Equity vs Commodity

More On Share Market

The stock market has reached its peak, and with it, the number of instruments to invest in has also increased. The two powerful instruments where the investors trade the maximum are equity and commodities. But have you ever wondered about the difference or equity vs commodity?

Though the instruments are primarily used for investment and successful trading, some significant differences set them apart.

Before you understand the difference between the two, it is essential to understand what equity and commodity mean.

Equity is commonly known as shareholder’s equity. It is representative of the value that will be given back to the shareholders in the case where all their assets are liquidated, and the debts are also paid.

Whatever stake the stockholder has is represented by the equity and is stated on a balance sheet. Equity is generally referred to as the book value of a company.

While on the other hand, an essential item in the commercial market that you can interchange for some other goods is the commodity. It can be anything,l ranging from oil, agriculture, live stocks, and many more.

The commodities can be bought and sold in the market directly and also through futures and options. The ownership of commodities is highly encouraged as the spectrum gets broader, and so makes the profit.

Let us now see what the fundamental differences and similarities between commodity and equity are.

Equity vs Commodity Market

There are multiple instruments available in today’s market. Out of all these instruments, the two prominent are equity and commodity. These are not the only ones but are the most used instruments in the financial market.

People usually prefer investing in equities and commodities when it comes to the stock market. The reason is the excellent output generated in the process, and the ultimate target of any investment is to gain significant profits.

Various reasons are responsible for deciding whether the chosen investment tool is right according to the trader or the trading portfolio. These reasons include the pros and cons, features, rules and regulations of share market, profits, and many more.

Only after considering all the factors, the investor decides to choose between either commodity or equity.

Various factors affect the value of equity and commodity, so it is crucial to monitor everything. The tracking and monitoring can help to lower the share market risk as well.

There is only one similarity between equity and commodity: they both are a type of investment instrument. Let us now look at some of the critical differences between commodity and equity.

Equity vs Commodity Trading

Apart from one similarity, there are some basic differences between equity and commodity trading. Let us have a look at some of these differences.

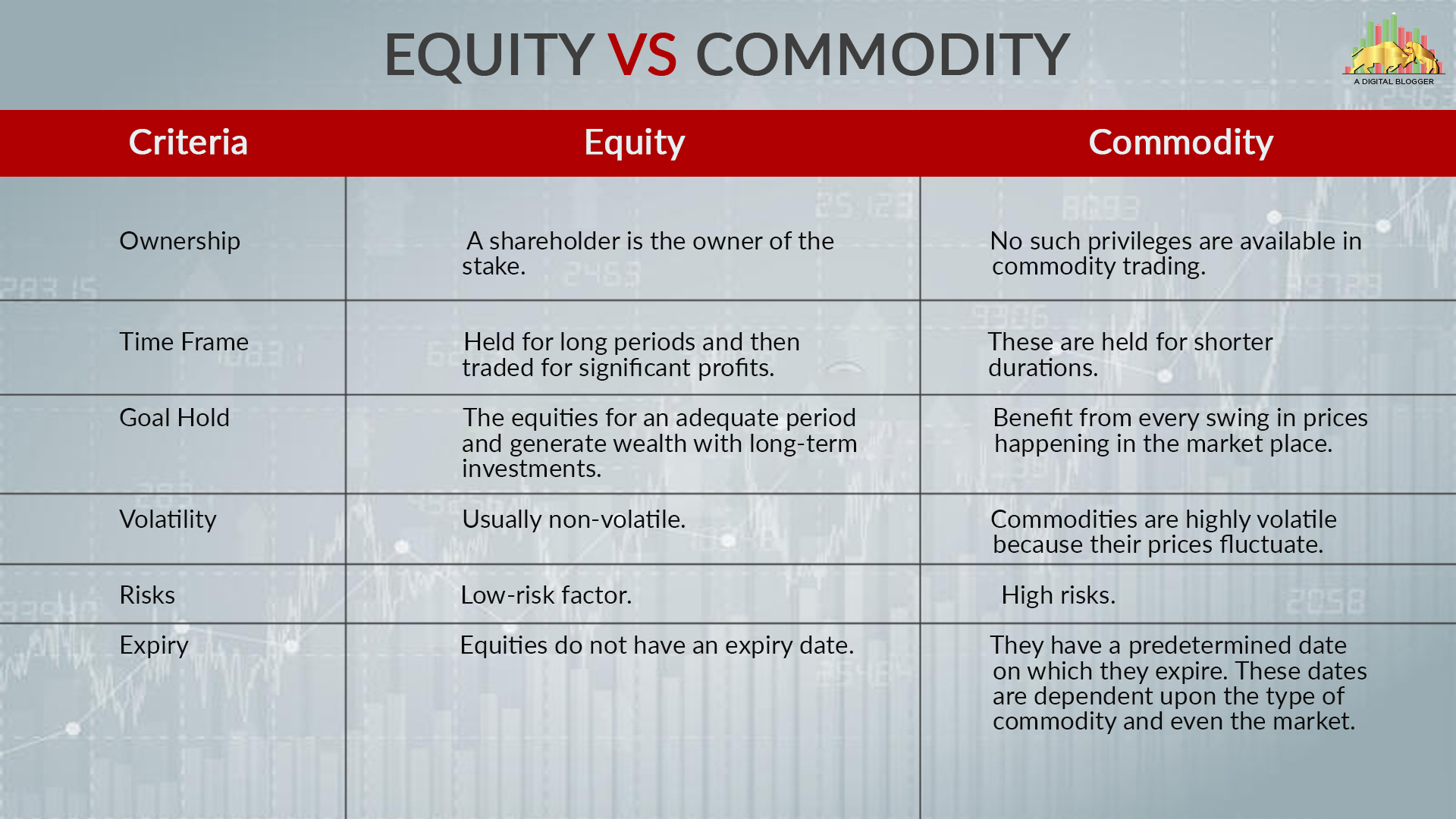

- Ownership

In the case of equities, the investor is the sole owner of the equity. You, as an investor, purchase an ownership stake in the company.

Whereas, when it comes to commodities, there is no owner. Leave the ownership stake, but the investors don’t even buy the commodities.

- Time Frame

Both the instruments have a different time frame for holding and trading the stocks. The commodities are usually traded for a shorter span of time.

The equities can be held for a long time until they are listed on either of them. (BSE or NSE)

- Goal

The final goal is to make a profit in both cases, but the purpose of both the instruments varies. The purpose of a commodity is to benefit from every swing in prices happening in the marketplace. The commodities hedge is in opposition to the price fluctuations.

When it comes to equity, the purpose is to hold the equities for an adequate period and generate wealth with long-term investments by considering it as goal based investing which means you can earn profits with moderate regular investment also.

The goals of both assets vary in this way. Although they both are equally used in the market, equity still holds a little more popular than commodities.

- Volatility

There is a difference in the volatility of both equity and commodity. When we talk about equity, it is usually non-volatile, and the commodities have very high volatility.

The commodities are highly volatile because their prices fluctuate, making it a tedious and challenging task to predict the market.

- Risks

It is also an essential factor when choosing an asset to begin trading. Commodity trading is volatile, and because of the unexpected market fluctuations, the risks associated with it are also high.

Therefore, users are often advised that commodity trading should be used only after a specific time, and beginners should abstain from it.

Whereas on the other hand, equity is usually steered clear of any such risks.

- Expiry

Just like the products have a shelf life, commodities also have an expiration date. They have a predetermined date on which they expire. These dates are dependent upon the type of commodity and even the market.

Equities do not have an expiry date. You can hold them for a longer time. The equity is valid till the time the shareholder owns it.

Equity vs Commodity Which is Better?

Now that we have reached the end of the discussion, it is time to see which option is best suited for you. Although the ultimate purpose is to achieve significant profits, the difference between them gives one an upper hand.

An investor considers a lot of factors before considering which option to choose. One of the primary factors to consider is the risks associated with the investments.

If we consider the risk appetite, then it is always safer to go with equity trading.

Commodity trading is highly risky as the market is very volatile. Due to the high volatility, the market prices fluctuate a lot, and these unexpected changes can be dangerous for an investor.

If you are a beginner, then it is best to steer clear of commodity trading.

The best option is to always consult advisors and experts before choosing an option. If an investor has some significant experience, then consideration of commodity trading can yield great results.

Therefore, with some guidance and carefulness, the rewards can be significant in commodity trading. But just in case you want to stay clear of the risks no matter the prize, equity trading is the best option.

In the end, the choice is in your hands, and you can pick one according to your trading style and your appetite for risks.

By the way, you must definitely check out the difference between Stock Market and Share Market too, as long as you are looking to understand the differences between various stock market entities.

Conclusion

Equity and commodity are two of the many investment instruments available in today’s financial market. Every investment’s essential purpose is to reach the point where the profits are maximum and minimal risks.

In commodity trading, an investor aims to hedge the market of all the market fluctuations. Whenever there is a slight swing in the prices, commodity traders look for an opportunity.

The commodities are not held for an extended period, but equities are held with the purpose of long-term investments. Equities are therefore traded for a more extended period and considered as one of the segments of goal based investing in India.

Commodities are more volatile than equities. This is because of the constant market fluctuations that occur in commodity trading. Seeing the risks, beginners usually refrain from setting their foot into commodity trading.

Commodities have a shelf life, which means that they expire at a predetermined date. This is not the case with equities. Equity does not have an expiration date.

Investors should know the fundamental differences before investing and picking an instrument to take the thought forward. We hope that this article gives you a clearer idea of the difference between equity and commodity trading.

Wish to get into the Share Market? Refer to the form below

Know more about Share Market