Sensex

More On Share Market

If you are an investor and stay active in the Indian Stock Market then you must have come across the word Sensex.

Even many among you who are not into trading also heard about Sensex.

But what actually a Sensex is? What is its role, and objective in the share market?

Many among you might be in trade but still not know the exact meaning and its role? Isn’t it?

Considering its importance here is the complete detail of the topic.

This article provides the in-depth details of and the complete meaning of the term, along with its objectives and various other parameters.

So, let’s get started.

BSE Sensex

Want to know How many Stock Exchanges in India? BSE Sensex is one of the stock exchanges, let’s discuss it here in detail.

Sensex or the S&P BSE Sensex Index is the metric uses to analyze the performance of stocks from the BSE listed companies.

Wondering what it implies?

Well! here BSE represents the Bombay Stock Exchange, the first and the largest securities market of India. But curious to know what is Stock Exchange?

Can understand your eagerness!

A stock exchange is a place that acts as a continuous auction market where buyers and sellers can trade securities.

BSE is based in Mumbai and was established in 1875 as the Native Share and Stock Brokers’ Association. It is one of the largest stock exchanges in the world which includes about 5000 listed companies.

Now, let us try to understand the meaning of Sensex.

It is actually a stock market index that in turn is a metric that tracks the performance of several selected stocks from each sector.

Also read: Nifty and Sensex that are the two economic barometer for measuring the market indexes.

Sensex consists of 30 companies picked from the 11 industrial sectors based on their financial soundness and performance in their respective sectors.

These selected companies are reviewed regularly and changes may be made in the constituent companies of the index as and when required.

Since, it is the oldest index of the country it offers the time series data of the longer period from 1979 onwards.

Earlier, the BSE Sensex index was calculated based on “Full Market Capitalization”. Later on the method was replaced by the “Free-Float Methodology” from September 2003 onwards.

The free float methodology is being adopted by all the major indexes of the world including MSCI, FTSE, STOXX, S&P and Dow Jones.

Some quick facts:

- The base year of S&P BSE SENSEX is 1978-79.

- Its base value is 100.

- The index is widely reported in both domestic and international markets through print as well as electronic media.

Sensex Meaning

Sensex is actually a combination of two different words Sensitive and Index. It is a stock market term that was coined by the analyst Deepak Mohoni.

In general, Sensex is an index that is used to showcase the performance of the companies listed on the Bombay Stock Exchange. SENSEX was chosen as an official index by BSE in 1986 to analyze the performance of the Indian market.

Sensex consists of 30 prominent stocks that are derived from the industries or sectors that remain active in the exchange market.

The value of Sensex points towards the market movement. The low value of Sensex means that the share price is decreasing while high value means the increase in prices of share.

Thus, an active investor can identify the boom and busts by observing the value of SENSEX.

The S&P index committee played a vital role in selecting the constituents of the index. The selection was done based on five criteria as enlisted below.

Basically, the securities that constitute S&P BSE Sensex are screened on two main criteria:

- Quantitative Criteria – They include the following five main points-

- Market Capitalization – The security should be in the Top 100 companies listed by full market capitalization. The weight of each security, which is based on free-float should be at least 0.5% of the Index.

- Listing History – The security should have been listed for at least one year on Sensex

- The frequency of Trading – The security should have been traded on every trading day for the last one year. Although, there are some exceptions that could be made in case of extreme situations like suspension of securities.

- Average Daily Trades – To get listed, the rank of the security must be among the top 150 companies that is analyzed on the basis of average trade done per day in a last one year.

- Average Daily Turnover – The security should rank among the top 150 companies listed by the average value of shares traded per day for the last year.

- Qualitative Criteria – The stocks selection committee or the index committee should think that the track record of the particular security is acceptable to be a part of the index.

As per the latest numbers, the companies that form the Sensex are listed below in decreasing order of their weightings:

| Company Name | Weightage |

| Reliance Industries | 12.38% |

| HDFC Bank | 11.34% |

| HDFC | 8.91% |

| Infosys | 7.14% |

| ICICI Bank | 6.71% |

| ITC | 5.17% |

| TCS | 5.21% |

| Hindustan Unilever | 5.12% |

| Kotak Bank | 5.17% |

| L&T | 3.00% |

| Bharti Airtel | 2.98% |

| Axis Bank | 2.79% |

| Asian Paint | 2.25% |

| SBI | 2.18% |

| Maruti | 2.14% |

| Bajaj Finance | 1.90% |

| Nestle India | 1.82% |

| HCL Tech | 1.54% |

| Sun Pharma | 1.52% |

| Titan | 1.28% |

| Powergrid | 1.12% |

| Ultratech | 1.12% |

| Mahindra and Mahindra | 1.12% |

| Tech Mahindra | 1.02% |

| Bajaj Auto | 1.00% |

| NTPC | 0.99% |

| ONGC | 0.94% |

| Hero Motor Corp | 0.78% |

| Tata Steel | 0.68% |

| Indusind Bank | 0.69% |

Sensex Full Form

The next important thing is to know the full form of the Sensex.

SENSEX- Stock Exchange Sensitive Index.

The term implies that it is an indicator that is used to gain an idea of the stock movement of the companies listed in the BSE.

It gives a wider view of various stock performance and is used to measure the ability of a particular stock based on liquidity and market cap. Other than this, it is used to evaluate the financial strength of the stock market.

Sensex offers many benefits to investors like:

- Better Visibility of shares of the company listed in BSE.

- Increases the prestige of the company.

- Gives the company a chance to raise its capital

- Enhance the liquidity of the equity holders and offers various growth opportunities.

Sensex Opening Time

There are two major stock exchanges in India BSE and NSE

Both these exchanges actively work on weekdays, i.e., Monday to Friday and remain closed during weekends and other holidays.

During the trading hours, the exchanges work from 9:15 AM to 3:30 PM.

However, the SENSEX timing is further divided into three main sessions to decrease the volatility in the market.

- Normal Session

- Pre-Opening Session

- Post Closing Session

Normal Session: It is an continous session starting at 9:15 AM and closes at 3:30 PM. It follows the bilateral matching session.

Pre-Opening Session: The pre-opening sessions the time before the stock market opens. It is further divided into three parts as discussed in a table below:

| SENSEX Pre-Opening Session | ||

| Session Time | Activities | |

| 9:00 AM-9:08 AM | Order entry session | |

| Allows you to place order to buy and sell stocks | ||

| Gives permission to modify or cancel order during the period | ||

| 9:08 AM-9:12 AM | Order matching and calculation of the opening price of the normal session | |

| Does not allow to modify or cancel order | ||

| 9:12 AM-9:15 AM | This is the buffer period | |

| Used for the smooth translation of pre-opening session to the normal session | ||

The calculation of the opening price of the normal session is done using the multilateral order matching system. This reduces the volatility of opening the market.

But still, most people do not reap the benefit of the pre-order session and therefore still the huge volatility prevails in the market.

Post-Closing Session: Last comes the post-closing session, i.e. the time after the market closes. It lies between 3:40 PM to 4:00 PM. The post-closing session also allows the trader to place the buy or sell stocks at the closing price of the stock. If the trader is available then your trade will be confirmed at the mentioned price.

Sensex Closing Time

Since the market closes at 3:30 PM and the time between 3:30 PM and 3:40 PM is the time when the price calculation is closed.

The closing price of any stock is done based on the weighted average of the price between 3:00 PM to 3:30 PM. If in case, the trader fails to trade between these periods, then you can place an AMO, Aftermarket order.

However, it does not allow actual trading but gives you permission to place buy or sell order.

Sensex History

As one can implicitly assume, that when the stock market and the corresponding indices were born, only a handful (if not none) number of people would have trusted the concept of investing in someone else’s business through something called a “share”.

From that point in history to today’s world where investing in the stock market is seen as one of the crucial investment methodologies to grow your income over time.

From using the ‘Market Capitalization-Weighted‘ method of using the ‘free-float market capitalization-weighted‘ method, the market and the indices have only matured.

When the index was launched in the year 1986, nobody could have imagined the manifestation it has seen over the last 3 decades or so.

In its time till today, the SENSEX has shown many rise and falls.

- During July 1990, the SENSEX first time touched the four-digit figure and closed at 1,001. La

- On February 19, 2013 SENSEX becomes S&P Sensex when the BSE ties up with the Standard and Poors and emerged as the brand for Sensex and other indexes.

- The year ahead on March 13, 2014 SENSEX closes at the value higher than the Hang Seng Index ( it is a stock market index in Hong Kong) thus becoming the major stock market index of Asia.

- Few months after in May 2014, SENSEX crossed the value of 25,000 making a new record and closed above its milestone value on June 5, 2014.

- A new record was again set in the year 2018 when the SENSEX scored 38,000 during the intraday aya trade and closed at 38,024.37.

Here is the brief of the SENSEX’s biggest falls and rise.

Major Falls in SENSEX

Sensex history depicts the major fall of the Sensex value to its maximum each year. Here you can gain a brief idea of the same.

| SENSEX Major Falls | SENSEX Major Falls | |||

| Year | Date | Points | ||

| 1992 | 28 April 1992 | 570 | ||

| 2006 | 18 May 2006 | 826 | ||

| 2007 | 17 December 2007 | 769.48 | ||

| 2008 | 21 January 2008 | 1408.35 | ||

| 2009 | 6 July 2009 | 869.65 | ||

| 2010 | 16 November 2010 | 444.55 | ||

| 2011 | 22 September 2011 | 704 | ||

| 2012 | 27 February 2012 | 477.82 | ||

| 2013 | 16 August 2013 | 769.41 | ||

| 2014 | 16 December 2014 | 538.12 | ||

| 2015 | 24 August 2015 | 1624.51 | ||

| 2016 | 11 February 2016 | 807.07 | ||

| 2018 | 2 February 2018 | 839.91 | ||

| 2019 | 8 July 2019 | 792.82 | ||

| 2020 | 23 March 2020 | 3934.72 | ||

Major Rise in SENSEX

Every year, Sensex sees its own high and its not necessary that this index sees a new high every year.

There have been instances when the Sensex has seen a high in the first year and the next year, the index has seen a sudden or even a gradual decline in its value.

Here is a quick look at how the Sensex valued the highest every year since 2008:

| SENSEX Major Single Day Highs | ||||

| Year | Date | Sensex Reading | ||

| 2020 | 14-Jan-2020 | 41,952.63 | ||

| 2019 | 20-Dec-2019 | 41,809.96 | ||

| 2018 | 29-Aug-2018 | 38,989.65 | ||

| 2017 | 27-Dec-2017 | 34,137.97 | ||

| 2016 | 08-Sep-2016 | 29,077.28 | ||

| 2015 | 04-Mar-2015 | 30,024.74 | ||

| 2014 | 28-Nov-2014 | 28,822.37 | ||

| 2013 | 09-Dec-2013 | 21,483.74 | ||

| 2012 | 11-Dec-2012 | 19,612.18 | ||

| 2011 | 06-Apr-2011 | 19,811.14 | ||

| 2010 | 08-Nov-2010 | 21,075.71 | ||

| 2009 | 20-Oct-2009 | 17,457.26 | ||

| 2008 | 10-Jan-2008 | 21,206.77 | ||

Sensex Objectives

Some of the objectives of the Sensex are:

- Measurement of Indian Market Movement: Due to a long history and wide acceptance, BSE is considered to be a very good indicator for reflecting Indian market movements and sentiments of traders, speculators and investors.

- Acts as Benchmark: Due to the complete and balanced representation of all the sectors, Sensex acts as an appropriate benchmark for fund managers to compare the growth of their funds.

- Index-Based Derivative Products: Due to the constituent companies of the Sensex, all kinds of investors refer to S&P BSE SENSEX for their trading and investment purposes. It is the most liquid contract in the Indian market.

BSE Sensex Index

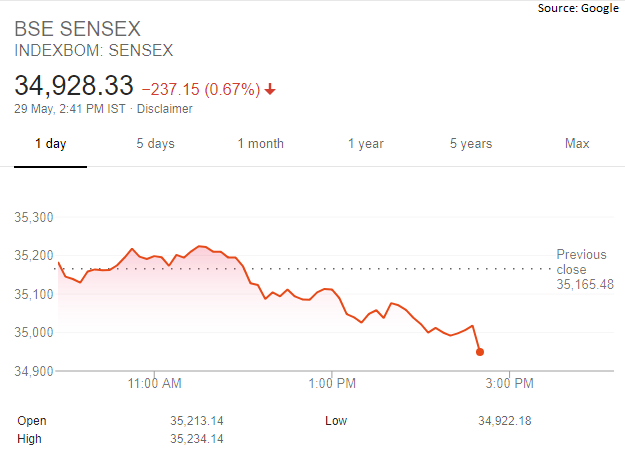

The index value of 34,928.33 comes from the total of the listing of the companies mentioned above. This total count varies based on the numerical stance of those companies at any given point in time.

Trading on BSE includes stocks, stock futures, stock options, index futures, index options and weekly options and the day-to-day maintenance of the index is taken care of by the Index Cell of the exchange.

Based on the above criteria, 100s of companies are listed in an index. The health of a particular index can be analyzed by knowing the objective number against it which fluctuates as er the overall market trend across the industries.

Therefore, Sensex considers 30 stocks (number of stocks vary from one index to another) from a total of 11 industry domains.

These 30 stocks are selected based on their current market capitalization.

Market Capitalization = Number of Shares X Price Per Share

Thus, such a methodology brings in complete transparency and objectivity while you try to understand the health of a specific index in regards to the overall market momentum.

Based on the value of the market capitalization of a company, it can enter or exit the top 30 stocks at any given point in time.

To give you a clearer idea, here is the Sensex reading from one of the trading sessions:

Sensex Calculation

Initially, SENSEX was calculated based on the “Full Market Capitalization” methodology but since it is a less effective and thus, less preferred method, the calculations later shifted to the Free-float methodology with effect from September 1, 2003.

This means that instead of considering the full market capitalization of the company, only the free-float capitalization is considered while calculation of the index and assigning weights to stocks in the index.

Free-float refers to those shares of the company that is readily available for trading in the market. It excludes promoters’ holding, government holding, insiders’ holding, equity held by Employee Welfare Trusts and other locked-in shares.

Every quarter, all the companies are required to submit a free-float format designed by the BSE. Then, the free-float factor for each company is determined by the BSE based on the information provided by them in the prescribed format.

The free-float factor is multiple with which the total market capitalization of a company is adjusted to arrive at the free-float market capitalization.

The market capitalization is evaluated by taking the price of the stock and then multiplying the same with the total number of shares issued by the entity.

Further to gives the exact value of the free-float market capitalization, market capitalization is multiplied with the free-float factor.

The SENSEX is then calculated by taking the value of free-float market capitalization of the top 30 companies and then dividing it with the index divisor.

Wondering what is index divisor!

Index Divisor is the adjustment point for each and every index adjustment arises out of scripts replacement, corporate action. Thus, the value helps in keeping the index comparable over some time.

After the free-float of a company is determined, it is rounded off to the higher multiple of 5 and each company is categorized into one of the 20 bands given below.

For example, a free-float factor of 0.65 means that only 65% of the market capitalization of the company will be considered for index calculation.

Free-float Bands

| % Free Float | Free Float Factor |

| >0 – 5% | 0.05 |

| >5 – 10% | 0.10 |

| >10 – 15% | 0.15 |

| >15 – 20% | 0.20 |

| >20 – 25% | 0.25 |

| >25 – 30% | 0.30 |

| >30 – 35% | 0.35 |

| >35 – 40% | 0.40 |

| >40 – 45% | 0.45 |

| >45 – 50% | 0.50 |

| >50 – 55% | 0.55 |

| >55 – 60% | 0.60 |

| >60 – 65% | 0.65 |

| >65 – 70% | 0.70 |

| >70 – 75% | 0.75 |

| >75 – 80% | 0.80 |

| >80 – 85% | 0.85 |

| >85 – 90% | 0.90 |

| >90 – 95% | 0.95 |

| >95 – 100% | 1.00 |

BSE Sensex Stocks

The S&P BSE SENSEX is a free-float stock market index that is designed to measure the performance of 30 well-established companies that are listed in BSE. These companies are from the different sectors of the Indian Economy.

Based on the performance and their value of shares these markets are listed and rank in the BSE.

Sensex Companies

Sensex Companies generally directs toward those 30 companies that are performing pretty well at the stock price and is growing rapidly.

Knowing about these companies give an idea to traders to know about which share to buy or sell to avoid much loss and take their investment in a positive direction.

Since the share price of the 30 companies depends on the demand and supply of shares, the prices are highly fluctuating and so thus the list of companies.

In case of more demand than supply, the price goes up while less demand than supply results in the reduction of the share price.

Have a look at the top 30 companies as per the latest data of April 2020.

Here are the details:

| Sensex Companies | ||

| Banking | HDFC Bank | |

| ICICI Bank | ||

| Kotak Bank | ||

| SBI | ||

| Axis Bank | ||

| IndusInd Bank | ||

| IT | TCS | |

| Infosys | ||

| HCL Tech | ||

| Tech Mahindra | ||

| Personal Care | Hindustan Unilever | |

| Consumer Goods | Titan | |

| Cigarettes | ITC | |

| Finance | Bajaj Finance | |

| Housing Development Finance Corporation Ltd | ||

| Auto | Maruti | |

| Bajaj Auto | ||

| Hero Motors Corp | ||

| Mahindra & Mahindra Ltd | ||

| Infrastructure | Tata Steel | |

| Ultratech | ||

| Larsen & Turbo Ltd | ||

| Telecom | Bharati Airtel | |

| Oil Drilling And Exploration | ONGC | |

| PowerGrid | ||

| Reliance | ||

| NTPC | ||

| Paints & Varnishes | Asian Paints | |

| Pharmaceuticals | SunPharma | |

| Food Industry | Nestle India | |

These stocks and the corresponding industries may change every now and then.

Sensex PE Ratio

If you have ever invested in equities than you might be familiar with the term Sensex PE ratio (Price Earning ratio).

It is the most fundamental thing that tells the investor the valuation of the market.

In simple terms it is used to understand the value of the share market. The Sensex PE ratio is updated daily.

To know the PE value for a single stock use the formula below:

PE= Price (MPS)/Earning (EPS)

Here,

MPS is Market Price per share

EPS is Earning Per Share

Now coming to the Sensex PE ratio, it is important to have the earnings of Sensex. Since Sensex is nothing but the price movement of 30 big companies listed in BSE price of Sensex is what quoted before us.

So this gives the price, now what about the earnings.

All these listed companies work to earn a profit. On dividing the total profit of the company by the number of shares it gives the Earning Per share which is then used to calculate the Sensex PE ratio.

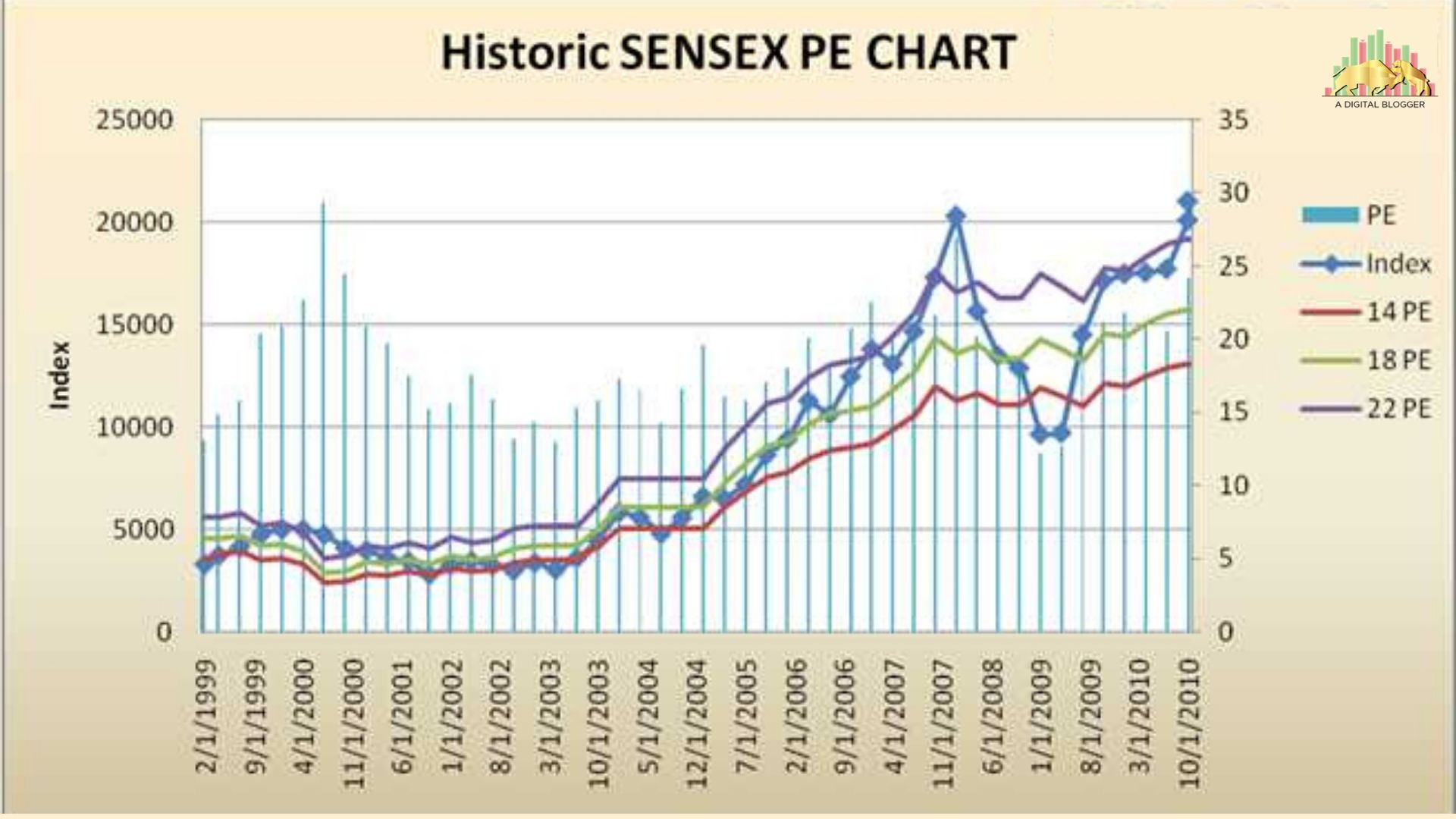

Sensex PE Chart

Understanding the Sensex PE chart helps you know the right time to buy and sell your shares. Giving the exact idea of the valuation of the shares make trading easy and less risky.

Here is one of the examples cited using the historical PE chart.

The blue bars in the above chart shows the Sensex PE from 1999 to 2010. As per the data, the SENSEX during the period remains close to 18.

The dotted line in blue shows the real movement of the Sensex.

The red ribbon shows the undervaluation and purples the overvaluation or stretched valuation.

Sensex Market Cap

Market Cap or Market Capitalization is the valuation of the company that is done based on the current share price.

To calculate it, the current market price of the company’s share is multiplied with the total outstanding shares of the company.

It is useful for investors as it helps them to analyze the returns and risks involved in buying and selling the share.

Although, there are more than 5000 stocks listed on this index, however, there is a clear segregation of these stocks based on their respective market capitalization.

If you are beginners, then here it becomes important to understand that the companies listed in BSE Sensex are further subdivided as small-cap, mid-cap and large-cap based on current share price and the total number of outstanding stocks.

However, no fixed parameter can be used to define such companies but in general, the companies with the market capitalization of 20000 crores rupees are considered as large caps while those with less than 20000 crore rupees as mid or small caps

BSE Sensex Small Cap

First of all, let’s talk about the small-cap stocks which generally fall within the range of ₹5000 Crore. Small-cap companies are generally the startups or mature companies with small industry size.

However you can gain by investing in their shares too, but it is good to do good research before investing your funds.

With high volatility, some of these stocks get busted every now and then, implying, these come with high risk (and opportunities of high returns).

Here are some of the listed small-cap stocks on Sensex as on April 2020:

- Zen Technologies Ltd

- Butterfly Gandhimathi Appliances Ltd

- Birla Cable Ltd

- 3l Infotech Ltd

- Advanced Enzymes Technologies Ltd

- ITD Cementation India Ltd

- JM Financial Ltd

- Balaji Telefilms Ltd

BSE Sensex Mid Cap

Moving ahead from the small-cap stocks, the mid-cap stocks’ market capitalization lies in the range of ₹5,000 Crore and ₹20,000 Crore.

These are those companies that lie in the growing phase and have good potential to grow to become a large-cap company.

Mid-cap stocks are relatively less volatile as compared to the small-cap stocks but more volatile than large-cap stocks (discussed later).

This also implies that the mid-cap stocks are riskier than large-cap stocks but safer than small-cap stocks.

Here is a quick look at some of the listed mid-cap stocks on Sensex at the time of writing this piece:

- JM Financial Ltd

- L&T Finance Holdings Ltd

- Oberoi Realty Ltd.

- Aditya Birla Capital Ltd

- Symphony India Ltd

- Max Financial Services Ltd

- Apollo Tyres Ltd

- IDFC First Bank Ltd

BSE Sensex Large Cap

Lastly, the top category of stocks in terms of market capitalization is the Large Cap. These stocks have a market capitalization of over ₹20,000 Crore.

Large Cap companies are well-established and run a stable business. Thus, they are the least volatile stocks that are safe to invest in.

Low risk in stocks implies that the companies are relatively dependable and are mature in their respective industries. Here are some of the examples of large-cap stocks:

- Bandhan Bank Ltd

- SBI Cards and Payment Services Ltd

- Vedanta Ltd

- MRF Ltd.

- ICICI Bank Ltd.

- HDFC Life Insurance Corporation Ltd.

- Petronet LNG Ltd.

- Titan Company Ltd.

- UPL Ltd.

- State Bank of India

- Sun Pharmaceutical Industries Ltd.

Sensex Prediction

Well, forecasting about the stock market can be really vague.

However, looking at the market trends and the overall historical index movement here is a quick snapshot of what you can expect in terms of how Sensex valuation can be anticipated for the next few months:

| Month | Forecast Value |

| January 2020 | 40940 |

| February 2020 | 41840 |

| March 2020 | 32315.20 |

| April 2020 | 29400 |

| May 2020 | 30160 |

| June 2020 | 31020 |

| July 2020 | 31590 |

| August 2020 | 31060 |

| September 2020 | 32040 |

| October 2020 | 32660 |

| November 2020 | 32980 |

source: forecasts.org

BSE Sensex Forecast

When it comes to forecasting the SENSEX, it put many challenges in front. Although it is good if someone can get a positive forecast, the same turns opposite if not.

A similar case happened in the year 2013 Sensex forecast. Many stock market predictions were made about the Sensex would close at 20,000 value or near giving the economy its green shoot, but in July, the Indian Economy moved downward when the US Fed treated to shut the taps of liquidity and the rupee value fell to its lowest value at 68.7 to a dollar.

A similar thing happened in the current year when the SENSEX was forecasted to reach the value of 40,000 or more in April or May but the sudden attack of the COVID-19 pandemic reversed the prediction marking the biggest ever fall in the Sensex points.

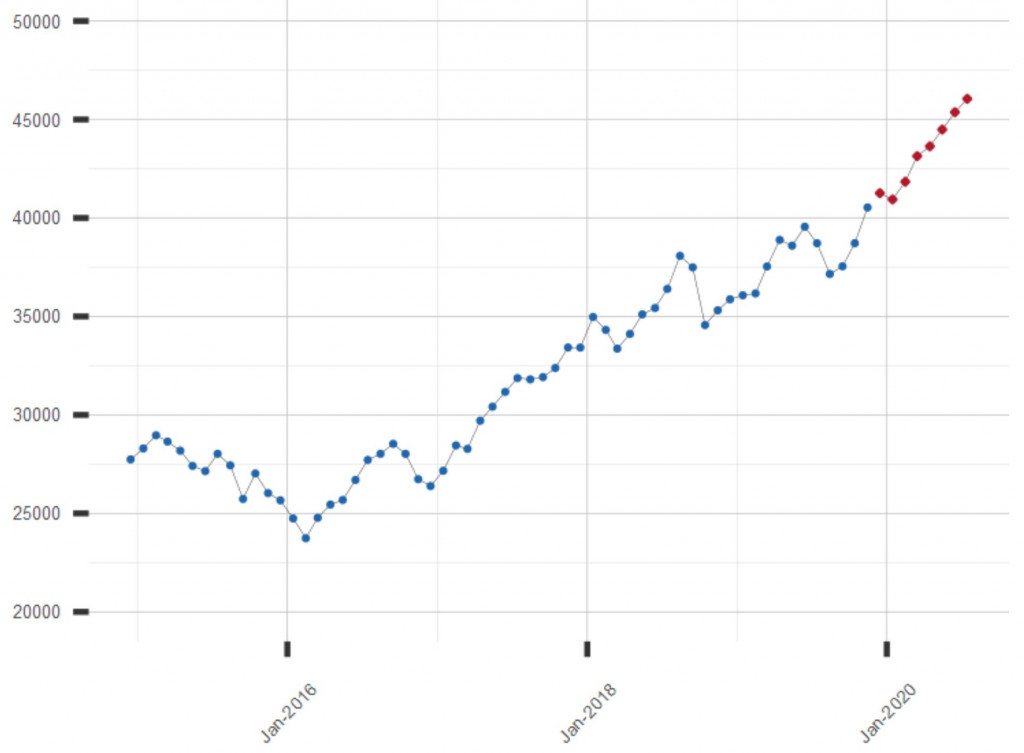

The Sensex usually interpreted graphically, here is how the forecast looks in the graphical form

BSE Sensex Holidays

Like other industries, the stock market industry has its share of holidays as well. On these days (apart from the weekends), the stock market is closed for trading.

The date of the holiday may vary depending on the day the corresponding event such as Diwali, Holi, etc falls.

For instance, Mahashivratari and Holi generally happen in March and Diwali may happen either in October or early November. While, there are holidays such as Christmas, Independence, Republic day that have fixed dates.

Stock Market indices such as Sensex are also closed during the days of elections in the state and the country.

Here are the details:

| S. No. | Date | Holiday | Day |

| 1 | January 26 | Republic Day | Friday |

| 2 | February 13 | Mahashivratri | Tuesday |

| 3 | March 02 | Holi | Friday |

| 4 | March 30 | Good Friday | Friday |

| 5 | May 01 | Maharashtra Day | Tuesday |

| 6 | June 15 | Eid - Ul - Fitr | Friday |

| 7 | August 15 | Independence Day | Wednesday |

| 8 | September 13 | Ganesh Chaturthi | Thursday |

| 9 | October 02 | Mahatama Gandhi Jayanti | Tuesday |

| 10 | November 07 | Diwali Laxmi Pujan | Wednesday |

| 11 | November 08 | Diwali Balipratipada | Thursday |

| 12 | December 25 | Christmas | Tuesday |

Conclusion

Thus Sensex value helps traders in making smart investment decisions and helps them in knowing the right time to invest their funds.

As per the records, the BSE Sensex has experienced good growth since the opening of the economy of India. The major growth occurred in 2002 when the Sensex rose by 3,377.28 points.

The overall growth of the Sensex is mainly due to the increase in the GDP growth of the country.

Further the Sensex is calculated using the Free-float capitalization and thus it is very important to first analyze the market cap.

Knowing the basics will help you in moving towards the right direction and in taking the fruitful decision even at the time of the market crash.

In case you are looking to get started with share market trading or want to open a Demat or trading account – just fill in some basic details in the form below.

A callback will be arranged for you:

More on Share Market Education:

If you wish to learn more about the stock market in general, here are a few references for you: