Bull Call Spread

All Option Strategies

When it comes to Bull Call Spread or most of the options trading strategies, a lot of traders either get confused or they end up facing losses. Here in this quick review, we have tried to explain the whole concept with the help of an example along with a video review.

But before we jump into the meat of the topic, let’s understand some of the basics related to Bull Call Spread options strategy.

Bull Call Spread Strategy

Options Trading is a phenomenon that requires a lot of knowledge, keenness to learn, skills and of course patience.

The seasoned options traders have their own ways and strategies to ensure that their objectives of high profits and low risks are met in the most effective manner.

A novice may jump into options trading without much know-how and end up in losses, whereas seasoned traders use their experience and efforts to form a strategy design that helps them to avoid Option Trading Mistakes.

One of the most successful strategies in options trading is Spreads.

Bull Call Spread Meaning

In basic options trading, call options or put options are bought or sold at a single strike price, with the same options expiration date and with one underlying security.

However, Spreads give the option to combine different strike prices, different expiration dates and also sometimes different underlying assets to form a strategy.

Basically, a spread is the combination of two or more options contracts, which are known as the legs of the spread. Thus, by combining two or more legs, the trader is often able to take positions on both sides of the market which creates dynamics that are opposite to each other and help to counterbalance risks.

Spreads can be formed in multiple ways, combining different variables.

Vertical spreads, in particular, are the spreads in which one option is bought and the other is sold simultaneously, with the same underlying asset and same expiration date, but different strike prices. The rewards are less but so are the risks. One of the most efficient vertical spread strategies is the Bull Call Spread.

Bull Call Spread is a vertical options strategy that involves buying and selling two option contracts simultaneously, both with the same underlying security and expiry, but different strike prices.

Call options are bought at a specific strike price, along with selling the same number of call options with the same underlying asset and a higher strike price.

The exact construction of a bull call spread involves buying an at-the-money call option and selling a higher strike price out-of-money call option of the same asset with the same expiration date simultaneously.

Fundamentally, bull call spread is best used when the trader is expecting the prices of the securities to go up moderately. So it is best suitable for a moderately bullish forecast.

The benefit of it is that it limits the risks but the drawback is that it caps the profits too. All in all, the trader can protect himself from higher risks but is also capping his profits.

Bull Call Spread Example:

Let’s make this tutorial relatively easier by taking a real-life example:

- Let us consider that Nifty Spot is at 6846 on March 30, 2018, and the ATM call option is at ₹6800 with a premium of ₹69 and the OTM call option is at ₹6900 with a premium of ₹15.

- When the bull call spread is set up, the 6800 call option is bought by paying a ₹69 premium and 6900 call option is sold by receiving ₹15 as premium. Thus, the net cash flow is ₹(69-15)=₹54.

- If the market closes at 6700, which is less than the lower strike price, call options will have zero intrinsic value and premium ₹69 is lost along with a gain of ₹15 in premium with net debt of ₹54.

- If the market closes at 6800, which is the lower strike price, both call options will have zero intrinsic value and the net debt will again be ₹54.

- If the market closes at 6900, which is the higher strike price, the intrinsic value of 6800 call option will be 6900-6800=100, and after paying a premium of 69, the net profit will be ₹31; and the intrinsic value of 6900 call option will be zero and a premium of ₹15 is received, making the total profit ₹(31+15)=₹46.

- If the market closes at 7000, which is higher than the higher strike price, the intrinsic value of 6800 call option will be 7000-6800=200, and after paying a premium of ₹69, the net profit will be ₹131; and the intrinsic value of 6900 call option will be 7000-6900=100 and a premium of ₹15 is received, making the net profit ₹(100-15)=₹85, the total profit being ₹(131-85)=₹46.

Bull Call Spread Diagram

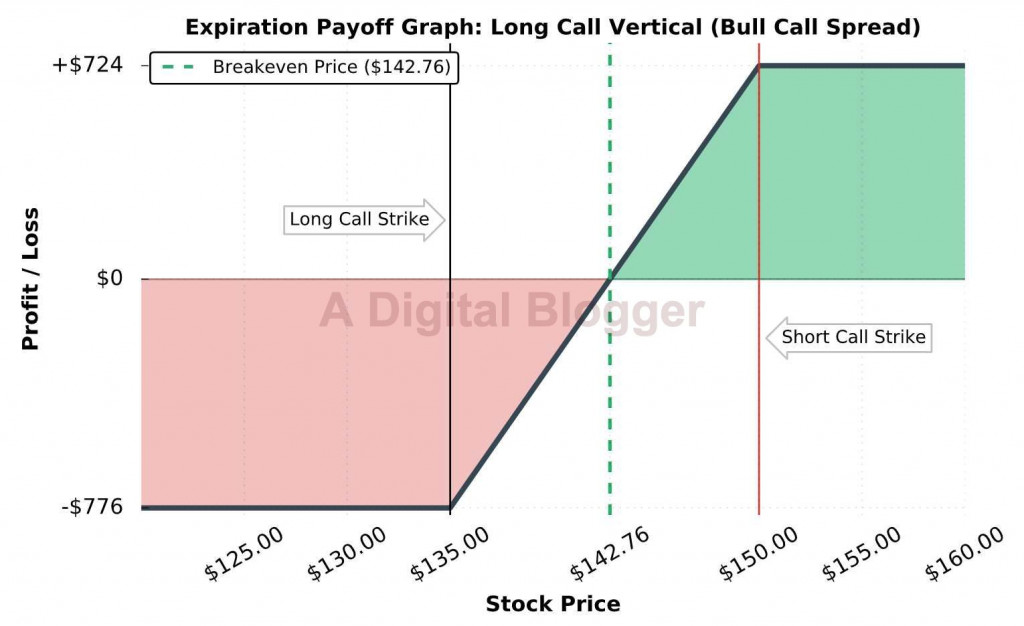

Although, we have shared the Bull Call Spread diagram above, here are few other versions of it for your reference along with a quick summary:

This is a representation of an expiration payoff graph and if you look at the above Bull Call Spread diagram closely, you will find a couple of strike points i.e. Long Call Strike and the Short Call Strike.

These price points basically imply the strike prices for both long and short calls respectively while the Breakeven price is somewhere in the middle of these two.

Bull Call Spread Risk

When it comes to risk, this strategy brings in a very limited amount of it. In fact, you would know the exact monetary amount of risk you are getting into while you go ahead with this strategy.

If in case, the stock price goes down and is actually lower than the strike price, then this strategy fails and brings loss to you.

And the loss would be the premium you paid to get into the contract (plus, the brokerage charges or some taxes you pay for any trade).

Thus, you’d know the exact amount of risk you are taking in a Bull Call Spread strategy right at the start.

Bull Call Spread Max Profit

Since in this strategy, you are into two positions are the same time – one long and one short, thus, you’d need to consider 2 strike prices while calculating your profit.

The maximum profit you can churn out in a bull call spread strategy can be calculated as:

Profit = Short Call Strike Price – Long Call Strike Price – Net Premium – Brokerage – Taxes

Where,

Short Call Strike Price = is the strike price of the call where you have gone short

Long Call Strike Price = is the strike price of the call where you have gone long

Net Premium = is the difference between the premium paid and premium received

Brokerage = is the amount of commission paid to the broker

Taxes = are the different charges paid to the regulatory bodies and state/central government duties.

Bull Call Spread Breakeven

Before calculating the breakeven price point for the bull call spread, we need to understand what exactly is a breakeven point?

Well, the price point where you neither make a loss nor a profit, is where your breakeven point is!

In the bull call spread strategy case, your breakeven point is the sum of the strike price of the option purchased and the net premium paid (explained above).

Let’s take a quick example to understand this.

A trader Ravish Kumar purchased a call option priced at ₹120 for ₹2 and sold out the ₹140 option for ₹0.50.

Here, the strike price for the purchase option is ₹120 and the net premium was ₹(2 – 0.50) i.e. ₹1.50

Therefore, the breakeven point, in this case, will be ₹120 + ₹1.5 i.e. ₹121.50.

In other words, if the stock price reaches at ₹121.50, then Ravish Kumar will breakeven and neither make a profit nor take a loss.

Bull Call Spread Margin Requirements

When you enter into a bull call spread strategy, you need to have a specific amount of margin in your trading account.

Not having this margin amount will either not allow you to place the trade or will directly call for an invite towards a margin call.

The calculation of the margin required is pretty straight-forward where you first find the difference between the premium paid and premium received amounts and then add that difference to the sell turnover amount.

Although, some might term this margin amount is to be unnecessarily high, there are specific reasons for having such an amount as per the recommendations of SEBI.

The rationale behind this is that there is a possibility that the trader closes one of the two positions and keeps the other open. When that happens, the broker gets exposed to unnecessary risk and thus, it must be the trader’s call whether to go ahead with such a strategy.

Bull Call Spread Adjustments

There are specific adjustments that you can do while using the bull call spread strategy on your trades. These adjustments may differ depending on the market movements and your objectives of the trade.

1. If the stock price movement is relatively slow as compared to the expected profits you are looking forward to, then you can tweak the expiry date to a nearer-term or lower the strike price itself.

2. If the stock price for a bull call spread starts moving down, then an adjustment towards a bear call spread can also be done.

These adjustments need to be done at the right moments post your analysis of the market trends and movements, else it will only be bringing confusions in your trades resulting in losses.

Bull Call Spread Zerodha

Like other stockbrokers, the trading platforms offered by Zerodha also allow you to use bull call spread in your trades.

However, the margin requirements are an area of concern as those are much higher as compared to the overall trade risk (reason explained above in the Bull Call Spread Margin section).

Make sure you find out the margin needed for the stock you are getting the contract of before placing your trade at both buy and sell levels.

Bull Call Spread Risks and Advantages

From the example stated above, we can clearly understand the advantages and drawbacks of a bull call spread.

- The advantage is that the downside risk will always be limited, and the loss will be restricted to the net debt of the strategy, which is ₹54 in this case.

- The drawback is that the profit is also capped. In any situation, the profit can only be the difference between the spread and the net debt of the strategy, which is ₹(100-54)=₹46 in this case.

In case, you have made up your mind to go ahead with share market trading or looking for some information around a trading account – just fill in some basic details below.

A callback will be arranged for you:

More on Share Market Education:

If you wish to learn more about options trading, strategies or stock market investments in general, let us assist you in taking the next steps forward.

Just fill in some basic details in the form below to get started: