SEBI New Margin Rules

Every step is taken with a motive and so was the formation of SEBI. Over the years, SEBI has been identified as the one who has worked in the favor of investors by bringing in different rules of stock market trading. But the SEBI new margin rules have put a lot of traders to question this whole idea.

But why?

Let us explore the details together but before that, accustom yourself to the concept of margin and how it serves as a blessing in disguise for the traders.

The concept of margin trading is very similar to a bank loan.

Suppose you want to buy a car worth ₹12 lakhs, then you would like the bank to help you and give you a loan so that you can get your hands on your dream car. Similarly, the margin in the stock market, helps a trader to trade with extra money.

Suppose you have ₹10,000 in your trading account and you want to buy shares ₹100 each. Now with ₹10,000, you will be able to purchase 100 shares. But what if you were given a 10X margin?

It would have made your trading amount,₹1,00,000, thus allowing you to purchase 1000 shares. This would have also increased your profit in the situation where the market would have shown a bull run.

So, let us see what these SEBI new margin intraday trading rules are and how are they going to impact the individuals associated with the stock market.

SEBI New Margin Rules Explained

What is SEBI’s new margin rule? As we were discussing earlier that with the margin that the broker provided, the trader got the benefit of trading with the extra amount and thus making more profit.

But the new margin rules from December changed it all. According to the new margin rule, from 1st December, with every quarter (three months), the margin will decrease 25%.

If we follow the same, the timeline of the same is given below.

- 1st December 2020- 25% less

- 1st March 2021- 50% less

- 1st June 2021- 75% less

- 1st September 2021- NO MARGIN

The maximum margin that is allowed is only 5X. Suppose a broker used to give 20X the margin, with the first reduction, it became 5x. Let us understand SEBI’s new margin rules for example.

Let us take a scenario where a trader is looking to earn 1% profit from the trading.

| SEBI New Margin Rules Explained | SEBI New Margin Rules Explained | |

| Old Margin | New Margin | |

| Amount in the Trading Account | ₹10,000 | ₹10,000 |

| Margin | 20x | 5x |

| Margin Provided | ₹2,00,000 | ₹50,000 |

| 1% Profit | ₹2000 | ₹500 |

As it is clear from the above example that the new margin rule impacts the overall profits that were earned by the traders. The brokers were in a way helping the traders to get maximum benefit even if they were running out of the required capital.

SEBI New Margin Rules Court Case

SEBI new margin rule raised a lot of doubts and agitated a lot of people belonging to this arena. But were any measured and legal steps taken? The answer is Yes.

There was and still is a lot of opposition regarding the new rules. There were a lot of brokers who started getting affected by the implementation but couldn’t raise their voices. But some brave hearts came forward and the timeline for the same is discussed below.

- The first one to raise their voice against the new margin rule was Wisdom Capital.

Wisdom Capital is a discount broker and took a major step in filling a case against SEBI for bringing in the new margin rules. Although, it was a very bold move still there has been no judgment as of now.

One famous dialogue that is always associated with Indian courtrooms is “tareek pe tareek” and it showed its impact in this case as well.

The timeline of the case is as follows.

- 2nd December 2020

- 8th March 2021

- 7th April 2021

- 9th August 2021

- 18th August 2021

The next date is 17th September 2021, and surprisingly it is after the implementation of the new margin rule.

- The second one to jump the gun was ANMI (Association of National Exchanges Members of India). A group of stockbrokers pleaded and drafted a letter to SEBI numerous times but it was left unheard.

- CPI came into the picture after this and requested SEBI to put a bar on this rule for the betterment as it will affect not only the equity segment but also the commodity segment. But this plea was left unheard.

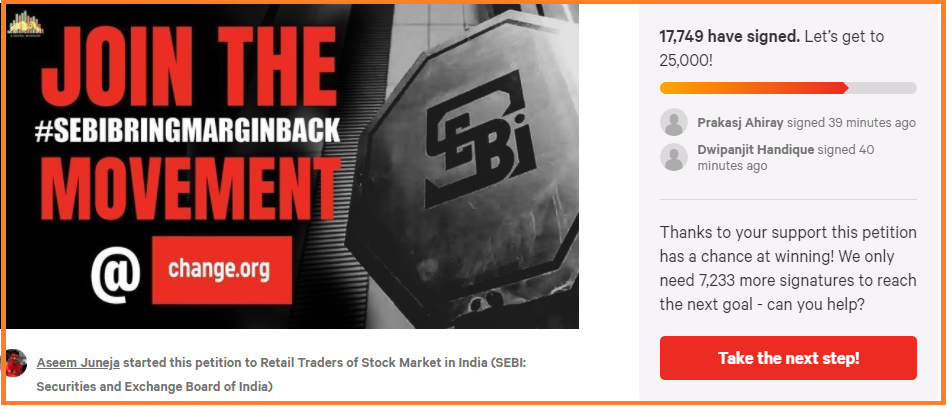

- A Digital Blogger also started a petition on change.org which has been signed by more than 17,000 traders.

These were the pleas that were in a way left unheard and did not stop SEBI from implementing this rule.

SEBI New Margin Rules Impact

The new margin rule is talked about a lot now and it has definitely left the traders and stockbrokers also in shock.

A lot of mixed reactions are pouring on the forefront regarding the same. Where the options trading turnover has increased 20-30 percent, the intraday traders are the ones who will or suffer the most.

Let’s hear what traders have to say about this new margin rule

Let us now have a quick look at how SEBI new margin rule will impact the different hierarchies of the stock market.

SEBI New Margin Rules Impact on Traders

SEBI new margin rules for intraday trading or trading, in general, will directly impact the high-volume and also the beginner traders.

Although there are some traders who are not well accustomed to the market, and they will be the ones least impacted, but reducing the margin of traders who have been trading with high leverages will be left with high disappointment.

The intraday traders will be impacted the most as they will not be able to trade effectively with high amounts.

The overall market that made most of the revenue (80-85%) from intraday traders will also be put on a halt.

The decrease in leverage is also pushing a lot of intraday traders to options trading, and this is not a very good chance for a lot of individuals. If someone is not familiar with the right option trading strategies, then the chances of high losses also increase.

This makes it essential for them to open a demat account with the stockbrokers offering advanced strategy and option chain for better analysis. Get the best suggestion of a stockbroker and open a demat account online for FREE!

SEBI New Margin Rules Impact on Brokers

Not just the traders but also the stockbrokers will also get impacted by this decision. The reasons for the same as listed below.

- Most of the stockbrokers ran their businesses on high-leverage facilities. Uniforming the margin for everyone will take this liability away from them and will impact their overall business.

- People will now start looking for the best stockbrokers for options trading and thus the business of the ones well-versed with the same will increase.

- The trades will reduce which will impact their overall revenue because of the decrease in brokerage.

Although, the safety will be insured on the broker’s end still a lot of impacts will be seen on the overall revenue.

No Trading Day

The increasing agony of the traders and SEBI’s negligence towards the pleas has made the traders come to a decision. The traders of India have decided to observe 1st September 2021 as no trading day to stand together against the SEBI new margin rules.

Join the #NoTradingDay Sign the petition here

Let’s see how this will impact the SEBI and will the regulatory body think and change its plan and rule around the intraday margin rule.

Click on the link to sign the petition now.

Get the free stockbroker suggestion and open a demat account online for FREE!