Trading in options without any strategy is like jumping from a plane without a parachute. There is a 99% chance that you will end up in some other world (1% for any miracle that may possibly happen).

Furthermore, it needs to be known that there are various kinds of option strategies out there.

You need to figure out and pick the ones that work the best for you, specifically for you!

Now, this choice must be made objectively based on aspects such as your risk appetite, your trading experience, profit expectations, trading intentions and expectations, and so on.

In this detailed review of Option Strategies Comparisons, we will be looking at some of the top option strategies, corresponding option strategies comparisons, and other related information.

The intent of this detailed review is to make sure you understand different strategies and then by the end of the review, cherry pick that you are going to use in your stock market trades.

Let’s go one by one.

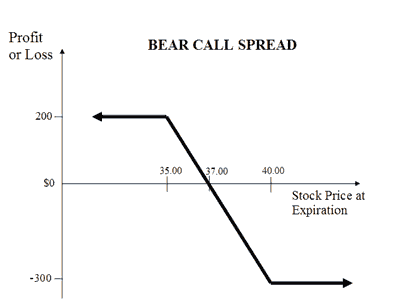

Bear Call Spread

The bear call spread consists of two calls, both with the same underlying asset and expiration date, but the strike price of the call options bought is less than the strike price of the same number of call options sold.

Like most of the spread strategies, it is a limited-risk limited-reward strategy…more

Market Position: Moderately Bearish

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

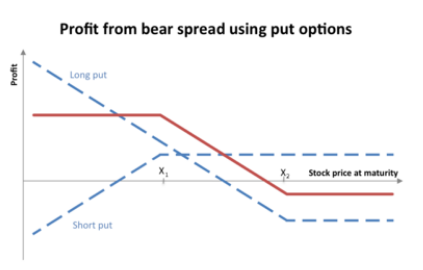

Bear Put Spread

Bear Put Spread is a type of vertical spread wherein the trader buys a put option hoping to make a profit due to the market decline, and at the same time writes another put option with the same expiration date but with a lower strike price to balance some of the cost…more

Market Position: Moderately Bearish

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

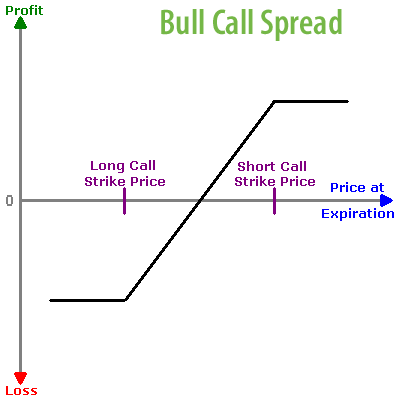

Bull Call Spread

Bull Call Spread is a vertical options strategy that involves buying and selling two option contracts simultaneously, both with the same underlying security and expiry, but different strike prices.

Call options are bought at a specific strike price, along with selling the same number of call options with the same underlying asset and a higher strike price…more

Market Position: Moderately Bullish

Suitable for: Beginners

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

Bull Put Spread

Bull Put Spread comes into play when the trader is expecting the market is going up gradually, but moderately. So, this is also suitable for a moderately bullish forecast, just like the bull call option.

The payoffs from both bull call spread and bull put spread are similar, but the situations in which both can be used differ…more

Market Position: Moderately Bullish

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

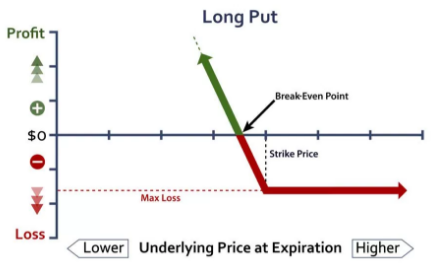

Long Put

Long Put is used when the trader has a bearish view on the market and expects the price of the asset to go down. He will then wait for the prices to go down and then exercise his option.

If the price goes up, he can choose to not exercise his option and let it expire worthlessly. The only loss will be the amount of premium paid…more

Market Position: Bearish

Suitable for: Beginners

Risk: Limited

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

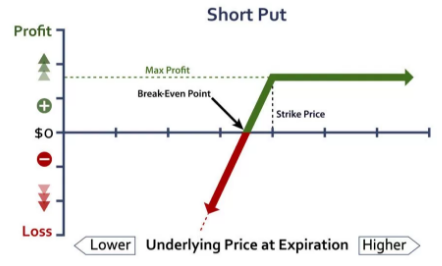

Short Put

The short put strategy is also called naked put or uncovered put. The investor does not need to own the shares or assets before writing a put option on them.

If the buyer wishes to exercise the option, the seller will then need to buy the securities at a higher price and sell them to the buyer of the put option…more

Market Position: Bullish

Suitable for: Beginners

Risk: Unlimited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

Long Call

Long call means buying a call option. This means the trader has the right to buy a security at a future date at a predefined price. The term long itself means buying security or buying an option.

In the case of a long call, it means buying a call option…more

Market Position: Bullish

Suitable for: Intermediates

Risk: Limited to Premium

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

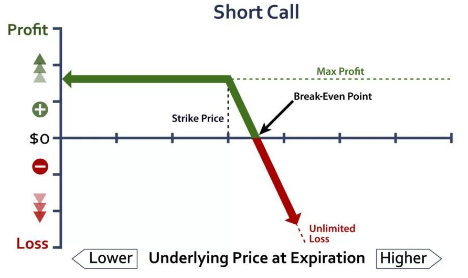

Short Call

When the trader expects that the price of the underlying asset will go down sharply, he shorts a call. If the price of the asset goes down, the strategy generates profit.

However, if the price of the asset goes up against the expectation, the trader is obligated to exercise the option and buy the security at a higher price…more

Market Position: Bearish

Suitable for: Experts

Risk: Unlimited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

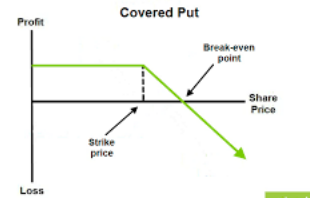

Covered Put

The covered put strategy is constructed by taking a short position on the stock and combining it with writing a put option of the same stock. The writing of put option gives the strategy a net credit.

If the stock price at the time of expiration is more than the strike price of the put option, the option can expire worthlessly…more

Market Position: Neutral or Slightly Bearish

Suitable for: Experts

Risk: Unlimited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

Covered Call

The covered call strategy works well when the trader is mildly bullish towards the market. He knows that by only holding the underlying asset, he will not be able to make a good profit.

So, he sells call options on the security, at a higher strike price, and receives premiums till that strike price is reached…more

Market Position: Moderately Bullish or Neutral

Suitable for: Beginners

Risk: Unlimited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

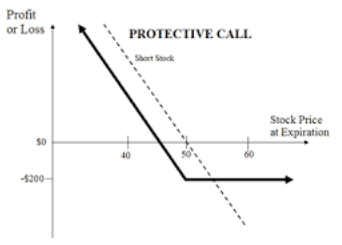

Protective Call

The protective call is a protection against the price reversal and works like an insurance policy. The profits expected can be retained and the losses can be averted with the right use of a protective call…more

Market Position: Moderately Bullish or Neutral

Suitable for: Beginners

Risk: Unlimited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

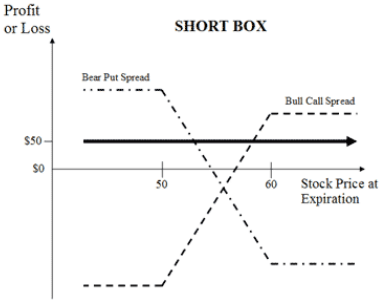

Short Box

Short box is the exact opposite of the box spread. In box-spread, the spreads are bought, whereas in short box the spreads are sold.

The condition for using a short box is when the spreads are overpriced compared to their combined value at expiration…more

Market Position: Neutral

Suitable for: Experts

Risk: No Risk

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

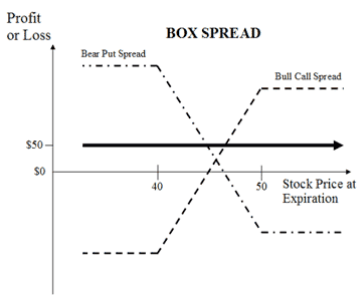

Box Spread

The box spread is constructed by combining the components of a bull call spread and a bear put spread.

It has four legs and comprises of buying one in-the-money call, selling one out-of-the-money call, buying one in-the-money put and selling one out-of-the-money put…more

Market Position: Neutral

Suitable for: Intermediates

Risk: No Risk

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

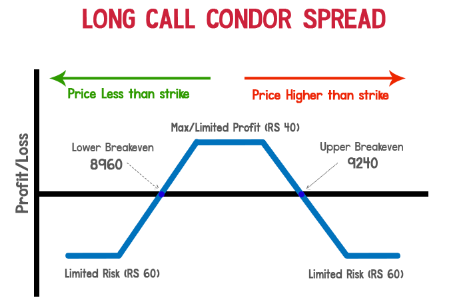

Long Call Condor

Long call condor is the options trading strategy which includes four legs, made up of four different call options with different strike prices, but same expiration date.

The strategy is used when the trader expects little or no movement in the price of the underlying asset…more

Market Position: Neutral

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

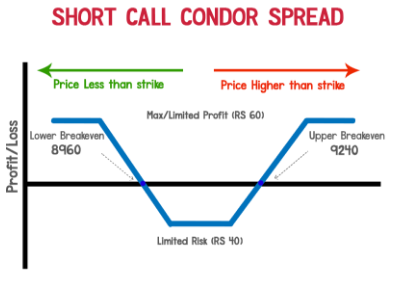

Short Call Condor

Short call condor is a four-legged strategy and is formed by the combination of selling one in-the-money call, buying one lower middle strike ITM call, buying one higher middle strike OTM call and selling one OTM highest strike call…more

Market Position: Neutral

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

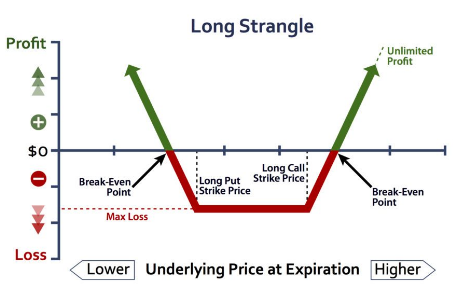

Long Strangle

Long Strangle is an options trading strategy that involves buying an out-of-the-money call option and an out-of-the-money put option, both with the same underlying asset and expiration date.

In this regards, it is similar to a long straddle, but the difference is that the call options and put options are at different strike prices in a long strangle…more

Market Position: Neutral

Suitable for: Intermediates

Risk: Limited

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

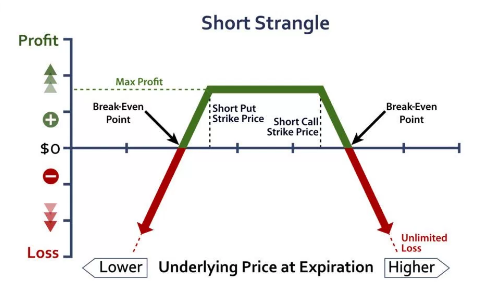

Short Strangle

Short strangle is formed by writing one slightly out-of-the-money put option and writing a slightly out-of-the-money call option, both for the same underlying asset and with the same expiration date.

Short strangle differs from short straddle in the way that the strike prices for both the options are different in short strangle…more

Market Position: Neutral

Suitable for: Experts

Risk: Limited

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

Long Straddle

This options trading strategy has the potential to give unlimited rewards, with limited risks. The trader is able to trade based on his conviction that the markets will move, without being concerned about the direction of the movement.

Therefore, a long straddle is a market-neutral strategy, based on high implied volatility…more

Market Position: Neutral

Suitable for: Beginners

Risk: Limited

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

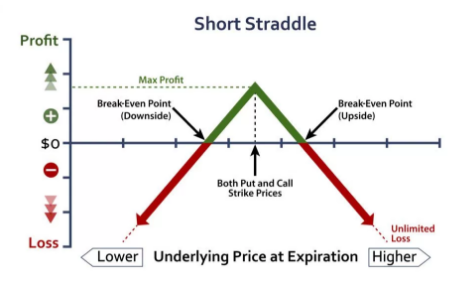

Short Straddle

Using the short straddle strategy, the investor makes an upfront gain through the premiums collected by writing the call and put options.

The investor expects that there will be no movement in the market and is able to make money even with no price movement…more

Market Position: Neutral

Suitable for: Experts

Risk: Unlimited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

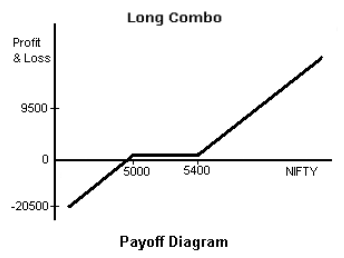

Long Combo

The long combo is used when the investor is bullish towards the market and is certain that the prices of the shares will go up.

In this case, the trader sells one out-of-the-money put option and buys one out-of-the-money call option. The put option is at a lower strike price and the call option is at a higher strike price…more

Market Position: Bullish

Suitable for: Intermediates

Risk: Unlimited

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

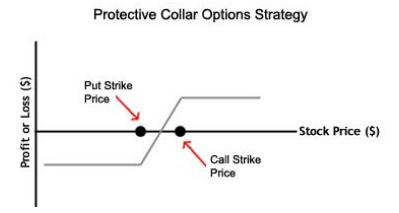

Collar Strategy

Collar strategy is an options trading strategy which is used when the trader wishes to protect himself from the downward move in the market.

In the collar strategy, the trader holds the underlying security, along with selling an out-of-the-money call option and buying an out-of-the-money put option…more

Market Position: Moderately Bullish

Suitable for: Experts

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

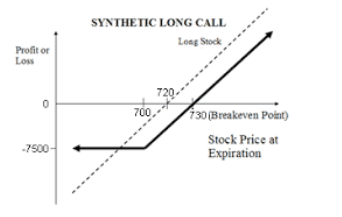

Synthetic Call

A synthetic position is the one option trading strategy in which a trading position is created to look like the characteristics of another position. This strategy can be used for avoiding Option Trading Mistakes.

In other words, using any synthetic strategy, same risk and reward profile are created, as it could have been in the equivalent position…more

Market Position: Bullish

Suitable for: Beginners

Risk: Limited

Profit: Unlimited

Here are some other Option Strategies Comparisons for your reference:

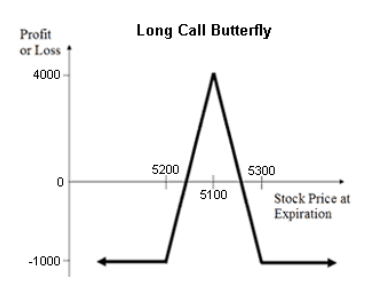

Long Call Butterfly

Long Call Butterfly is the options trading strategy which is used when the trader has a neutral outlook towards the market and expects the prices to remain range-bound.

The trader believes that there will not be much movement in the prices of the underlying asset…more

Market Position: Neutral

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

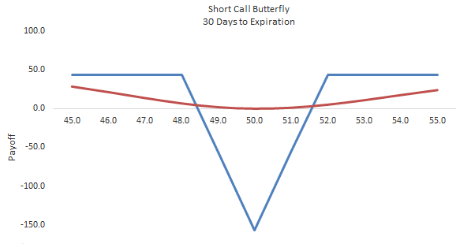

Short Call Butterfly

Short Call Butterfly is the options strategy which is used when the trader expects a lot of volatility in the market. It is the opposite of the long call butterfly, in which the investor expects no volatility at all.

It is a neutral strategy in terms of the trend but the purpose is to protect against the high volatility…more

Market Position: Neutral

Suitable for: Intermediates

Risk: Limited

Profit: Limited

Here are some other Option Strategies Comparisons for your reference:

In case you are looking to get started with options trading or stock market investments in general, let us assist you in taking the next steps forward.