Debt To Equity Ratio

More on Share Market Analysis

Debt to Equity Ratio, also known as the risk ratio or gearing ratio, is one of the leverage ratio or solvency ratio in the stock market world as part of the fundamental analysis of companies.

If you are looking for long-term investments, you need to make sure the stocks you have chosen have strong fundamentals in terms of their financial health and business performance. Going through such fundamental tools like the Debt-Equity ratio provide you with an objective understanding of the company.

Also Read: Put Call Ratio

Debt To Equity Ratio Formula

Leverage Ratio is a kind of financial ratio which helps to determine the debt load of a company.

To explain this in simpler terms, any person who has advanced money to the business on a long-term basis is expecting the safety of their money in two ways:

First in the form of regular payment that is “Interest”.

Second in the form of repayment of the “Principal Amount” at the end of the loan period.

Therefore leverage ratio or solvency ratio are calculated to determine the ability of the business to pay back its debts in the long run.

Debt To Equity Ratio is used to determine the amount of capital that is financed through debt and equity, that whether the company is depending on its debt or equity to progress in business, to explain this further we need to understand the terms debt and equity in details.

Debt, in the simplest forms, means the money that we owe to the others, in other words, the amount that we have borrowed from an outside source for the growth of the business, it is comprised of both short-term debt and long-term debt.

Debt: Short-Term Debt + Long-Term Debt

Where Short-Term Debt: Any debt which the company has to pay within a year is called short-term debt.

It appears as a current liability in the balance sheet of the company. For example accounts payable (creditors), wages due to employees, dividend payable, current portion of long-term debt.

Long-Term Debt: Any debt which has a maturity of a year or more than a year is called long-term debt.

That means it has to be paid back after a year, it appears as a non-current liability in the balance sheet of the company.

Debt To Equity Ratio Example

For example, long-term loans, capital leases, deferred income taxes.

Equity is a larger term referring to an ownership interest in a business.

Equity can be described in a number of ways as following :

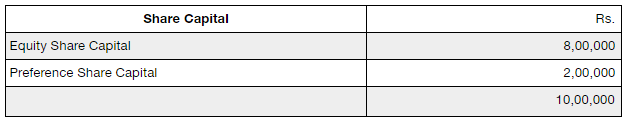

Equity = Share Capital + Reserve & Surplus

(where Share Capital = Equity Share Capital + Preference Share Capital)

or

Equity = Non-Current Assets + Working Capital – Non Current Liabilities

(where Working Capital = Current Assets – Current Liabilities)

To understand this further we need to define all these first:

Share Capital: Every business requires a certain amount of funds for the functioning of its business.

These funds are raised by the issue of shares.

Shares refer to part ownership in the business, the one who buys shares gets certain rights, like the right to vote etc in the company.

When you buy shares in a company you become part owners of that company, the people who buy shares are called shareholders.

Reserve and Surplus :

The capital profit of the company which is not available for distribution of dividend is called reserve and surplus.

Reserve and Surplus are represented in the balance sheet of a company under the heading of shareholders funds.

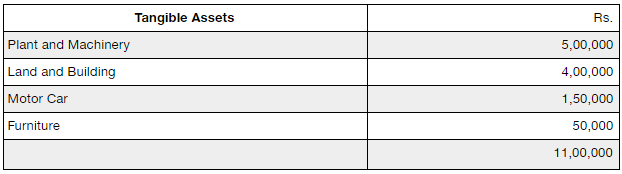

Non – Current Assets:

Non-current assets are the assets which have a long-term association with the company or business.

These assets render benefits in the upcoming years of the business and not immediately.

Example plant and machinery and equipment.

Non – Current Liabilities :

Non-current liabilities are the liabilities which are due for payment in the due course of the business.

These payments do not have to be made within the current financial year of the business.

Working Capital :

Working capital is the excess of current assets over the current liabilities of the business.

Working capital is the amount used for the day to day functioning of the business.

Now let’s understand how to calculate the Debt To Equity Ratio of a company from its Balance sheet:

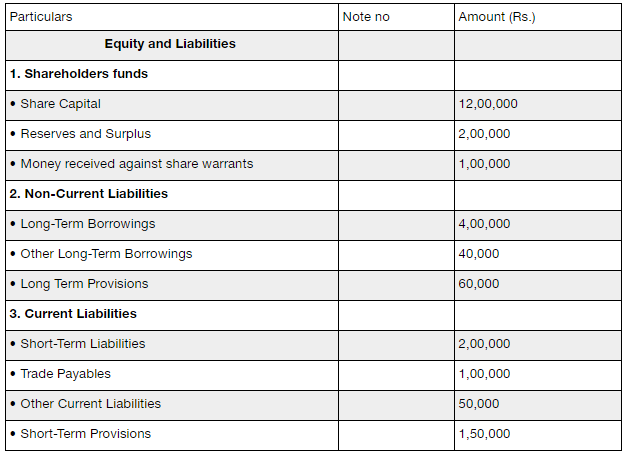

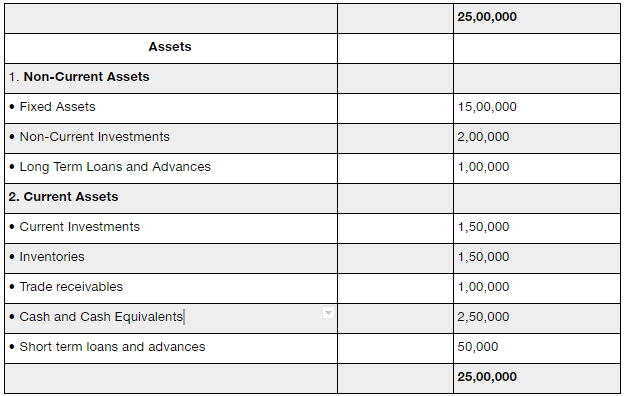

Balance Sheet

Debt To Equity Ratio = Debt / Equity

Debt = Long-term borrowing + Other long-term liabilities + Long-term Provisions

= ₹4,00,000 + ₹40,000 + ₹60,000

= ₹5,00,000

Equity = Share capital + Reserves & Surplus + Money received against share warrants

= ₹12,00,000 + ₹200,000 + ₹1,00,000

= ₹15,00,000

Alternatively:

Equity = Non – Current Assets + working capital – Non – current Liabilities

= ₹18,00,000 + ₹2,00,000 – ₹5,00,000

= ₹15,00,000

Working Capital = Current Assets – Current Liabilities

= ₹7,00,000 – ₹5,00,000

= ₹2,00,000

Debt To Equity Ratio = 5,00,000/15,00,000

= 0.33 : 1

Significance :

The debt-equity ratio, in this case, is 0.33: 1 which signifies that there is lesser use of debt than equity in the firm and hence the lenders will feel safe about the funds invested in the business.

The business is operating at low risk because it is primarily using its own funds for the functioning of business than borrowing money from outside sources.

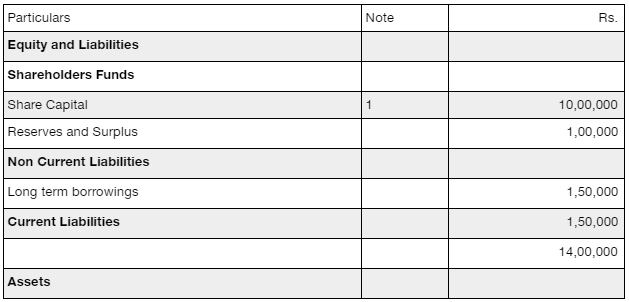

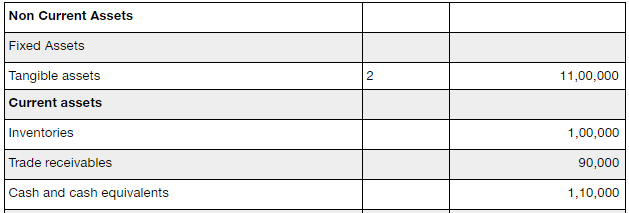

Now let’s take another example :

Balance Sheet

Note 1

Note 2

Debt To Equity Ratio = Debt / Equity

Debt = Long-term debts

= ₹1,50,000

Equity = Share Capital + Reserves and Surplus

= ₹10,00,000 + ₹1,00,000

= ₹11,00,000

Debt To Equity Ratio = 1,50,000 / 11,00,000

= 0.136 : 1

Significance :

The debt-equity ratio, in this case, is 0.136: 1 which signifies that the company has very less component of debt and more or equity, which is considered safe but it also signifies that the company is underutilising it resources to generate more income, hence optimum level should be attained.

Debt To Equity Ratio Significance:

This is how you as a beginner trader can interpret the Debt To Equity Ratio:

- Ratio analysis is an important financial tool for the statement analysis because it represents a relationship between two accounting numbers.

- Debt to equity ratio measures the relationship between long-term debt and equity. If the debt component of the total long-term funds employed is small, outsiders feel more secure.

- From the security point of view capital structure, use of lesser debt and more equity it is considered favourable as it reduces the chances of bankruptcy.

- Debt to equity ratio measures the degree of indebtedness of an enterprise and gives an idea to the long-term lender regarding the extent of security of the debt.

- A low debt to equity ratio reflects more security, on the other hand, a high debt to equity ratio is considered risky as it may put the firm into difficulty in meeting its obligations to outsiders.

- But, there is another perspective of the owner which highlights the use of more debt,

- They say that greater use of debt may help in ensuring higher returns for them if the return on earnings is more than the interest which has to be paid on the debt.

- Also, debt to equity ratio has different significance in different industries, before coming to any conclusion about the debt to equity ratio it is important to understand the industry and the needs of the industry

- Debt to equity ratio indicates the proportion of the company’s assets that are being financed through debt.

Debt To Equity Ratio Ideal:

High debt to equity ratio means a high risk to the business and low debt to equity ratio means low risk.

If the ratio is higher the lender will have more say in the business as they have more holding in the company.

In case the ratio is lower then the firm has more chances to borrow as an when required by the business.

The ideal debt to equity ratio is 2:1. Which means that at no given point of time should the debt be more than twice the equity because it becomes riskier to pay back and hence there is a fear of bankruptcy. But it is difficult to put a mark of the ideal ratio since every type and size and nature of industry and business is different.

Debt to Equity Ratio Limitations:

At the same time, here are a few concerns you must be aware of when it comes to using such ratios in the stock market analysis:

- One of the biggest limitations of the debt to equity ratio is that it is industry-specific.

- One cannot make a comparison through a debt to equity ratio across the industry.

Debt To Equity Ratio Summary:

- Debt to equity is one of the most favoured ratios while calculating the long-term financial stability of the firm.

- It helps in keeping the debt and equity level of the company in check.

- Debt to equity ratio can be calculated from the different point of views for different parties, for example, investors, management and government.

- Objective and meaning have to defined and interpreted quite wisely.

- It is important to have a good balance of debt and equity in the firm for proper utilisation of funds and maximisation of the profits.

In case you are looking to invest in the stock market, let us assist you in taking the next steps forward: