Option Premium in Zerodha

More on Zerodha

Want to start an options trading journey in Zerodha but still have so many doubts and questions about option premium in Zerodha? If yes, then you are at the right place.

Here we are going to provide you the complete detail of the premium, its calculation, and when this value becomes positive or negative.

Option Premium in Zerodha Means

Let’s begin with an understanding of what option premium in Zerodha means? It is simply the value of an option contract as per the market trend, volatility, and other parameters.

You can say that this is the amount, that an option seller earns if the option expires worthless.

It is calculated by adding intrinsic value and extrinsic value also called time value.

Here the time value depends upon the number of days left in expiry, more days will be the time value. The intrinsic value, on the other hand, is the minimum value of the premium which is the difference between the strike price and the spot price.

The formula of Intrinsic Value for call and put option are as follow:

- Call Option= Spot Price-Strike Price.

- Put Option= Strike Price-Spot Price.

Intrinsic value is always positive and thus is regarded as zero for options that have negative intrinsic value. Such options are categorized as Out of Money options.

This is the major reason why premium varies acout-of-the-money options are cheaper than ITM and ATM options.

When do you Receive Option Premium in Zerodha?

Options trading is all about buying and selling a particular contract with the strike price at which the seller agrees to settle the trade with the buyer in the future on the day of expiry.

The option seller is obligated to execute the trade at the pre-determined price (strike price) on the day of expiry and thus hold a maximum risk. To reduce the risk, he charges a certain fee called the premium.

So, in simple terms, you receive an option premium in Zerodha whenever you short your position or say sell a particular option.

Here it is important to note that the option premium is the maximum profit that a seller earns from his position if the option expires worthless on the day of expiry.

How Option Premium is Calculated in Zerodha?

For a single trade, you can get the detail of the option premium on the Zerodha option chain under the LTP column. But what if you have taken multiple positions in Zerodha, where you buy and sell a few options contracts?

Here it could be quite confusing for the beginner trader to get an understanding of the total premium displayed on the screen and how it is calculated.

To make it easier let’s take an example.

Suppose you take a long position to buy 2 lots (1000 shares each) of XYZ company by paying a premium of ₹50.45. And simultaneously you short your position where you sell 2 lots of XYZ at ₹49.75 and one more lot at ₹50.05.

Now let’s calculate the total premium value:

Long Position= Premium debited

=2000*50.45

=₹1,00,900

Short Position= Premium credited

=3000*49.85

Here 49.85 is the average value of the premium received.

= 99500+50050

= ₹1,49,550

Net premium= 1,49,550-1,00,900

=48650

This is the net premium credited to the account.

How to Check Option Premium in Zerodha?

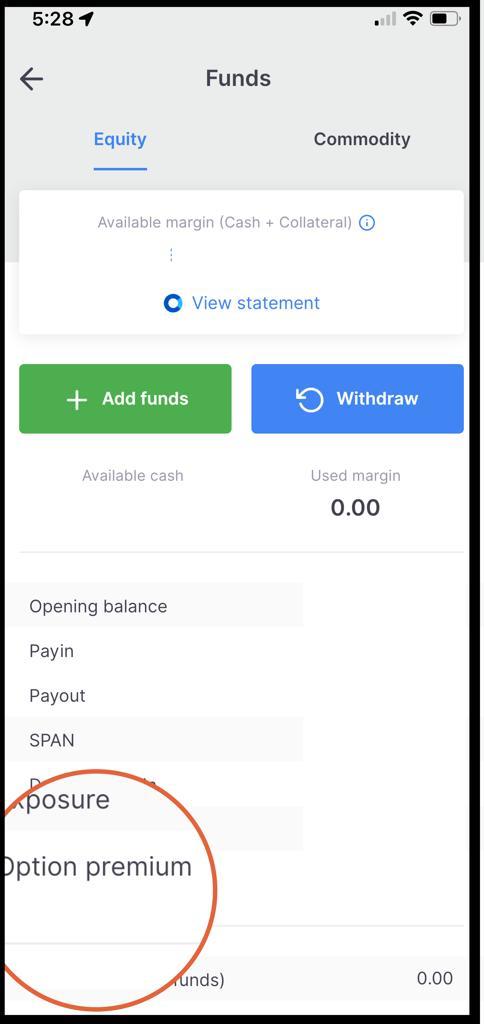

The above data is available on Zerodha Kite under the fund’s section. But here, is it important to note that

Option Premium is negative in Zerodha whenever the premium is credited for taking a short position in an option contract.

On the other hand, option premium positive data signifies the debited amount on taking a long position.

To check this detail, just follow the steps below:

- Login to Zerodha Kite app.

- On the bottom menu bar, click on Funds.

- Fund details will appear on the screen with information on opening balance, paying, payout, span, margin, and option premium.

- There you can validate the net credit or debit of the amount.

How to Withdraw Option Premium in Zerodha?

Now on shorting your position in options, you get the premium right away, but you cannot withdraw the amount. However, you can use the premium received to take another position in the same segment.

For example, if you have received a premium on the shoring equity option, then you can use it for another option in the equity segment only.

To withdraw the option premium in Zerodha, you have to wait till expiry. If the option expires out of the money i.e. worthless then the margin is unblocked and you can transfer or withdraw the premium amount to your bank account.

Conclusion

Option premium in Zerodha is thus the amount you pay or receive on buying or selling particular options. You can see the detail of the premium and the change in its value on the option chain and on the execution of trade in the order book in Zerodha.

For option sellers, it is the maximum profit and for buyers the maximum loss in the options trade.

Interested in opening a demat account online for FREE! Get in touch with us and we will guide in choosing the right stockbroker and in your trading and investment journey.

More on Zerodha