price and quantity and click on place order.

How to Buy Put Options in Zerodha?

What are you bearish on the current market?

What would you do in such a situation?

You can in such cases opt for a put option. In the put option, the seller has bearish sentiments and therefore pays the premium.

In the put option, the seller is actually the put option buyer.

Since the seller here(who is actually the buyer) has paid the premium, he/she has the right to exit the trade at any point in time. Let us now have a look at the steps which you can use to buy put options in Zerodha.

- Easily Login using your credentials and password.

- Now you will see a dashboard, you can easily search for your scrip from the drop-down menu. (PE is used for a put option).

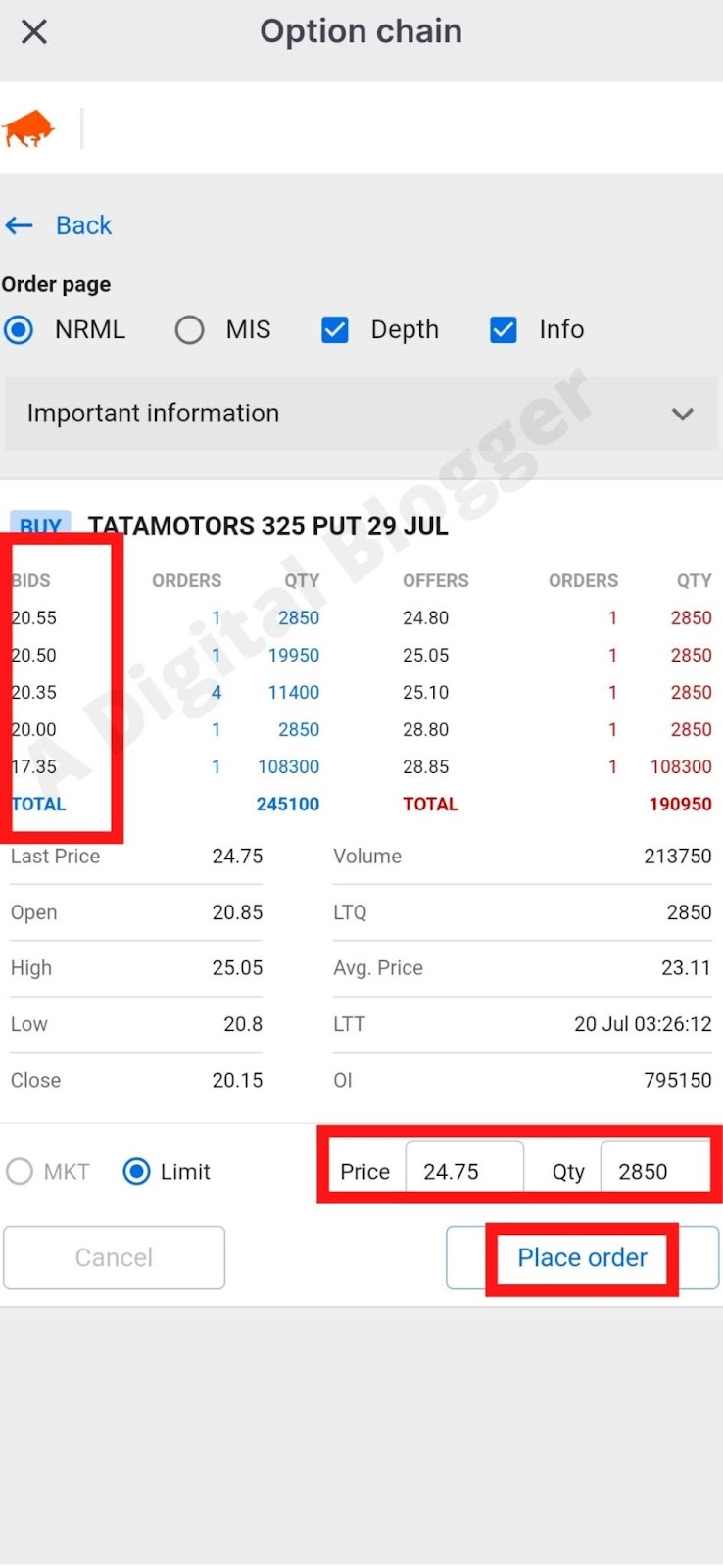

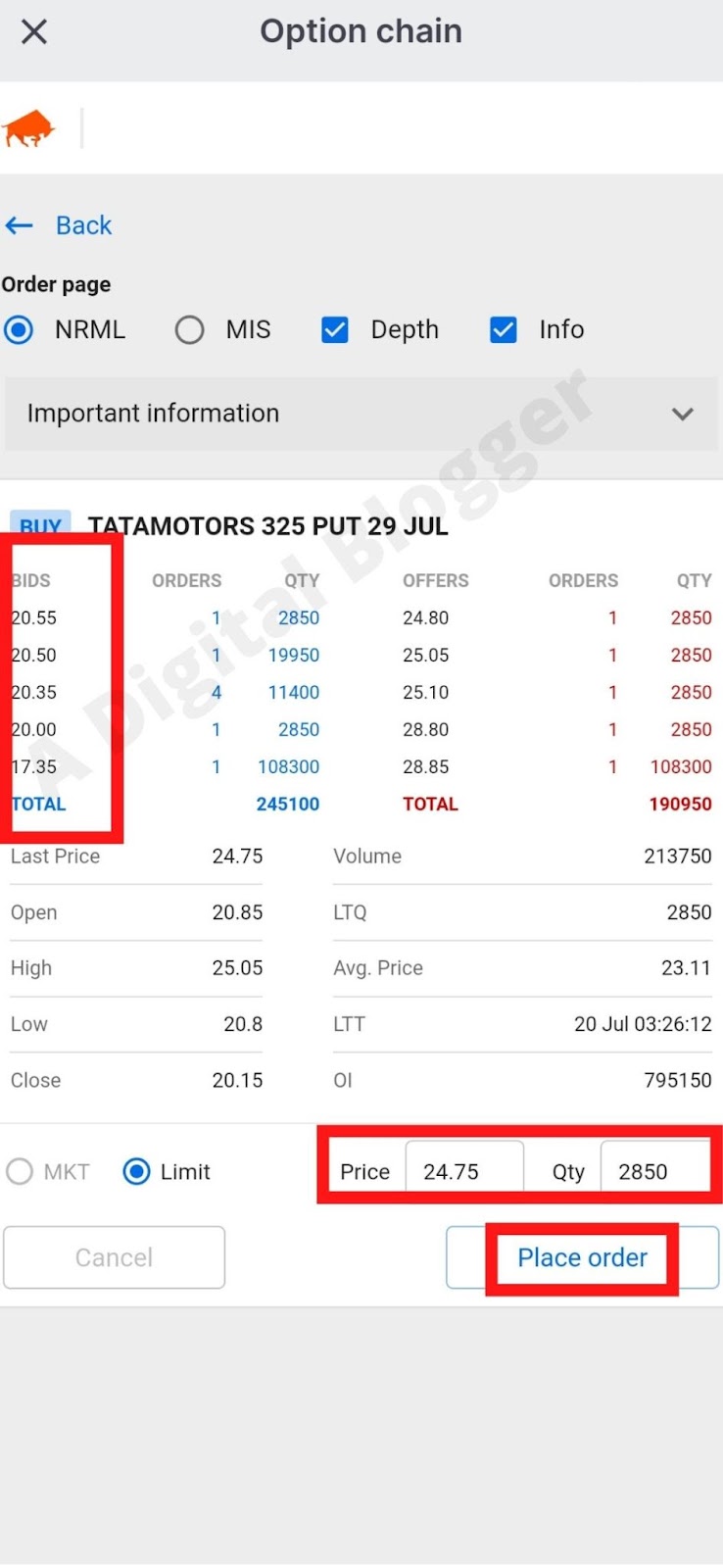

- A window will pop up, you can easily scroll down and open the option chain for a better analysis. You will see the put options on the right-hand side and the strike price in the center.

- Choose the one which is most suitable for you.

- Now click on the buy option and then on ‘trade’.

- A new window will pop up. You will see the different bids here, which is the premium price. Choose the price and quantity and click on place order.

Buying a put option is as simple as that. Zerodha makes sure that you have a seamless experience.

How to Sell Put Options in Zerodha?

Similar to the buying of a put option, you can also sell a put option. In the case of a put option, the buyer is actually the seller since he/she will be receiving the premium. You can sell a put option by following the given steps.

- Log in using your credentials and password.

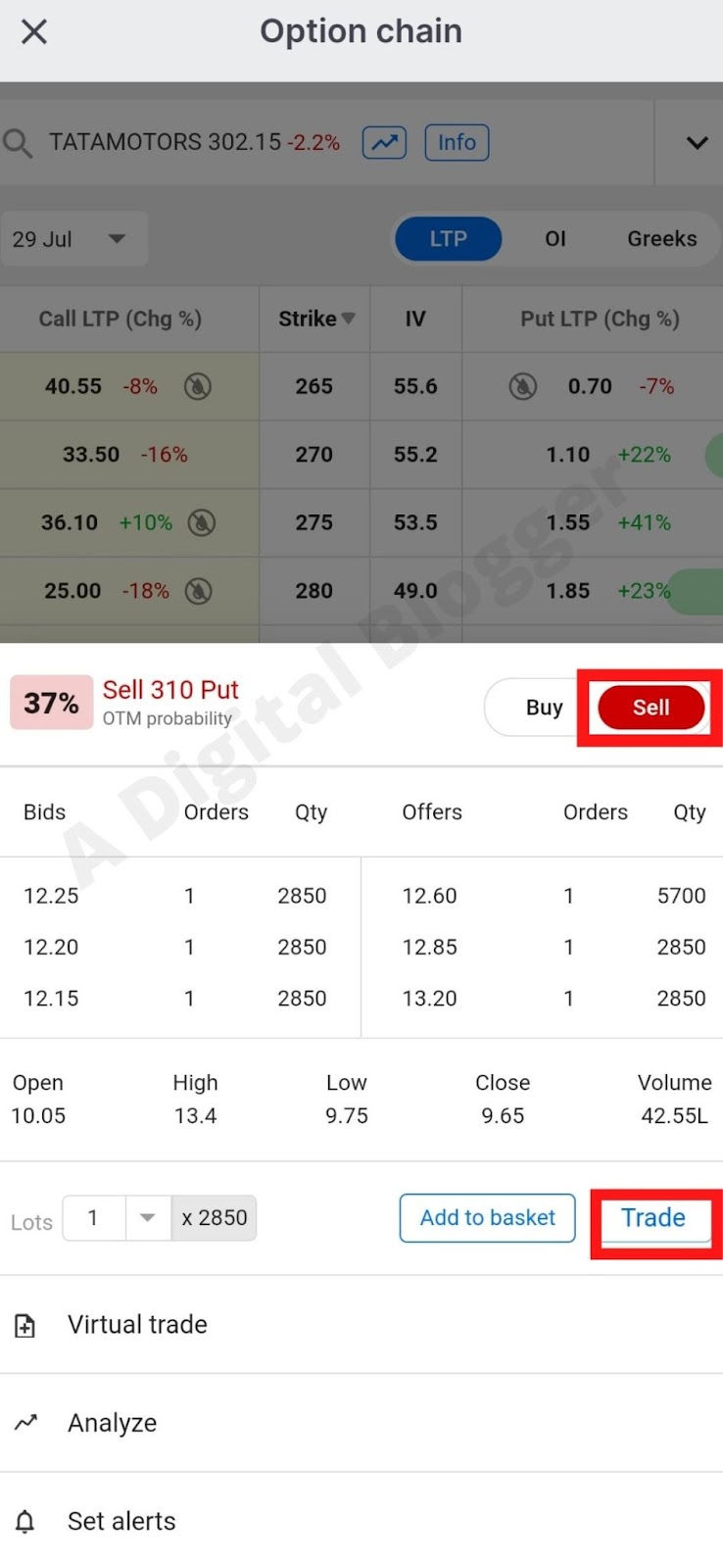

- Search the scrip and select the one that you want.

- You can at this point open the option chain and choose the strike price that you want.

- A window will pop up. Now click on sell and then trade.

- Further, you will see the bid price, now select the quantity and price and click on place order.

Now, what if you have to place multiple orders. What are you going to do, opening the option chain, choosing the strike price and placing an order again and again?

Don’t you think, it will take a lot of time and leads to taking entry at the right time?

If you don’t want to get stuck in such a situation, then you can choose for basket order in Zerodha. It allows you to place multiple multiple trades in the basket and execute them together.

Zerodha Options Charges

Now for buying and selling options, there are brokerage fees that need to be paid. This brokerage varies across the segment. For equity segment option charges are flat ₹20 per trade.

On the other hand for commodity and currency trade, brokerage for options is 0.03% or ₹20 per trade.

Here is the detail in the table below:

| Zerodha Option Trading Charges | |||

| Option Trading Charges | Equity Options | Currency Options | Commodity Options |

| Brokerage charges | Flat Rs. 20 per executed order 0.05% on sell side (on premium | 0.03% or Rs. 20/executed order whichever is lower | 0.03% or Rs. 20/executed order whichever is lower |

| STT/CTT | 0.05% on sell side (on premium) | No STT | 0.05% on sell-side |

| Transaction charges | NSE: 0.053%(on premium) | NSE: Exchange Taxation charge: BSE: 0.001% | Exchange Taxation charge: 0.05% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI Charges | ₹10/Crore | ₹10/Crore | ₹10/Crore |

| Stamp Charges | 0.003% or Rs. 300 / Crore on buy-side | 0.0001% or Rs. 10/Crore on buy-side | 0.003% or Rs. 30/Crore on buy-side |

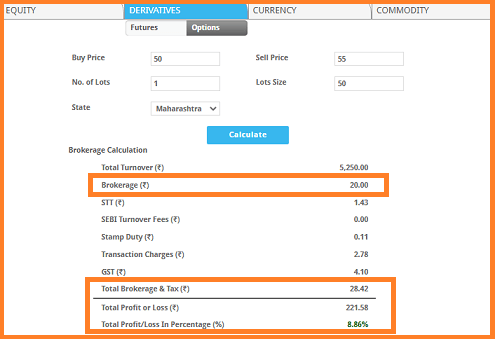

Brokerage Calculator Zerodha Options

Now as you can see there is a taxes and other fees associated with the Zerodha option trade. This often makes it difficult for traders to calculate the overall brokerage and charges.

To simplify this, here are the brokerage calculator Zerodha options that calculate stamp duty, STT charges etc.

Conclusion

Options trading can look a little intimidating at first but with the right option strategies, you can definitely earn good returns.

Zerodha gives you a chance to smoothly and seamlessly trade-in options.

So, if you don’t have a Demat account, open it today and explore the world of options: