Parasram Holdings

List of Stock Brokers Reviews:

Shri Parasram Holdings Pvt. Ltd. is a part of Parasram Group. The group is a known player in the financial markets and it is highly customer-oriented. The full-service stockbroker has a presence across 160 cities and towns of the country with around 350 partners in the form of sub-brokers and franchise.

Also Read: Shri Parasram Franchise

Although it has been around for a while in the stockbroking space, it has done limited marketing and branding exercises in order to improve its visibility among the potential client base.

Nonetheless, we will have an exhaustive look at the value propositions the broker claims to offer in this detailed review. Hopefully, it will assist you in taking a decision on whether to choose Shri Parasram Holdings as your stock market broker or not.

Parasram Holdings Review

Shri Parasram holdings has memberships with the leading stock exchanges, like National Stock Exchange (NSE) – Capital Market segment, National Stock Exchange Futures & Options segment, Bombay Stock Exchange (BSE) and Commodity Exchanges including NCDEX and MCX.

Shri Parasram holdings is also a Depository Participant with NSDL. Commodity trading is facilitated through the associate company, Shri Parasram Commodities Pvt. Ltd.

The characteristic features that set Shri Parasram holdings apart are its client-first policy, customised investment strategies, strong infrastructure, supportive back-office team, fast payment services, merging trading facility, loan provisions against security and a dedicated and trained team of brokers.

Parasram Holdings Active Clients

Shri Parasram has about 34,628 active clients as of 2019. The clients include high net-worth investors, NRIs, corporates and retail clients.

Currently, with its client base, the broker claims to churn a daily trading turnover of around ₹1000 Crores.

The clients are spread throughout the country and are catered to by the branch offices and business offices of Shri Parasram, that are present all through the country.

Parasram Holdings Products & Services

Shri Parasram deals in varied market segments, including equity, equity futures & options and currency, currency futures & options.

The products and services include trading in equity cash, trading in derivatives of stock, trading in derivatives of currency, trading in debt, providing research services, Mutual Funds, Depository services, Insurance broking (both general & life), Margin funding, tours and travel and distribution of initial public offering (IPO).

The portfolio tracker is a free service provided to all the investors. It has the capability to create unlimited portfolios with unlimited stocks. The portfolio tracker also has customised market watch and watch lists can be created to keep an eye on the stocks.

The Depository Services provided by Shri Parasram offer a safe, convenient and cost-effective way to keep track of investments. It helps in dematerialisation, rematerialisation, pledging of shares, transfer and lending and borrowing of shares.

Shri Parasram also offers other financial products like Mutual funds, Fixed Deposits, Bonds and IPOs. It also provides insurance services.

Parasram Holdings Trading Platforms

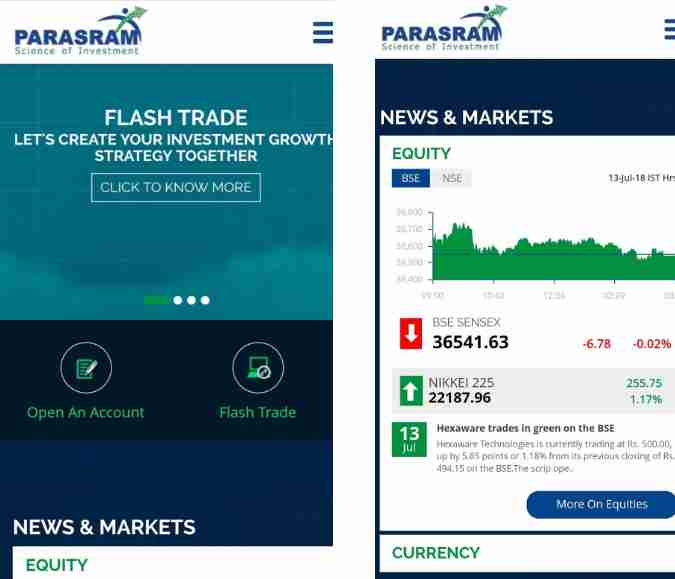

Shri Parasram provides a web trading platform by the name of Flash Trade.

The platform contains various tools and research facilities. The clients who do not have the time or expertise to handle their investments on their own, reach out to the broker for this responsibility.

Parasram holdings claims to have a dedicated team of expert research analysts and advisory managers, who provide the appropriate solutions based on their knowledge, research and expertise. It can also be accessed on smartphones.

The platform provides strategies for equity and derivatives trading, recommendations for trading in futures and options, and many other products.

The Parasram platform provides unique Support & Resistance levels.

The levels are denoted by multiple touches of price without a breakthrough of the level. The Parasram platform provides Nifty Fifty stocks with their intraday support & resistance levels, along with the buy and sell targets for each stock in the list.

The platform of Shri Parasram also provides a daily newsletter with the coverage of technical outlook for the day, and summary of the sectors and stocks to watch for the day. The newsletter also has information about the important expectations of the day.

The mobile application offered by Shri Parasram is called Now. It is an efficient application which can be used to trade as you go. All the transactions can be done through the application, including portfolio management services, placing orders, transferring funds etc.

Apart from the mobile app, Shri Parasram Holdings also provides access to third-party trading platforms namely ODIN Diet as well as NEAT.

Make sure you check with the executive of the broker before using these applications. Sometimes few brokers levy some hidden charges in the form of Technology Charges in your overall invoice.

This can unnecessarily result in a compromised trading experience.

You can check out this Hindi review as well.

Parasram Holdings Customer Care

Shri Parasram offers excellent customer care. It is evident from the fact that the number of complaints filed against this stockbroker for the financial year 2018-19 was only 2 on BSE and 3 on NSE.

The customer support is provided through Emails, Calls, Offline assistance at the branches and online assistance through email.

Overall, the stockbroker still relies primarily on phone and offline assistance. Thus, for traders who are comfortable with online channels such as chat, bots or quick email – there won’t be much to look out for when it comes to this stockbroker.

Parasram Holdings Pricing

With this stockbroker, the following is the pricing and the other charges like the demat account opening and maintenance charges:

- There is no Trading Account Opening Fee.

- For a Demat account, there are two options: first is to open the account free and pay annual maintenance charges of ₹350 per year and the second option is to open the account by paying a fee of ₹885 with no annual maintenance charges (or AMC) for 10 years.

- If the value of holdings is less than ₹50,000, there are no holding charges and holding charges of ₹100 if the holdings are between ₹50,001 and ₹200,000.

- An advance deposit of ₹1000 needs to be made in case of corporate accounts.

- Dematerialisation charges are ₹40 courier charge DRF, plus ₹8 per certificate.

- Rematerialisation charges are ₹30 per certificate or per 100 shares, whichever is higher, plus ₹40 courier charges.

- Pledge creation and pledge invocation charges of 0.01%, with a minimum of ₹50 per pledge and maximum of ₹200 per pledge of shares.

- Failed instruction charges of ₹25 per transaction.

The fee charged by Shri Parasram holdings is as follows:

- ₹15 for every market trade through Shri Parasram holdings.

- ₹30 for every market trade through others.

- ₹30 for each off-market trade.

- ₹30 for each inter-depository trade.

- ₹25 debit per transaction for BSDA accounts.

The Brokerage charges are:

- 0.02% for Intraday trading

- 0.2% for Delivery trading

Check this Shri Parasram Holdings Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

Parasram Holdings Margin

The exposure provided by Shri Parasram holdings is 4 times the credit balance in the account for the intraday trading.

The exposure can go up to 5 or 6 times, depending upon the credibility of the investor. It is advised you negotiate well when it comes to exposure or margin.

It also really depends on the kind of trading capital you start with. Furthermore, your profit trends can also assist you in getting a higher margin from the broker.

Parasram Holdings Advantages

This full-service stockbroker offers many advantages as a broker. Here are those listed:

- The portfolio tracker offered on the platform provides intelligent tools, with a customised market watch and real-time monitoring.

- The depository service has no account opening charges and the transaction charges are among the lowest in India. Lifetime AMC is available at very low cost.

- Brokerage charges are on the lower side.

- It offers a variety of financial products like mutual funds, IPO, fixed deposits and bonds, along with the forms of trading.

- The insurance services are also quite comprehensive, including health, personal accident, group insurance, car insurance, fire insurance and travel insurance.

Parasram Holdings Disadvantages

There are some disadvantages to opening a brokerage account with Shri Parasram holdings. They are as follows:

- The company has not established brand equity as of yet.

- There are some hidden charges, as observed by some customers.

- Customer support quality can be improved.

- Not much of an emphasis on in-house trading platforms.

Parasram Holdings Membership Information

The membership information of Shri Parasram holdings with different exchanges is as follows:

In case you are looking to get started with share market trading, let us assist you in taking the next steps forward.

Parasram Holdings Branches

Shri Parasram holdings has 350 offices spread in about 160 cities in India.

The offices are run and managed by highly qualified and skilled staff and brokers. As per the broker, these offices have ultra modern facilities to fulfil the depository, trading and other requirements.

Although, it is recommended that you have a personal check at your end if there is an office of Shri Parasram holdings around your area (that is if you are interested in opening an account with the broker).

More on Parasram Holdings

If you wish to learn more about this full-service stockbroker, here are a few references for you: