Option Pricing

As part of option trading, you get derivatives contracts which provide the buyer with the right, but not the obligation, to buy an underlying security at a predetermined price, at a predetermined time. Similarly, the seller of the option has the obligation to sell the underlying security at a predetermined price and time.

The price of the option or the option pricing is the price at which the option is traded, or how the options are valued in the market.

Since the options are the derivatives that derive their value from an underlying asset, the pricing of the asset is dependent on the current price of the underlying. However, the price of the underlying is not the only factor that determines option pricing.

Overall, the value of an option is the sum of intrinsic value and the time value.

The intrinsic value of an option is based upon how the price of the underlying asset moves in relation to the strike price of the option. It is calculated as the difference between the stock price and the strike price of the option for the call option and the difference between the strike price and stock price for the put options.

On the other hand, the time value of the option is the amount of premium that can be earned on the option.

The time value keeps on reducing as the expiration comes closer and becomes zero at expiration. At the time of options expiration, the value of an option is only equal to the intrinsic value.

Option Pricing Factors

Along with the value of the underlying asset, option pricing is also dependent on a number of other factors. Some of them are:

Price of the underlying security:

The option pricing is dependent on the price of the security that they are a derivative of.

The effect is opposite on call and put options. When the price of the underlying security increases, the value of the call option generally increases and the value of put option decreases.

Similarly, with a decrease in the price of the underlying, the value of the call option goes down and that of a put option goes up.

Strike Price:

The purpose of the strike price is to determine the intrinsic value of an option.

When an option becomes in-the-money, its intrinsic value increases and when it becomes more out-of-money, the intrinsic value decreases. Therefore, with an increase in the strike price, the value of the call option decreases and that of put option increases.

Volatility:

Implied volatility is quite subjective, but it is a clear indicator of the sentiments of the market.

High volatility means higher fluctuations are expected at the prices. The increase in volatility has a positive effect on the option pricing, both call and put options.

Time until expiration:

The time till expiration has an effect on the time value of the options. As the time to the expiry gets closer, the time value decreases and thus the option pricing also goes down.

Thus, with the decrease in the time until expiration, the option pricing decreases for both call and put options.

Dividends and interest rates of the underlying:

The effect of dividends and interest rates on option pricing is less. When the interest rates go up, the present value of the strike price goes down.

Therefore, the pricing of call options increases and that of put options decreases. At the same time, when the dividends are paid on the security, the present value of the strike price goes up.

This leads to a decrease in the value of call options and an increase in the value of the put options.

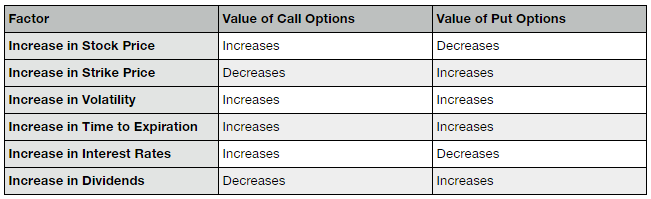

Summary of the effect of various factors on call and put options

The Black-Scholes Model for Option Pricing

Black-Scholes model is one of the option pricing models that take all the factors into consideration. It was discovered by Fischer Black and Myron Scholes in 1973 and plays a significant role in determining the price of the options.

As we can notice, the Black-Scholes model takes almost all the factors into consideration. The main variables of the model are the current stock price (S), the strike price (K), volatility, time until expiration (T), interest rate (r) and dividend yield.

This set is the entire set of variables that have an effect on the option pricing.

By using the formula above, the Black-Scholes model is used to find out the fair value or the theoretical value of the call and put options.

As a rule, it is considered that the options that are priced under the formula calculated value are to be bought, and those priced above the fair value are to be sold.

The Purpose of Option Pricing

The purpose of the traders to trade options is to earn profits. They want to take the benefit of difference in the current price and future price and bet on it to earn money.

The ultimate purpose behind option pricing is to find out the probability that an option will expire in-the-money. The trader needs to know if the option will be in-the-money to yield him profits, and then make the investment decision accordingly.

This is when the option pricing comes into the picture.

It can be done by considering the individual factors separately and determining whether or not to buy or sell an option. Instead, the models like Black-Scholes Model and Binomial Model can be used to perform the complicated function.

As a bottom line, it is critical for an investor to understand the dynamics of option pricing.

He must understand that the pricing of an option is not only affected by the price of the underlying, but also by multiple other factors like the strike price, volatility, time till expiration, interest rate, dividends etc.

Once the trader is able to determine the fair price of the option, he can make an informed decision on whether or not to invest in the option.

In case you are looking to get started with options trading or share market investments in general, let us assist you in taking things forward.

More on Share Market Education: