Long Strangle

All Option Strategies

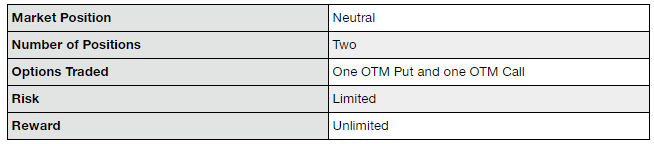

Long Strangle is an options trading strategy that involves buying an out-of-the-money call option and an out-of-the-money put option, both with the same underlying asset and options expiration date. In this regards, it is similar to a long straddle, but the difference is that the call options and put options are at different strike prices in a long strangle.

The long strangle strategy helps the trader to take advantage of the volatility in the market.

It is a trend neutral strategy, so the trader does not need to be certain of the direction of the price movement. The call and put options bought are out-of-the-money, so the premiums paid are less than at-the-money options in the straddle.

This makes the long strangle strategy less expensive, but due to the gap between the strike prices of the call and put options, the movement in the price has to be big enough to bring profits.

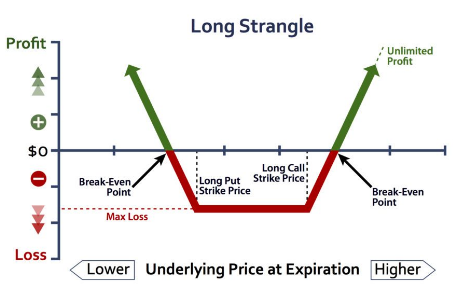

The long strangle strategy has limited risk and unlimited reward profile.

The loss occurs when there is no or very less volatility. The profit occurs when there is high volatility, as expected, and the price of the underlying only has to move beyond the call and put strike prices to start giving profits.

Long Strangle Strategy Timing

The perfect time to use a long strangle is when the market is expected to show high volatility in the near future due to an expected event or news.

At this time, the trader may not be sure of how the market will react to the news, but he is certain that there will be a reaction and hence, sharp price movement. The trader can deploy long strangle without predicting the direction of the trend. That is the best part of this options strategy.

So, when high volatility is expected, the trader buys a slightly out-of-the-money put option at a lower strike price and a slightly out-of-the-money call option at a higher strike price.

If the price of the underlying goes above the call strike price, the call option gets exercised and brings in profit and if the underlying price falls below the put strike price, the put option gets exercised and pays a profit.

However, if there is no big movement in price and the price remains within the two strike price range, the strategy will incur a loss.

Long strangle is a modification of the long straddle to make it less expensive.

The premiums paid for the out-of-money options is less than the one paid for the at-the-money options. However, the tradeoff is that due to a wide range between the two strike prices, the price swing has to be big enough to start earning profits.

In the case of the long straddle, the price only had to move anywhere from the current price in any direction to start delivering profits.

The risk potential in the long strangle is limited and can only be a maximum of the sum of the two premiums paid. The situation for maximum loss occurs when the price remains between the call and put strike prices.

The potential for profit in this strategy is unlimited.

This is because the price of the underlying asset can move to any extent in either direction. The gross profit is calculated as the difference between the stock price and the strike price. The net profit is calculated by subtracting the number of premiums paid.

Long Strangle Strategy Example

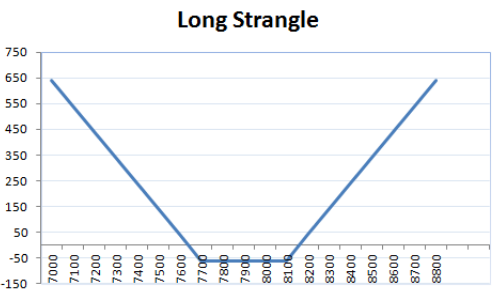

Let us consider that NIFTY is at 7900 points currently, and the investor is expecting high volatility in the market. The direction of the expected trend is not known.

In this situation, the investor sets up a long strangle by buying a put option at 7700 and a call option at 8100. The strike prices are different, but the underlying security and expiration date needs to be the same. The premium paid for the put option is ₹28 and for the call option is ₹32.

Scenario 1:

If NIFTY closes at 7900 points, both the call and put options will expire worthlessly and the premiums paid will be lost.

The net loss will be 28+32= ₹60.

It is to be noted that this is the maximum loss that can be incurred using the long strangle.

Also note that in case long straddle strategy had been used, at 7900 both call and put options would also have expired worthless and resulted in the loss of premiums. However, the premiums paid would have been much higher for the at-the-money options in a long straddle.

Scenario 2:

If NIFTY closes at 8100, still the call and put options will expire worthlessly and result in loss of premiums paid.

However, in case long straddle was used, this would have resulted in a profit.

But the premium paid would have been quite high.

Scenario 3:

If NIFTY closes at 7400, which is an indication of high implied volatility, the call option will expire worthlessly and a premium of ₹32 will be paid.

The put option will be exercised and the profit will be (7700-7400)= ₹300.

The net profit after paying the premium for put option will be 300-28= ₹272.

The net payoff will be 272-32= ₹240.

Thus, when there is volatility in the market, the profit will keep on increasing as the price keeps on moving away from the current price.

Long Strangle Advantages

- The premiums paid for out-of-the-money options are lower than the premiums paid for at-the-money options. Therefore, long strangle is a less expensive strategy.

- The maximum loss is limited to the amount of premium paid.

- The maximum gain is unlimited.

Long Strangle Disadvantages

- Due to the difference between the put and call strike prices, the price movement has to be big enough to start making profits.

Long Strangle in a Nutshell

Thus, long strangle options trading strategy is an improvisation of the long straddle strategy.

Both call and put options are bought but at different strike prices and out-of-the-money, to make the strategy less expensive. As a trade-off, the range of price in which loss is incurred is wider.

The price of the underlying has to show a big move to start bringing in profits.

In case you are looking to get started with options trading or share market investments in general, just fill in some basic details in the form below.

More on Share Market Education: