Bull Put Spread

All Option Strategies

Options Spread is an effective way of trading options.

Spreads are the building blocks of the options strategies. They are formed by entering into two or more options contracts by buying and selling the same number of options, with different strike prices, sometimes different options expiration dates and also different underlying assets.

Bull Put Spread Basics

Vertical spreads, in particular, are the spreads in which one option is bought and the other is sold simultaneously, with the same underlying asset and same expiration date, but different strike prices. The different options contracts for the legs of the spread and help in counterbalancing each other’s effects.

One of the most effective options strategies is the Bull Put Spread.

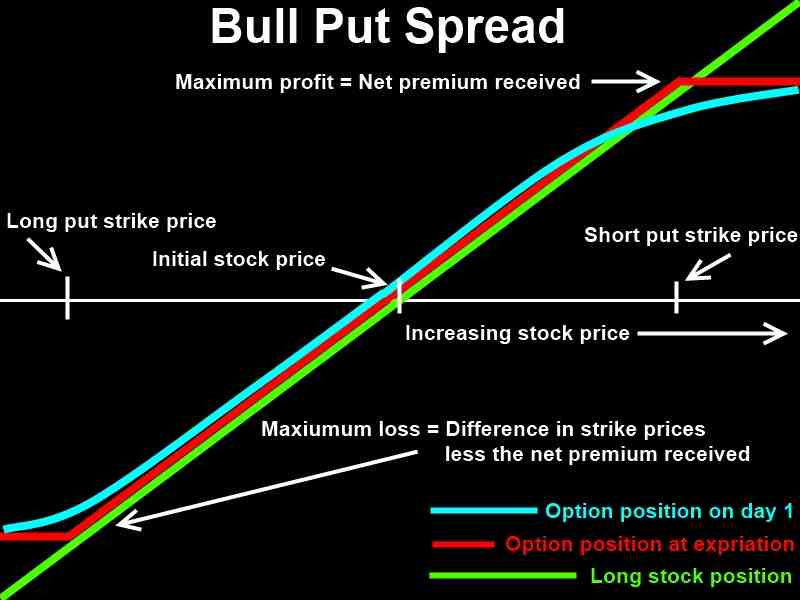

It is a vertical spread, that involves buying and selling two put option contracts simultaneously, both with the same underlying security and expiry, but different strike prices. Put options are bought at a specific strike price, along with selling the same number of put options with the same underlying asset and a higher strike price.

The exact construction of a bull put spread involves buying an out-of-the-money put option and selling a lower strike price in-the-money put option of the same asset with same expiration date simultaneously.

Bull Put Spread comes into play when the trader is expecting the market is going up gradually, but moderately. So, this is also suitable for a moderately bullish forecast, just like the bull call option. The payoffs from both bull call spread and bull put spread are similar, but the situations in which both can be used differ.

The bull call spread is used for the net debit, whereas the bull put spread is used for a net credit, which means that upfront payment is received at setting up a bull put spread. So, bull put spread is more ideal if there is very high volatility in the market, time to the expiration date is more and the market has declined considerably.

Bull Put Spread Example:

- Let us consider that Nifty Spot is at 6805 on March 20, 2018, and the OTM put option is at ₹6700 with a premium of ₹62 and the ITM put option is at ₹6900 with a premium of ₹153. The trader expects the market to go higher. The cash flow of this transaction is ₹(153-62)=₹91.

- If the market closes at 6600, which is less than the lower strike price, the intrinsic value of 6700 put option is ₹(6700-6600)=₹100, and a premium of ₹62 is paid, so the trader makes ₹(100-62)=₹38; and the 6900 put option has an intrinsic value of ₹(6900-6700) = ₹300, and a premium of ₹153 is paid, so the trader makes ₹(153-300) = -₹147. The strategy payoff will be ₹(+38-147) = -₹109.

- If the market closes at 6700, which is the lower strike price, the 6700 put option will have no intrinsic value and there will be a loss of premium= -₹62, and the intrinsic value of 6900 put option will be ₹(6900-6700) = ₹200, plus a premium of ₹153 will be received. The total payoff will be ₹(153-200-62)= -₹109.

- If the market closes at 6900, which is the higher strike price, the intrinsic values of both the put options will be zero and the net payoff of the strategy will be the premium received-premium paid = ₹(153-62)= ₹91.

- If the market closes at 7000, which is higher than the higher strike price, the intrinsic values of both the put options will be zero and the net payoff of the strategy will be the premium received-premium paid = ₹(153-62)= ₹91.

Bull Put Spread Advantages and Drawbacks

Based on the above-mentioned example, we can explain the benefits and the drawbacks of entering into a bull put spread strategy.

- The strategy works when the market is moving higher.

- The advantage is that the maximum loss is capped at the difference between the spread and credit of the strategy, which is Rs 109 in the above case.

- The drawback is that profit is also capped, and it is equal to the net credit of the strategy, which is equal to Rs 91 in this case.

In case, you have made up your mind to go ahead with share market trading or looking for some information around a trading account – just fill in some basic details below.

A callback will be arranged for you:

More on Share Market Education:

You can read this review in Hindi as well.