DBFS Securities

List of Stock Brokers Reviews:

DBFS Securities or Doha Brokerage and Financial Services Limited is a Kochi based flagship company of the DBFS Group. This full-service stockbroker was incorporated in 1992 and is one of the leading financial services company in India.

Currently, it has a network of around 200 branches across different parts of India & the middle east.

The broking company is currently being headed by Dr R Seetharaman, who is the Chairman and Group CEO of the Doha Bank.

DBFS Securities Review

DBFS or Doha Brokerage and Financial Services Limited is a Kochi based flagship company of the DBFS Group. This full-service stockbroker was incorporated in 1992 and is one of the leading financial services company in India. DBFS Securities provides security information and trading calls on a real-time basis through trading terminals and other modes.

Diverging from the traditional forms of brokerage, DBFS Securities follows total wealth management and investment centred approach. DBFS Securities has trading licenses in BSE and NSE for cash and derivative segment and has memberships in premier commodity exchanges like MCX, NCDEX and NMCE.

DBFS Securities also has membership in DGCX Dubai for trading in international commodity and currency segments.

DBFS Securities Active Clients

DBFS Securities reported 11,263 active clients as of 2019-20. The clients of the company include retail, institutional and corporates, including high net-worth individuals and non-resident Indians.

With this number of the client base, DBFS Securities can be termed as one of the smaller stockbrokers in India.

Also Read: Top Stockbrokers with Active Clients

DBFS Securities Products & Services

As mentioned above, DBFS Securities provides brokerage and financial advisory services in equity segment at the NSE, BSE and MCX-SX, along with the derivative segment including stock futures, index futures, stock options and index options.

Besides equity and equity derivatives, the broker also offers to trade in the currency derivative and commodity futures.

DBFS Securities provides special services to the non-resident Indians. The NRIs are allowed to trade in all segments except the currency derivatives and commodities. The company also offers portfolio investment schemes to its clients.

DBFS Securities also provides portfolio management services, being a SEBI registered portfolio manager, along with the depository services. In addition, the company also deals with the distribution of mutual funds and other NBFC products.

In summary, DBFS Securities deals in the following investment products and services for its clients:

- Equity Trading

- Derivatives Trading

- Currency Trading

- Commodity Trading

- NRI Demat Account

- Portfolio management services

- Depository Services

- Mutual funds

DBFS Securities Research

DBFS Securities has a competent and professional research team, which is committed to building and managing the financial assets of the clients. The research includes

- Morning reports

- Equity Reports

- Commodity Reports

- Weekly Reports

- IPO reports

- Seasonal portfolios

- New Year Portfolio

- Diwali Portfolio

- Monthly portfolios

- Sectoral analysis

- Techno-fundamental reports

- Technical reports

- Call analysis reports and

- Fundamental reports.

These research and reports help the managers and clients at this stockbroker stay ahead of other brokerage firms.

DBFS Securities Trading Platforms

This full-service stockbroker offers trading platforms for different devices. Here are the details:

Trading Platform- Flip Ultimate

DBFS Securities provides the trading platform or software. The platform is technologically advanced and provides inbuilt features like charting, online demo and is suitable for trading in equity, derivative, currency and commodity, along with providing access to mutual funds, bonds and debt investing.

The platform shows the online portfolio, with ledger and details of the orders. The platform also sends alerts to the clients, and allows investment in insurance, SIP, PMS and Gold ETF, along with the other methods.

Web Trading- iNET

Web trading is also available through the web version of InvestNet software. The software is technologically advanced and has all the required features. It can be used to access the account from anywhere at any time and can be used to place, cancel and modify orders.

It has various technical indicators like charts and market watch to provide real-time updates.

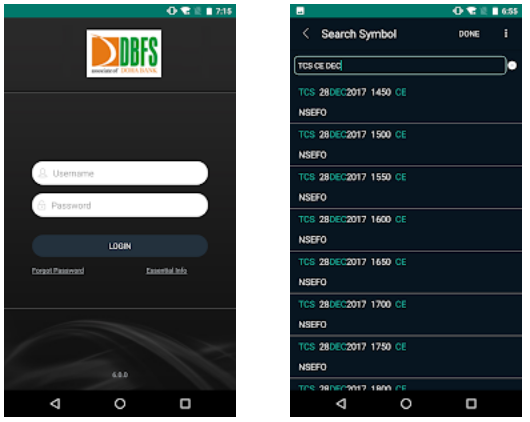

Mobile Application- DBFS iNET

iNET or InvestNet is a user-friendly investment and trading application provided by DBFS Securities. The mobile application allows the users to stay in touch with the market, to invest, to trade, from anywhere, at any time. The high technology also comes with strong security.

The application provides multiple market watches with real-time updates and dynamic real-time charts. The app is user-friendly and provides convenient access to the account. It can be used to place orders to all cash and derivative exchanges and the trader can access portfolio information, trade book and order status.

DBFS Securities Customer Care

This full-service stockbroker offers customer service to its clients, through the following communication channels:

- Emails

- Online live chats

- Phone support

- Toll-free number and

- Offline branches

As far as the quality of communication is concerned, the full-service stockbroker does an average level job. While the knowledge of the executives about the services offered is up to the mark, the turnaround time the executives take for resolving a query can be really long at times.

This can be frustrating for clients who are stuck in their trades. Having said that, this occurs intermittently and though and overall the customer support can be termed as around average.

DBFS Securities Pricing

Here are the pricing details related to DBFS Securities:

- There are two options for opening the account with the broker.

- The first option is to open an account by paying ₹500. This type of account carries an annual maintenance charge of ₹120 per year.

- The second option is to open an account with ₹2000, which does not carry any annual maintenance charges.

- Dematerialisation and rematerialisation charges are ₹25 per transaction.

- Pledge creation and invocation shares are ₹25 per transaction.

Here is a quick look:

DBFS Securities Brokerage

As far as the brokerage is concerned, you will be charged the following values across segments:

- DBFS Securities charges a brokerage of 0.03% for intraday trading and 0.3% for delivery trading.

- If you are looking to trade in options, you will be charged in the range of ₹60 to ₹140 per lot depending on your turnover value and negotiation skills.

Here is the summary of the brokerage charges levied:

For more information, check this DBDS Securities Brokerage Calculator for your reference.

DBFS Securities Margin

These are the exposure values you get if you choose the services of this full-service stockbroker:

- The company is soon to launch a Super-Multi scheme, under which the exposure provided will be about 20-25 times, depending on the credibility and the experience of the trader.

DBFS Securities Advantages

Here are the benefits of this stockbroker:

- It has the latest cutting-edge technology for front-end trading and back-office processing. This enables seamless transactions, and centralised monitoring and risk management.

- The manpower at DBFS Securities is its biggest asset. The team is trained and professional, and highly qualified to provide adequate research and advisory services to the clients.

- The pricing matches the market standards.

DBFS Securities Disadvantages

At the same time, here are some of the concerns you must be aware of:

- The distribution network is limited to the south of India and a couple of international locations. It is not accessible throughout the country.

DBFS Securities Membership Information

As far as the membership information is concerned, here are the details of its licenses with different regulatory bodies in the Indian stockbroking space:

In case you are looking to get started with stock market trading and investments in general, let us assist you in taking the next steps forward:

DBFS Securities Branches

The stockbroker has its main office at Kochi in Kerala, with many other branches in Kerala, including the ones at Thiruvananthapuram, Kottayam, Pala, Kozhikode, Palakkad, Kasargod, Thrissur, Vazhakkala, Kottarakara, Kanjirappally and Alappuzha.

The company also has branches in Tamil Nadu at Chennai, Salem, Coimbatore, Madurai, Karur, Theni, Tirunelveli, Trichy and Erode; in Karnataka at Bangalore, Tumkur, Mysore and Bijapur; in Andhra Pradesh at Hyderabad, Vijayawada and Nellore and in Maharashtra at Thane.

DBFS Securities also has overseas branches in Doha and Dubai.

You can read this review in Hindi as well.

Doing some fraud activities against client and sub brokers…. No response also… ?

DBFS provide NRO Non PIS account facility for NRI clients. The brokerage is only 0.3% where as others like Geojit and HDFC charge 0.75%.

Also No PIS reporting charge at Bank.