Mastertrust Franchise

View All Sub-Broker Reviews

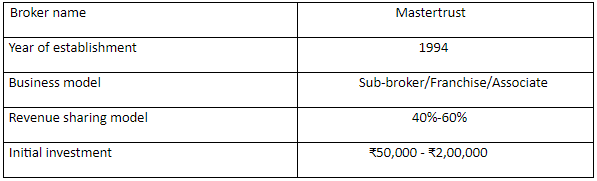

Mastertrust is a Ludhiana based broking company established in the year 1994. The company is the broking arm of the Mastertrust Group. The broker is maintaining a good track record in the broking space. When it comes to Mastertrust franchise model, the broker has a few offerings in its kitty for its potential partners.

As far as the background is concerned, Mastertrust is one of the leading broking company in India which offers customized services to the clients, attractive trading plans with dedicated 24-hour service.

Mastertrust Franchise Review

Presently, the broker has 650+ employees with over 1,50,000 clients all over India. The company is one-stop-shop for the clients and make products as seamless as possible for them.

Mastertrust has all India presence with over 500+ branches and franchise network.

Mastertrust deals in equity and derivatives trading through BSE and NSE and currency trading through MCX-SX. The company also deals in the commodity segment through MCX and NCDEX and works through its subsidiary company Master commodity service Ltd.

Mastertrust has its own DP services and registered with NSDL and CDSL.

More importantly, the Mastertrust believes in a strong relationship with every client and business partner. They provide relationship manager to the clients for their personal help. Clients can access all their reports for the fast and quick look.

They also have the subscription for research reports as well as SMS service to get quick service. Other than above services, they have live chat, email service, centralized query resolution service, and online query resolution through MasterTrust login page on their trading platforms.

The broker offers the following products and services to their clients:

- Equity

- Derivatives

- Commodities

- Currency

- Mutual funds

- IPO

- Depository services

- Portfolio management services (PMS)

- ETFs

- Life insurance

- General insurance

- Demat account

- Trading account

- Financial planning

- Margin funding

- Loan against shares

In this article, we are going to discuss different aspects of the Mastertrust franchise or sub broker. We will discuss the type of business model offered, initial investment/security deposit, steps to become a sub-broker, advantages etc.

Mastertrust Franchise Advantages

If you start a partnership business with Mastertrust then you will get the following advantages:

- Mastertrust is a one-stop-shop for all investment needs of a customer. The broker offers a wide range of products and services to the clients. And ultimately a business partner can offer those to their clients.

- Mastertrust understands the requirement of customer support for the clients. Any service is incomplete without a proper customer support system. That is why the broker offers the best customer care service.

- You will get customized care with online access to your all reports. You can also access research reports for trading and there is a facility of SMS alert if you are a regular trader.

- Research and advisory support in which you will get risk calculator, stock screener, and news and market commentary.

- The broker offers a fully integrated investment portal which will allow you to trade in different segments like MF, equities and IPO.

- Dedicated relationship managers to help in making investment decisions.

- Attractive revenue sharing ratio.

- Helps in the new business set-up.

- Minimal initial investment.

Mastertrust Franchise Business Models

Mastertrust offers a few types of business model

- Sub-broker/Franchisee

- Business Associates

- Business Partners

Let’s talk at depth about these models now.

Mastertrust Sub-broker/Franchisee:

This is one of the prominent business models through which you can start a partnership with the Mastertrust. This is a very common type of model which is offered by almost all brokers.

Under this model, You will get full support from the Mastertrust in the set-up of your new business. You will get support like help in client acquisition, Office set-up and other necessary things which are required to run a new business.

A range will be given to you for deposit of security money and you can choose any amount to pay according to your convenience.

This partnership is also called Mastertrust business partner.

Mastertrust Sub-broker/Franchisee Benefits:

Here are a few benefits you will be able to avail if you go ahead with the Mastertrust franchise model:

- A sub-broker will get a strong brand name to run their new business easily. It will help in easy client acquisition.

- You will get a wide range of financial products to offer to your clients. This is one of the best things to attract more and more clients to the company.

- You will get regular training and education to run your new set-up easily in this competitive world.

- Marketing related support will be provided by the Mastertrust to their business partners. Support like the advertisement of new business through TV channels, newspaper, Pamphlet, mouth to mouth publicity etc.

- A good customer care support which will help to resolve your all queries related to the business you started. You can call anytime to the customer care to know anything about your new business.

- You will get a competitive revenue sharing from the broker. The revenue sharing ratio offered by the broker is satisfactory in comparison of the related industry.

- New technology and advanced trading platforms offered by the broker assures solid profits.

Mastertrust Business Associates

If you choose to become a Mastertrust business associate, then you don’t need to do a lot of work operationally. Your primary job is to bring business leads, clients to the broker. Rest of the tasks including client acquisition, onboarding, trading, servicing, demat/trading account management are taken care of by Mastertrust.

That’s the beauty of this business model.

Since you have a limited responsibility to manage in this model, obviously, the revenue sharing part will also be not too high. Thus, make your choice accordingly.

Mastertrust Franchise Revenue sharing:

Mastertrust shares a competitive revenue sharing ratio with their business partners. The range of revenue sharing ratio is 40%-80%. It means you will get a minimum share of 40% and a maximum of 80%. The maximum range can be increased with the revenue generated and the amount of security deposit.

If you generate more revenue than the given target you can request to increase the revenue sharing. In the same way, if you deposit the highest range of security money then also you can request to increase the revenue sharing ratio.

The given range is in line with the industry, it may be higher or lower also.

Mastertrust Franchise Costing:

Before starting your business with Mastertrust you are required to deposit some initial investment or security deposit money to the broker. The range of security deposit is Rs.50,000- Rs.2,00,000.

The security money deposited with the broker is refundable money. It will be refunded at the time of your exit from the agreement with the broker. But, some money is non-refundable which will be deducted from the deposited amount.

The non-refundable money will be charged as a membership fee of the stock exchange, expenses during new business set-up, infrastructure expense etc.

The range of security deposit/Initial investment is in line with the industry, It may vary depending on the terms and conditions of the broker.

Mastertrust Franchise Registration:

By following the below-mentioned steps you can become a sub-broker of the Mastertrust Franchise:

- Fill-up the registration form available on the website with your basic details. You may choose to provide your details in the below form as well to get started:

- You will get a call from an executive to confirm your interest in the sub-broker business and will connect you to the broker.

- Another call will be from the broker side to know your interest and make you understand the basic things about the partnership business. An appointment will be fixed with the executive of the broker.

- During the meeting, they will make you understand everything about the partnership with the Mastertrust franchise. You are also supposed to clear your all confusions during that meeting.

- You will be asked to submit all the required documents for verification purpose.

- After verification, an account Id will be provided to start your business.

- Now, you are ready to take benefit of a partnership business with the broker.

The whole process will take almost 7-10 business days to complete.

Mastertrust franchise Problems

Following are some issues with Mastertrust

- Lack of instant fund transfer. It takes 2-3 days in fund transfer depending on the mode chosen.

- Margin calculator not available.

- Offline presence needs to increase.

Mastertrust Franchise Summary

Mastertrust believes in its business expansion through their sub-broker/franchise and branches in different cities. The broker provides all possible help and support to the business partners to grow and run their business smoothly.

Mastertrust offers an attractive revenue sharing ratio, affordable initial investment, various offers to sub-brokers with a wide range of products and services.

So, if you are interested in starting a partnership business in the broking space, you can go with the Mastertrust also.