Swing Trading Setup

More on Online Share Trading

Are you looking for a swing trading setup? Do you completely understand how it actually works? In this detailed review, we will assist you in taking it forward, but before that, let’s take a step back and understand this form of trading in the first place!

Swing trading is a technique where traders make profits from the swings coming at stock prices in either direction. This format of trading is generally done for short to intermediate-term, more like a one-day international game in the context of Cricket.

It is different from intraday trading because, in intraday trading, the trades are squared off within the same trading day before the closing of the trading session whereas, in swing trading, the trades are normally kept overnight and usually squared off within a few days or sometimes weeks.

Swing Trading Setup India

With a proper swing trading setup, you could achieve a profit of around 5% – 10% in a short time which seems quite good.

In order to start swing trading successfully, you need to have a little knowledge about fundamental as well as technical analysis of stocks.

Knowledge about technical analysis and technical indicators is needed in order to identify patterns of stock prices and the points at which the trades should be entered as well as squared off.

The information about technical indicators and how to use them effectively in a live share market is a MUST for swing traders.

Knowledge about fundamental analysis of stocks is required to know the intrinsic values of stocks. Now, the question arises that how to select stocks for swing trading and which setups to use?

Well, the selection of stocks should be done on the basis of the volatility of stocks and liquidity.

The stocks selected for swing trading should be volatile or should show good price movements within a few days and the other thing is liquidity.

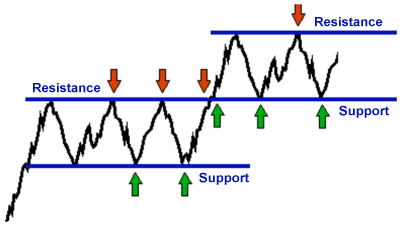

It is one of the most important things to check because it becomes very difficult to enter a trade as well as the square it off if the liquidity is not enough in the stock. In order to make an effective swing trading setup, you should be aware of some basics like resistance and support levels on technical charts.

The resistance level is that level on a technical chart where the bearish forces start to appear and overpower the bullish forces. The bears at this level tend to make it difficult for bulls to take the price further higher.

On the other hand, a support level is that level on a technical chart where the bullish forces start to appear and overpower the bearish forces. The bulls at this level tend to make it difficult for bears to take the price further lower. Here is a picture to show resistance and support levels on a technical chart.

There are some swing trading strategies that work in stock markets if practised properly. I am going to discuss one of them that has worked for me before.

You can learn all these complex concepts and strategies of swing trading in some of the available swing trading books. Picking the right book helps you in understanding how and when to take a right position in the market.

Swing Trading Setup Strategy

This is one of the most commonly used strategies in the context of a swing trading setup.

This setup is made by observing how the stock price reacts at specific levels of support as well as resistance. As we know, at resistance and support levels, trend reversal call takes place.

If you want to confirm that if the trend is going to reverse after reaching support or resistance levels, you should check the volumes of trades done at those levels.

If it is accompanied by huge volumes, then, it could signal to reverse the trend. And a trade entered into at the right time could give you good profits in a short interval of time.

There are different technical and best intraday trading indicators that can help you decide the entry point and exit point of a trade. While initiating any trade through swing trading, you should know about three different points where you need to take action.

The first one is the entry point where you initiate a trade. The second one is the exit point where you need to square off the trade.

One should maintain discipline here and square off without getting stuck in the greed for earning more profits. As we know, things can turn around quite quickly in stock markets.

And the last point, without any doubt, is stop-loss which is one of the most important things to remember.

Even the best of the best traders do not have a 100% probability of winning all the trades. A pre-defined stop loss would protect you from making huge losses.

If you are a beginner and want to know the basics of fundamental as well as technical analysis in order to trade effectively, you should consider downloading a stock market education app called Stock Pathshala and take some very good short online courses on these subjects.

If you select the beginner level of this app, you would be shown stock courses on different things and specific courses n fundamental analysis, financial ratios, technical analysis, technical indicators and oscillators.

Furthermore, if you wish to kick-start your trading journey, let us assist you in taking the next steps towards account opening.

Just fill in the form below to get started: