Long Straddle

All Option Strategies

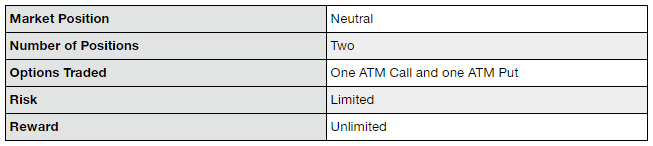

Long Straddle is an options trading strategy which involves buying both a call option and a put option, on the same underlying asset, with the same strike price and the same options expiration date.

The strategy comes into play when the trader expects the market to move sharply, however, the direction of the movement cannot be predicted. The purpose of the strategy to allow traders to benefit from volatile markets.

Long Straddle Option Strategy

A long straddle is a strategy that helps to solve the directional dilemma which can be used to avoid Option Trading mistakes.

The trader knows that news or event is expected in the near future. The market is waiting for the event to happen and is usually at low volatility. However, as soon as the news is released, the market will react to it.

The stored bullishness or bearishness of the market will be released and the prices will move drastically and suddenly.

The investor is, however, unsure of the direction in which the market will move. This is when long straddle comes of importance.

This options trading strategy has the potential to give unlimited rewards, with limited risks. The trader is able to trade based on his conviction that the markets will move, without being concerned about the direction of the movement.

Therefore, a long straddle is a market-neutral strategy, based on high implied volatility. The trader is betting on the volatility and not on the trend.

Long Straddle Timing

The perfect time to use the long straddle strategy is when the trader wants to profit from a big price change, in either direction. The strategy is the best of both worlds and will help the trader in making profits whichever way the market moves provided it moves.

Thus, when the investor is expecting big news in the market, he constructs a long straddle by buying a call option and a put option at-the-money or as close to the current strike price as possible.

Both the call and the put options are at the same price so the trader will make a profit if the price of the underlying deviates from the original strike price in either direction.

If the market goes up, the trader can exercise the call option and let the put option expire worthlessly and if the market goes down, the put option is exercised and the call option expires worthless.

However, the premium paid is high and a swing is definitely needed to break even. If the market does not move at all, both the options expire worthlessly and the investor ends up paying premiums.

The maximum loss in this strategy is limited and can only be equal to the total of the two premiums paid. The worst-case scenario is when the stock does not move at all. In that case, both the premiums will need to be paid and the amount is lost.

The maximum profit in this strategy is unlimited.

The stock price can move in either direction and to any extent. The profit will be equal to the difference between the stock price and the strike price, less the premiums paid. There is no limit to the profit potential of the long straddle strategy.

Long Straddle Example

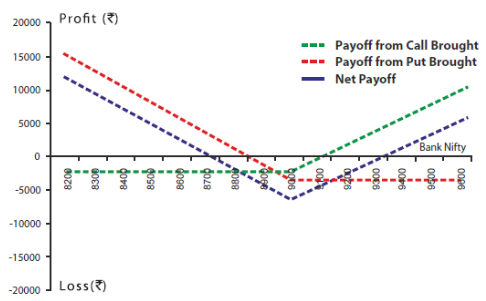

As an example of the long straddle strategy, we will consider the positions at Bank NIFTY. Let us consider that NIFTY is at 8900 points and the trader expects high volatility in the future due to an expected event.

In this case, the trader buys a call option at 9000 and a put option at 9000, with the same expiry. The premium to be paid for the call option is ₹100 and for the put option is ₹200.

Let the lot size be 25.

Therefore, the total premium to be paid is 300*25= ₹7500.

Scenario 1:

If NIFTY closes at 10000, which is above the current strike price, the trader’s expectation turns out true and he should make a profit.

The put option will expire worthlessly and ₹200*25= ₹5000 need to be paid.

The call option will be exercised and give a profit of (10000-9000)-100= 900*25= ₹22500.

So, the net payoff will be 22,500-5,000= ₹17,500.

If the trader had not used the long straddle and bought the underlying asset instead, the profit could be ₹27, 500. But he would have had to make an initial investment and will still be at high risk of the price going down.

Long straddle protects the trader against high risks and he does not have to predict the direction of price movement.

Scenario 2:

If NIFTY closes at 9000, both the call and put options will expire worthlessly.

The trader will have to pay both the premiums and will incur a loss of 300*25= ₹7,500.

However, this is the maximum loss that the investor can incur using the long straddle.

This maximum loss occurs when the market shows no volatility at all, which is completely opposite of what the investor had anticipated.

Scenario 3:

If NIFTY closes at 9300, the put option will expire worthlessly and the premium paid will be 200*25= ₹5000.

The call option will be exercised and will provide a profit of (9300-9000)-100= 200*25= ₹5000.

The profit from call option will be neutralised by the loss from put option and the net payoff will be zero.

This is the break-even point!

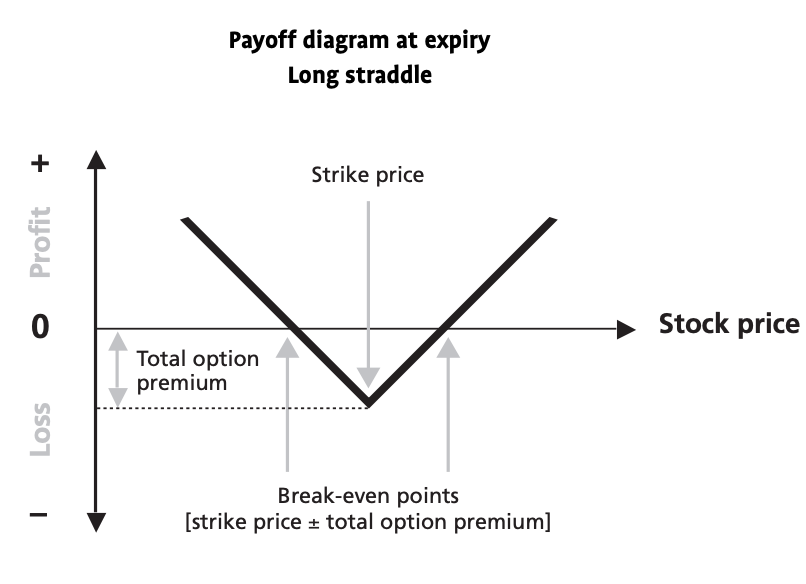

Long Straddle Payoff Diagram

In the case of a long straddle strategy, the trader is taking up a call as well as a put option at the same time.

The profit from one of the options is most likely going to be more than just offsetting the loss incurred from the other option.

As far as the long straddle payoff diagram is concerned, you can have a quick look below:

The break-even point depends on the trade making the profit and can be represented by a range where the break-point is either the sum or difference between the strike price and the total options premium.

Long Straddle Intraday

A lot of traders start using long straddle options strategy for intraday trading but does that make sense?

Well, for this strategy to work within a day trading set-up the market movement has to be good enough, which is not the case on a regular basis.

Thus, if you really think the market is going to move strongly today in one direction or the other, then you give it a shot. However, this also needs to be known that in such a case, the premium amount will be high too.

More or less, this high premium will offset the profit you may make at the end of the trade.

In simpler terms, the Long straddle strategy is not generally recommended for intraday trading.

Long Straddle Breakeven

As there are more than 1 transactions happening in this strategy, there will be more than 1 breakeven points as well. And both of these breakeven points will involve the strike price and the premium paid as these are the payments the trader makes nonetheless.

Here is how you can calculate the long straddle breakeven points:

Upper Breakeven point = Strike Price + Premium

Lower Breakeven point = Strike Price – Premium

Remember, understanding the breakeven points is important for those will tell you whether it makes sense for you to go ahead with the strategy or not.

Long Straddle Advantages

Here are some quick advantages of using Long Straddle options strategy:

- The strategy has the potential for unlimited profit, with limited risks.

- The investor does not have to be concerned about the direction of the price movement. He can benefit from the high volatility of the market in either direction.

Long Straddle Disadvantages

At the same time, here are some quick concerns you must be aware of while you use the Long Straddle strategy:

- The premiums paid are high.

- There has to be a big swing in the prices to make profits, after paying the premiums.

Conclusion

As a bottom line, a long straddle is an excellent and one of the simplest ` strategies.

It has the potential to provide an opportunity to make money even when the exact effect of the news is not known. The prices may go up or down, the trader will end up making profits.

The high volatility of the market can be cashed on, without involving a lot of risks.

In case you are looking to get started with option trading or share market investments in general, just fill in some basic details in the form below.

More on Share Market Education:

If you wish to learn more about options trading or stock market investments in general, let us assist you in taking the next steps ahead: