Value Investing

More On Share Market

Value Investing is a kind of investment strategy which involves buying those stocks that are trading for less than their intrinsic values.

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

― Benjamin Graham, The Intelligent Investor

Value Investing India

According to value investors, the market overreacts to good as well as bad news which results in movements in stock prices that are not consistent with the long-term fundamentals of the company.

Therefore, value investors want to pick stocks at those instants where the share price becomes lower than the intrinsic value of the stock. They are in constant search of undervalued stocks.

Benjamin Graham is regarded to be the father of Value Investing. He developed the concept of fundamental security analysis and introduced value investing strategies. He was the author of two of the best books written on investing, “The Intelligent Investor” and “Security Analysis”.

His student, the great Warren Buffet also focuses on value investing and according to him, “It’s far better to buy a wonderful company at a fair price than to buy a fair company at a wonderful price.”

Now, what is the problem?

Why does not everyone become a millionaire through such a great tried and tested strategy of Value Investing?

It seems quite simple from the definition but the tricky part in value investing is to estimate the intrinsic value of the stock as it is a subjective matter.

Some value investors look into the price to earnings ratio (P/E ratio), some look at current earnings and assets and do not give much weight to the future growth potential of the stock.

On the other hand, some value investors formulate their whole strategies on the basis of the estimation of future growth and cash flows. Analysts use various techniques in order to calculate the intrinsic value of a stock and decide whether the stock is undervalued or overvalued.

Undervalued stocks are those stocks whose current stock price is less than their intrinsic value. Value investors like to invest in these stocks.

Also Read: How to Find Value Stocks?

Overvalued stocks are those whose current stock price is greater than their intrinsic value. Value investors tend to stay away from such stocks.

Value Investing Models

We shall discuss two of the most commonly used models for calculating the intrinsic value of a stock:

Dividend Discount Model

Many models calculate the intrinsic value of the security factor in variables largely pertaining to cash: dividends and future cash flows and utilize time value of money as well.

One of the most popular models based on this concept is the dividend discount model. This model is based on the idea that the intrinsic value of a stock should be calculated by estimating the expected value of the cash flows it will generate in the future.

The driving principle behind the model is the net present value (NPV) of the cash flows, which draws from the concept of the time value of money (TVM).

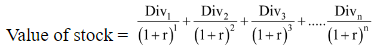

The fundamental value of the stock is calculated as follows:

Where: Div = Dividends expected in one-period

r = Required rate of return

Discounted Cash Flow

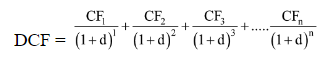

Discounted Cash Flow or DCF is the most commonly used valuation method to calculate a stock’s fundamental value.

Where: CFn = Cash flows in period ‘n’

d = Discount rate, Weighted Average Cost of Capital (WACC)

When intrinsic values are calculated through various methods, it becomes imperative to keep a margin of safety in order to cover some risk involved.

The margin of safety is basically a principle according to which an investor buys stocks only if their value is much lower than the intrinsic value calculation.

Investors choose their own margin of safety according to their risk appetite.

Value Investing Books

Like every form of investing, it makes complete sense to read books and equip yourself before placing your capital in the share market. Let’s quickly discuss 5 such books that can help you prepare yourself:

1. “The Little Book of Value Investing” by Christopher H. Brow

Christopher H. Brow was a famous value investor from the US, died in December 2009. However, one of his contributions to the investing community is this book on value investing.

This book titled “The little book of Value Investing” talks about how patience plays a crucial role in deciding whether you can churn returns from your investments or not.

The book has been rated 4 STARS out of 5 at Amazon by 160 buyers validating the value it offers.

2. One up with Wall Street by Peter Lynch

This book has been recommended by multiple experienced investors and is seen as one of the first few books one must read before he/she starts investing in the share market.

It guides and clears out all sorts of basic confusions one may have towards investing and picking (or not picking) the companies/stocks to invest in.

The book talks about facts and myths around diversification, fund managers, listed businesses etc, and is rated 4.5 out of 5 by more than 1000 users.

3. Security Analysis by Benjamin Graham and David Dodd

Although written by different writers, the book has a foreword by Warren Buffet saying that the book is about the investing principles he himself has been following for 57 years.

The book provides several ways to assess the business whose stock you are looking to invest in. The authors take multiple examples to prove their point about several companies that were overlooked by investors for multiple reasons but turned out to be gold later.

Furthermore, the book also talks about the ways how one can figure out the intrinsic value of a company before deciding to invest in it. It has been rated 4.5 out of 5 by around 200 readers.

4. Value Investing: From Graham to Buffett and Beyond

This book starts with the introduction of value investing as a form of proven investment technique and then takes the theoretical aspects to the practical applications.

The author takes examples of some of the most successful investors the world has seen including Warren Buffet, Mario Gabellio, M Price and more to show how these investors used the principles of value investing in their portfolios.

The book is recommended for those investors who are already into investing and are looking to upgrade their sense of share market investments.

5. “Value Investing and Behavioral Finance” By Parag Parikh

This book is especially recommended for Indian investors and basically talks about how greed and fear work in the minds of investors in the stock market.

The book talks about investor psychology and how it impacts market decisions, stock returns and more. The book further discusses the common pitfalls and opportunities that are generally overlooked even by experienced investors for the sake of short-term risks and benefits respectively.

Value Investing Stocks

From the definition perspective, the stocks that trade on the stock market at a price that is relatively lower than its fundamentals as per the dividends, sales, profit and other related metrics, are termed as value investing stocks.

Some of the most common aspects you must be looking at while making a selection for value investing stocks are:

- Quality rating of the stock

- Current ratio

- Debt to Asset Current ratio

- Positive earnings per share growth

- PE Ratio

- Price to book value

- Dividends (learn more on how to invest in Dividend stocks)

There’d be very few stocks that would give you value across all the above-mentioned factors, however, your job must be to filter out the specific stocks that take care of these factors at the most.

Value Investing Strategies

Value investing is not everyone’s cup of tea. There are some things that must be considered at all times if a person wants to become a value investor. Let us discuss some of them:

1. Keep a Long Time Frame for Investment

Suppose an aspiring value investor picks an undervalued stock and invests in it. It will be of no use if he/she will have to take out the money before it starts showing results. Sometimes, stocks may take a few months to a few years time to reach their intrinsic values.

One must have the confidence and patience to wait, else, all the hard work in selecting the stocks will be useless. One must develop the practice of thinking in terms of years or even decades instead of a few weeks or months.

2. Have the Confidence to Not Go With the Popular Sentiments

It is quite obvious that if the general public is recommending a stock and investing in it in huge amounts, it is unlikely that it will remain an undervalued stock.

Therefore, by definition only, undervalued stocks or stocks preferred by value investors are those stocks that are being overlooked by maximum investors either due to some other hot stocks or that sector is out of the limelight.

In such circumstances, one must have the confidence to invest in stocks that are completely out of the focus of the general public. A beautiful quote by Benjamin Graham would help an investor to keep the required confidence –

“The stock investor is neither right nor wrong because others agreed or disagreed with him; he is right because his facts and analysis are right.”

3. Always Have a Margin of Safety

The basic rule of any kind of investing is to protect one’s wealth against losses, otherwise, the purpose is definitely defeated. In the case of value investing also, it becomes essential to always have a margin of safety to avoid losses or minimize them to a large extent.

4. Stay Updated

We know that not researching various aspects of a company before investing is a kind of financial suicide.

But what happens once a person is invested in a stock?

The research and awareness should not end at the time of investing. One must be able to answer some basic questions about his/her stocks at all times.

The most important question is about good reasons to hold that stock. One must keep his/her knowledge about the stocks up to date by at least reading all the latest reports on the company and news related to not only the company but also its sector, etc.

If anything happens that has a negative impact on the stock’s intrinsic value, one must reconsider his/her situation and take calls accordingly.

Value Investing Examples

Let’s take an example to understand this concept before we show the curtains.

Imagine Ravish, a beginner investor looking for stock market investment opportunities and wants to put up his bonus of ₹5 Lakh into a few appropriate funds for mid to long term period.

Since he is a beginner and thus, in a sense, naive – he goes ahead with a preferred sector of textiles because he loves clothing of the brand XYZ which is also listed in the NSE.

Although he has selected XYZ, more or less, randomly, he wants to perform a detailed analysis before he decides to invest his money into this fund.

Thus, he starts by looking at the financials of the business by starting with the balance sheet followed by the income statement and the cash flow statement. He likes what he sees there as the company has been performing well over the last few years with a consistent increase in its revenue as well as profits.

The business has also been able to lower its operational costs over a period of time, thereby, contributing to the profit.

Ravish then decides to have a look at the credit rating of the company and is shocked to find that the company has a B- rating. This establishes that business management has not been able to take care of its debt and has been, in a way, careless or irregular in this aspect.

This brings in fear the XYZ may falter in the future in paying its debts and thus, will end up using its profits to fix that.

Not a good sign, in fact, it’s a bad omen!

However, he suddenly sees that the company PQR has a credit rating of AAA and in fact has done marginally better in its numbers as well.

Ravish then calculates all sorts of fundamental metrics including debt-equity, ratio, asset turnover, PE Ratio and what not.

To his surprise, the stock of PQR can be termed as way more attractive than his earlier gut feeling of ABC. Ravish then decides to invest a good portion of his bonus in PQR.

Conclusion

So, now we know the definition of value investing, the basic principle behind it and some of the commonly used models to calculate the intrinsic value of stocks in order to find undervalued stocks for our portfolios.

But one must remember that there are things that are equally important as stock selection in order to earn profits.

Some of them are having the spare money for value investing so as not to take out money even before the stock has reached its intrinsic value, having the confidence to go against the popular opinion of the general public, having the patience to wait for years or even decades to reap the benefits of value investing.

In case you are looking to get started with Value Investing and need assistance of any kind, let us help you in taking things forward: