Short Straddle

All Option Strategies

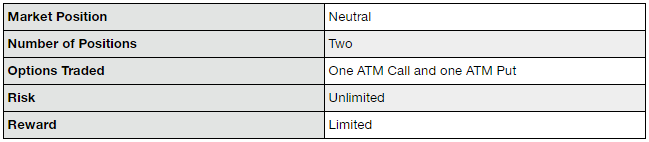

Short straddle options trading strategy is a sell straddle strategy. It involves writing an uncovered call (also called a Short Call) and writing an uncovered put (also called a Short Put), on the same underlying asset, both with the same strike price and options expiration date.

This strategy is the complete opposite of long straddle wherein the high volatility in the market pays off. In short straddle, the profits are made when there is least or no volatility in the market.

Using the short straddle strategy, the investor makes an upfront gain through the premiums collected by writing the call options as well as put options. The investor expects that there will be no movement in the market and is able to make money even with no price movement.

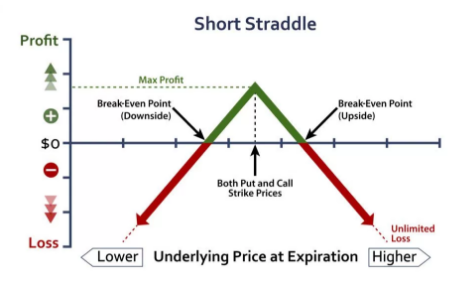

However, the risks of the strategy are unlimited, if the market moves beyond the expected volatility range.

The premiums collected are not enough to cover for the losses due to price movements. The investor must hold strong views of the steadiness in the market to be involved in the short straddle.

The profit from the strategy is limited to the premiums received.

The profit from the strategy is limited to the premiums received.

Therefore, it is a tricky strategy with less potential for profit and more potential for loss. The short straddle must be used very cautiously and only when the opinion of low volatility is very strong.

Short Straddle Timing

The most appropriate time to use short straddle is when the market is expected to have very low or no volatility at all.

The strategy gives the maximum benefit when the price remains stable and does not move at all. It allows the traders to profit from the lack of movement, rather than taking directional positions, hoping for a big high or low.

So, when the trader expects that the markets will remain stable, he constructs a short straddle by writing an at-the-money call option and an at-the-money put option, both at the same strike price, with same expiration date and for the same underlying asset.

If the price remains stable, both the call and put options will expire worthlessly and the trader will receive both the premiums. However, if the price moves beyond the range, the trader will end up in losses.

The strategy can also be used when the implied volatility is extremely high, causing the calls and puts to be overvalued and is expected to go down soon. In this situation, a short straddle can be constructed and then wait for the volatility to go down and close the position before expiration.

The maximum profit of the strategy is limited to the amount of premium received from writing both the call and put options. This maximum profit is received when the stock price of the underlying is the same as the strike prices of the options, upon expiry.

The maximum loss from the strategy is unlimited.

The loss is incurred when the price of the underlying asset shoots upwards or downwards sharply. In this case, either the short call or the short put will expire deep in the money. The premiums received are not enough to compensate for the losses in most cases.

Short Straddle Example

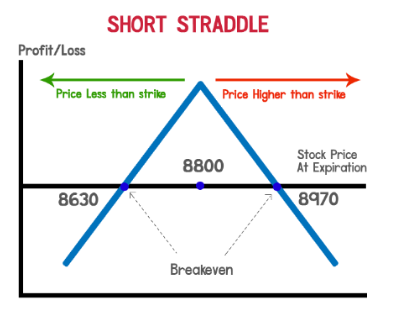

To explain the short straddle options trading strategy, let us consider the example wherein NIFTY is at 8800 points currently. The trader expects that there will not be much volatility in the market. He wishes to make a profit in spite of the lack of movement and activity.

For this purpose, a short straddle is constructed by selling a call option at 8800 and selling a put option at 8800. Both options are at-the-money. The premium received for selling each call is ₹80 and the premium received for selling each put is ₹90.

The lot size is assumed to be 75.

The upfront profit received is the sum of the premiums. It is the maximum possible profit from this strategy and is equal to (80+90)*75= ₹12,750.

Thus, the trader will be able to make a profit without any movement in the prices. However, the strategy is based on no volatility. So, there will be an unlimited loss if the price of the underlying asset moves in either direction.

Scenario 1:

If NIFTY closes at 8800, which is the same as the current price, both the options will expire worthlessly and the trader will receive a total payoff of Rs 80+90= ₹170.

This is the maximum profit that the trader will make from the short straddle.

If short straddle was not initiated, the trader would have made no profit at all, due to the lack of the movement in price.

Due to the strategy, the trader is able to make a profit of ₹170*75= ₹12,750 in spite of no volatility.

Scenario 2:

If NIFTY closes at 8300, which is a huge movement from the current price, the call option will expire worthlessly and a premium of ₹80 will be received.

The put option will be exercised and the loss will be equal to (8800-8300)-90= ₹410.

The net payoff will be a loss of Rs 330*75= ₹24,750.

Using short straddle, the loss can be unlimited and will keep on increasing as the price moves farther away from the current price, in either direction.

Scenario 3:

If NIFTY closes at 8970, the put option will expire worthlessly and the trader will receive a premium of Rs 90.

The call option will be exercised and the loss will be (8970-8800)-80= ₹90.

The loss due to the exercising of the call option will be compensated by the premium received from the put option expiring worthless and the net payoff will be zero.

This is the break-even position!

Short Straddle Advantages

Here are some quick advantages of using Short Straddle Strategy:

- The strategy is beneficial in letting the trader earn a profit even when there is no volatility in the market

- Suitable for risk-prone traders.

Short Straddle Disadvantages

You must be aware of the following risks while using short straddle:

- The risk involved with the strategy is unlimited

- The reward the limited to the amount of premium received

- Huge losses can occur if the price of the underlying asset moves in either direction.

Short Straddle in a Nutshell

Thus, the short straddle is a complex strategy which should only be used by experienced traders. It has the potential for unlimited losses.

If the stock market prediction of the trader of no volatility does not hold true, the trader can suffer huge losses. The rewards are also quite limited.

Therefore, short straddle must only be used when the investor is very certain that there will not be any price movements and he wants to benefit despite the lack of volatility.

In case you are looking to get started with option trading or share market trading in general, let us assist you in that.

Just fill in some basic details in the form below.

More on Share Market Education:

You can read this review in Hindi as well.