NCDEX

More On Share Market

NCDEX or National Commodity and Derivative Exchange is the online commodity trading exchange of India. With an independent Board of Directors, the commodity exchange offers an independent platform to traders for commodity trade.

It was established on April 23, 2003, under the Companies Act, 1956 with its headquarter in Mumbai and came into functionality on December 15, 2003.

Going back to its initial stage, the exchange had 848 registered members and 20 Lakhs client base as on July 13, 2013.

At present, NCDEX has 594 warehouses and 8 warehouse service providers having a holding capacity of 1.5 million tonnes that facilitates the deliveries of the commodity.

With the headquarter in Mumbai and branches in different zone: Delhi, Ahmedabad, Indore, Hyderabad, Jaipur, and Kolkata NCDEX offer services to traders and farmers across the nation.

NCDEX Full Form

Want to know how many stock exchanges in India? NCDEX is one of those stock exchanges, let’s know about it in detail.

NCDEX an acronym of the National Commodity and Derivative Exchange is a highly trusted exchange for trading in agriculture-based products like oil, oilseeds, cereals, etc.

It uses the state-of-art technological infrastructure that helps traders to do fast and error-free trading of some of the top commodities with its members.

Also, the online trading platform of the NCDEX can be accessed easily by all the members with the computer-to-computer link and through the trader workstations via media like VPN, VSAT, leased lines and the internet.

In all, the electronic trading platform oft the NCDEX helps in bringing the buyers and sellers on one single platform.

NCDEX Meaning

The National Commodity and Derivative Exchange (NCDEX) is a commodity exchange that deals with agricultural commodities in India.

NCDEX get the contribution from different leading financial institutions like the National Bank for Agricultural and Rural Development (NABARD), Life Insurance Corporation of India (LIC), and National Stock Exchange (NSE).

It is the top commodity exchange of India located in Mumbai and offering services in different locations of the country is established to facilitate trade.

Since India is the largest producer of many crops like wheat, rice, milk, etc, the NCDEX also plays a vital role in promoting the growth of the agriculture sector of the nation.

Also, read NCDEX IPO. and check NCDEX IPO Allotment Status.

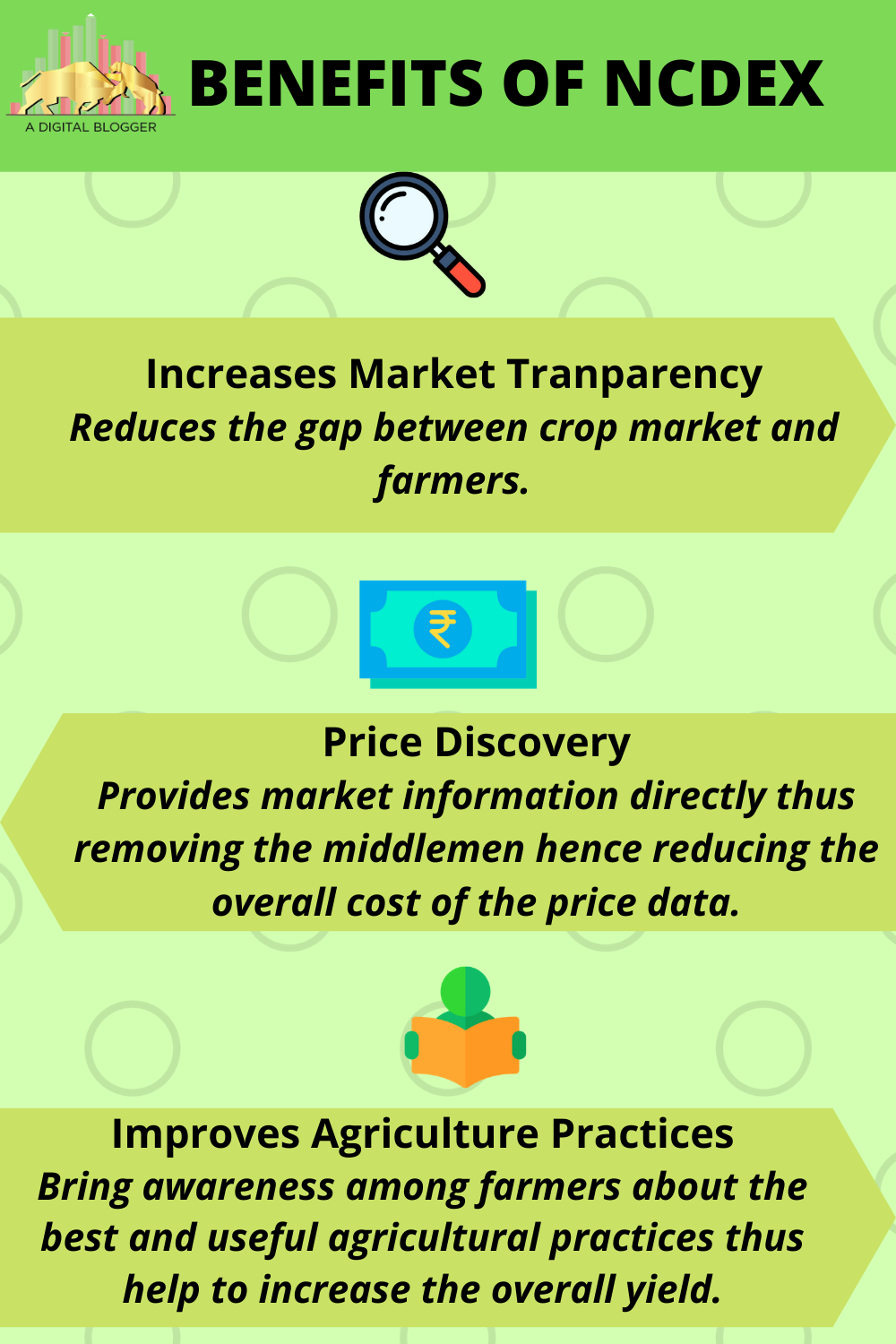

Benefits of NCDEX

National Commodity and Derivative Exchange was established to maintain the online future market for crops and work continuously to bring improvement in the sector. Some of them are:

- Increasing Market Transparency: It reduces the gap between the crop market and farmers thus bringing more transparency.

- Price Discovery: Also, it helps the farmer in discovering price directly without the involvement of the middlemen who were meant to control the market information. Thus, the commodity exchange platform offers relief to farmers by reducing the cost of price data by eliminating the middlemen.

- Improves Agricultural Practices: Also, NCDEX plays a vital role in improving the practice of agriculture and also aware farmers of the quality of the product. The farmers now remain more focused on the need for testing requirements and in implementing the right agricultural practices that help in obtaining a higher yield.

NCDEX Commodity

Many people think that they can trade only in stocks, but there are various commodities like oil, wheat, soybean that are being traded in the commodity market especially for hedging.

The Commodity exchanges open a gateway for trade in the commodity. This offers great relaxation and peace of mind to farmers who remain worried about the price fluctuations and loss in their cultivation.

Trading in commodities allows the farmer to sign a contract to sell their crop at a particular price at a specific time in the future. This reduces the occurrence of loss in many cases.

This is one major objective of commodity trading, other than this, apart from farmers anyone can come and trade in the commodity to earn a profit.

NCDEX Trading

Since the price of a commodity never remains the same even 24 hours brings a great variation in the price of the commodity. It is therefore very important that while doing online NCDEX trading one should remain aware of mark to market settlement.

Mark to Market settlement is the type of adjustment of price per day.

In commodity trading, at the end of each day, each product ends up with the settlement price. This settlement price is then compared with the agreed price. If the price goes up then the difference in the amount is credited to your account while if the price goes down the amount is debited from the trading account.

Myths About Commodity Trading

Many people come forward to do trade in the commodity because of certain myths they believe to be true.

1. Beneficial Only For Large Traders: Commodity trading can be done even at a small margin and can earn profit by following the right strategy of doing trade.

2. Poor Quality of Commodity: The commodity exchange helps in maintaining the quality of commodities as it tends to adopt the right quality control measures.

3. Commodity Trading is Difficult to Understand: The commodity market is operative with the regular demand and supply chain. The slow and steady progress in the field can help anyone to master the field. Doing a little research and understanding the basics of the commodity market can help anyone to do trade and earn a profit.

How to trade in NCDEX?

NCDEX trading differs from the regular equity futures in the following terms:

1. The long trader in commodity trading can treat the commodity as a trading position and sell out or can choose the physical delivery of the equivalent commodity from the warehouse.

2. Considering the role of short traders in commodity exchange, they can either square off their position by buying back the commodity future or can deliver the commodity at the warehouse.

3. Hedging is included in both the market but it becomes meaningful in the equity market only when it comes in the case of the investment portfolio.

Placing Orders on the NCDEX

Some of the salient features of placing an order on National Commodity and Derivative Exchange are enlisted below:

- One can place a stop-loss order that will be visible to the market only if it satisfied the particular business condition.

- The user can specify the trigger price which depicts the price at which the order gets triggered.

- There are two orders: market stop loss (SL-M) order or the limit stop loss (SL-L) order on the trading screen, the trader can place either of the two.

- The trading of stop loss is done only when it satisfies the two conditions. Triggering of the stop loss by the LTP and Trigger Price condition. The other is the occurrence of the counterparty.

- Some of the types of orders on NCDEX are: Day Order, Immediate or Cancel (IOC) order, Good Till Date (GTD) order, and Good Till Days (GTDys). Among all these only GTD, GTC and GTDys are carried forward to the next day.

NCDEX App

National Commodity and Derivative Exchange the leading commodity exchange of India released the NCDEX app that gives access to the prices and market information of the commodities to the traders anytime, anywhere.

NCDEX develop this app by partnering with the leading Singapore based financial technology firm, Trakinvest.

One can download the app for free on the Google Playstore. The app is useful to get access to price, news, updates, market data, etc.

The app is useful for traders and farmers:

- Obtaining the real-time future/spot price and commodity news

- Keeping the users in touch with the market.

- Managing trading portfolio

- Browing the relevant information on the market.

NCDEX e-Market Limited

NCDEX e-Market Limited or NeML is the leading National Spot Exchange in India. It works along with the domain expert to offer the trading platform to traders who are willing to trade in both agriculture and non-agriculture based commodities.

NeML (earlier known as NCDEX Spot Exchange, NSPOT) was incorporated on October 18, 2006. After gaining national recognition the firm becomes the first one to break through initiatives like the one Mandi Modernization Program (MMP), e-Pledge, e-Marketing.

It offers a trading platform that merges it with technological efficiencies and market-friendly trading features. This brings more transparency thus offering a good trading experience to the traders.

NeML creates an efficient commodity market by working in collaboration with the ecosystem partners. Also, the e-market helps buyers and sellers in enhancing their efficiencies of buying and selling.

It also offers useful and affordable financial products by crediting the e-pledge mechanism to smallholders against the commodity stored in NeML and Bank approved warehouses. This helps farmers in making more money and providing supplies on time.

Here are some of the top benefits of NCDEX NeML:

- Facilitates the Farmer Producer Organizations (FPOs)

NeML facilitates the buying and selling of farmer’s products via the trading platform. According to the data, NeML has worked with more than 60 FPOs and offers benefits to more than 28000 farmers of Maharashtra, Gujarat, Rajasthan, Karnataka, Andhra Pradesh, and Madhya Pradesh. To help FPOs transaction it works closely with the Small Farm Agri-Business Consortium (SFAC).

- Meet Social Objectives of Government

NeML plays a significant role in fulfilling the basic objective of the government like food security and price support initiatives that offer great benefits to the ecosystem, commodity participants, warehouse service providers, assayers, and financial institutions.

Also, it organizes various food security programs that offer great help to government organizations like Food Corporation of India (FCI), NAFED, SFAC, PEC, and MMTC.

- Helps in Financial Inclusion

The electronic pledging of commodities in the market accredited warehouses help farmers to get easy access to finance. In all the advanced systems of the NeML facilitator brings the units like warehouses, banks, and clients under one electronic platform.

NCDEX Options

NCDEX Option or Commodity option is the financial derivative instrument or the contract that is sold by one party (option writer) to another party (option holder). It gives the buyer the right to buy or sell the commodity upon the agreed price during a certain period.

Options have been used since ancient times while the trade-in exchange options began in 1973 as a part of the financial instrument class.

Open NCDEX Account

NCDEX Account can be opened online. For opening the National Commodity and Derivative Exchange account, one needs to follow a few generalized steps as given below:

1. Select a Stockbroker: Consider the brokerage, platform fee, clearing fee, transaction charges, kind of services while choosing a stockbroker for the commodity trading.

2. Fill the Application Form: After choosing the stockbroker to fill the commodity account opening form online. Download the application form from the broker’s website. Fill in all the essential details and submit all the essential documents like Address Proof, Identity proof for validation.

3. Verification: Once you submit the form the broking company verifies all the information provided by you.

4. Deposit Margin Money: Deposit the initial margin money into the account. The margin money is generally 5-10% of the contract value. Apart from this, deposit the maintenance charges, etc.

For more details read How to Open the Commodity Trading Account Online?

NCDEX Profit Calculator

Since the person enters into trading intending to earn the profit. So when making your way into the commodity trading in NCDEX it is very important to know how to calculate the profit.

On opening an account with the commodity broker make sure you are not trapped in paying the heavy brokerage charges. It will be good if you can negotiate to the maximum.

Here are a few terms you must be aware of to know for calculating profit in the National Commodity and Derivative Exchange.

| Terms | Description |

| Commodity Name | The name of the commodity of which you want to calculate profit or loss. |

| Lot Size | It is set by the exchange and its size is flexible i.e. it can change in the near future. |

| Transaction | All transactions made are either long calls (buy and sell) or short calls (sell or buy). |

| Bought Price | It is the price at which the commodity is bought. |

| Sold Price | The price at which the commodity is sold. |

| Brokerage | It is the commission charged by the broker. It generally ranges between 0.03% to 0.05%. |

| Gross Profit or Loss | It is calculated using the formula (sold price-bought price)*Lot Size |

| Net Profit | Gross profit minus Lot size. |

| Total Loss | Loss plus brokerage |

1. Profit Calculation for National Commodity and Derivative Exchange Commodity

For NCDEX profit calculation one needs to follow the steps and formula below:

- Brokerage Calculation=(Bought Price*Lot Size*0.003)+(Sold Price*Lot Size*0.003)

- Gross Profit=(Sold Price-Bought Price)*Lot Size

- Net Profit=Gross Profit-Brokerage

2. Loss Calculation for National Commodity and Derivative Exchange Commodity

Here is the formula for calculating the loss for NCDEX

- Brokerage Calculation=(Bought Price*Lot Size*0.003)+(Sold Price*Lot Size*0.003)

- Loss=(Sold Price-Bought Price)*Lot Size

- Total Loss=Loss+Brokerage

NCDEX Brokers

NCDEX brokers allow the trader to trade in all the commodities of the National Commodity and Derivative Exchange by charging little brokerage fees.

NCDEX Broker List

Here is the broker list for National Commodity and Derivative Exchange. All the brokers charged0.01% brokerage fees.

- Sharekhan

- Indiainfoline

- Commodity Online

- Angel Commodities

- Rathionline

- Kedia Community

- Edelweiss

- SMC Trade Online

- RK Global

- Unicon

- Commo Hifi

- India Trade

- Indo Vision Group

- Fair Wealth

- Monarch Project

- GEPL Capital

- Berkeley Gains

NCDEX and MCX

NCDEX and MCX both come under the exchange board of India and deals with the trading in commodity since 2003.

Both MCX and NCDEX were regulated by the Forward Market Commission till 2016 but with the merger of FMC into SEBI in 2016 the two commodity exchanges, NCDEX and MCX have been regulated by SEBI.

NCDEX, on one hand, deals with agro-based commodities like wheat, oil, oil seeds, on the other hand, MCX dominates the industrial metal, precious metal, and oil futures.

NCDEX Historical Data

To explore the historical data of National Commodity and Derivative Exchange click here.

NCDEX Report

To get the complete information of the NCDEX commodity, commodity price, charting, future, historical data, price, etc click on the link.

NCDEX Timings

NCDEX the agricultural and metal commodities exchange of India offers membership for all including individuals, private companies, public companies, etc.

The exchange is operative from Monday to Friday between 10 AM to 11:30 PM.

| NCDEX Timings | ||

| Operative Days | Monday to Friday | |

| Operative Hours | 10 AM to 11:30 PM | |

NCDEX Careers

If you are looking for a relevant job role then feel free to send the resume at the following link.

The member of the Talent Acquisition of the National Commodity and Derivative Exchange will contact you with the relevant details of the opening.

You can explore fro the latest job opening and careers at NCDEX by keep visiting the website.

NCDEX Exam

To enhance the level of competence, the NCDEX Institute of Commodity Market and Research (NICR) offers the NCDEX certification course, NCDEX Training with the examination facility. The exam is conducted at 40 different centres across the country.

The NCDEX course is introduced to refine the knowledge of learners in both academic and applied fields about commodity derivative trading.

By getting enrolled in the NCDEX NICR you would get the study material, access to an e-learning platform that offers you the right blend of theoretical education and practical application of Commodity trading.

You can find the complete detail fo the National Commodity and Derivative Exchange commodity certification course here. Also, grab the complete information on the NCDEX exam and enter the trading world with confidence.

Now interested to invest in NCDEX, know about Stock Market Timings in India and Invest accordingly.

NCDEX Address

Explore the complete contact details and the NCDEX office address of the different locations.

| NCDEX ADDRESS | ||||||

| S.No. | Office Location | Address | Telephone Number | |||

| 01. | Mumbai | National Commodity & Derivatives Exchange Limited Akruti Corporate Park,1st Floor, Near G.E.Garden , L.B.S. Marg, Kanjurmarg (West), Mumbai - 400 078 | (+91-22) - 66406789 | |||

| 02. | Delhi | National Commodity & Derivatives Exchange Limited 2nd Floor, Jeevan Vihar , 3 Sansad Marg Parliament Street, New Delhi - 110 001 | (+91-11) - 66114848 | |||

| 03. | Indore | National Commodity & Derivatives Exchange Limited 4th floor, 401, Gold Arcade, Opp. Curewell Hospital, New Palasiya road # 1, Pent House, Indore - 452001 (MP) | 0731 2549720/2549730 | |||

| 04. | Hyderabad | National Commodity & Derivatives Exchange Limited 207, 2nd Floor, Ashoka Capitol , Opp. K.B.R. Park, Road No. 2, Banjara Hills, Hyderabad – 500 034. | 040-66586700 | |||

| 05. | Kolkata | National Commodity & Derivatives Exchange Limited Jasmine Tower, 5th Floor, Unit 503B, 31 Shakespere Sarani, Kolkata-700017 | 033-44213500 | |||

| 06. | Ahmedabad | National Commodity & Derivatives Exchange Limited 502, Kaivanna Complex, Off C.G.Road, Near Panchvati Circle, Central Mall, Ambawadi, Ahmedabad-380015 | +91 79 26566641/42 | |||

| 07. | Jaipur | National Commodity & Derivatives Exchange Limited Prestige Tower, 2nd Floor, Office No 1A, Amrapali Circle, Vaishali Nagar, Jaipur – 302021 | 0141-4291100 | |||

NCDEX Circulars

To get the latest circular report of National Commodity and Derivative Exchange click here.

Conclusion

Although India is the top producer of many agro-based commodities but still lags behind in the commodity futures market. This is because the production and distribution of agricultural commodities are governed by the state and future trading is introduced only by stringent regulatory control.

To flourish in the future market it is essential to let the market forces role come into play rather than staying limited to control the prices.

In case you are looking to invest or trade in commodities via NCDEX or any other related exchange, let us assist you in taking the next steps forward:

If you are looking to know more about the Indian Share Market basics, here are some reference tutorials for you: