JM Financial Sub Broker

View All Sub-Broker Reviews

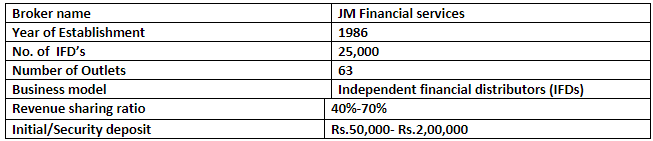

JM Financial Sub broker business is certainly one of the lucrative partnership offerings out there in the stockbroking space. When it comes to the full-service broking, JM Financial service is one of the oldest and largest stockbrokers in India. It was established back in the year 1986 as JM Shares and Stockbrokers (JMSSB).

Today, the broker has spent more than three decades in the Indian financial market.

JM Financial Sub Broker Review

The broker offers customized business solutions and services to their clients including comprehensive investment advisory and investment management services to banks, institutions, corporate, high-net-worth clients (HNI) and family offices.

Apart from that, the broker offers In-depth capital market expertise and research capabilities to clients to achieve their targets and even more than that.

The broker offers services to their clients through three distinct services which are through research base, group resources, and expertise to generate investment ideas to the clients and business partners. These three solutions include a wide range of products and services to meet both short-term and long-term business needs of clients.

Following product are offered by JM Financial in their equity brokerage group:

- Equity

- Derivatives

- Systematic investment plan (SIP)

- Initial public offerings or IPO

- Commodities

- Currency

- Portfolio management services (PMS)

- Stock lending and borrowing scheme (SLBS)

- Buybacks

- Creeping

- Block Trades

In this article, we are going to discuss types of business models, initial investment, advantages, steps to become a business partner etc of JM Financial services.

Interested in PMS? Why not to invest in JM Financial PMS and save your money from risk.

JM Financial Sub Broker Advantages

The following are the advantages of starting a partnership business with the broker JM Financial services.

- JM Financial has spent a long time of over 3 decades in the stockbroking market. So, the company has quite good experience in this field in the comparison of other broking companies.

- The broker offers various products and services to their clients and business partners. So, they do not require to move to any other broking house for any product.

- JM Financial has 63 outlets (through its sub-brokers, franchises) all over the country which allows people to access easily all products which they require to trade in the stock market.

- A strong research team, their expert opinion and the report analyzing power help business partners and clients to make a good income by getting benefits of those research reports.

- Trading platforms like ODIN and BNST help investors in getting more knowledge about the stock market and its opportunities.

- The online software of JM Financial services helps the clients to do trading via mobile apps and SMART software application.

- The broker is one of the pioneers in the area of training and education of IFDs.

JM Financial Sub Broker Criteria

If you are looking to become a business partner of JM Financial services, you must have the following eligibility.

- A person who is passionate about equities, interested in sales and achieving targets, has a good understanding of the financial/stock market and knows the related regulatory environment.

- He/she should have a good record and reputation in the financial/stock market where they worked with a good client base.

- Has the interest to invest in infrastructure and people on a regular basis.

- Minimum 3 years of experience in selling financial products as a sub-broker or Remisier or an insurance advisor or Mutual fund distributor or Financial planner or an employee of existing broker/sub-broker.

JM Financial Sub Broker Types

JM Financial services offer you only one kind of business model to work – Independent Financial Distributors (IFDs).

Here are the details:

Independent Financial Distributors (IFDs):

Independent financial distributors is the only business model offered by JM Financial services. The company has a network of over 25,000 Independent financial distributors and 6500 AMFI distributors in 63 cities/towns/districts all over India.

Independent financial distributors are able to select products and services available in the market for their clients according to their individual needs.

If you a financial advisor and want a partnership business under a brand name then the partnership with the JM Financial distributor is a good idea.

JM Financial Sub Broker Benefits

It is very normal that you wish you could do things differently for your clients and get rewarded for the service you provide them. So, if you are one of them who are thinking on similar lines, you can choose this broker for partnership.

You will get below-mentioned benefits by starting a partnership with JM Financial services.

- There will be full control over the products and solutions you provide to your clients.

- State-of-the-art technology solutions for trading, performance, billing and client reporting.

- You can provide comprehensive research tools and required resources to your clients.

- You can make your own decisions for your client.

- Access to a wide range of investment products such as structured products, managed accounts, and alternative investments.

- You will get full support from the broker for day-to-day operation.

- You can provide expert guidance to your clients to help them in their investment decisions.

- A dedicated service team will be provided to get support for any hurdles you face in your business.

JM Financial Sub Broker Revenue Sharing

The revenue sharing ratio for Independent financial distributors (IFDs) is in the range of 40%-70% of revenue generated by the partner. It depends on the deal, which is made between the broker and sub-broker.

In other words, JM Financial services will keep 40% of revenue generated by the partner while the business partner can keep 60% of revenue generated.

For instance, if you are able to generate a monthly brokerage of ₹1,00,000 – then ₹40,000 will be kept by the broker and rest ₹60,000 will be transferred to JM Financial sub-broker.

The higher range of the revenue sharing may go up to 90% of the revenue generated also depending on the security deposit and negotiation done between both parties.

Some broker gives offers to their respective business partners, from time to attract them towards the company and in that case, the sharing range can go high in favour of the franchise or sub-broker.

The above revenue sharing range is in line with the industry average, It may be a little lesser and higher also since it differs from the broker to broker.

JM Financial Sub Broker Initial Deposit

The initial or security amount required to be deposited with the JM Financial services is somewhere in the range of ₹50,000 – ₹2,00,000.

Although, you can negotiate for the minimum amount of security deposit with the executive at the time of discussion on the rest of the matter.

Both the minimum and maximum range of the initial deposit can be negotiated. It can go in your favour if you have a good number of client base in your running business. And, the higher range of security deposit might be for the total investment required for starting the partnership business.

This is in line with the industry average.

Depending on the brand name, it may require a higher security deposit and if you are getting much lower security deposit offer from the broker, you will have to compromise on the brand image side.

JM Financial Sub Broker Limitations

Though the JM Financial services is in the broking market for a long period, the broker is still working on some of its concerns. Some big problems related to the broker are mentioned below:

- There are a lot of complaints registered against the JM Financial services in different stock exchanges by the clients and brokers which is yet to resolve.

- The rating given by google play to the apps of JM Financial services is not good. All apps have got less than 4 ratings out of 5. The number of apps download is also very low which shows the interest of clients and brokers in the company.

- Most of the business of JM Financial services are focused on large investors, which ultimately leaves less opportunity for small and medium investors.

JM Financial Sub Broker Registration

In case you are interested in setting up JM Financial sub broker business, there are the specific steps you need to take:

- Check whether you fall under the criteria of JM Financial business partner franchise.

- Fill-up the registration form available on the website. You can fill the below-displayed form as well:

- Know and accept all the clauses related to the business.

- Deposit all required documents for the verification with initial/security deposit amount.

- After verification of documents, you will have to complete some onboarding formalities.

- You will be explained some basic aspects of the business which you will have to take care to become part of the brand.

- An agreement will be signed by both parties with all terms and conditions.

- Now, you are ready to start your business and get an attractive income.

Normally, the whole process of registration takes 6-8 working days to complete.

Summary

JM financial services is one of the oldest and leading names in the stockbroking market. It offers a wide and customized products and services to their clients. The low-risk environment of the company makes it a good option for new investors.

You are also getting the convenience of trading from your home or office by using its SMART software application. This software is also friendly to the first time user. Yes, it has some complaints but, if we look at its positive side then one can give this company a chance and start a partnership business by taking its benefits.

If you want assistance in setting up your sub-broker or franchise business, let us assist you in taking the steps forward:

Worst broker. Worst experience. They have really bad customer care service. Phones do not work, customer care executive do not reply to customer complaints in timely manner. On top of that, THEY CHARGE UNNECESSARY INTEREST AMOUNT in your ledger without any reason.

Not recommended!