IDBI Direct

List of Stock Brokers Reviews:

IDBI Direct is a bank-based full-service stockbroker based out of Mumbai. It was established back in the year 1993 and joined the online trading cohort with IDBI Paisa builder in 2006. Since it is a full-service broker, it provides you with offline assistance through its 14 branches across the metro cities of India.

Like any other bank-based stockbroker, IDBI Direct provides you with a 3 in 1 Demat Account as well, which basically integrates your trading account with your bank account. This helps you to avoid any manual fund transfers on your own and the transfer process happens automatically.

IDBI Direct Review

IDBI Direct works at retail, corporate and institutional level trading and has an employee base of around 200. As per the latest records, this stockbroker has an active client base of 42,401, which is not so high but not so bad either. To give you a perspective, as per the same records, ICICI Direct has an active client base of 8,70,070.

If you choose to become a client of IDBI Direct, then you may avail trading and investment services in the following segments:

- Equity

- Derivatives Trading

- IPOs

- Mutual Funds

- NCDs

- Bonds

In this review, we will do an exhaustive analysis of its trading platforms and how they focus on technology in their operations, brokerage charges, customer service, exposure, research, pros and cons of this broker etc.

Hopefully, by the end of this IDBI Direct review, you should be able to make a call about whether to go ahead with this broker or not.

Nagaraj Garla, MD & CEO – IDBI Direct

Demat Account in IDBI

IDBI Direct offers a 2-in-1 account opening facility to its clients that further gives its customers access to trade in the equity segment. Along with this, being a bank-based stockbroker gives an assurance of safety and security.

The best benefit is the broker provides the account for FREE and further comes with the advantage of minimal annual maintenance charges of ₹350 from the second year onwards.

What is more interesting is its seamless account opening process.

You just need to fill in the basic details and the executive will reach out to complete the entire process via insta KYC.

Other than this with the Demat account in IDBI you can access its three different trading platforms the detail of which is given below.

IDBI Direct Trading Platforms

One of the good parts of this full-service stockbroker is that they have an in-house technology team that focuses on developing and maintaining its trading platforms. The reason this part is good is that a lot of stockbrokers generally outsource this key aspect which leaves the trading clients in a state of confusion.

Let’s talk about the different trading applications you will get access to, in case you choose to go ahead with IDBI Direct.

IDBI Power Pro

Different kinds of traders and investors have different kinds of preferences from trading platforms. IDBI Power Pro is designed specifically for heavy volume intraday traders who prefer high speed/performance, a varied number of charting and stock analysis features and quick market updates.

IDBI Power Pro comes with the following features to be specific:

- Personalization of market watchlists that allow you to monitor specific scrips across industries. This way you save time while checking the same stock every time you login into the application.

- Visual and audio-based alerts can be set with specific conditions placed on stocks.

- Multiple types of charts allow you to analyze stocks in the kind of display you prefer.

- Order tracking available on a real-time basis.

- Research reports, tips and recommendations across stocks at fundamental and technical levels are provided within the trading platform.

This is how the application looks like:

IDBI Power Pro is a terminal based trading platform which you will need to download and install on your computer, laptop or desktop. Once installed, you will need to login to the application with valid credentials and start trading.

You will need the following configuration on the device you use for trading in order to use this terminal software:

- Minimum internet speed of 56 kbps, however, higher the bandwidth, better will be your trading experience.

- Windows 98/2000, XP, 7 or higher

- Pentium 4 Processor or higher

- 512 MB RAM or above

Again, this trading softwares is best recommended for high volume traders.

IDBI Power Streaming

IDBI Power Streaming is a web-based trading application which can be directly accessed through a web-browser. There is no need to download or install anything in order to use this application. Some of the features this browser-based trading application includes:

- You may use up to 7 market watchlists in this web trading application with 50 scrips in each watchlist to track.

- Single click order placement feature.

- Real-time charting with colour-coded price movements giving you a quick glimpse of the market/sector/stock momentum.

- Hotkey function present for quick analysis, order placement, feature browsing so that you get to waste minimal time while the stock price changes.

- Market depth window shows you 5 top bids available at any given point in time.

This is how the application looks like:

This web-application is suitable for frequent investors since the number of features is not that exhaustive as in IDBI Power Pro.

IDBI Power Classic

IDBI power classic is by far, one of the basic trading applications out of the ones provided by this full-service stockbroker. This application comes with the following features:

- Live rates from NSE and BSE Stock exchanges

- Provision to add, update or cancel orders from the trading platform

- Since it is a web-based trading platform, it can be accessed from anywhere without any dependency on the device you use for trading.

- Different reports, ledgers, contract notes, account notes etc available within the trading application.

This platform is suitable for beginner level traders and investors. An intermediate or a heavy level trader will find the number of features relatively limited.

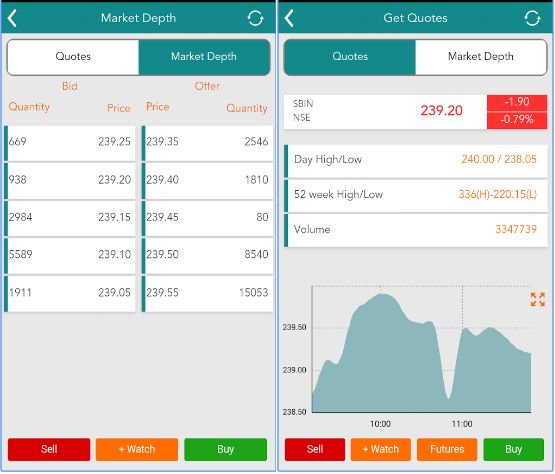

IDBI Direct Mobile App

Although most of the trading platforms discussed above fit one kind of a trader or investor, this IDBI Direct Mobile app seems to be pretty mediocre in its performance – lost in its positioning.

The mobile app provides you with the following features:

- Multiple market watchlists

- Real-time market streaming of quotes from different exchanges

- Different types of charts for market analysis at fundamental and technical levels.

This is how the IDBI Direct mobile app looks like:

Some of the concerns raised by the users of this mobile app include:

- Issues with the market watchlists seen on a persistent basis.

- Inconsistency in the data displayed reported multiple times

- Low update frequency cycle.

- Session expiry without any notification seen

Here are some of the stats related to this mobile app from Google Play Store:

Thus, as of now, looking at the performance and the focus of the stockbroker towards this mobile app, we will recommend you NOT to use this trading application for your trades.

IDBI Direct Research

IDBI Direct, as a full-service stockbroker, provides tips, research and recommendations to its clients across multiple communication channels. You can talk with the executive on your preferred mode of communication including Email, SMS or Whatsapp.

Here are the different kinds of research and analysis products that are provided to the clients of IDBI Direct:

Morning Reports

This is a daily level report that provides stock picks for the day with target and stop-loss prices along with the analysis done by the research team of IDBI Capital. Users looking to perform intra-day level trading can check these reports on a daily basis.

You can expect 3-4 tips on a daily basis in these reports along with the overall expectation from the market momentum. However, at the onset, it is suggested that you perform your own analysis on top of the tips provided in these reports to gain some trust.

This is how the report looks like:

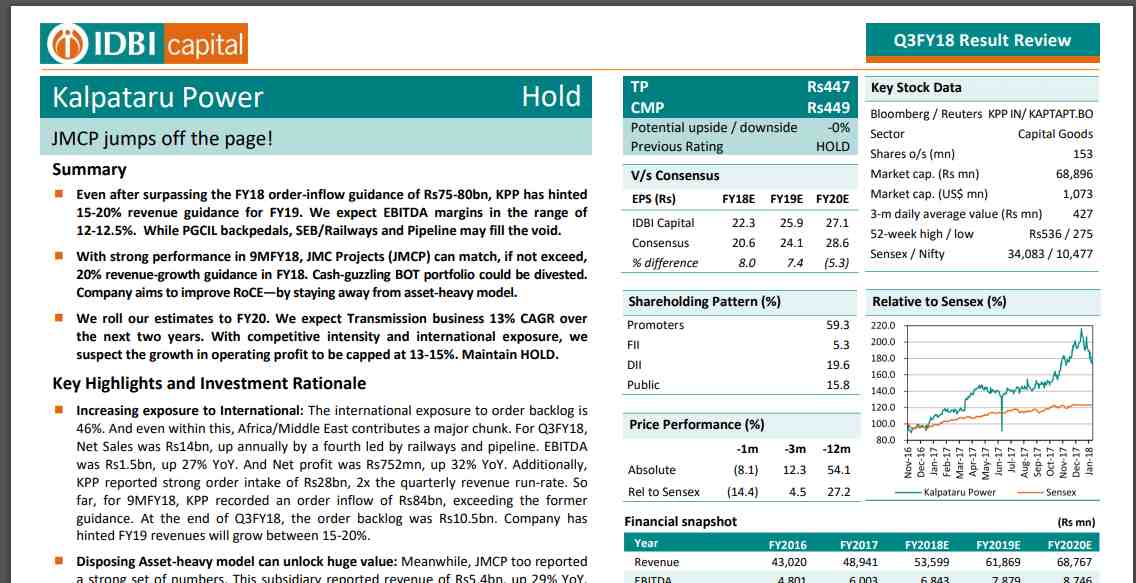

Investment Guide

This type of report is also published on a daily basis with an exhaustive analysis done at the stock level. Some of the areas covered in Investment guide reports include:

- Recommendation

- Stock summary

- Highlights and reason of investment

- Financial Summary includes balance summary, Financial ratios, P&L statement etc.

Again, on a daily basis, 4-5 reports are published on this tune with similar level analysis.

This is how the investment guide report looks like:

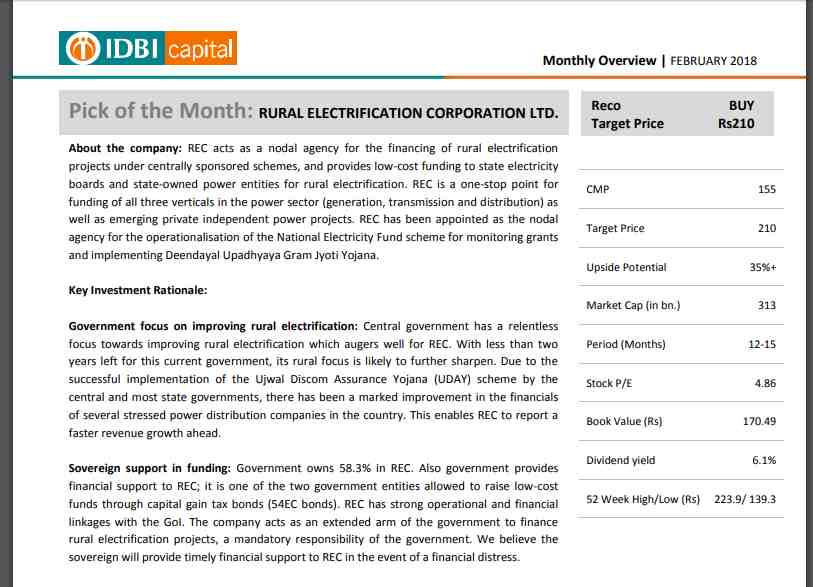

Equities Fact Sheet

This is a fundamental research-based report that is published once every month with a focus on a specific stock. These reports go at length and talk about broker recommendation, target price, investment period, return potential along with some specific financial metrics related to the company’s performance.

The analysis on the stock picked covers areas such as:

- Macro as well as microeconomic events that impact the stock directly or indirectly

- Company background

- Technical overview of the stock

This kind of research report is published on a monthly basis and thus, if you are looking for a relatively long-term investment, then these are the reports you can check out.

Equities fact sheet reports look like this:

Yes, IDBI direct publishes these research reports and recommendations to its clients and in isolation, this certainly impresses at the onset. However, if you compare it with some of the other full-service stockbrokers with an exhaustive research focus, then you might find IDBI direct to be doing an okayish job.

Nonetheless, if you opt for this stockbroker then for fundamental research or long-term investments, you can keep an eye on these recommendations. For short-term quick profits, it’s better to look for some other options or do it yourself.

IDBI Direct Customer Care

Generally, clients have high expectations from bank-based stockbrokers as far as customer service and support is concerned. Now, when it comes to IDBI Direct, it provides the following communication channels:

- Toll-free number

- Landline phone

- 14 Branches

The number of communication channels is certainly limited. Plus, a lot of companies use Google play store as one of the foremost communication channels since the feedback there is direct and specific. However, none of the comments provided to the mobile app of IDBI direct has received any response whatsoever.

This is completely disappointing, especially, when we are talking about a prominent bank-based broker. Further, coming back to the earlier point of the number of communication channels, the broker can certainly work on setting up channels such as Chat-bots, social media in this high technology day and age.

IDBI Direct Charges

As you might already know that bank-based stockbrokers fall in the most expensive bracket when it comes to stock market trading. Be it brokerage, transaction charges, account related payments, such kind of brokers are going to be the heaviest on your pocket.

The big reason bank-based stockbrokers such as IDBI Direct end up charging such high rates, is the “trust” factor they bring along apart from their other propositions. Such these brokers have a bank as their parent company, users “assume” that such brokers will never fail while they see the rest of the mainstream stockbrokers with little doubt.

Nonetheless, let’s talk about the different charges levied by IDBI Direct:

IDBI Direct Account Opening Charges

These are the account opening and maintenance charges related to your demat and trading accounts with IDBI direct:

If you choose to receive statements through email, then your Demat Account AMC goes down to ₹400 while senior citizens pay an AMC of ₹350.

IDBI Direct Brokerage Charges

Brokerage is one of the most crucial expenses that you must be keeping your eye on. It’s better if you are able to negotiate on brokerage as much possible as you can while you open your account through an executive.

The stockbroker here provides multiple plans that are based on your initial margin or deposit you put in into your trading account. Here are the details:

Flat Classic Plan

Flexi-Gold Brokerage Plan

This is a subscription-based plan where you are required to pay a specific prepaid amount for a duration of 6 to 12 months. Based on the trading you perform, corresponding brokerage charges are deducted and at the end of the plan duration, you are refunded the unused amount.

Here are the different options available with the prepaid amount and corresponding subscription durations:

Thus, as you can see above, as long as you are increasing the prepaid amount, you can see a corresponding drop in the brokerage charges you will be paying across all trading segments.

Ace Trader Brokerage Plan

Then there are Ace Trader Plans where brokerage varies based on the trading turnover done on a monthly basis. Higher the turnover, lower will be the brokerage applied across your trades.

These values vary based on the trading segments. Here are the values for Equity Delivery trading:

Then, here are the values for Equity Intraday trading:

And finally, are the values for Futures Segment trading:

For more information, you can check this detailed IDBI Direct Brokerage Calculator to figure out all sorts of charges and taxes. It will also tell you the final profit/loss you will be making in the trade.

IDBI Direct Transaction Charges

Here are the details on the transaction charges levied by IDBI Direct:

IDBI Direct Margin

Exposure is something that can certainly amplify your profits but at the same time, is risky enough to eat up from trading balance as well.

In the case of IDBI direct, these are the exposure or leverage values you get from the broker:

IDBI Direct Disadvantages

Here are some of the concerns of opening your Demat account with IDBI Direct that you must be aware of:

- Mediocre mobile trading application with a lot of room of improvement in terms of features, performance etc.

- The average performance of technical analysis and the corresponding tips provided.

- A limited number of communication channels are provided for customer service.

- Expensive brokerage at low initial investment and turnover.

- Commodity Trading not allowed.

IDBI Direct Advantages

At the same time, here are some of the top benefits if you use IDBI Direct for your trading in the stock market:

- Being a bank-based stockbroker, IDBI Direct provides a trust factor at the onset.

- You get access to a 3 in 1 Demat account that integrates with your bank account directly.

- Multiple trading platforms for different types of traders.

- Strong fundamental research in terms of details and accuracy.

- Multiple brokerage plans provided depending on your initial deposit and turnover on the stock market.

- NRI Investment services provided.

IDBI Direct Membership Information

Finally, here are the official membership details of IDBI Direct with different exchanges and stock market regulatory bodies:

Are you looking to Open a Demat Account?

Enter Your details here to get a callback.

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

IDBI Direct Branches

This bank-based stockbroker, although has a limited presence, but still it has offices in the following locations:

More on IDBI Direct

If you wish to know more about this full-service stockbroker, here are a few reference links for you:

Such a wonderful information admin boss. It’s really gonna help us , thanks for sharing informative post here thanks alot… Great Job

See You

Tc ?