Return On Capital Employed

More on Share Market Analysis

Return on Capital Employed (ROCE) is a financial ratio which helps to measure the percentage of profit generated by a business from the total capital it has employed.

In other words, it measures how well the company is using its capital to earn returns in business. This is one of the most important metrics for an investor performing fundamental analysis of stocks before investing.

Return On Capital Employed Basics

Furthermore, it explains the overall utilisation of the funds of the business enterprise i.e. what amount of the overall capital is being used in research, operational activities, business expansion and so on.

Technically speaking, Return on capital employed (ROCE) uses end period capital numbers. On the other hand, if we use the average of opening and closing capital period numbers, in that case, they obtain Return on Average Capital Employed (ROACE).

It is a key profitability ratio and it is calculated in percentage form.

In this detailed tutorial on ROCE, we will be touching aspects such as:

- ROCE Formula

- ROCE Example

- ROCE Interpretation

- ROCE Ideal Returns

- ROCE Limitations

Return On Capital Employed Formula:

The formula used to calculate ROCE is as follows :

Return on Capital Employed: Profit before Interest and Tax / Capital Employed

where,

Capital Employed: Shareholder’s Funds + Debentures + Long-term loans

or

Capital Employed: Non-Current Assets + Working Capital

Now let’s understand these terms in brief

Profit Before Interest and Tax:

Profit before Interest and tax is the operating profit before deducting the interest and tax.

Operating profit is the excess of all the operating income over the operating expenses for a firm. To arrive at the profit before tax and interest we need to add back tax and interest to the Net Profit of the firm.

Capital Employed:

Capital Employed means the long-term funds employed in the business, capital employed can be calculated in two ways :

Method#1

Capital Employed is the sum total of Shareholders funds, Debentures and Long Term Loans.

Let us discuss in brief each one of them.

Shareholder’s Funds :

Shareholders funds refer to the excess of total assets over total liabilities. Shareholders equity is the amount that shows how the company has been financed with the help of equity and preference shares.

Debentures :

It is a document issued by a company under its common seal acknowledging the debt and it also contains the term of repayment of debt and payment of interest at a specified rate.

Long Term Loans :

Loans that have a longer repayment period. These loans are usually for 3 years and above.

Method#2:

Capital Employed can also be calculated as a sum total of Non-Current Assets and Working Capital.

Non-Current Assets :

Non-current assets are those assets which are the investments of the business for more than a year, they have a long-term association with the company.

Working Capital :

Working capital refers to the capital used for day to day working of the business. It is the excess of current assets over current liabilities.

Return on Capital Employed Calculation:

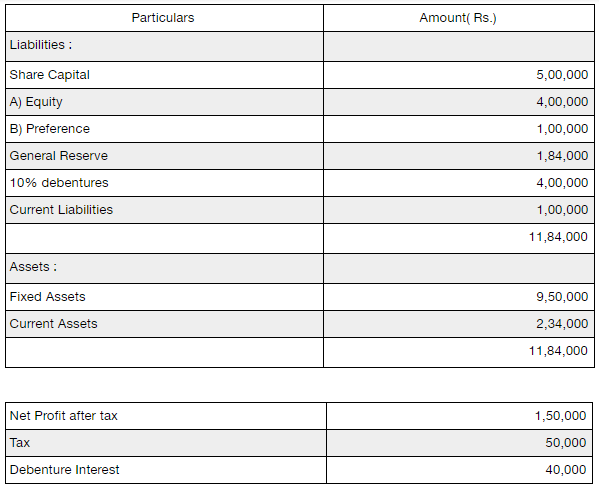

Balance Sheet

Return on Capital Employed :

Profit before interest and tax = Net profit after tax + Debenture Interest + Tax

: ₹(1,50,000 + 40,000 + 50,000)

: ₹2,40,000

Capital Employed = Equity Share Capital + Preference Share Capital + Reserves + Debentures

: ₹(4,00,000 + 1,00,000 + 1,84,000 + 4,00,000)

: ₹10,84,000

Alternatively

Capital Employed: Non-Current Assets + Working Capital

(Working Capital : Current Assets – Current Liabilities)

: ₹9,50,000 + ₹( 2,34,000 – 1,00,000)

: ₹(9,50,000 + 1,34,000)

: ₹10,84,000

Return on Capital Employed = Net profit before tax and dividend / Capital Employed

: (2,40,000/ 10,84,000) * 100

: 22.14%

Return on Capital Employed Interpretation:

The Return on Capital Employed is 22.14% which is a good percentage. This tells that the company is efficiently utilising its capital. For long term financial soundness of the first, the return should be greater than the interest which is being paid by the firm.

In this case, the firm is paying interest of 10% on debentures hence the return is 22.14 % which is higher than the interest hence this proves that the company is financially quite stable.

- Return on Capital Employed reveals the efficiency of the business in the utilisation of funds entrusted to it by shareholders, debenture holders and long-term loans.

- It helps in assessing whether the firm is earning a higher ROCE than the interest rate paid.

- Return on capital employed should be higher than the capital costs, otherwise, it shows that the company is not utilising its capital properly and not generating good shareholder value.

- Higher ROCE implies a more economical use of capital.

- Return on Capital is considered a good measure of profitability.

- In the case of inter-firm comparison return on capital employed is considered a good measure of comparison.

- It is important to determine an industry benchmark in case of return of capital employed because it makes the assessment of the firm easier.

- In many cases, the company use Net Operating profit after tax (NOPT) as a numerator for calculating the ROCE.

- Return on capital employed is very useful when comparing capital-intensive companies.

- ROCE is more dependable because unlike other ratios it takes into consideration all the components of debt and equity and long-term loans.

- ROCE can be used with the other profitability ratios like return on equity and return on assets for comparison of the financial profitability of the company.

- ROCE ratio is one of the best ratios from the point of view of the investors.

Ideal Return on Capital Employed

Ideal Return on Capital Employed is the one which gives a higher return.

Higher the ROCE better it is for the firm because it gives a fair idea of the financial soundness of the firm.

But it is important to compare the return on capital employed with the industry benchmark as well.

Lets explain this with the help of an example the ROCE for firm 1 is 15% and firm 2 is 19% so these can be interpreted as a good return on capital employed ratio’s but the industry benchmark is 30%, so in this case the profitability of both is very less as compared to the industry average.

Hence they are not very sound as compared to other firms in the industry.

Return on Capital Employed Limitations:

There are a number of limitations while using the return on capital employed. Few of them are cited below :

- It is very important to use the ratio for comparison in the same industry, return on capital employed cannot be used for comparison across the industries.

- One of the biggest limitations is that they are calculated on the book value of assets and hence even if cash flow remains same the assets are depreciated which will generate a higher return even if it does not exist.

- It is essential to compare the ratios of the same period.

- Comparison of the ratio of a different time period can lead to wrong interpretations.

Return on Capital Employed Summary

Return On Capital Employed is one of the best ratios for measuring the financial profitability of the firm. It not only gives a good picture of the firm while comparing through different periods but also when we compare the firm with the other companies of the industry as well.

Investors often use this ratio as a benchmark when they are deciding about investing their funds in the company.

If you want assistance in stock market trading through research and tips, let us assist you in taking the next steps forward: