Zerodha Franchise

View All Sub-Broker Reviews

Zerodha Franchise business is relatively new especially since it is coming from a discount broker. Generally, offline assistance is provided through full-service stockbrokers in the form of different partners, sub-brokers, franchise models.

Zerodha has been around in the Indian stockbroking market for less than a decade and in a short span of time, it has been able to make a good impression of its brand. It offers trading service in various segments to the clients and business partners.

In this detailed review, we will have a look at the different value propositions offered by the brand and see whether Zerodha franchise works for your business requirements or not.

Zerodha Franchise Review

Zerodha broking company was established in the year 2010 headquartered in Banglore. It is one of the fastest-growing discount broking houses in India. As per the latest check, it is the number 2 stockbroker in India in terms of the active client base.

Their products and services offered to the clients are of good quality and just in a few years, they have made a big impact in the broking business. They offer a wide range of services to both customers and business partners. The broker offers you the following segments to trade and invest:

- Equity

- Derivatives

- Currency

- Mutual funds

- IPO

- Commodities

- Government securities

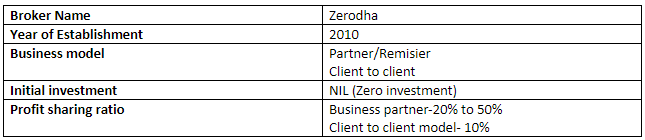

In this article, we are going to discuss in detail the types of model, revenue sharing ratio, initial investment and many more important aspects of the broker. But, before that, here is a quick overview:

Zerodha Franchise Business models

Zerodha Franchise offers two models of business to those who want to start a business with them. Both are suitable for different types of businessmen as per their need and capability.

- Partner or Remisier model

- Client to Client model

Partner or Remisier model

Zerodha launched this partner or Remisier program recently in the year 2015. Since then, the company has made almost 1000 business partners under this model. You need to pay a fee of ₹1500 for the enrollment under this model. Also, you are not required any office space to work from there.

The most important part of this model is the acquisition of clients to get traded with Zerodha. The company does not offer any extra facilities to the partners other than the profit sharing.

Profit/commission sharing under this model is not fixed, it is based on the slabs of revenue generated by the clients.

Client to Client model

This is a very basic model as any client of the company can earn some percentage of money just by referring his/her family, friends or relatives. For this, they get 10% of the revenue sharing from Zerodha. Clients are not required to pay any extra charge for working under this model.

This model is more or less like any other “Refer and Earn” model provided by businesses across industries.

Zerodha Franchise Revenue Sharing

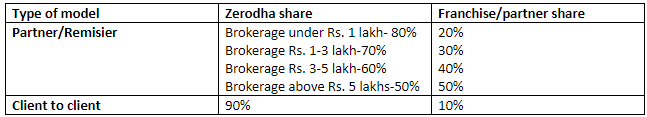

Revenue sharing ratio for the business models discussed above is different and is generally based on the different slabs of revenue generated by the clients.

Partner/Remisier model:

The revenue/commission sharing ratio in this model is totally based on the brokerage generated by the sub-broker clients. The partner gets their share according to the brokerage of Zerodha they make by their franchise clients.

Here are the different revenue sharing slabs:

- If the brokerage generated by the clients of sub-broker is less than ₹1 lakhs, then the partner will get 20% and Zerodha will get 80%.

- If the clients of sub-broker generate brokerage between ₹1 lakhs and ₹3 lakhs then the partner will get 30% and Zerodha will get 70%.

- And if the partner’s clients generate brokerage between ₹3 lakhs to ₹5 lakhs then they will get 40% and Zerodha will get 60%.

- Lastly, if the brokerage generated by the partner’s clients goes above ₹5 lakhs then the sharing between the partner and Zerodha will be 50:50.

Client to Client model

The revenue sharing ratio of client to client model is very basic. The effort to be given under this model is minimal. So, the revenue share is also accordingly.

The partner under this model gets only 10% of revenue generated by the referred client and Zerodha gets 90%.

Here is a quick summary:

Zerodha Franchise Cost

Here is a quick look at the initial investment you’d need to put in before you choose any of the business models offered by this discount broker:

Partner/Remisier model:

The partner under this model is required to open a Zerodha Free Demat account and a trading account with the Zerodha broking house. There is a one-time registration chargee of ₹1,500 that you are required to pay and register yourself as a partner.

A partner under this model can work by sitting in the office of the main broker or may also choose to work from home. So, they are not supposed to invest any money for office set-up or any other infrastructure expense.

Client to client model:

Under this model, only the mouth to mouth publicity is required to bring clients to the company. Hence, this model requires zero investment for those who work under client to client model.

Here is a quick summary of the initial costs:

Zerodha Franchise Registration

In order to become a sub-broker of Zerodha you will have to follow the following steps:

- Fill the registration form with all the details required. Here is the form for your reference:

- You will get a call from the call centre representative of the company to verify your interest.

- You will get another call to fix an appointment with the sales representative.

- You can get detailed information and can clear all your confusion by attending a meeting with the sales representative.

- Submit all required documents for the verification.

- The documents will be verified.

- At last, an account ID will be provided after all verification.

The complete process will take almost 3 days to complete.

Zerodha Franchise Advantages

Following are the advantages which attract you towards zerodha broker for business partnership.

- As a business partner, it is easy to acquire clients as the broker is a discount broker.

- Provides free user education in investment and trading through Zerodha Varsity.

- Offline presence over 75 cities of India.

- Offers innovative trading platforms which include a web application, terminal software and mobile app.

- Provides a 3 in 1 Demat account with an association with IDFC bank.

- No requirement of any minimum balance in your trading account.

- All procedures and brokerage sharing percentage is clear and transparent.

- An excellent Zerodha Backoffice support system helps business partners to get all details of the clients and brokerage reports.

- The broker provides quick support and has a fast acquisition process which makes clients happy and attracts them towards the company.

Zerodha Franchise: Pros and Cons of business models

If we talk further into the different business models offered, here are some of the positives and negatives of setting up a Zerodha franchise:

Partner/Remisier model Pros:

- Flexible revenue sharing ratio.

- No any expense of office/infrastructure set up.

- No security deposit required.

Cons:

- A partner can earn the highest 50% of revenue only with this maximum cap.

Client to client model Pros:

- Less effort required.

- No security deposit required.

Cons:

- Limited opportunity to earn.

Zerodha Franchise: Sub-broker offer

Zerodha discount broker offers a lot of offers to the sub-brokers. By getting those offers business partners can easily move towards the broker for partnership business.

Following are the offers are given to the sub-broker by the discount broker.

- A wide range of services available to provide to the client or business partner.

- The discount broker provides all types of required trading platforms to the clients.

- Partners are not required to invest any money for starting a partnership business with the Zerodha broker.

- Flexible revenue sharing ratio gives business partners an opportunity to earn according to their calibre.

- Provides back-office software to keep track of brokerage and client trading activity.

Summary

Zerodha is the one who brought the concept of discount broking in India. It provides two business models to clients with zero investment.

The revenue sharing of the broker is flexible. Overall, Zerodha broking is a good option if you want to start a partnership business in broking field without an initial investment.

In case you are serious about getting started with a business in the stockbroking space in India, let us assist you in taking things forward for you:

Zerodha Franchise FAQs

Here are some of the frequently asked questions about Zerodha Franchise, that you also have:

How long does it take to get my Zerodha franchise activated?

Generally, it takes 2-3 business days for all the formalities to get completed. However, if there are any fallacies with your documentation, there could be a few rounds of to and fro, leading to an unnecessary delay.

In such cases, the overall onboarding process may take a few more days.

What are the costs involved in setting up my Zerodha franchise?

As a Zerodha franchise, you need to provide the registration cost of ₹1500 as a one-time cost. In case you are looking to set up an offline office as well, there could be a few costs associated in setting up the office but the exact amount depends on the total space and the corresponding internal furnishing it needs.

What documents are needed to set up a Zerodha franchise?

You need to be very circumspect of the documentation you need to provide to the broker as part of the onboarding process as a Zerodha franchise:

- Aadhar Card

- PAN Card

- Educational Certificates

- Address Proof

- CA attested reference letter

- Bank account details in the form of a bank statement or cancelled cheque

- Passport-sized photographs

Is revenue sharing percentage offered by Zerodha competitive as compared to other stockbrokers in India?

Yes, it is pretty competitive. Although, it depends on the overall brokerage generated by you. There is one concern though, the broker has kept a maximum cap of 50% whereas a lot of other brokers allow brokerage sharing up to 80% as well.

Having said that, in those cases, the partner does more than just providing business leads and in fact, takes care of client acquisition and client service.

Zerodha is a discount broker? How does its franchise work?

Yes, Zerodha is one of the very few discount brokers who have an offline presence as well. However, most of these offline locations serve to fix basic issues or query resolutions. Majorly, these are used for customer acquisitions. Servicing part is done by the corporate team of the broker themselves.

Zerodha franchise plays no part in that.