Covered Call

All Option Strategies

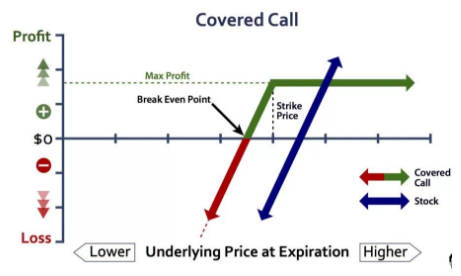

Covered call is an options strategy that combines owning the underlying asset, along with an options contract on the underlying.

The trader holds a long position in a security and at the same time, he writes the call option on the same security to generate income through premiums.

Covered Call Strategy

The covered call strategy works well when the trader is mildly bullish towards the market. He knows that by only holding the underlying asset, he will not be able to make a good profit.

So, he sells call options on the security, at a higher strike price, and receives premiums till that strike price is reached.

Since the trader is mildly bullish or almost neutral, the higher strike price will not be reached and he will receive premiums till the expiry of the options contract.

The strategy offers limited profit to the trader, however, the loss can be unlimited as the trader has not protected himself against the downward price movement. Thus, the strategy can be used to avoid Option trading mistakes.

Therefore, this strategy needs to be used very cautiously and only when the trader is quite certain that there will not be much price movements.

Thus, in order to create a covered call trade, the trader must buy or already own a certain number of shares and then sell an out-of-the-money call option for the same number of shares at a higher strike price.

The trader then waits for the call option to either get exercised or expire.

If it expires, the trader retains his shares and also earns a steady income through the premiums till expiry.

Covered Call Option Timing

The suitable time to use a covered call option strategy is when the investor is only moderately bullish or neutral towards the market. He expects that the price will neither move up nor go down too much.

Without the increase in the price of the underlying asset, he can still manage to earn a constant income from his holdings by writing a call option on the security and receive premiums.

This strategy is absolutely not suitable in circumstances when the investor is highly bullish or bearish towards the market prices. If he expects the prices to go very high, he is better off just holding the underlying asset.

In that case, he will earn due to the price rise and his profits will not be limited or capped by the call option.

In the case when the trader is highly bearish on the asset prices, he must rather sell the stock and prevent losses, rather than writing a call option.

If the price goes very low, the premiums received will not be enough to compensate for the loss on the stock.

The maximum profit in covered call strategy is limited to the difference between the strike price of the call option and the purchase price of the underlying, plus the premiums received from selling the call option.

The maximum loss in this strategy is unlimited.

It depends upon how much the price of the underlying asset falls. The only saviour is the premium received on selling the call option.

Covered Call Writing

When somebody says they are looking to go ahead with Covered Call writing, this simply implies that they are looking to sell off the right to buy a stock they currently own.

Let’s say you have 100 shares of Infosys and you are not much bullish about this particular stock in the near future.

This situation gives you a chance to write a covered call for these Infosys shares at a price you think is reasonable for a nearby options expiration date.

Obviously, you will get a premium for putting that covered call for writing.

But while you set out the premium price and choose the expiration date, make sure you perform a quick check on what is happening around the industry of that stock (IT, in this case) at domestic as well as global level.

Also, keep your ears open on any kinds of deals, acquisitions, policies getting announced not only by the company in question but also by its closest competition.

Covered Call Payoff

When you are down to calculating payoff from a covered call, then you need to take care of a few variables in order to come down to the number.

First of all, you need to calculate the value of the covered call, which is equal to the difference between the price of the underlying asset at the exercise date and the maximum value out of Zero and the difference between the asset price at the exercise date and the exercise price.

These values can be easily deduced with the help of a couple of paragraphs.

Make sure you go slow with the next section to understand this concept clearly.

Covered Call Formula

Simply it can be calculated as:

CCV= PU – MAX [0 or PU – EP]

where,

CCV: Covered Call Value

PU: Price of the underlying asset at the exercise date

EP: Exercise Price

The next thing you need to calculate is the profit from this covered call, right?

Calculating that value is an extension to what we just calculated above.

Profit = CCV – PS + Premium

where,

PS: is the price of the asset at the start of the strategy and of course Premium is the price paid by the buyer to the covered call seller/writer.

If you are confused, it is suggested that you re-read the above 2 formulae.

Covered Call Returns

In order to calculate covered call returns, again there is a formula that you need to use.

You must be circumspect of the different formulae used across calculations in order to be completely objective about your risks and returns.

When it comes to covered call returns, here is the formula you can use:

Returns = (Income/Investment) X Time

Now, if you break these entities down, then Income can be seen as the sum of the Call option and Dividend received if the latter exists.

Furthermore, the time factor is seen as the total days in a year divided by the days you are left with before the call expires.

Let’s take a quick example to illustrate all these jargons.

For instance, ICICI bank share worth ₹1000 had a call worth ₹10 with 60 days left for the contract to be expired. There was a dividend of ₹1 declared by the company as well.

Putting all these values into the formula, we get:

= ₹(10+1)/100 X 365/60

= 0.67 or 67%

Looks simple to calculate now, right?

Covered Call Risk

The only risk associated with a covered call is the loss of upside.

What it means, in simpler terms, is that “what if” the stock price actually goes really high as compared to your initial thoughts of moderately bullish or even neutral.

When that happens you lose out on the opportunity of selling the stock at the current high market price and you have to live with the sum of the strike price and the premium you fixed.

Well, there is no end to the debate of greed.

However, the price of the stock can go down as well or probably stay somewhat higher as compared to what you make in the deal.

Let’s call it a truce and move to the next trade, please!

Covered Call Dividend

When it comes to dividend, things a bit tricky in a covered call option.

What basically happens is tweaking of the strike price, the option value and the corresponding stock volatility (an indirect impact).

Stocks guaranteed with dividend are priced relatively lower. This impacts the premium to be paid and such stocks are then seen as a safe bet. When safety increases, the volatility of the stock decreases and thus, the fun of high risk-high return goes away.

However, when all of this is happening, there is one interesting bit that comes along.

The call option buyer generally wants to exercise the covered call earlier so that on the dividend payment date the stock is owned by him or her.

Yea, that happens!

Covered Call Example

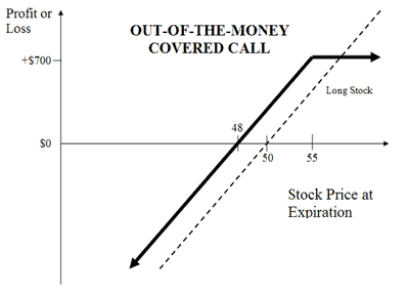

To understand the covered call strategy, we consider that a trader owns 100 shares of Adani Power which are currently at a market price of ₹50 each.

The trader does not expect the prices to move much. So, in order to generate a steady income, he sells a call option with a strike price of ₹55 for the 100 shares.

The premium received for selling the call option is ₹2 per share, which becomes a total of ₹200.

Scenario 1:

If the price of the shares of Adani Power goes up to ₹57 per share, the call option will get exercised as the share price goes above the call strike price. The total profit will be (57-55)*100= ₹200.

The premium received will be 2*100= ₹200.

Thus, the net payoff will be 200+200= ₹400.

If the covered call was not created, the trader would have earned a profit of (57-50)*100= ₹700.

Thus, the price went above the expectations of the trader and he ended up making a limited profit

Scenario 2:

If the price of the shares goes up to ₹54 per share, the call option will not be exercised. The trader will receive a profit of (54-50)*100= Rs 400, plus a premium of ₹200.

The net payoff will be 400+200= ₹600.

In this case, if the covered call was not created, the profit would have been only (54-50)*100= ₹400. Thus, the covered call is beneficial only when the prices move moderately

Scenario 3:

If the stock price of Adani Power falls to ₹40, the trader will incur a loss. The total loss is equal to (50-40)*100= ₹1000.

After receiving the premium from the call option, the net loss is reduced to 1000-200= ₹800.

Covered Call Advantages

Some of the positives of using a covered call options strategy are:

- The strategy helps to generate a steady income from an asset which would otherwise not give profits, due to the lack of volatility in the market.

- The trader can benefit from the movement in the stock prices.

Covered Call Disadvantages

At the same time, there are a few concerns of covered call options strategy you must be aware of:

- The strategy has an unlimited risk potential.

- The profit gets limited due to the use of a covered call.

Conclusion

As a conclusion, the covered call strategy is quite a risky strategy and should be implemented only when the trader is certain that there will be no price movements in the underlying asset.

| Entity | Value |

| Market View | Moderately Bullish or Neutral |

| Number of Positions | Two - Underlying & Call |

| Position Types | 1 Call |

| Options Traded | Call |

| Risk | Unlimited |

| Reward | Limited |

If the price moves very high, the trader will lose on the high profits due to a cap on the earnings due to the covered call.

On the other hand, if the price goes too low, the strategy does not have the potential to protect against the losses.

Therefore, it is necessary to work with stocks that have medium implied volatility. Also, the trader needs to be prepared for every contingency and keep a clear view of his investment objectives and the long-term positions.

In case you are looking to get started with option trading or share market investments in general, just fill in some basic details below.

More on Share Market Education:

If you wish to learn more about options trading or stock market education in general, here are a few references for you: