Return on Equity

More on Share Market Analysis

Return on Equity (ROE) is a key financial ratio which helps to measure the profitability of the company. It helps in measuring the efficiency of the company by using the shareholder’s equity.

In other words, it measures how good the company is at earning a decent return on the shareholder’s money. It is one of the most useful ratios from an investors point of view. This is one of the most important tools for investors looking to perform fundamental analysis of stocks.

Also, review Equity Investment Types to take the benefits of investment.

Thus, if you are looking to invest in a stock, it makes total sense for you to have a quick check at the historical level as well as recent return on equity numbers published by the company.

Return On Equity Basics

Return on Equity helps the investors to understand the growth they get from an equity investment in the company. It is also known as Return on Shareholders Funds or Return on Net Worth (RONW).

It is calculated in percentage form.

In this detailed tutorial on Return on Equity, we will have a look at different related areas such as:

- RoE Formula

- RoE Calculator

- RoE Example

- RoE Significance

- RoE Limitations

- Ideal RoE Value

Let’s get started!

Return On Equity Formula:

The formula used to calculate RoE is as follows :

Return On Equity = Net Income / Shareholder’s Funds

And this what the factors mean on which the return on equity depends:

Net Income :

In business and accounting terms, net income is the excess of income generated from the business from the sale of good and services over the expenses incurred.

After deducting all the operating expenses (which generally include the cost of goods sold, management expenses and others) from the income we arrive at the operating income and hence we have to deduct tax from this to get a net income after tax.

This is also called PAT or Profit After Tax.

You can mostly find the Net Income at the bottom of the Income Statement published by the company.

Shareholder’s Funds:

In the most simple language possible, Shareholders funds’ is the equity which is raised by the shareholders. Shareholders funds can be found in a company’s Balance Sheet.

Average common stockholders equity is usually used while computing return on equity. Average common stockholders equity is the average of start period equity and end period equity.

Alternatively, Shareholders funds’ is also the excess of total assets over the total liabilities of the firm.

Return on Equity Calculator

Usually, return on equity is calculated on average method basis, because it gives a better and fairer picture of the growth. If one looks at the number in isolation without any benchmarking, it will be difficult to make any sense about what that number stands for.

Let’s try to understand this with the help of an example.

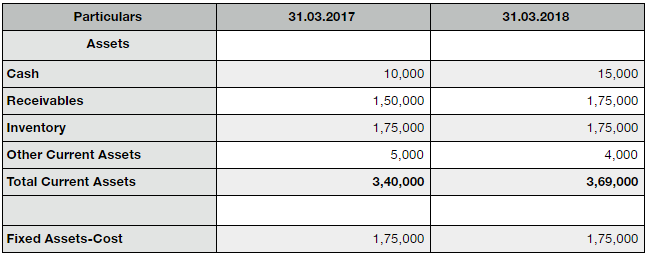

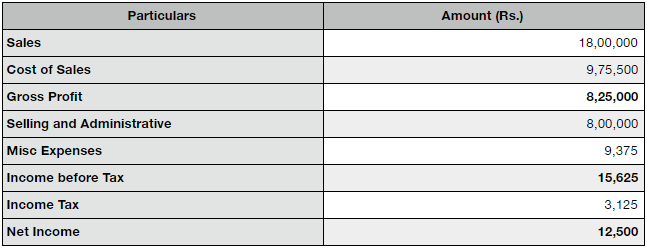

Balance Sheet

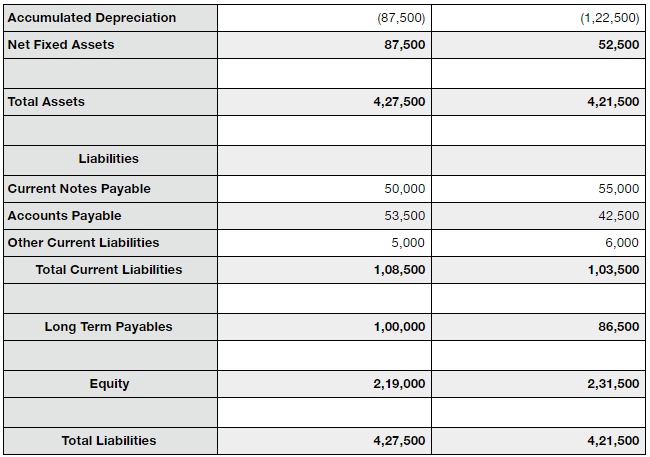

Income Statement

Let’s understand how to calculate Return on Equity:

Like mentioned above, the formula for RoE is:

Return On Equity: Net Income/ Shareholder’s Equity

Net Income: Income before Tax- Income Tax

: 15,625- 3,125

: 12,500

Shareholders Fund’s: Equity Share Capital ( 31.03.2017)

: 2,19,000

Alternatively,

Shareholders Fund ’s: Total Assets – Total Liabilities

: 4,27,500 – 2,08,500

: 2,19,000

Shareholders Fund’s: Equity Share Capital ( 31.03.2018)

: 2,31,500

Alternatively,

Shareholders Fund’s: Total Assets – Total Liabilities

: 4,21,500 – 1,90,000

: 2,31,500

Average Shareholders Equity : (Equity at 31.03.2017 + Equity 31.03.2018) / 2

: (2,19,000 + 2,31,500)/2

: 2,25,250

Return On Equity or RoE: 12,500 / 2,25,250 * 100

: 5.55%

Return On Equity Interpretation:

While calculating the RoE we have used the average equity method because it gives a better picture of growth over the period. RoE, in this case, is 5.55% which is quite satisfactory BUT not very good.

Hence there is more scope of better utilisation of the equity of the investors by the firm, they need to improve their decision making while using the equity in the business.

Higher the return better it is for the company and the investors.

Any financial ratio that you use for stock analysis at the fundamental or technical level, has its own set of benefits and significance level. As far as RoE is concerned, this is what it brings to the table:

- Return on Equity ratio is from the point of view of the investors and not from the point of view of the company.

- Investors want to know the growth between the start period and the end period so that they can gauge the trend and efficiency of the company. RoE helps to find that!

- Return on Equity helps to keep track of the profits of the company.

- Higher the RoE better it is for the investors, this gives them the security that the company is utilising their equity well and it is helping in the growth of the company. On the other hand lesser return on equity is an indication of under utilisation of the equity by the company.

- Increasing RoE is a good indicator both from the company point of view and investors point of view. It gives an indication that decision making is going right.

- Decreasing RoE is not a good indicator, it shows poor decision making of the company.

- It is important to compare the RoE to the cost of equity. The RoE should be more than the cost of equity only then its a true indicator of growth.

- An average of 5-10 years of RoE gives a fair picture to investors about the growth of the company.

- Return on equity is more useful when it is compared within the same industry, across the industry comparison is not recommended.

- A higher return is generated by cyclical industries as compared to defensive industries. So an investor can choose cyclical stocks for better returns.

- Risker the firm is will usually generate a larger return as compared to a firm which is less risky because risky firm tends to demand the higher cost of capital and higher cost of equity.

- Higher return on equity attracts the investors to pick up stocks of the company and companies which give similar return within the same industry.

Return On Equity Limitations

At the same time, here are a few concerns you must be aware of while using Return on Equity as a parameter to judge a company performance:

- RoE can only be used to compare the firms within the same industry, it is tough to make a comparison outside the industry.

- It is easy for companies to manipulate return on equity ratio either with the buyback of shares or by assets writing down.

- In case of buyback of shares, the return of equity can be affected because when management repurchases shares from the market it decreases the number of outstanding shares, hence leading to decrease in shareholders equity and the return on equity will become higher because the denominator is smaller now.

- While calculating RoE some firms exclude intangible assets like goodwill and patents as they are non-monetary items, this leads to a misleading return on equity in comparison to firms that decide to include them.

- High level of debt can artificially boost the RoE. If the company has more debt then it will have less equity and hence its RoE will be higher. At the same time, it will have an artificial impact on the Debt to Equity ratio as well.

- RoE may vary in case the company decided to distribute dividends and not use the profit generated as cash for the business.

Ideal Return On Equity

Higher return on equity is an ideal ratio for the company. RoE of 15-20% is normally considered as good. In some cases, there are some industries which have a higher RoE as compared to other industry.

So it is recommended to make the comparison within the same industry as it helps to understand the ratio against the average of the industry.

Return On Equity Summary

Return on equity is a very important ratio from the shareholder’s point of view in assessing whether their investment in the firm generates a return or not.

It should be higher than the return on investment otherwise it would imply that the company’s funds have not been employed profitably.

RoE must be compared to the previous RoE of the company and the industry average as well.

On its own, return on equity holds less meaning and is difficult to interpret as well.

If you want assistance in stock market trading through research and tips, let us assist you in taking the next steps forward: