ICEX

More On Share Market

ICEX or the Indian Commodity Exchange of India is the commodity exchange. Being regulated by the Securities and Exchange Board (SEBI) the exchange is known for its demutualized corporate structure, clearing and settlement, online trading and many other best practices.

ICEX gain approval from SEBI for the recommencement on August 28, 2017, and signed a Diamond Derivative Contract of 1 carat in the beginning. It is the first exchange of the world that launches the Diamond Derivative Contract.

ICEX India

ICEX is one of the stock exchanges, let’s discuss it in detail.

ICEX India has its headquarter in Mumbai, Maharashtra become operative in August 2017.

On August 28, 2018, i.e. exactly after one year of the completion of the recommencement of the trading operation, the exchange launched the Steel Long Contract.

Later in the financial year 2018-19, the honourable National Company Law Tribunal (NCLT) sanctioned the amalgamation of the National Multi-Commodity Exchange of India Limited (NMCE) with ICEX. This allows the automatic trade of commodities on NMCE on the ICEX platform by the operation of law.

As per the requirements of SEBI and in consent with the former SECC regulations, 2012 the exchange signed an agreement with the Metropolitan Clearing Corporation of India Limited (MCCIL) and started outsourcing its services of clearing, settlement, deliveries, risk management to the MCCIL from October 1, 2018

Next on July 11, 2019, another contract Paddy Basmati derivative was launched. The exchange remains active to introduce such contracts to maintain its position as an innovative exchange in the market.

Apart from regular innovation and maintenance of the exchange position in the market the commodity exchange has a well-experienced management team that puts efforts toward the development and set-up of infrastructure and technology.

The leading technology provider and the subsidiary of the London Stock Exchange Group, Millenium IT tied up with the ICEX and is completely involved in the exchange businesses around the world.

ICEX encourages the participation of farmers, traders, and actual users and helps them in different aspects like price discovery, risk management, and supply chain management in the commodity exchange.

Apart from all these, ICEX becomes the first exchange in India that launched a global hi-tech platform. The technology platform is highly optimized with different processing techniques that offer many benefits like switching over from the data centre, the capability to handle large orders with latencies under 300 microseconds.

ICEX Full Form

ICEX, Indian Commodity Exchange Limited a Securities and Exchange Board of India (SEBI) that is meant to regulate the online commodity derivative exchange. With its headquarter in Mumbai, Maharashtra the company offer a commodity trading platform to trade in diamonds.

ICEX Trading

ICEX is the only commodity trading exchange that allows trading in Diamond. Other than this, another non-Agri product included in the list is Steel.

Apart from this, ICEX open a gateway for trading in Agri products like Spices, Oilseeds, plantations, Fiber, Cereals, etc.

The exchange aims to grab investors’ attention not only for investment purposes but also to clear their visibility towards the vibrant commodities market. The highly skilled team of the company aims towards achieving the goals and financial growth of the member associated with it.

The company offers hassle-free, strong research, commitment and a lot more to its members thus working towards offering better customer satisfaction.

Some of the prominent shareholders of ICEX are MMTC Ltd, Central Warehousing Corporation, Indian Potash Ltd, KRIBHCO, Punjab National Bank, IDFC Bank Ltd, Gujarat Agro Industries Corporation, Reliance Exchangenext Ltd, Bajaj Holdings and Investment Ltd, Gujarat State Agricultural Marketing Board, NAFED and Indiabulls Housing Finance Ltd.

ICEX Membership

Members play an important role and work as an interface between any exchange (here ICEX) and the users. The transactions on the ICEX platform is executed between the registered members. The member of the commodity should maintain a high standard of integrity, appropriate staff, infrastructure along with following the agreement with the stringent capital adequacy requirements.

To maintain public confidence in the Exchange the application for membership is evaluated by following the strict standard of rules.

Anyone who comes under the following category can become a member of ICEX by following the right membership process:

- Registered Partnership Firm

- Hindu Undivided Family (HUF)

- Individual/Proprietorship Firm

- Private Limited Company

- Public Limited Company

- Co-operative Societies

Also, there are different categories of ICEX membership that depends on the specific needs of the market participants:

- Trading Member (TM)

- Trading Cum Clearing Member (TCM)

- Professional Clearing Member (PCM)

- Institutional Trading Cum Clearing Member (ITCM)

ICEX Membership Eligibility Criteria

The eligibility of the ICEX member is subject to the regulatory norms and provision of SCRA 1956, SEBI Act 1992, and as per the Rules and Regulation, Byelaws and Circulars of the Exchange. The applicant looking forward to attaining the ICEX membership must be:

- Individuals

The eligibility criteria for the ICEX membership for individuals is shown in the table below.

| Criteria | Eligibility Requirement |

| Age | Minimum 21 years |

| Status | Indian Citizen |

| Education | Minimum 12th standard or equivalent examination from the recognized university |

| Experience | Minimum 2 years experience in derivatives or commodities future market |

- Partnership Firms registered under the Indian Partnership Act, 1932.

Here is the eligibility for the ICEX membership for the partnership firms that are registered under the Indian Partnership Act, 1932

| Criteria | Requirements |

| Age | Minimum 21 years |

| Status | Registered Partnership firm under the Indian Partnership Act, 1932 |

| Designated Partners Education | Minimum 12th Std or equivalent from the recognized institution or as prescribed by the Exchange from time to time. |

| Designated Partners | At least two partners who would take charge of day to day management tasks. |

| Designated Partners Experience | Minimum 2 years experience in derivative or commodities future market |

| Dominant Promoter Norms | Identify sharing the interest of the partner as per the Exchange DPG norms |

- Any corporations, companies or institutions of Corporations or Companies that are established with the objective of offering the financial services

The eligibility criteria for the corporations are given in the table below:

| Criteria | Eligibility |

| Age | Minimum 21 years |

| Status | Corporate registered under the Companies Act 1956 or Companies Act 2013 |

| Designated Director Education | Minimum 12 std or equivalent from the government recognized university |

| Designated Director | Identification of two directors who manages the daily management tasks |

| Designated Director Experience | Minimum 2 years experience in derivative commodities future market or equivalent |

| Dominant Promoter Norm | Dominant Group as per the Exchange DPG norms |

| Paid-up Capital | Minimum 30 lakhs |

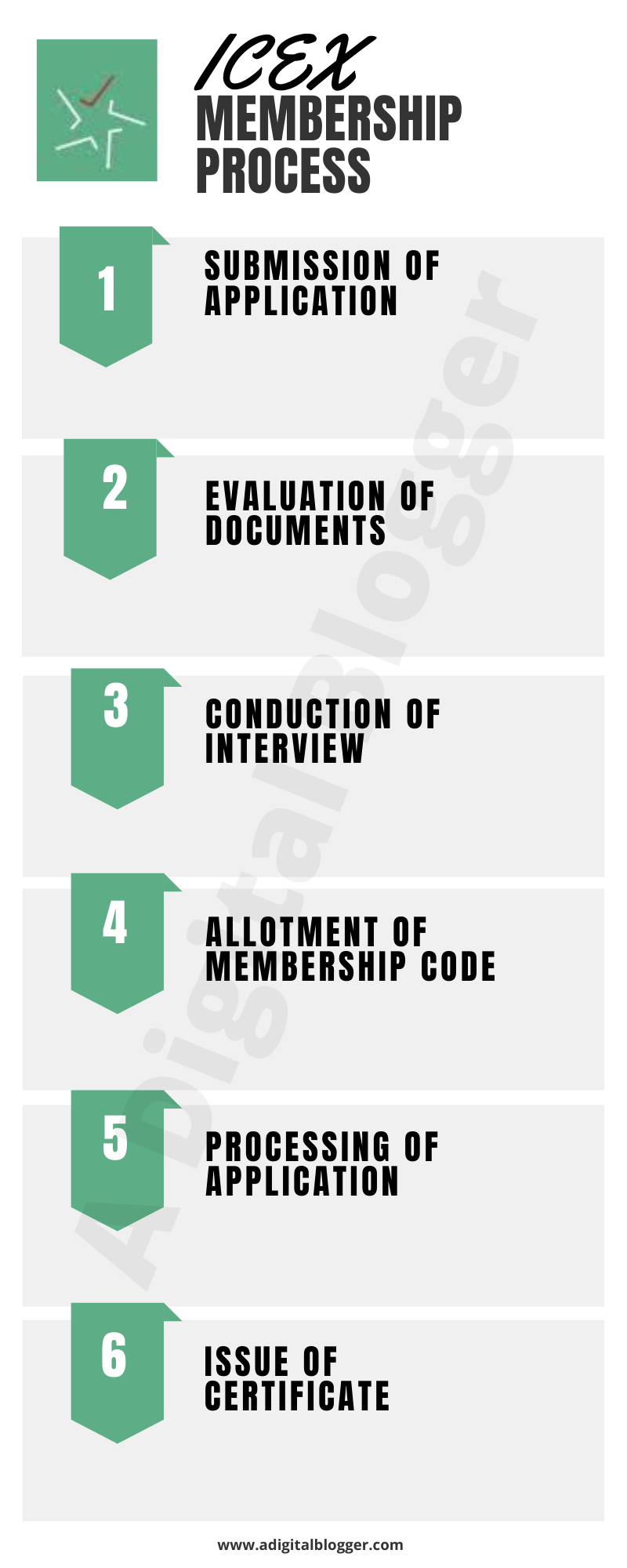

ICEX Membership Process

Here is the process involved to become the ICEX membership.

- Submit a Form: This step involves filling and submitting the application form along with documents and the fees. To download the membership form click here.

- Evaluation of Documents: The ICEX team evaluates the information and documents submitted by the applicant.

- Conduction of Interview: The interview of the member is conducted.

- Allotment of Membership Code: On the basis of the interview, the member got admission to the Exchange and the membership code is allowed to the member.

- Processing Application: The application is being processed for the final registration of the Securities and Exchange Board of India (SEBI).

- Issue of Certificate: The registration certificate is issued to the member by SEBI.

- Membership Activation: On completion of the above steps the membership is activated.

ICEX Membership Charges

Have a quick glance at the ICEX membership charges in the table below.

| Particulars | Category | ||||||

| Trading Member | Trading-Cum-Clearing Member | Institutional Trading-Cum-Clearing Member | Professional Clearing Member | ||||

| Admission Fees | 100,000 | 250,000 | 1,000,000 | 1,000,000 | |||

| Networth Requirement | 500,000 | 4,000,000 | 10,000,000 | 20,000,000 | |||

| Interest Free Security Deposit | According to ITCM/PCM requirment | 750,000 (250,000 Cash+5,000,000 Cash/Cash Equivalent) | 450,000 (150,000 Cash+3,000,000 Cash/Cash Equivalent) | 450,000 (150,000 Cash+3,000,000 Cash/Cash Equivalent) | |||

| Processing Fee | 2,500 | 2,500 | 5,000 | 5,000 | |||

ICEX App

ICEX or India Commodity Exchange Limited is an online derivatives exchange for a commodity. The exchange was established to offer a reliable, time-tested, and transparent trading platform. Along with this, it employs the process to put the robust assay and warehousing facilities in place.

Reliance Exchangenext Ltd. is the anchor investor of the exchange while the reliable partner of the ICEX is enlisted below:

- MMTC Ltd,

- Indiabulls Financial Services Ltd.,

- India Potash Ltd.,

- KRIBHCO

- IDFC.

With all the great objectives and partners, ICEX India has created a free software application available on Google Play Store and App Store. ICEX app is available in the English language and provides real-time information on the ICEX traded commodities and a lot more.

The app has a file size of 2.94 MB and is used to keep track of Futures & Spot Price of ICEX traded Commodities in real-time.

The app is useful to watch real-time graphs, market depth, trade information.

To download the app click on the link.

ICEX Career

ICEX always remains keen to appoint the right and desired person who fits best for the job. The person with good creativity and is able to offer the best and customer-oriented solutions.

So if you are a keen learner, share knowledge and have the skill to grow the company then you can explore the best career opportunities offered by it.

It offers a great opportunity to learn the dynamic field of commodity trading to its employees. Also, the commodity exchange helps in refining the skills and in thinking of innovative ideas to implement in the field.

To stay updated about the current openings in ICEX India keep visiting at the link.

Know about Stock Market Timings in India and start investing.

Conclusion

ICEX merged with the NMCE (National Multi Commodity Exchange of India Ltd) and it is the first merger deal in the commodity exchange of India. According to the merger, ICEX holds the 62.8% stake while the rest of 37.2% will be owned by the NMCE.

The new merger and exchange will offer a wide range of contracts like bullions, oil, rubber, and other agri-commodities. Also, the new commodity exchange is the first futures contract in the world.

This is the first merger deal in the commodity exchange space in India. It has been approved by the boards of both exchanges and is expected to be completed by December 2017, subject to regulatory approvals.

In all, this merger will result in financial strength, the consolidation of clients and members and higher operational synergies that will help in strengthening the position of the exchange in the country.

In case you are looking to invest or trade in commodities via ICEX or any other related exchange, let us assist you in taking the next steps forward:

If you are looking to know more about the Indian Share Market basics, here are some reference tutorials for you: