Short Call

All Option Strategies

Short call is one of the option trading strategies which means selling or writing a call option. The strategy generates net credit in the beginning as the premium is received for writing a call.

The trader has the obligation to buy the stock at the predetermined price at the time of options expiration. It is also known as naked or uncovered call as the trader does not own the underlying assets at the time of writing them.

Short Call Option

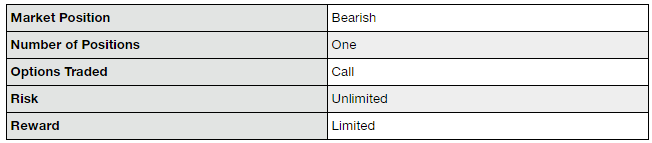

The options trading strategy, opposite to the long call options strategy, is used in bearish times. Thus, the trader needs to be aware of the current market conditions and based on that this strategy needs to be made use of.

When the trader expects that the price of the underlying asset will go down sharply, he shorts a call. If the price of the asset goes down, the strategy generates profit. However, if the price of the asset goes up against the expectation, the trader is obligated to exercise the option and buy the security at a higher price.

The investors attempt to let the option expire worthless for the short call to be profitable.

Therefore, at most times, the options written are out-of-the-money.

Short Call Definition

This strategy is quite tricky and may lead to unlimited losses. Therefore, it should always be used by the experienced traders, who need to be certain and watchful of their moves.

Choosing the correct strike price is important for the success of the short call strategy. The strategy can be adopted to avoid Option Trading Mistakes.

The strike price must be above the current market price, and the closer it is to the current market price, the higher the premium it generates.

However, a closer strike price also increases the chances of the option expiring in-the-money and lead to unlimited losses.

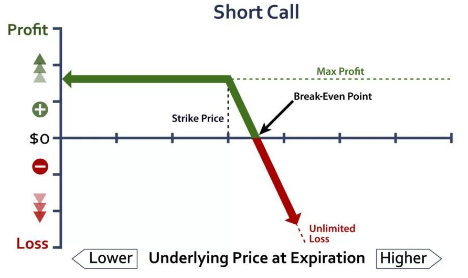

This options trading strategy comes with limited reward and unlimited loss for the traders employing it.

The profit is limited only to the amount of premium received by writing the call. The losses can be unlimited and will keep on increasing as the price of the asset goes up.

Short Call Timing

The correct time to use this strategy is when the trader is quite bearish towards the market. He, then, writes a call and receives a premium. For the strategy to be profitable, the price of the security must fall and the option must not get exercised.

The trader commits to writing the option at a predetermined strike price, which is higher than the current market price. As long as the price of the security keeps falling, the trader keeps earning the profit as a premium.

If the price rises, the short call option will get exercised and the trader will be obligated to buy the asset, and incur losses.

The maximum profit from the strategy is equal to the amount of premium received and it is achieved when the price of the security remains less than the strike price of the short call.

The maximum loss can be unlimited, and it is calculated as the difference between the price of the security and the strike price of the short call, less the premium received. The loss situation is reached when the price of the underlying goes above the strike price of the call.

Short Call Example

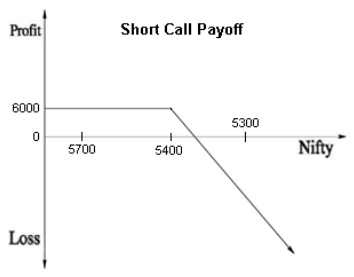

Let us consider the following example to discuss this options trading strategy in detail. Let us assume that NIFTY is trading at 5300 points and the trader expects it to go down sharply in the future.

Therefore, he writes a call and sells a call at 5400 points for a premium of ₹120.

The lot size is 50.

Scenario 1:

If NIFTY closes at 5100, as expected by the trader, the strategy will generate a profit. The short call option will expire worthlessly and the trader will receive the premium, which is equal to (120*50)= ₹6,000.

This the maximum profit that can be generated using this options trading strategy.

Scenario 2:

On the contrary, if NIFTY closes at 5600, which is higher than the current price, the strategy will cause loss. The loss will be equal to (5600-5400)= ₹200.

However, after receiving a premium of ₹120, the net loss will be (200-120)= ₹80*50= ₹4,000.

The loss will keep on increasing as the price of the asset keeps moving in the upward direction. There is no upper limit to the loss that can be incurred using the short call.

Scenario 3:

If NIFTY closes at 5520, the loss incurred will be (5520-5400)= ₹120.

However, this loss will be compensated by the premium received of ₹120.

The net payoff will be 120-120=₹0.

This is the break-even point of the strategy and is equal to the sum of the strike price of the short call and the premium received.

Till this point, the strategy can bear the increment in price, without causing losses. Thus, the trader has to stay cautioned all the time when this strategy is in place.

Short Call Payoff

When you are looking to calculate payoff for a short call strategy, then you need to consider two key factors in your calculations:

- The Option price at the initial point

- The Option price at the expiry point

The initial option price is readily available, however, to calculate the option price at the point of expiration, you need to perform a quick subtraction (OE): Underlying price – Strike Price

Now, if OE is greater than 0, use that else user 0 as the option price at the expiry point.

Thus, your short call payoff is equal to the difference between the option price at the initial point and OE, as discussed above.

Short Call Graph

Like mentioned above, a short call option is basically a position that can benefit you from multiple levels, if you trade smartly.

As shown in the graph below, when you enter into a short call position, you go short with the call i.e. you sell it. In lieu of this sale, you get cash.

From here, you have 2 options to make a profit:

- Buy the option at a price lower than what you just sold it for.

- Wait and watch to see if the option expires worthlessly or at a price which is lower than the value you sold it for.

In both these cases, you will make money.

Of course, both these cases have a lot to do whether the market moves in the direction you are anticipating or not.

Short Call Risk

This is one of those option strategies which offer high risk to the trader. The extent of the risk is actually limitless.

Since nobody knows how the market is going to behave in the next trading session, it is advised not to carry forward your position and exit the trade in the same trading session.

You are also recommended to use stop-loss while dealing with such a strategy.

Short Call Profit

There are 2 situations when you can make a profit while using this strategy:

- If the price of the underlying security falls

- If the price does not change and stays as it is

Furthermore, the potential of making a lot of profit is not so high either and it actually is limited to a specific number which is your premium amount.

However, if you do careful analysis and pick out the options which have a longer duration in their expiry, lower strike prices and are overall expensive contracts. However, this approach needs to be carefully executed as it increases the risk level as well.

Short Call Advantages

Talking about some of the advantages of this strategy, here are the following listed:

- Profit can be earned even in a bearish market when the price of the security is falling.

You can read this review in Hindi as well.

Short Call Disadvantages

Here are a couple of concerns you must know before using this options strategy:

- The profit is limited to the amount of the premium received.

- The risk potential of the strategy is unlimited and can lead to huge losses if the price of the asset goes up.

Conclusion

Thus, a short call is a highly risky strategy. It does help the trader to earn profits at the time when the price of the underlying security is going down, however, the profit potential is quite limited as compared to the risk potential.

If the strategy goes wrong, the trader can incur unlimited and huge losses, and the tradeoff of receiving premium is not sufficient to cover up the losses.

So, essentially, the short call must only be used by the advanced level traders, who have the experience, knowledge and certainty to determine the right time to use the short call.

Any wrong move can lead to negative returns and the loss becomes unquantifiable.

In case you are looking to get started with options trading or share market investments in general – let us assist you in taking things forward for you.

More on Share Market Education:

If you wish to learn more about share market or options trading, here are a few references: