Coimbatore Capital

List of Stock Brokers Reviews:

Coimbatore Capital is a leading financial services provider that provides a wide range of investment services. It is one of the leading broking houses in the retail segment in South India and operates as a full-service stockbroker.

Coimbatore Capital Review

Coimbatore Capital was incorporated in 1995 by financial expert Mr D. Balasundaram, who is also the founder Director of Coimbatore Stock Exchange Limited and Inter-Connected Stock Exchange of India Limited.

The stockbroker is a member of NSE in the equity, futures & options, currency derivatives segment and mutual funds services scheme. It is also the depository participant of National Securities Depository Limited (NSDL). It is the first depository participant of NSDL outside Mumbai and Delhi.

Coimbatore Capital is headquartered in Coimbatore, with over 150 terminals and branches in South India. The company is expanding its reach to the semi-urban and rural areas. It uses advanced technology and extensive research and analysis for profitable returns for its clients.

Coimbatore Capital Active Clients

As of 2020-21, Coimbatore Capital reported 5,523 active clients. The clients include individuals, retail clients and corporates, with specific options for high net-worth individuals and non-resident Indians.

With the number of clients mentioned above, Coimbatore Capital is one of the smallest stockbrokers in India.

Read More: Top Stockbrokers with Highest Active Clients

Coimbatore Capital Products & Services

Coimbatore Capital provides broking services for equity, equity futures, equity options, currency futures and interest rate futures. It also provides online trading services in these segments, along with commodity derivatives trading.

Along with broking and trading services, it is a depository participant and assists in the trading of shares in safe, paperless form.

The other services provided by the stockbroker include mutual fund distribution, IPO services and insurance services. They provide all the relevant information to the clients regarding mutual fund investment options or new issues and help them make an informed decision.

Coimbatore Capital Research

Coimbatore Capital has a business model that is built on in-depth research and proven analysis.

The research and analysis include equity analysis, with detailed reports on gainers & losers, new High & lows, advances & declines, buyers & sellers, bulk & block deals, sector watch, index movers, unusual volume, out/underperformers and index constituents.

The other reports include:

- Corporate Action reports

- Company Profiles

- IPO reports

- Forex reports

- FII Investment reports

- World Indices reports

- Mutual fund reports

- Pre-session, mid-session and end-session news

- Daily, weekly and monthly reports

The stockbroker does an okayish job in its overall research reports and recommendations.

If you are or looking to be a client of this stockbroker, it is advised you perform an analysis at your end as well before you invest your money in the stock market.

Coimbatore Capital Trading Platforms

The full-service stockbroker provides a wide range of in-house as well as outsourced trading applications to its clients as listed below:

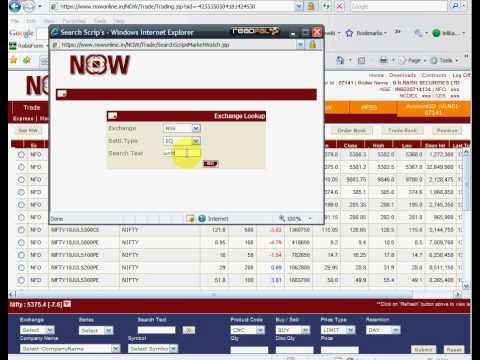

NOW-Web-based Trading Platform

Coimbatore Capital provides internet trading through NOW, the trading platform provided by NSE. It provides direct connectivity to NSE for trade execution and data feeds through trading terminals and web.

The platform provides a common login for cash, equity derivatives and currency derivatives, and live market data.

The software is fast and seamless and it gives speedy broadcast and refreshing of data. The orders can be placed, modified and cancelled through the software, with an instant order confirmation.

The clients can view their positions and limits and also perform online funds transfer in a secure manner. The platform also provides connectivity to the back office where clients can access their ledger, holdings and balance.

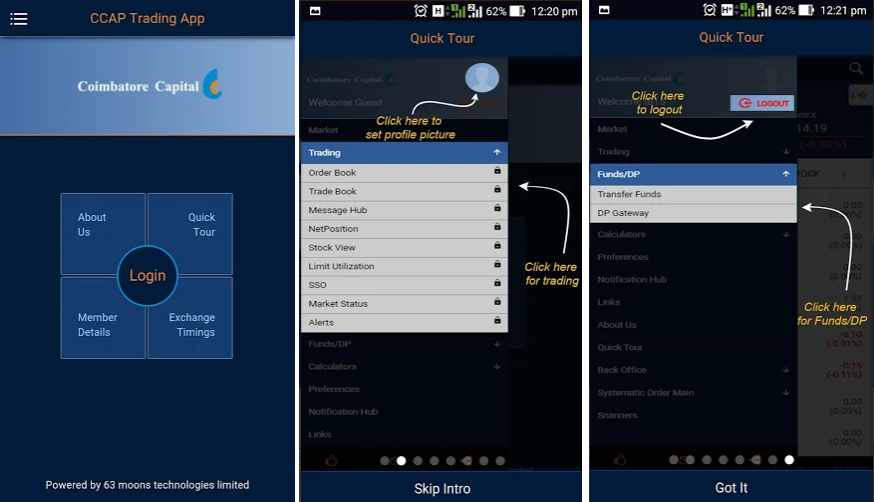

CCAP Trade – Mobile Application

The mobile app of Coimbatore Capital is called CCAP Trade. It can be used by the traders to access their account and trade anytime from anywhere. The app supports scrip search, instant alerts and reminders and trading in all segments.

The traders can access their order book, trade book, net positions, stock view and market status through the application.

Some of the features provided in this mobile trading app are:

- Order and trade book provision

- Trading in different indices allowed

- Real-time market quotes

- Fund transfers feature provided

- Alerts and notifications

At the same time, a few of the issues you must be aware of include:

- Login Issues

- Limited Number of features

Here are a few stats of this mobile trading app from the Google Play Store:

| Number of Installs | 1,000+ |

| Mobile App Size | 30 MB+ |

| Negative Ratings Percentage | 10% |

| Overall Review |  |

Coimbatore Capital Customer Care

The ideology of Coimbatore Capital revolves around its clients. It is known for excellent customer service. The clients can contact the broker through:

- Phone, including a toll-free number

- Compliance Officer

- Physical Branches

Client service is quite important at Coimbatore Capital. The customers can contact through any of the above methods for grievance redressal and Coimbatore Capital provides quick resolutions.

From the quality perspective, however, the customer care services can be improved from varied aspects.

Coimbatore Capital Pricing

When it comes to pricing, Coimbatore Capital charges the following rates for the Demat and trading accounts. Furthermore, there are specific conditions on how the stockbroker levies different charges on its clients. Here are the details:

- The account opening charges are ₹300, with no monthly fees.

- All statutory and regulatory levies are charged to the clients.

- Minimum margin is ₹1,00,000 for ODIN Diet and ₹50,000 for NOW.

- Funds & Securities pay-in T+1/ Funds & Securities pay-out T+2.

Coimbatore Capital Brokerage

At the same time, you must be aware of the brokerage rates applied across different segments. You must remember that brokerage levied has a lot to do with the initial trading deposit amount you put in your account.

Higher the trading deposit, lower is the brokerage rate you get from the broker. Nonetheless, you still should try to negotiate the brokerage charges as much as you can before opening the account with the broker.

Here are the rates applied by Coimbatore Capital:

- The brokerage charges for intraday trading are 0.02%.

- The brokerage charges for delivery trading are 0.2%.

- The brokerage for options is ₹50 per lot.

- Brokerage is applicable only for net trading through CCap Net Trade.

For more information, check this detailed Coimbatore Capital Brokerage Calculator to understand all sorts of taxes and payments you need to pay to the stockbroker.

Here are all the details of Coimbatore Capital pricing for your reference:

| Demat Account Opening Charges | ₹300 |

| Demat Account Maintenance Charges | ₹0 |

| Trading Account Opening Charges | ₹0 |

| Trading Account Maintenance Charges | ₹0 |

| Initial Margin Money | ₹1 Lakh for ODIN Diet & ₹50k for Now online |

| Equity Delivery | 0.2% |

| Equity Intraday | 0.02% |

| Equity Futures | 0.02% |

| Equity Options | ₹50 per lot |

| Currency Futures | 0.02% |

| Currency Options | ₹50 per lot |

| Commodity | 0.02% |

Coimbatore Capital Margin

As far as exposure is concerned, you get the following limits across different trading classes:

- The leverage provided for intraday trading is up to 30 times.

- The margin for delivery trading is up to 5 times.

Looking at the Intraday exposure, the values provided are pretty significant and can be used by expert level traders to amplify their profits.

Here is a quick summary:

| Equity | Upto 30 Times for Intraday Upto 5 Times for Delivery |

| Equity Futures | Upto 5X for Intraday |

| Equity Options | Upto 5X for Intraday |

| Currency Futures | Upto 5X for Intraday |

| Currency Options | Upto 5X for Intraday |

| Commodity | Upto 5X for Intraday |

Coimbatore Capital Advantages

Here are some of the positives the stockbroker puts in front of its (potential) clients:

- The pricing structure is optimum, and at par with the competitors.

- The technology is advanced, with secure and fast transactions.

- The company provides reasonable research and advisory services.

- The management of the company is highly seasoned and experienced, with a strong vision.

Coimbatore Capital Disadvantages

At the same time, you must be aware of some of the concerns related to this stockbroker:

- The broking services of the company are restricted to the South of India. The lack of pan India presence leads to fewer clients than other leading nationwide broking houses.

- Average customer support quality.

Coimbatore Capital Membership Information

Here are the membership details of Coimbatore Capital with different regulatory bodies of India:

| Entity | Membership ID |

| SEBI | INZ000032039 |

| BSE | INB 230752939 |

| NSDL | IN-DP-NSDL-19-97 |

| MCX | MCX/TCM/CORP/0886 |

| NCDEX | NCDEX/TCM/CORP/0010 |

| Registered Address | Coimbatore Capital Limited Stock Exchange Building, 1st Floor, 686, Trichy Road, Coimbatore-641005 |

In case you are looking to get started with stock market trading or investments in general, let us assist in taking your next steps forward:

Coimbatore Capital Branches

Coimbatore Capital is headquartered in Coimbatore, with over 90 branches in South India.

Some of the branches include Chennai, Cuddalore, Erode, Kangeyam, Karaikal, Madurai, Mannargudi, Mayiladuthurai, Neyveli, Ooty, Pattukottai, Pollachi, Puducherry, and Pudukottai.

The other branches are located in Rajapalayam, Thanjavur, Theni, Thiruvarur, Trichy, Tuticorin, Vellore, Bangalore, Kochi, Mettur, Salem, and many others.

More on Coimbatore Capital

If you want to learn more about this stockbroker, here are a few references for you: