IndiaNivesh Securities

List of Stock Brokers Reviews:

IndiaNivesh Securities is a financial services company which caters to the growing needs of the investors and businesses. The company, based out of Mumbai, has a thorough understanding of the financial markets, which it uses for the benefit of its clients.

IndiaNivesh Review

This stockbroker was incorporated in 2006 as a full-service stockbroker and is a member of NSE, BSE, MCX-SX, MCX and NCDEX. The demat services are provided through CDSL.

The specialised services of IndiaNivesh Securities include broking and distribution of financial products, along with the sales and trading of institutional equities. The broking is available for equity, derivatives, currencies and commodities and is customised for the clients based on their requirements.

The sales of institutional equities are managed by experienced professionals and the trading facilitates the clients to carry out trades with efficiency, speed and confidentiality.

The company also gives portfolio management services, private equity operations and strategic investments. It also specialises in investment banking and corporate advisory, along with wealth management.

IndiaNivesh Active Clients

As of 2019, IndiaNivesh Securities had 14,708 active clients.

IndiaNivesh Securities understands the financial and investment needs of its clients, which include retail, corporate and individuals including non-resident Indians.

IndiaNivesh Products & Services

IndiaNivesh Securities caters to the equity, derivatives, currency and commodity segments. The services include stockbroking in the mentioned segments and distribution of financial products like mutual funds and insurance.

The brokerage services are tailor-made to the clients’ requirements.

The company also provides research services to its clients in terms of macro research, sector and strategy research and company research. The research services also include derivative or quantitative analysis.

Along with the research on institutional equities, IndiaNivesh Securities also undertakes sales and trading in the equity segment. The trades are carried out on behalf of the clients, in a seamless, efficient, objective and confidential manner, with speed and client-focus.

The other services encompass portfolio management services for capital preservation and long-term wealth creation, with the help of effective portfolio management strategies. IndiaNivesh Securities also performs private equity operations through funds and strategic investments which are not conflicting with its interests.

Check Indianivesh PMS for more information.

The investment banking and corporate advisory services include capital raise, globalisation of Indian companies and assistance in mergers and acquisitions.

The stockbroker offers a unique product called Wealth Cafe for wealth management. Wealth Cafe is, essentially, a library of research ideas and reports and includes a daily performance report, morning updates, mutual fund trends, macro capsules and wealth reports.

IndiaNivesh Trading Platforms

The full-service stockbroker provides trading assistance through applications across web, mobile and terminal software. Below we figure out the quality of these trading applications along with the benefits and concerns those bring along.

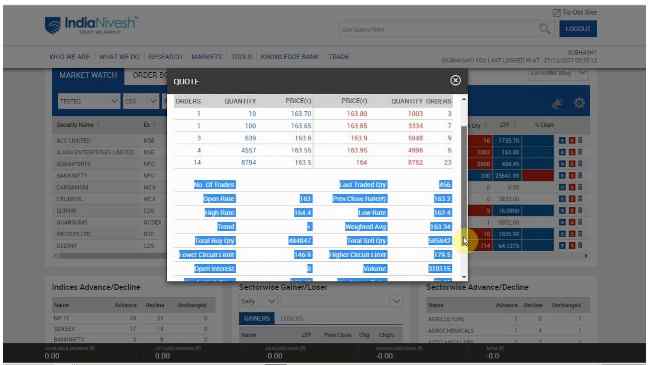

IndiaNivesh Web Platform

The web platform of IndiaNivesh Securities is very comprehensive and technologically advanced. It provides a portfolio tracker to manage the portfolio, along with the trading features.

The equity, derivatives and commodity markets can be accessed, along with research and advisory from the company’s experienced professionals. The platform also helps in financial goal planning.

Along with the usual features like charting, the trading platform also has portfolio clinic, risk profiler and SIP calculator.

M-Nivesh- Mobile Application

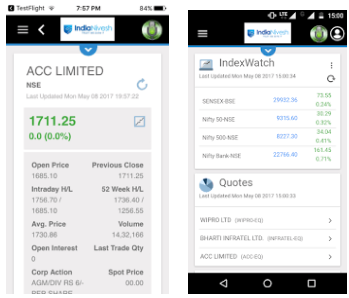

IndiaNivesh Securities also provides access to mobile application M-Nivesh.

The application has multiple features like the market watch, ability to place orders, cancel or modify orders, view and manage the portfolio and real-time data and alerts. However, the application is not technologically advanced. The customers do not find it user-friendly and it is quite slow.

It needs a lot of improvement in terms of interface and performance.

Apart from that, there are a few concerns raised by the clients of IndiaNivesh around the usage of this mobile trading app, such as:

- The app gets stuck or hangs at times.

- Unnecessary security checks done at multiple instances

- Poor app design and user experience

- Low Update frequency cycle

Here are some of the stats for this mobile app from the Google Play Store:

| Number of Installs | Around 5,000 |

| Mobile App Size | 13 MB |

| Negative Ratings Percentage | 39% |

| Overall Review | 3.2 |

| Update Frequency | 18 Months |

Apart from this, IndiaNivesh provides access to third-party terminal softwares (NEST) as well. A word of caution – make sure you get the total understanding of the pricing involved in using these softwares, otherwise, the charges may be levied to you as hidden charges later.

IndiaNivesh Research

The full-service stockbroker provides research, recommendations and tips to its clients at multiple levels. Here are different types of research products that are availed by the broker:

- Institutional Research

- Holding Disclosure

- Technical Disclosure

- Fundamental Research (long-term investments)

- Initial Coverage

- Quarterly and Annual Updates

- IPO Notes

- Daily Market Commentary

- Thematic Reports

- Sector Reports

- Technical Research (short-term trades)

- Tech-30 (monthly recommendations)

- Swing Call (12- day horizon)

- Momentum Calls (5- day horizon)

- BTST Tips (2-day horizon)

- Nivesh Overview (daily report)

Thus, from the research range point of view, IndiaNivesh provides a wide variety of reports and recommendations. Furthermore, even from the quality perspective, the recommendations are pretty good and are certainly on par or better than the industry standards.

Nonetheless, it is advised that users perform basic verification of the tips at their end before investing their money into the specifically recommended stocks and investment segments.

IndiaNivesh Customer Care

IndiaNivesh Securities provides reasonable customer care services. The company uses a personalised approach with its customers and gives them a decent experience while fulfilling their goals.

As far as the communication channels are concerned, the broker offers the following to its users:

- Phone

- Social Media

- Offline branches

As you can see, the broker offers limited communication channels and can actually explore areas such as a Toll-free number, web assistance, chatting etc. Nonetheless, the quality of the support stays better than the industry average with a room of improvement in the communication methods.

IndiaNivesh Charges

When it comes to pricing, a full-service stockbroker such as IndiaNivesh may charge relatively higher as compared to the discount stockbrokers. You must be aware of all sorts of charges otherwise you may end up paying way more than expected.

In the case of this stockbroker, here are the different charges related to your Demat/trading account:

- The account opening charges for the trading account are nil and Rs 500 for a Demat account.

- The annual maintenance charges (or AMC) are Rs 300 per year.

- The DP transaction charges are Rs 15 or 0.03%, whichever is higher.

IndiaNivesh Brokerage

- IndiaNivesh charges 0.015% brokerage for intraday and 0.15% for delivery trading in the equity segment.

- Brokerage charges for equity futures are 0.015%.

- Charges for equity options are Rs 25 per lot, for currency futures and options are Rs 15 per lot.

Check this IndiaNivesh Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

IndiaNivesh Margin

The thing about exposure or limit is that it is a double-edged sword. If you understand how it works, then you would know that it certainly amplifies your profits but at the same time, at the time of loss – you end up losing a lot too.

Thus, make sure you use it according to your risk appetite and not just go with the flow.

In the case of this full-service stockbroker, these are the exposure values you are provided with:

- IndiaNivesh provides exposure of 5 times for intraday and 3 times for delivery trading in equity segment.

- The exposure is up to 3 times for intraday for equity futures and currency futures.

- There is no leverage provided for equity options and futures options.

IndiaNivesh Advantages

Here are the benefits of using the services of IndiaNivesh as your stockbroker:

- The brokerage charges are very less and quite competitive in the industry.

- The leverage provided is also very high.

- Free Research is provided.

- Offline assistance through sub-broker and franchise offices available.

- A wide range of investment segments.

IndiaNivesh Securities Disadvantages

At the same time, you must be aware of the other side of the coin i.e. the concerns related to IndiaNivesh as a stockbroker:

- The trading platform does not provide instant fund withdrawal facility.

- The tools do not include a margin calculator and brokerage calculator.

- The strategies and coding cannot be backtested.

- Limited exposure is provided on your trades.

IndiaNivesh Securities Membership Information

Here is the membership information related to the different regulatory bodies IndiaNivesh is associated with, as part of the stockbroking space in India:

| Entity | Membership ID |

| BSE | INB011256638 |

| NSE | INB231256638 |

| SEBI | INZ000010132 |

| CIN | U74999MH2013PTC240603 |

| CDSL | IN-DP-CDSL-392-2007 |

| NSDL | IN-DP-NSDL-297-2008 |

| PMS | INP000003815 |

| MCX - SX | INE261256638 |

| Investment Advisor | INA000004625 |

| Registered Address | IndiaNivesh Securities Limited 601/602, SukhSagar, N.S. Patkar Marg Girgaum Chowpatty Mumbai-400007 Maharashtra, India |

In case you are looking to get started with stock market investments or open a trading account – let us assist you in the process.

IndiaNivesh Securities Branches

IndiaNivesh Securities has one branch in Gujarat in Ahmedabad, one branch in Karnataka in Bangalore, one in Madhya Pradesh in Indore, eight branches in Maharashtra in Dhule, Dombivali, Kolhapur, Mumbai, Nagpur, Nashik and Pune and one branch in New Delhi.

IndiaNivesh Securities also has two branches in Punjab in Chandigarh and Ludhiana, six branches in Rajasthan in Bhilwara, Bhilwara Old, Jaipur, Kota and Udaipur, four branches in Tamil Nadu in Chennai, Coimbatore, Madurai and Tambaram and two branches in West Bengal in Kolkata and Kharagpur.

If you wish to learn more about this stockbroking firm, here are a few references for you: