Stock Vs Shares

More On Share Market

In the financial markets, traders often remain confused between two common terms, stocks and shares. Are you one among them? If yes, then here we are with complete information on stock vs shares.

In general, both are kinds of securities that denote a slice of ownership in a public company, and different companies issue them for funding.

Here in this article, let us study much more about Stock vs Shares in detail.

Stock vs Shares Definition

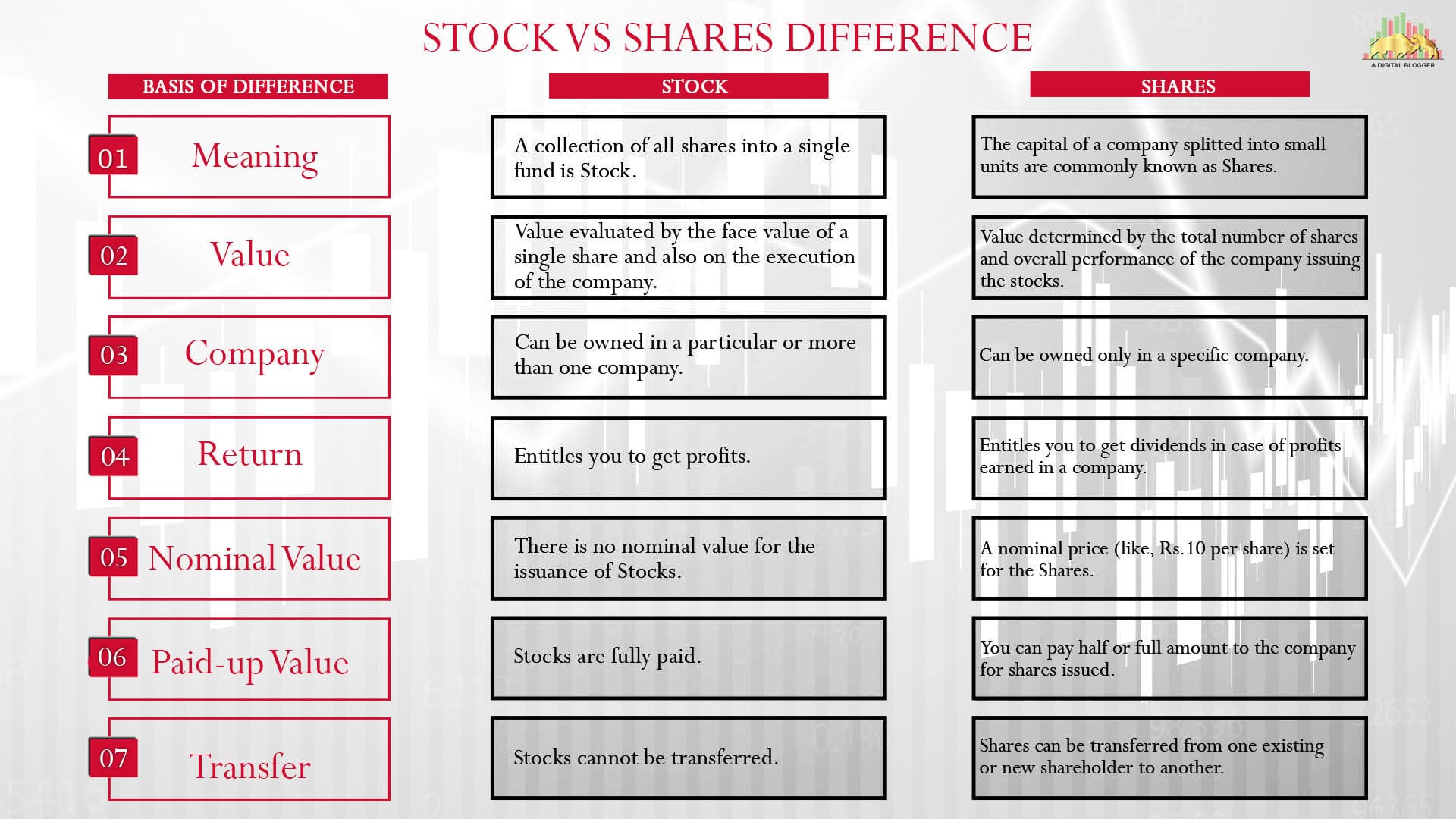

When comparing the two different aspects, then why not start with the definition and meaning of terms. Basically, both stocks and shares determine the ownership of the company but are used interchangeably by traders and investors.

But when considering the differences, they differ from each other in terms of the nature of quantity.

For example, when talking about the ownership of a single company it is called share while shares of different companies are called stocks.

Also, as per Section 61, Companies Act, 2013 company can convert fully paid-up shares into stocks. Now let’s dig deeper to understand their meaning and to learn basic differences with the Stock Vs Shares.

What are Shares?

To know the concept around stock vs shares let’s begin with the definition of shares.

As the name itself says, Shares mean small units. Suppose there is a company A having share capital that is not adequate for its expansion or process.

So it decides to raise some funds from the stock markets. For this, it breaks its capital into small units, i.e., Shares. And it issues some of its shares to the investors, which are also called shareholders.

An investor who buys any share becomes the company shareholder and gets a unit of ownership in the same company. Investors can buy one or more than one share but of a single company.

Shares are first sent by ṭhe company to the Primary Market for listing whereas, in the Secondary Market, the buying and selling of the shares occur through an exchange.

Also Read: Stock Market Types

To illustrate more, Let’s suppose

A company issues 1000 shares @10.

B company issues 2000 shares @20.

C company issues 3000 shares @30.

All the above-mentioned companies are different and issue shares with different values. Now here an investor shows interest in investing and buy 10 shares of company A.

In all, investing in shares is specifically gaining ownership in one particular company listed in the exchange.

You can invest in shares after opening your Demat account. But after opening an account, one question usually arises in a beginner’s mind i.e., What to invest in stocks?. There are various segments in the share market you can invest in.

To get started, fill the form below and a callback will be arranged in no time.

Equity Shares

Now shares further have types. Starting with equity shares, it is also called ordinary shares and common shares. They are such shares that offer investors a right to become the company’s owner to the extent of their shareholding.

They can gain a share in the company’s earnings and be involved in its decision-making process. Besides, they also have to bear the losses incurred. In the name of returns, they are only offered a portion of profits & assets that is called Dividends. Dividends can be paid quarterly, monthly, and annually.

Preference Shares

The next on the list is Preference Shares. It offers a fixed amount of return to its shareholders called a Dividend. They have no voting rights like Equity Shareholders. Besides, if you invest in a company with a sound balance sheet and funds, you can gain a handsome amount of dividends or bonuses.

What is Stock?

To gain a better understanding of stock vs shares here we jump to understand the meaning of stocks.

When you collect all the shares and combine them into a single fund, that is called Stock. You can invest in stocks in more than one corporation. A Stock is a larger unit of share. They are fully paid-up funds. There is no fractional transfer done in the case of stocks.

Here is an example, that helps you in understanding the concept of stock in a clear way.

A company issues 10000 shares @10.

B company issues 20000 shares @20.

C company issues 30000 shares @30.

All the above-mentioned companies are different and issue shares different values.

An investor Mr. X wants to invest by buying one or more shares of more than one company. Suppose, he buys 1000 shares of company A @10, 2000 shares of company B @20, and 3000 shares of company A @30.

This means that Mr. X has 6000 shares worth ₹1,400,000.

Stock vs Shares Growth

After the meaning, next comes another differentiating parameter that helps you in defining stock vs shares difference and i.e Growth.

Now to understand the difference between stocks vs shares in terms of growth, let’s take into consideration the two commonly available stocks in the market, growth and value stocks.

Wondering what are they?

Well! as the name signifies, growth stocks are those that grow above the average price as compared its peer competitors, while value stocks are the one that offers you valuable returns overtime.

Let’s learn more about them.

Growth Stocks

Growth stocks are those companies that show above the average growth of their competitors, sectors, or overall market.

Here the growth is calculated in terms of revenue, profit, and earning per share or EPS.

Considering the numbers, these stocks grow by 30% to 40% in a year thus offering you good returns.

This much speed in earnings growth indicates that these companies have any competitive advantage because they can offer this growth.

Here are some of the characteristics features of Growth Stocks:

- They possess products and a line of products.

- The shareholders of Growth Stock gain dividends in terms of returns.

- It is always expensive and overvalued – The price of such stocks is high as all investors have higher return expectations. Their cost to book value and earnings ratio is higher as compared to other companies.

- Growth Stocks have a high P/E ratio, price-to-earnings ratio & higher price-to-book ratios.

- Investing in growth stocks involves high risk due to high volatility.

Value Stocks

These are such companies that are trading with less growth and at less price than they are worth. When comparing the cost of stocks, value stocks can be bought at a much cheaper price.

Parameters of how to find Value Stocks:

There are certain ways by which you can identify the value stocks in the market, like:

- Value Stocks are traded at a low P/E ratio. Make sure to check the Average P/E percentage of all stocks, like Steel Stocks.

- They have a low Price to Book Ratio (P/B) if they have a 1 to 2 ratio.

- Yield High dividend means that they do not have more growth and investment opportunities. This is because they have less valuation.

Next comes the characteristics of Value stocks, which includes:

- As discussed, these stocks are available at a much cheaper price.

- There are less volatility and hence lesser risk involved in investing in value stocks.

Stockholder vs Shareholder

Moving further with the stock vs shares not let’s move ahead to understand the difference between stockholder and shareholder.

Both the words Stockholder and Shareholder refer to the possessor of shares in a company. They are not the overall owners of a business (company) but the part-owners.

Stockholder and Shareholder can be an individual or an organization that owns a share in a corporation and mutual funds. However, the rights of both holders are similar.

Let’s get into details of stockholder and shareholder one by one.

Stockholder

When an investor buys stocks, they get partial ownership of that company. They are involved in the actions, goals, and policies of the company. Moreover, they take an interest in the performance of a company they invest in.

They get affected mainly by the performance of the company as they are the largest stakeholders.

There are also two types of Stockholders (Stakeholders), namely Primary Stockholders and Secondary Stockholders.

Primary Stockholders include managers, workers, and many more. They are in direct contact with and have a direct stake in the company. In contrast, Secondary ones involve Government, Securities, and Civil Societies.

Shareholder

A shareholder can be one who even owns one or more than one share in a particular company.

After the investment, they become the company’s part-owner and gain some income from the claims to the extent of their sharing or holding.

A shareholder can purchase the shares from the company or an existing shareholder.

As discussed, a shareholder can invest in two types of shares namely; equity and preferred. Both have their own risk and returns, on the basis of which you can invest smartly to meet your long-term investment goals with goal based investing.

Difference Between Stock Market And Share Market

When considering the details of stock vs shares it becomes vital to understand the concept of two different market types.

There are mainly two financial markets, the first one is the Stock Market, and the other one is the Share Market.

These are the platforms where brokers arrange to buy and sell the shares for the clients (investors) at negotiated prices, which are published in the markets to let them know about the prevailing prices.

Let’s begin with the Stock Market.

The Stock Market is also known as the Stock Exchange, a platform where stocks, equities, securities, and even bonds are traded actively between stockbrokers and investors.

Also Read: How many stock exchanges in India?

While in the Share Market, only shares are sold or bought. Here you can purchase shares of any company to become a shareholder and get partial ownership in that company.

In simpler words, the Share market allows you to buy shares and earn some income from a company’s profits in the form of dividends, and in case of loss, you also require to pay off the loss.

Both markets are regulated by SEBI (Securities and Exchange Board of India). You can sell or buy a stock even if it is not registered on the Stock Exchange. Whereas, in the case of shares, the listing is mandatory.

Stock markets are of two types; National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). In the Stock Market, stocks’ prices are calculated based on the demand and supply of stocks, and the overall trade is being carried out digitally using various trading platforms and apps provided by the broker.

Conclusion

The distinction between Shares vs Stocks is one of the most perplexing concepts. They both are different concepts in some manner. However, both are related to financial equities and indicate the ownership of investors.

Share is part of possession of ownership in a specific company whereas, stocks offer you ownership in more than one company.

Besides, shares provide you dividends as profits whereas, you get fix profits in stocks. The shares are issued at the partial or full amount. On the other hand, the issuance of stocks is done in full value.

At last, you can transfer the shares to existing shareholders while stocks cannot be transferred.

This is all about the stock vs shares. Hope you understand.

Want to get into a trade or plan long term investment, get started with the Free Demat Account. Just fill the form below and a callback is arranged for you in no time.

More on Share Market