Kotak PMS

More PMS

Kotak PMS is a popular and old name in the portfolio management services sector. The company is well-known for its renowned portfolio investment strategies and investment philosophy.

Like every other bank-based business arm, Kotak Mahindra PMS also enjoys the brand equity created by Kotak Bank and Kotak Securities.

But before you get enticed by the brand and hand over your hard-earned capital to Kotak PMS, you need to understand whether this firm is good enough for your investments and management of your portfolio?

Further, this needs to be understood that the PMS service is regulated by SEBI and all the firms are mandated to follow the Portfolio Management Services SEBI regulations.

Going through this information is necessary as it might come out as hazardous to your funds. Well, let’s have a detailed look at the different aspects of this portfolio management services company before coming to a conclusion.

Kotak PMS Review

Kotak PMS was established in 1985 by Mr Uday S. Kotak. The head office of the company is in Mumbai and is registered under SEBI. Today the company is among the best portfolio management services in India.

The company runs its PMS service by making concentrated investments in high-quality stocks at a reasonable price. The portfolio stocks are purchased at discounts to the intrinsic value.

The company follows a disciplined investment process in which the company believes that the risk associated with the PMS can be minimized by thoroughly analyzing each company to make it part of a portfolio.

It has created a team of analysts, portfolio managers, and researchers. They work round the clock to analyze each stock in the portfolio and take the right decision related to the portfolio.

Kotak PMS offers a variety of successful portfolio investment strategies. The PMS strategies are created by giving priority to the client needs, risk appetite, and financial stability.

The investment parameters of Kotak PMS are:

- Management quality based on capital allocation and operations management.

- Market opportunity of a stock/sector.

- Strong earnings growth and Financial of a company.

- Cheap stocks or fair valuation.

In this article, you will find all important aspects related to Kotak PMS such as PMS Types, the commission models offered, other charges, investment plans, fund managers, customer support, conclusion and Finally Frequently Asked Questions (FAQs).

Name of the company Kotak PMS Founded in the year 1985 Founder name Uday S. Kotak Company type Privately held PMS Strategies Small and mid-cap strategy Special situations value portfolio Pharma focused strategy Commission model Prepaid commission Volume-based commission Profit sharing commission

Kotak PMS Types

Kotak PMS always gives priority to its clients. The company wants to offer all services to their clients so that the customer experience is enhanced and Kotak becomes a single stop solution for every problem related to PMS. Thus, the company offers both types of PMS services.

Discretionary PMS

This service allows the portfolio manager to directly take the portfolio investment decision (buy or sell) without taking the client’s consent for each trade of the portfolio. The fund manager is free to take the decision independently.

This service is cost-effective as the client needs to pay charges to the fund manager for the service he gets from them. It saves investment time as it requires very less or no involvement of the client.

Non-Discretionary PMS

Under this service, a fund manager plays the role of a broker only. He/she executes the trades by following the client’s instructions. The funder manager can only suggest to the client the right decision based on his research and analysis.

This service is less cost-effective, requires more client involvement, and wastes a lot of time in taking the approval of the client for the investment decision.

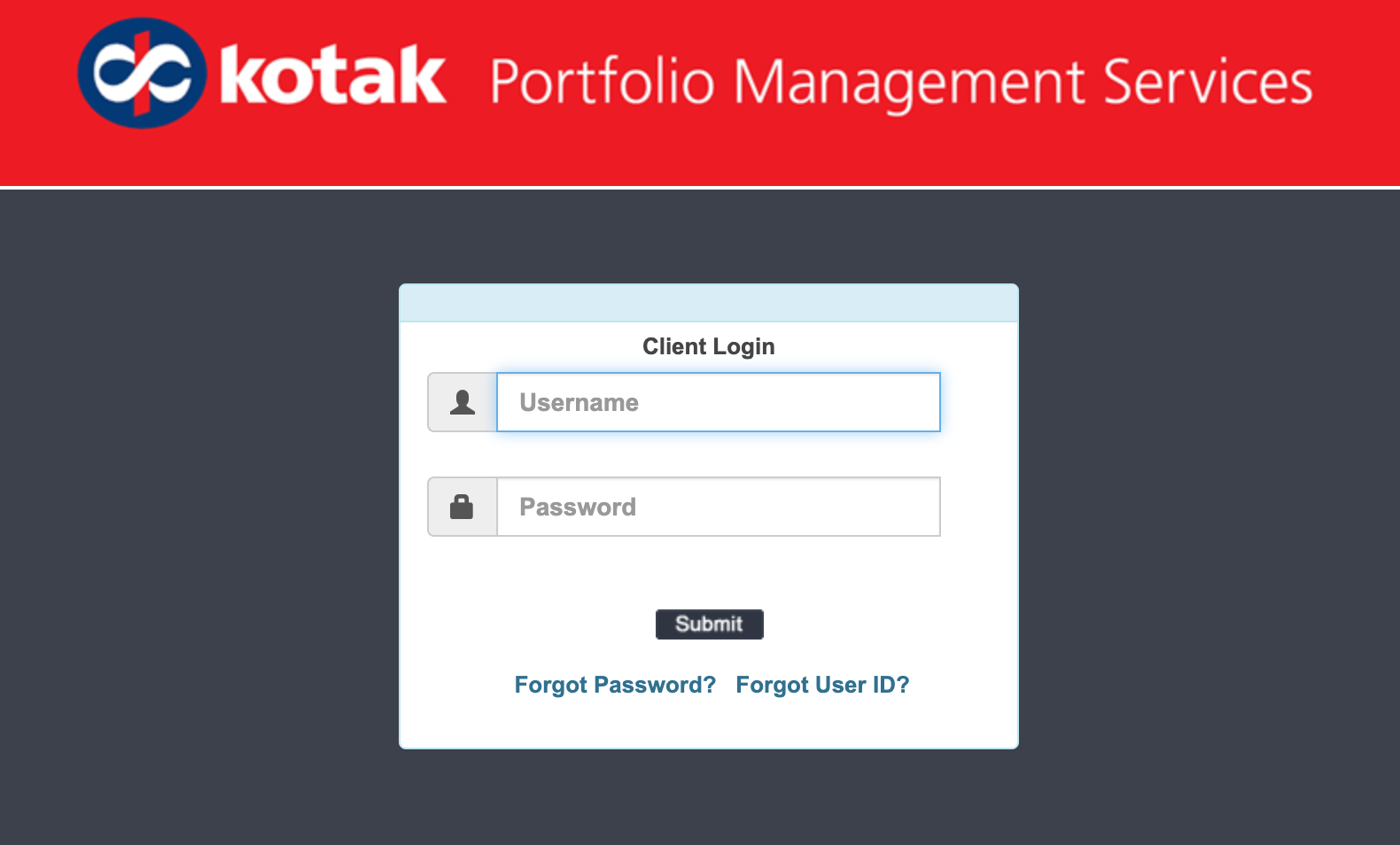

Kotak PMS Login

If you are an existing client of Kotak Portfolio management services, you just need to log in to this link and enter your valid credentials into the Kotak Mahindra PMS Login Portal. The login screen looks like this:

Remember, you must put the correct username and password combination otherwise, you might get locked out of your account. In such a case, you would need to reach out to the customer support team of Kotak PMS.

Kotak PMS Fund Manager

The research analysts, the portfolio managers, their PMS experience and their track record are the most important factors which one would like to know before he invests with a particular company.

So, here we are going to discuss a brief introduction and experience of the two most experienced portfolio managers and equity research analysts of the Kotak Securities PMS.

Mr Anshul Saigal

Anshul Saigal is the head of Kotak PMS and looks at portfolio management. In his total experience of 16 years, Mr Saigal has spent almost 10 years at Kotak.

He has working experience with JP Morgan, Standard Chartered Bank, ICICI Bank. He has experience in analyzing corporate credit and equity analysis also.

He has an interest in expanding his interest in the field of finance. He Continuously tries to enhance his portfolio investment knowledge so that the clients can get benefit from his investment decisions.

Mr Saigal has completed an MBA in Finance from Management Development Institute, Gurgaon and Engineering in the field of Industrial Engineering from SIT, Tumkur.

Mr. Rukun Tarachandani

Rukun Tarachandani is responsible for equity research at Kotak PMS. He is also responsible for performance tracking of the existing portfolios and generating new ideas.

Mr Tarachandani is a CFA and an MBA in Finance from Management Development Institute, Gurgaon and Engineering in IT from Nirma University.

Kotak PMS Strategies

The portfolio investment strategies offered by a PMS house decide the success (Return) of a portfolio. So, before going to any PMS house, it is very important to get information about the strategies available with a company.

Kotak PMS focuses on the investment in those companies which are highly managed and fundamentally strong.

The most important is the price of a stock that is purchased at appreciable discounts to its fair value. It means the stock can be unfavourable but will be able to provide a healthy return after a long time.

Kotak PMS offers three types of strategies based on their strict and disciplined investment philosophy. The strategies are provided to fulfil the financial needs and objectives of the client’s investment.

The following are the strategies used to build a Kotak PMS portfolio:

- Small and Mid-cap Strategy

- Kotak Special Situations Value Portfolio

- Pharma Focused Strategy

Small and Mid-cap Strategy

Here the stocks are managed with an open-ended term perspective. Under this strategy, special preference is given to those companies with strong fundamentals and future growth potential.

In this approach, approximately 75% of the portfolio will be invested in small and mid-cap securities with a significant market capitalization.

The reasons why you should invest in small and mid-cap companies include:

- Small and mid-cap companies are the market leaders in their respective sectors.

- Greater returns on investment, if the investment is done at attractive valuations.

- Diversification of risk.

- Mid stocks provide a balance of growth and stability.

Here is some key information about the small and Mid-cap strategy:

- Portfolio composition: The strategy focuses on the opportunity of investment in small and mid-cap stocks. The strategy has the flexibility of investing approx 25%-30% large-Cap stocks. The portfolio is made up of 10-25 stocks.

- Investment Approach: Kotak PMS opts Bottom-up investment approach.

- The investment Tenor of the small & mid-cap strategy is open-ended.

- The investment return is measured against the benchmark S&P BSE MidSmall Cap 400.

Returns history of this strategy:

Number of Years Return %age 3 Years 15% 5 Years 13% 7 Years 11% 10 Years 15% 11 Years + 18%

Kotak Special Situations Value Portfolio

This strategy is also known as Kotak SSV PMS. In this strategy, the main criterion is to make money by enhancing special situations in the financial market like corporate restructuring, mergers, and price-related changes.

The special situations refer to buybacks, mergers, and corporate restructuring. Under this strategy, the portfolio will contain 10-30 stocks that are benchmarked against India Value Index. This strategy is a unique product by Kotak PMS Services.

The PMS minimum investment requirement in the special situations value portfolio is 50 lakh. Here the portfolio is a mix of value opportunities and special situations.

The main motive of this strategy is to invest in some golden value opportunity stocks as well as in some Special situations in some stocks and related instruments.

The key information related to the special situations value portfolio strategy is mentioned below:

- Portfolio composition: The investment is made in those stocks in which price-related situations arise, merger & acquisition, and corporate restructuring. The portfolio consists of 10-30 stocks.

- Investment approach: Bottom-up investment approach is opted-in this strategy by the fund manager.

- The investment tenor of the special situation value portfolio is open-ended.

- And the benchmark Index is India Value Index.

Historical Performance of this strategy:

Number of Years Return %age 1 Year 12.5% 2 Years 28.9% 3 Years 21.8% 4 Years 36% 5 Years 33.4%

Pharma Focused Strategy

Pharma focused strategy’s main aim is to invest in pharma companies as these companies are sustainable value creators.

The stocks under this strategy offer a combination of growth potential & stability. This Kotak Pharma PMS is a distinctive product by Kotak PMS.

The steady and strong growth of the Pharma industry in India offers a golden opportunity to the investors in the long term.

So, Kotak PMS created this strategy to grasp the opportunity that arises in the pharma industry in the domestic as well as outside the Indian market.

Kotak PMS Performance

This company is among the best companies with fantastic Kotak PMS returns because of its healthy rate of return from the portfolio investment. The company has beaten the performance of 10-years of Mutual fund return.

Let’s have a quick look at the portfolio management services returns provided by Kotak PMS over a period of time:

Number of Years Return %age 3 Years 15% 5 Years 13% 7 Years 11% 10 Years 15% 11 Years+ 18%

The robust performance of Kotak PMS is evident.

Kotak PMS Investment Plans

The investment plan offered by the Kotak PMS is flexible so that a client can choose the investment plan according to their financial stability and need.

The investment plans have different ranges of investment amount which starts from the minimum of ₹50L and goes above ₹5 Cr. Here are the names and the range of investment plans:

- Bronze- ₹25 L to ₹50L

- Silver- ₹50 L to ₹1 CR.

- Gold- ₹1 Cr. to ₹5 CR.

- Platinum- ₹5 CR & above

Bronze: This plan is created for the investors of low financial capacity as well as low-risk appetite. The range starts from the minimum investment amount prescribed by the SEBI i.e. ₹25 Lakhs and goes up to ₹50 Lakhs. Investors come under low net-worth clients.

Silver: The investment plan ‘Silver’ starts from ₹50L and goes up to ₹1 Cr. This plan suits those investors who can bear relatively higher risk than the bronze plan investor.

Gold: Those investors who want to invest a minimum of ₹1 Cr in the investment portfolio, opt for this plan. They can invest up to ₹5 CR. Under this plan. They get some better investment support in comparison to both plan investors.

