Stock Split Reverse

More On Share Market

Stock Split Reverse, as the name suggests, is an exactly opposite concept to what stock split does.

In order to make it less confusing, especially for beginner level traders, le’ts go step by step and understand how it works and impacts your investments.

Stock Split Reverse – Basics

It is always better to know what you own, and why you own it. This is because if you own the wrong stock there is a possibility of a stock split reverse. It is according to its name is the reverse or opposite of forwarding stock split.

This is done by companies to reduce the number of shares in the secondary market and increase its prices in the exchanges (NSE, BSE, MCX etc) where it is traded. The decision is taken by the board of directors (BoD) of the company to safeguard their company from delisting or being without trading or considered as a penny stock in the market.

A stock split reverse is also known as stock merge.

Again, with this concept in action, the number of shares go down but the monetary value of those shares increases. There is no direct inherent value since the overall market capitalization of the company remains the same but with this, the stock value certainly sees an upgradation.

Stock Split Reverse: How It Works?

To know more about reverse stock split it is better to know first about stocks. Stocks are the term used by the Americans for shares. The stock is divided part of the company’s shares.

Each stockholder of with even one share of the company has a fractional ownership in the company, The share of any public listed company is open to being traded in the secondary markets, which are the stock exchanges in a country.

Like mentioned above, in India, we have exchanges such as the National Stock Exchange, Bombay Stock Exchange, Multi-Commodity Exchange etc.

Reasons For The Stock Split Reverse:

When the trading in a particular stock is minimum or very rare it is considered to be a penny stock (not a good news for the company the stock belongs to).

This could be due to the poor performance of the stocks and the company’s prospects due to various reasons. There is also a possibility of being delisted from the exchange.

Hence to avoid this and to increase liquidity and the price of the stock, the board of directors of the company may decide for stock split reverse or increase the face value of the share or merge it with other group companies or with a similar company for better prospects.

How It Works:

The reverse split is done in many ratios. It could be 5:1 or 10:1 or many more. It means if you have 5 share or 10 shares it will be made into one share respectively. This could make the price to go up 5 or 10 times accordingly and also the liquidity of the share.

Record date:

This reverse of a stock split is done at a particular announced date. It is called the record date. After this date, the merged shares or the reduced will start trading in the exchanges with the increased price.

“D” At the End of the Ticker of the Stock Symbol in Exchanges:

The “D” symbol at the end of the ticker in the exchanges of the stocks indicates the stock has undergone reverse split. So, make sure you keep an eye on such indications and stay aware.

If you are a new investor or looking to investing in a stock that has gone through a stock split reverse, it makes complete sense to understand the reason for this move taken by the company. Based on the rationale, you may choose to invest or not in that particular company.

A stock split reverse may or may not work in the company’s business favour, therefore, there are way too many factors that need to be considered before taking this step.

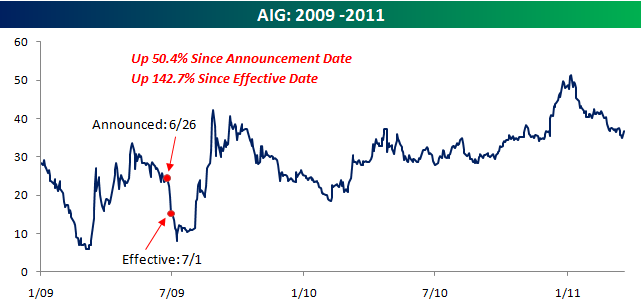

If it works, then the picture looks all good as shown below:

Although, as shown above, there was a quick dip right after the stop split, however, gradually the company and the investors (old and new) recognized the movement, and the stock saw consolidation and then an improvement in its valuation.

At the same time, things can go south if the decision to go ahead with a stock split reverse is not taken objectively, like shown below:

Thus, as an investor, it is utmost important for you, to understand the rationale provided by the board of directors of the company behind this movement.

If what they say goes in line with the business objectives and numbers, then it makes sense to hold. Otherwise, you MUST look for other investment options.

Reverse Stock Split Example

There would be many of you who want to understand this in an easy way and therefore an example is being shared here.

Let’s suppose there is a company A listed on stock market. Its management announced a reverse stock split 1 for 100 shares that mean for every 100 stock a person own will become 1 stock after the reverse stock split. For better understanding let assume you have 1000 shares of a company and current price of that single share is 50 paise or ₹0.5.

That means the total price of 1000 share of company A is ₹500. After the reverse stock split process is complete you are left with 10 shares with a single share price at ₹50 and the total price of that 10 shares is remain constant that is ₹500.

This tells us that reverse stock split does not affect the market capitalization of the company and definitely not the value of the holding you possess.

On the other hand, let person X has 50 shares of company A. In this case, company A cannot complete the process of reverse stock split because of the quantity of shares person X holds. So, the company management will have to buy those shares and pay the current share price for those 50 shares person X holds, which cost around ₹25.

Stock Split Reverse: Benefits

There are many advantages to the stock split reverse to both the company and its investors.

The company could be able to recover from its losses and have a better chance for rejuvenation of the company. Also, it could avoid adverse results of delisting and near nil trading in the exchanges.

Many stocks have shown an upper rise with the reverse split.

The investors could be able to trade in the shares with better liquidity after the reverse.

This also increases the psychological value of the shares in the market with higher value and increase in volume.

Also, the number of shareholders could be reduced with those fewer than the required stocks for reverse split will be paid in cash.

Stock Split Reverse: Concerns

The stock split reverse is considered as a negative activity in the financial markets.

The near push down to penny stocks makes this split necessary is the general feeling in the market sources. Also, it may lose faith because of this stigma attached to it by institutional investors and high net worth clients.

Hence any big buying in it even after the reverse split is a question for many stocks that is supposed to be answered.

Lastly, there is a possibility of the shareholders being reduced and as per the authorities of controlling the financial markets; the company could come under the purview of a different regulatory category.

Stock Split Reverse: Conclusion

It is always better to go forward than reverse and it aptly suits for stocks with the forward split. But in some exceptional cases, the reverse also becomes imminent to avoid the drastic consequences and could be moved forward after the reverse. This has been proven in many stocks.

Hence if at all a reverse split is to happen to stocks it is better to be aware of it beforehand and be prepared for its consequences both financially and mentally. It is better to invest in safer stocks with good track record and management to hold for a longer period of time to avoid stock split reverse.

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking the next steps forward:

For more information on the Indian Share Market, feel free to check the below mentioned tutorials: