JM Financial

List of Stock Brokers Reviews:

JM Financial is one of the leading full-service stockbrokers in India. It was incorporated on 30th January 1986, as JM Share & Stock Brokers (JMSSB).

Having spent more than three decades in the stockbroking business in India, JM Financial has now expanded their scope to include a wide range of financial services and cater to numerous corporations, financial institutions, high net-worth individuals and retail investors across India.

JM Financial Review

The company provides financial services related to investment banking, institutional equity sales, trading, research and broking, private and corporate wealth management, equity, portfolio management services, asset management, Non-Banking Finance Company activities, private equity and asset reconstruction.

This article though focuses on the broking arm of JM Financial’s business. Under their equity brokerage group, the company provides equity trading and research services i.e. equity advisory is provided to significant clientele based on the insights of their research.

Some of the clients include retail bigwigs, HNIs, institutions like corporate treasuries and banks. Their objective is to create wealth for their customers using innovative stock ideas and trading strategies.

JM Financial provides a variety of products in their equity brokerage group including equity broking and advisory, derivatives, systematic investment plan (SIP), portfolio management services (PMS), commodities and currency futures among others.

For more information, check this detailed review on JM Financial PMS.

Let us explore the various trading platforms, research services, brokerage details and pros & cons of JM Financial Services through this review.

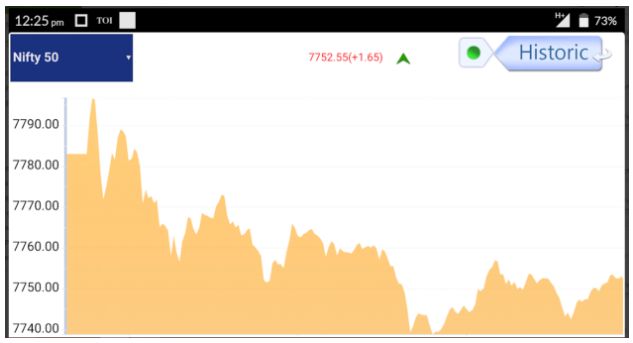

JM Financial Trading Platforms

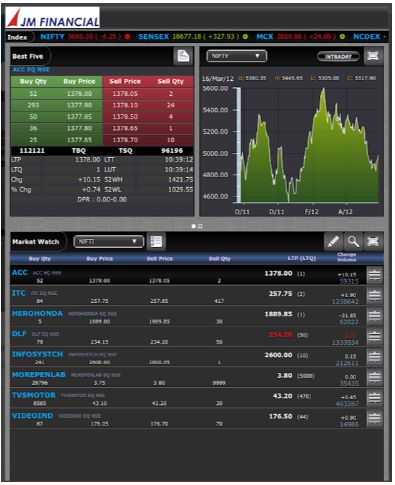

JM Financial Services has developed their own trading front-end “SMART” for enabling “anywhere – anytime” access to financial services for its investors. This software allows JM customers to avail online trading facilities using their laptop, mobile or tablet from anywhere in the world.

Some of the variants and their features have been discussed below:

JM Financial Smart App

This is a desktop-based installable application for investors to access real-time market information and to monitor the performance of their shares.

It is a state of the art online trading portal which runs on an advanced technology making higher accessibility and availability possible. Salient features of the SMART App are:

- The app allows you to view real-time market updates in a user-friendly and easy to understand format

- Investors may create multiple investor profiles to manage multiple portfolios

- Users may access updates from different exchanges that they may be trading in and may send requests to buy or sell to multiple exchanges through the App

- Customizable list of stocks that a user may like to keep an eye on

- Access research reports and analysis by JM Financial research team through the App

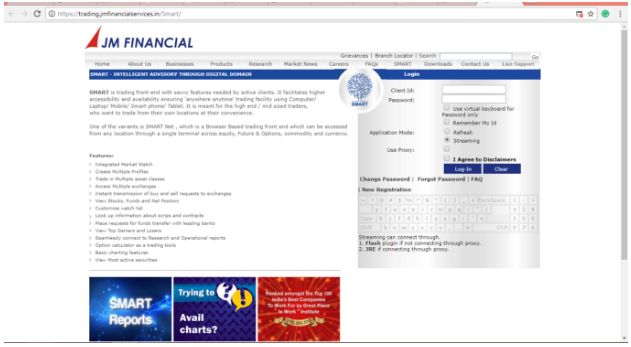

JM Financial Smart Net

SMART Net is a web portal which serves as an online trading front end for the JM clients. One of the best reasons for some to trade through the SMART Net is the ease of access irrespective of location or device. Also, one may trade-in equity, future & options commodity and currency through a single terminal using the SMART Net.

Let’s take a look at the features of the SMART Net:

- SMART Net provides integrated market updates allowing investors to be well-informed about the market events before they make a buy or sell decision

- This web portal is designed to enable trade in multiple asset classes and not just for share trading

- Users may view stocks, funds and net position. They may also lookup other information related to scrips and contracts

- Allows investors to manage multiple investment portfolios by creating multiple profiles

- Access updates of gainers, losers and favourited stocks in real-time

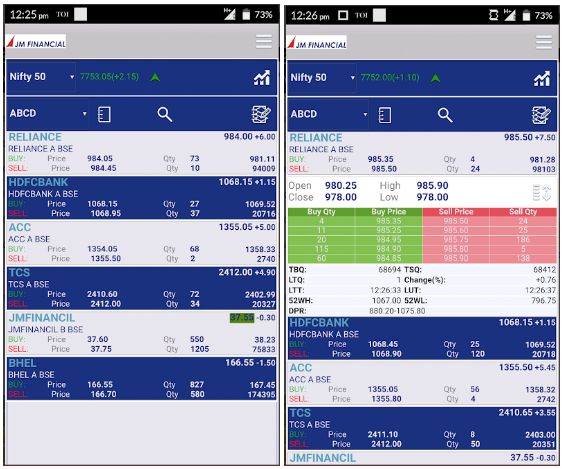

Blinktrade

BlinkTrade is a mobile trading application available in the Android, iOS and Windows Stores to help investors access their investment information on the go. It has been designed to provide almost one hundred per cent functionalities as provided by the desktop app or the web portal.

In keeping with the handiness it so promises, the SMART Mobile App, among other things:

- Provides instant alerts of news and analysis from the markets

- Allows investors to place requests for fund transfers using the application

- Allows investors to place buying and selling orders

- Investors may access data from multiple exchanges

- Options calculator available for aid in trading decisions and strategy

Rated as average (3.9 out of 5) on the Google Play Store by 76 different users, it is mostly perceived as a light and quick application, barring the recent complaints of the app crashing.

Here are the stats of this mobile app from the Google Play Store:

| Number of Installs | 10,000+ |

| Mobile App Size | 19 MB |

| Negative Ratings Percentage | 23% |

| Overall Review |  |

| Update Frequency | 4-5 Weeks |

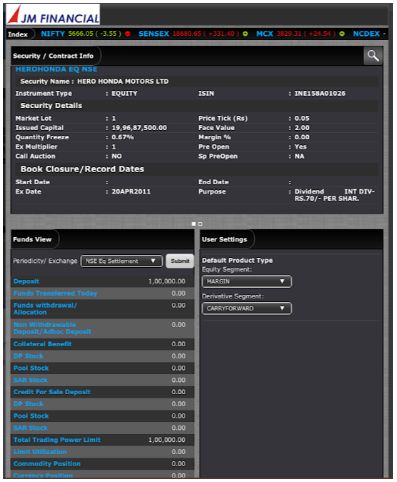

JM Financial Smart Tab

The SMART Tab Application is mostly similar to the Mobile Application albeit with even lesser features. It allows users to view the interface in a tab-friendly display, however, the functionalities are significantly reduced.

It is supposed to provide a comprehensive trading and market monitoring platform for all tab users (iPad and Android) however, the tab app being relatively new – looks like the developers still have some tweaking to do. Features are more or less similar to the mobile app:

- Real-time monitoring of information and data from the market

- Access information from multiple exchanges

- A dedicated section for the top gainers and losers in the market

- Seamless connectivity to request detailed reports and analysis from the research team

- Users may view the most active securities in a special section

Rated only 3.9 out of 5 on Google Play Store by a meagre 7 users – makes this review unreliable. However, it remains to be seen if JM Financials plans to continue with an app dedicated to tablets or will they integrate it with the mobile app soon.

JM Financial Research

It always helps if the stockbroker of your choice has a dedicated research team who may provide you with the information you need to make your trading decisions.

One of the USPs of JM Financial is their team of professional researchers and analysts who regularly supply the investors with important information which may help with trading. Apart from daily updates and analysis, they also come up with detailed monthly, quarterly and annual reports for the benefit of their investors.

The highlights of JM Financial Research division are:

- The dedicated research team for conducting independent, in-depth research and analysis for all major market events

- Detailed periodical reports on firms, sectors and the Indian economy, on the whole, corporates and other aspects of market intelligence

- Co-ordination between the sales and research team which helps to identify better investment opportunities

- Quality research with a focus on developing innovative stock ideas

- The client servicing section of the research team is focused on keeping customers well-informed about the stock market predictions and trends

JM Financial Customer Service

JM Financial provides a diverse range of products and services – from hedging risks to providing personalized services and effective risk management systems to high-end customers engaged in equity trading as well as strategic advice on client investment ideas tailored as per their budget, risk appetite and investment horizon- the company does it all with panache and efficacy.

In this regard, the top of the crop in equity products and services have been listed below:

- Equity Derivatives

- Equity Trading

- Equity Advisory

Some of the related equity customer services provided by JM Financial include:

- Odin Diet

- Buy Now & Sell Tomorrow (BNST)

- Arbitrage

JM Financial Brokerage

Here is a quick look at different kinds of charges levied by this full-service stockbroker once you begin trading after opening a JM Financial demat account. You must know all these rates so that there is no confusion later.

Here are the details:

| JM Financial Demat Account Opening Charges | ||

| Name of the charges | Explanation | Amount (INR) |

| Demat account opening fee | Charged by brokers on account opening. Usually different as per the different scheme | NIL |

| Demat account AMC | Annual account maintenance fee | 1500 p. a. |

| Advance Deposit | Applicable to schemes with lifetime free AMC | N.A. |

| OTHER DEMAT CHARGES | ||

| Dematerialization Charges | Charge to convert physical certificates to electronic form | Rs 35 per Request plus Rs 3 per certificate subject to a minimum of Rs 50 per request |

| Rematerialization Charges | Charge to convert electronic shares to physical certificates | Rs 20 per 100 shares or part thereof subject to a minimum of Rs 50 per request |

| Transaction Charges (Credit or Buy) | Demat transaction charges to buy shares | NIL |

| Transaction Charges (Debit or Sell) | Demat transaction charges to sell shares | 0.06% of the market value of Transaction subject to a minimum of Rs 50 per Transaction |

| Pledge Creation Charges | Charges paid to depository participant when he creates a pledge on the securities lying in the demat account in favour of the lender | 0.02% of the market value of transaction subject to minimum Rs 50 per transaction |

| Pledge Creation Confirmation Charges | 0.02% of the market value of transaction subject to minimum Rs 50 per transaction | |

| Pledge Invocation Charges | Charges paid to invoke the pledge | 0.02% of the market value of transaction subject to minimum Rs 50 per transaction |

Check this JM Financial Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

JM Financial Advantages

Here are some of the benefits you can get, in case you go ahead with the services of this full-service stockbroker:

- With more than three decades in the stockbroking business, JM Financial has rich experience and understanding of the way the share market works in comparison to the other players in the market.

- A strong research team which provides periodic reports analyzing trends, market events and IPOs across multiple exchanges helps to keep the investors well informed.

- Sixty-three outlets across the country allow for easy access to those who don’t prefer to trade online.

- Services like ODIN and BNST help new investors in learning more about the stock market and making informed decisions about their investments.

- SMART – JM Financial’s online trading software has helped bring the whole functionality of comprehensive trading software to your mobile phone or tablet PC.

JM Financial Disadvantages

At the same time, here are some of the concerns you must be aware of if you are trading through JM Financial:

- For a company that has spent so long in the broking business, there are quite a lot of complaints registered in the different stock exchanges against JM Financial by their clients and brokers who are yet to have their grievances resolved.

- SMART Mobile and Tab apps have not been received with as much enthusiasm as expected. The ratings for both the apps are less than 4 out of 5 on Google Play Store and the number of downloads is also low hinting bad user experience and low popularity.

- Even though JM Financial provides a plethora of services for the small and medium level investors, most of their business is focused on large investors with substantial portfolios that ultimately shrinks the eventual reach of the company.

JM Financial Recommendation

As one of the oldest and leading names in the stockbroking business, JM Financial is no doubt a reasonable option for new investors. As discussed above, they have several distinctive services and useful products which provide the kind of low-risk or risk-free environment often preferred by new investors.

The convenience of trading from your home or office using the ODIN or the simpler SMART software applications is also a feature which is helpful in hand-holding for first-time players in the share market.

The overall verdict is relatively positive – if you are looking to trade and want to give this company a chance!

Furthermore, in case you are looking to start trading in the share market and want to open a Demat Account – just fill in some basic details here.

We will arrange a callback for you:

JM Financial Membership Information

Corporate Identity Number: U67120MH1998PLC115415

National Stock Exchange

- Capital Market INB231054835

- Clearing Member Code 10548

- Derivatives Segment (TM Code) INF231054835

- Derivatives Segment (CM Code) INF231054835

- CMBP ID IN562531

- Currency Derivatives Segment INE231054835

Bombay Stock Exchange

- Cash Market INB011054831

- Clearing Member Code 325

- Derivatives Segment INF011054831

- CMBP ID IN653884

Metropolitan Stock Exchange of India

- Capital Market Segment INB261054838

- F&O Segment INF261054838

- Currency Derivatives Segment INE261054835

NSDL– IN-DP-NSDL-241-2004

CDSL– IN-DP-CDSL-236-2004.

PMS-(SEBI) INP000000621.

AMFI– ARN0002.

Research Analyst – INH000001196.

More on JM Financial

If you wish to learn more about this full-service stockbroker, here are a few references for you:

| JM Financial Review |

JM Financial Brokerage Calculator  |

| JM Financial Sub Broker |

| JM Financial PMS |

JM Financial Comparisons  |