Platinum: This plan is opted by High net-worth clients who are ready to invest above ₹5 CR. They have a risk appetite and financial strength. They can wait for a long time to get a better return from the investment portfolio.

So, we can see that Kotak PMS has four different types of investment plans which fit the different categories of investors.

Kotak PMS Commission Model

The commission model of a company is a very important factor that retains the existing client and attracts new clients to the company.

Though almost all PMS houses offer the same commission model to the clients, the percentage of commission differs from company to company.

And, on the basis of the percentage of PMS commission, clients prefer the PMS house.

Here is the commission model offered by the Kotak PMS:

- Prepaid Commission Model

- Profit-sharing Commission Model

- Volume-based Commission Model

Kotak PMS Prepaid Commission Model

Prepaid commission model, this model is opted by the client if he/she agrees to pay commission to the portfolio manager in advance.

This model is dependent on the total investment amount i.e. the client is required to pay a higher commission if his investment amount is higher or vice-versa.

The percentage of commission is fixed for the different ranges of the investment amount. Higher the range, the less the percentage of commission.

Generally, in this model, less percentage of commission is charged in comparison to the other two models because of the high risk of return or performance of the portfolio.

Kotak PMS Profit-sharing Commission Model

The profit-based commission model is thought to be the best commission model. In this model, there is a certainty of performance/return of the portfolio otherwise an investor need not pay commission.

Due to this condition, a portfolio manager puts his full effort with his years of experience for getting a superior return. He knows that he will get his commission only after the realization of profit.

We can say that this model is based on the rule of no profit, no commission.

Generally, in this model, a higher percentage of commission is charged because of the low-risk model. The percentage of commission decreases with the increase of the total return from the portfolio.

Kotak PMS Volume-based Commission Model

This model is based on the total volume of the transactions completed by a fund manager. The commission is charged on the value of total transactions. The model is affected by the capital market status as well as the other aspects of investment.

If your portfolio manager is genuine, you will pay the right commission.

But, sometimes the fund manager increases the transaction volume just to charge more commission from the investor. So, it is also important to get information about the fund manager before accepting him as your fund manager.

Here is the table which is showing the percentage of the commission under each model:

Prepaid commission (Yearly) Prepaid commission (Yearly) Volume-based commission (Yearly) Profit sharing based (Yearly) Profit sharing based (Yearly) Investment range Commission in % of investment Transaction volume range Commission in % of volume Profit Commission in % of profit ₹25 L- 50L 1.50 ₹25 L- 50L 0.16 ₹2.5L-5L 25 ₹50L-1 CR 1.40 ₹50L-1 CR 0.14 ₹5L-10L 23 ₹1CR-5CR 1.20 ₹1CR-5CR 0.12 ₹10L-50L 20 ₹5CR & above 1.00 ₹5CR & above 0.10 ₹50L & above 15

Kotak PMS Charges

Like other PMS houses, PMS charges are various types of fees from the portfolio investors. This Kotak PMS fee structure includes a management fee, brokerage fee, custodian fee, exit load fee, depository fees etc.

Here are the details of other charges of Kotak PMS, you are required to pay as an investor.

- Fixed management fee: It is required to pay 2.5% per annum payable quarterly.

- Performance fees: This charge is NIL for the investors.

- Brokerage charge: The company charges 0.1% of total Asset value as a brokerage charge.

- Custodial charge: This charge is levied according to the custodian.

- Exit load fee: This fee is charged for the withdrawal of the amount before one year of portfolio creation. The fee is charged 3% for the first year, 2% for the second year, and 1% for the third year.

Kotak PMS Benefits

Following are the benefits of portfolio management services of Kotak PMS as a portfolio investor:

Among the Oldest PMS Houses: Kotak PMS is one of the oldest PMS houses in the country. It comes in the name of the oldest PMS houses in the country. It has Parentage support from Kotak AMC.

Track Record of Performance: Kotak PMS has a proven track record of superior performance or return of portfolio investment.

Since the creation of strategies, the two strategies, small & mid-cap strategy and Special situation value portfolio have outperformed the benchmark Index by a huge margin.

Strong Professional Team: Kotak PMS has a strong team of research analysts and fund managers. The company has ten members of the research team.

Best Back–office Support: It has the best quality of back-office support system for the clients, In-house research team and IT system.

Regular Client Interaction: The clients can remain in contact with the company on a regular basis. Also, they are provided quarterly performance reporting and market & portfolio outlook of the fund manager. The company offers email support as well as WhatsApp service to investors.

Customers have the advantage of calling the funds manager any time to know the details about their investment.

Kotak PMS Customer Care

Kotak PMS tries to offer all required support to the portfolio investors. This support helps the client to clear all queries and ultimately the company can retain the client for a long time by gaining their trust.

At first, A client gets the basic means from the company to get the answer to their queries that is through Email and call support. The Whatsapp facility is also offered by the company as this application is very famous among the clients.

A relationship manager is also appointed by the company to short out problems/confusions that arise between the client and the fund manager.

Apart from this, the company offers direct calling facilities to the fund managers. The high net-worth client can call the portfolio manager 5-7 times in a month while a low net-worth client can call 3-4 times in a month.

The TAT for issue resolution is 7 working days.

The investors can contact the company at the email – kmamcpmsclient.servicing@kotak.com.

Kotak PMS Contact Number

If you are looking to get in touch directly with the Kotak PMS team, here are the contact details:

Contact Method Details Toll Free Number 1800 222 299 / 1800 209 9191 / 1800 209 9292 Phone +22 43360000 Whatsapp +91 77389 88888 /+91 77389 88889 Fax +22 67132430 Address 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051

For more information, you can check this detailed review on Kotak Securities Customer care as well.

Kotak PMS Minimum Investment

In order to use the portfolio management services of Kotak Securities, you are required to invest a minimum capital in the order of ₹50 Lakhs.

In a few special cases, the investment house may allow lower initial investments but for that, you’d need to talk with the executive of Kotak Securities.

Kotak PMS Disclosure Document

It makes complete sense to go through the disclosure document of any investment house before using their services. This is for the simple reason that you MUST know what sort of responsibilities the investment house is taking while you provide them with your capital for investments.

As far as the Kotak PMS Disclosure document is concerned, here is the Kotak PMS disclosure link.

Kotak PMS AUM

As per the latest SEBI numbers, the total Kotak PMS AUM or Assets Under Management are ₹1766.67 Crore. This amount includes all kinds of clientele such as:

- Individual Residents (₹1291.01 Crore)

- Individual Non-Resident (₹421.84 Crore)

- Corporate Resident (₹53.82 Crore)

The overall client base for this PMS house is segregated as follows:

- Individual Residents (3930)

- Individual Non-Resident (1260)

- Corporate Resident (101)

Conclusion

The name of Kotak PMS comes among the names of the greatest PMS houses. It is a well-known PMS company in India. The Company offers customized portfolio strategies to investors.

The two strategies offered by the company have been outperforming since its inception. The clients also get flexible investment plans and commission models. The other charges of Kotak PMS are also at par with the other PMS houses.

The company runs its business with the help of well-qualified and well-experienced professionals who work round the clock to catch each opportunity that arises in the market.

Hence, if you are someone who is in search of the best PMS services in India for getting an outstanding return, then you are at the right place. You can keep Kotak PMS at the top of your list.

In case you are looking to use reliable and promising portfolio management services that provide consistently high returns, let us assist you in taking the next steps forward:

Kotak PMS FAQs

Here are some of the most frequently asked questions about Kotak PMS:

- What is the minimum amount to invest in the PMS?

According to the guideline of SEBI, one can invest in PMS with the minimum amount of ₹50 Lakhs.

2. What are the strategies offered by Kotak PMS?

Kotak PMS offers three types of strategies:

- Small & Mid-cap Strategy

- Special Situation Value Portfolio

- Pharma Focused Strategy

3. What is the minimum time Horizon for PMS services?

The company focuses on stocks for long term investment. So, it expects that an investor should wait for a minimum of 3 years to get the return from the investment portfolio.

4. When an investor can withdraw his/her fund?

An investor can withdraw his/her fund at any time, but the exit load fee is levied if the fund is withdrawn within 3 years of portfolio creation.

5. How can an investor pay the initial corpus?

One can pay the initial corpus by cash, stock or by the combination of both.

Furthermore, here are a few related facts to Kotak PMS:

- Transfer of existing stocks or a combination of cash and stocks: Yes, the transfer is possible. But, the bank account or demat account for the transfer should be in the name of the investor.

- The ideal time horizon for PMS investors: The investors should go for long term investment, to enjoy the benefits. As for the withdrawal is concerned, the investor can withdraw the money at any point after opening the account.

But, in case of the withdrawal within the first 3 years, investors will have to pay exit fees.

- Updates on PMS performance: Quarterly updates are given to clients. Investors can also go for a web login to view the performance of their accounts.

More on Kotak Securities

If you wish to learn more about this financial house, here are a few references for you:

Also Read:

Most pathetic PMS service, the fund manager is a donkey, if you want to end up crying and want to see your capital vanished go and invest in Kotak PMS.