Zerodha Fundamental Analysis

More Stockbroker Research Reviews

Is there anything called Zerodha Fundamental Analysis in place for the clients of this broker? If no, why not? If yes, how can you carry out such an analysis?

Well, let’s find out!

Fundamental analysis of stocks means selecting stocks for buying on the basis of financial, microeconomic and macroeconomic factors affecting the prices of stocks.

Stocks are generally bought for medium to long term after analyzing the financial health of the company and factors affecting the industry of the company.

In this article, we will learn how Zerodha’s fundamental analysis can be done with the help of its platforms.

Zerodha Fundamental Analysis Techniques and Tools

Fundamental Analysis of stocks through Zerodha is done using balance sheets, income statements, cash flow statements, key financial ratios, etc. After analyzing various aspects of the financial health of a company, one tries to find out whether it is overvalued, undervalued or correctly valued.

Even in the technical analysis of stocks for intraday trading, Zerodha fundamental analysis plays a big role too.

One can choose undervalued stocks in order to gain profits from their investment.

Now, let us first see what functionalities are available on Zerodha Kite and Zerodha Kite 3.0 mobile app for Zerodha fundamental analysis.

First, one needs to add a particular stock to the watch list on Zerodha platform. Then, after clicking on more, one needs to go to financials. It will appear as shown in the picture below:

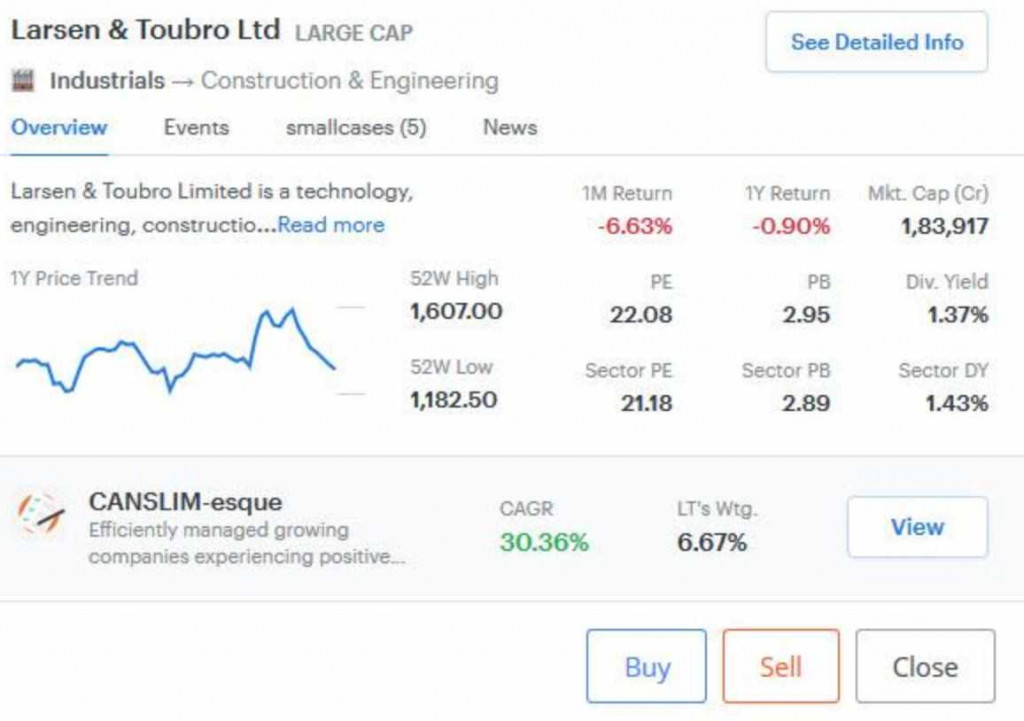

Let us take an example of Larsen & Toubro stock. The Zerodha platform shows the following basic fundamental information about the company –

1. Information about the market capitalization of the company: It shows L&T is a large-cap company and has a market cap of around ₹1,83,917 crores.

2. The sector of the company – L&T belongs to construction and engineering. One can also get to know additional information about the business of the company by reading more about it.

3. Historical Price Trends – One-year price trend of the stock prices is shown on the platform. The detailed information about the historical prices of the stock can also be seen in the charts on the Kite platform. One can also see the 52-week high and 52 week low prices there.

Zerodha fundamental analysis can be done by analysing the one month and one-year return figures.

4. Financial Ratios In Comparison with Sector – Financial ratios tell a lot about a company’s financial health. However, the figures of the ratios do not say much about when viewed alone.

They make sense when they are compared with the ratios of the same company with last years’ figures or when they are compared with the same ratios of the industry to which the company belongs.

Zerodha fundamental analysis helps in the selection of stocks on the basis of some important financial ratios.

Let us discuss some of the important ones :

a. PE Ratio or Price – to – Earnings Ratio: This ratio measures the current stock price in relation to the earnings per share (EPS) of the company. If you are looking to calculate the PE ratio, it is pretty straight-forward. You just need to divide the current stock price by EPS.

PE = Current stock price per share / EPS

In the above example, Zerodha fundamental analysis shows that PE ratio of L&T is 22.08 and that of the sector is 21.18. A PE of 22.08 is stronger in comparison to the sector.

b. PB Ratio or Price – To – Book Ratio: This is a very crucial metric as this particular ratio measures the current stock price per share in a specific index in relation to the overall book value of the listed company.

If the PB ratio is relatively low, it could implicitly indicate that the stock is undervalued. PB ratio is calculated by dividing current stock price by book value of the company.

PB = Current stock price per share / Book value

In the above example, Zerodha fundamental analysis shows that PE ratio of L&T is 2.95 and that of the sector is 2.89.

c. Dividend Yield – A comparison of L&T’s dividend yield and that of the sector can be seen in the picture posted above. Dividend yield of L&T is 1.37% whereas the sector’s dividend yield is 1.43%.

Once the basic information has been seen, one can press the “See Detailed Info” button on the top. It takes us to another link where complete, comprehensive detailed financial information is available for fundamental analysis.

Now, let’s focus our attention on some of the most crucial aspects:

1. Zerodha Fundamental Analysis Using Income Statement – This would tell us about the financial performance of the company in terms of revenues, expenses, net profit or loss, etc.

A comparison of the following data points with the corresponding historical figures would help one do Zerodha fundamental analysis:

- Total revenues

- Gross profit

- EBITDA (Earnings before interest, tax, depreciation and amortization)

- PBIT (Profit before interest and taxes)

- PBT (Profit before taxes)

- Net income

- EPS

For more information, check this detailed review on how to read a profile and loss statement.

2. Zerodha Fundamental Analysis Using Balance Sheet – This would tell us about the assets, liabilities and shareholders’ equity of a company.

Important ratios that should be used to analyse a company’s financial health are:

- Debt to Equity Ratio – A healthy debt to equity ratio should be maintained for any company. More debts are risky for cash flows and too little debt shows lack of aggressive growth and expansion plans of a company

- Current Ratio – It measures the company’s ability to pay its short-term obligations.

For more information, check this detailed review on how to read a balance sheet.

3. Zerodha Fundamental Analysis Using Cash Flow Statement – This would tell us about all the sources of a company’s cash inflow and outflows. Changes in working capital can also be seen through cash flow statements.

For more information, check this detailed review on how to read a cash and flow statement.

Peer Comparison

In order to know whether to invest in a particular stock or not, it is extremely important to make comparisons within the companies operating in the same sector. All the important ratios should be compared along with their market cap.

Conclusion

Zerodha fundamental analysis is a very convenient way to select stocks to invest in for medium to long term.

A thorough analysis of balance sheets, income statements, cash flow statements, key financial ratios, etc. is needed before making a decision to put one’s hard-earned money in a particular stock.

A comprehensive analysis of a company, as well as comparison with peers, are the most important things to be done while using fundamental analysis as a means of investing in the stock market.

In case you are looking to get started with stock market investments, let us assist you in taking the next steps ahead. Just fill in a few basic details below to get started:

More on Zerodha

If you wish to learn more about this discount broker, here are a few references for you: