Share Market Account Opening

More On Share Market

There are a lot of stockbrokers and brokerage firms that open a gate for stock investment through the Share Market Account Opening service. Moreover, they are of two types, namely, Full-service stockbrokers and discount stock brokers.

When you purchase the shares of any company as an investor, that means you possess a part of its ownership.

And for this, you need to create a Share Certificate. It is a small piece of document that entitles you as the owner of the shares you buy.

Curious to know how to enter in the stock market? It is easy to do so. You can enter in by just having a share market account. Thus, here in this piece of article you are going to know about stock market account opening so that you can start trading and enjoy investing.

It was in a paper or physical form, which is now converted into a digital format. This process is called Dematerialization or DEMAT in short.

Share Market Account Opening Meaning

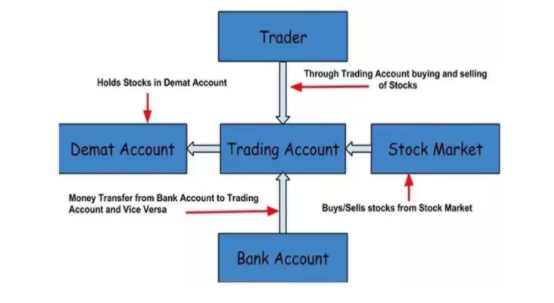

Apart from the share certificate, there is also a requirement for opening two accounts, a DEMAT account, and a Trading Account. Only a full-service stockbroker provides both facilities.

Starting with the DEMAT Account, it is that Account where your shares and other financial instruments you buy are kept in a dematerialized or digital format. Moreover, you can convert them into paper form.

On opening the DEMAT Account, you will be provided a DEMAT account number to settle your trade further electronically. Also, there is no need that a person should have any shares for DEMAT account opening.

The shares that you buy or sell make changes in the ledger of your DEMAT Account.

This means when you buy the shares, the shares in the DEMAT Account are credited, and in contrast, when you sell them, they are debited from your DEMAT Account.

Next comes the Trading Account. It is connected to both your DEMAT Account and your current bank account. But it works in the same way as the current bank account does.

With its help, you can buy and sell shares in the share market during trading hours (hours during which the share market remains open for buying and selling of shares).

To illustrate more, suppose you transfer Rs. 15,000 from your bank account to your Trading account and you utilize this amount to buy shares worth Rs. 10,000. The stakes are sold off on the same day.

When securities are purchased and sold on the same day, this technique is called Intraday Trading.

After purchasing is done, a broker sends you a digital contract note by email after trading hours. A broker also provides you a unique trading ID to get access to your trading transactions.

Besides, Rs. 10,000 will be debited from the Trading Account, and the remaining amount, i.e., Rs. 5000 will show as a cash balance.

However, you can also take out your cash from your trading account after submitting a withdrawal request in the trading app. And within 24 hours, the money is sent to your account.

Share Market Account Opening Process

Before opening an account in any brokerage, the three things come to our mind. These include safety where you invest, annual maintenance charges, & brokerage charges, latest technologies, and convenience to invest.

All brokers are SEBI regulated and run under NSE and BSE, but regulation does not indicate that a particular brokerage firm is doing well in the financial market.

Therefore, you should try to connect with professional and reputed brokers.

Charges need to be paid for DEMAT and Trading account-

- Account opening charge

- Yearly maintenance charge

- Brokerage charge

Share Market Account Opening Online

Earlier, it was like the traders and investors have to be physically present in the share market to take the trading decisions, verbal communication, and trade.

With the arrival of the digital era, this method is replaced with the online DEMAT and Trading accounts. Moreover, people also find opening accounts via the Internet more convenient.

Share Market Account Opening Documents

- PAN card number

- Bank proof – Write cancel on it to convert it into cancel cheque, do not sign on it. Click its picture and upload it. In case you do not have a cheque, you can use a bank statement or passbook.

- Adhar Card -You need an Aadhaar Card number to put at the time of registration.

There are a huge number of brokerages and financial institutions with whom you can open your DEMAT account.

- You can go to their sites and enter your phone number. To confirm it, enter your OTP.

- Then type your name and email ID. To confirm it, enter the OTP received in Email-ID. Enter your PAN number on the screen, DOB, and click on the continue button.

- There are some options shown that you can see on the screen. They are Equity, F&O, Currency, and Commodity. However, they may differ from broker to broker.

- Here it is your choice on which security you want to invest in. Besides, the opening charges are mentioned beside them.

- Then, there will be shown payment options such as card, UPI, and net banking. You can select any option for payment.

- Type your necessary details, like marital status, name, experience, and occupation.

- Link bank account: Enter the FSC, MRC code, and bank account number and read the declarations, and if agreed, click agree to continue.

- Next, you will come across the webcam verification screen, providing camera permission.

- Then write the number shown on the screen on paper and hold your camera over that number and click on the capture button.

- Next, you will see an upload document screen, upload all your three documents; if you want to buy equities, you do not need to upload income proof.

- After uploading all documents, click on the eSign document. The email authentication screen will be seen to you; enter the same code you got in the mail.

- Read declaration, enter Mobile OTP and Adhar card number.

- Here you will see a document. Click on the button.

- Again enter the Adhar card number.

- Verify it.

- Sign Successfully

- Again, the broker’s screen will show to you, enter the finish button, and here you have opened your DEMAT account.

In case of any help, you can call the team of that particular broker you are opening your account with. They will help you complete this process, and you will get an email within 20 to 40 hours.

They will provide you a user ID for individual identification and carrying out the transactions.

Share Market Account Opening Charges

Mostly the new investors and traders look for brokers who provide account opening service at a low rate.

However, there are some Full-service and Discount brokers who provide this service with zero balance mean free.

Apart from charges for opening the account, other different charges are applicable for maintaining the Trading account. These are called Annual maintenance charges (AMC).

But apart from the account opening charges, investors should also check the customer support service and AMC.

Share Market Account Opening Free or Zero Balance

Excluding some brokerage firms, some provide free account opening service as well. It is known as a zero brokerage plan. However, they charge nominal fees for their processing and maintenance.

Wish to open an Account? Refer to the form below

Share Market Account Opening Hours

You also need to be aware of the Share Market Account Opening time in India before investing and trading in the financial markets.

The standard timings or continuous trading timings are the same in two major stock exchanges; namely, NSE and BSE. The share market opens at 09:15 AM and closes at 03:30 PM.

However, as the account opening service is all digital. It remains open for 24 hours. You can open your account with any broker at any time from where you are.

Once you get to know the Share Market Account Opening Hours, you can buy, sell, and trade in shares from any part of India.

Share Market Account Opening Rules

Before opening any share market account, firstly try to begin it with choosing a broker or firm and do a comparative study about services provided and charges charged by that broker. It can assist you to save a lot of money.

There are some share market rules and regulations designed by the SEBI, which you need to stick to while opening a DEMAT and Trading account. It requires all documents (PAN card, Bank proof, Address proof, application form).

After filling in all the info, re-check it to make sure that you have put accurate information. Once your selected firm or broker verifies you, you can provide them your account details.

Share Market Account Opening Benefits

There are many benefits of opening a demat and trading account in the share market. Some of them are:

- You can easily trade in a variety of exchanges in commodities and securities.

- You have access to using multiple software-based and reliable smart tools such as daily reports, strategy builders, and advanced reports.

- You can customize the features of an online trading account according to your needs like you can make changes in the stock watchlists to track them, and also you can create charts to have an insight on the stock movements.

Online account opening needs you to have your mobile phone with all of your three documents. This process takes just 15 minutes of yours.

Conclusion

For trading in the Share Markets, it is significant for an investor to have both a DEMAT and a Trading account. Although, it is your choice where you want to open your account with.

However, it would be best to do in-depth research about stockbrokers to keep your risk factor to the minimum.

Also, you should compare their charges and services. Besides, upload the correct credentials for quick account opening following all SEBI guidelines and within trading hours.

Want to start trading in Stock Market? Honor us to help you. Look at the form below

Know more about Share Market