Angel Bee

Check Reviews of Mobile Trading Apps

Angel Bee is an ARQ based mobile trading app that helps you in your investments across equity and mutual fund products.

In this detailed review, we will have a look at how this application can help you with mutual fund investments and whether you should be using it or not.

Angel Bee Reviews

With Angel Bee, it seems that Angel Broking is finally trying to seriously stretch towards a much widely accepted investment product in India – Mutual funds.

Yes, Equity and stock market have been something the broking company has been chasing since its existence and the mobile app does allow to invest in the stock market as well.

But undoubtedly, the Mutual funds market spread is way bigger than Stock market investments in India. One of its major competitor, Zerodha has already introduced a Mutual fund investment platform Zerodha Coin a few months back.

Angel Bee is basically a mobile app for retail investors who are looking to plan out their financial goals and targets and correspondingly invest in different segments.

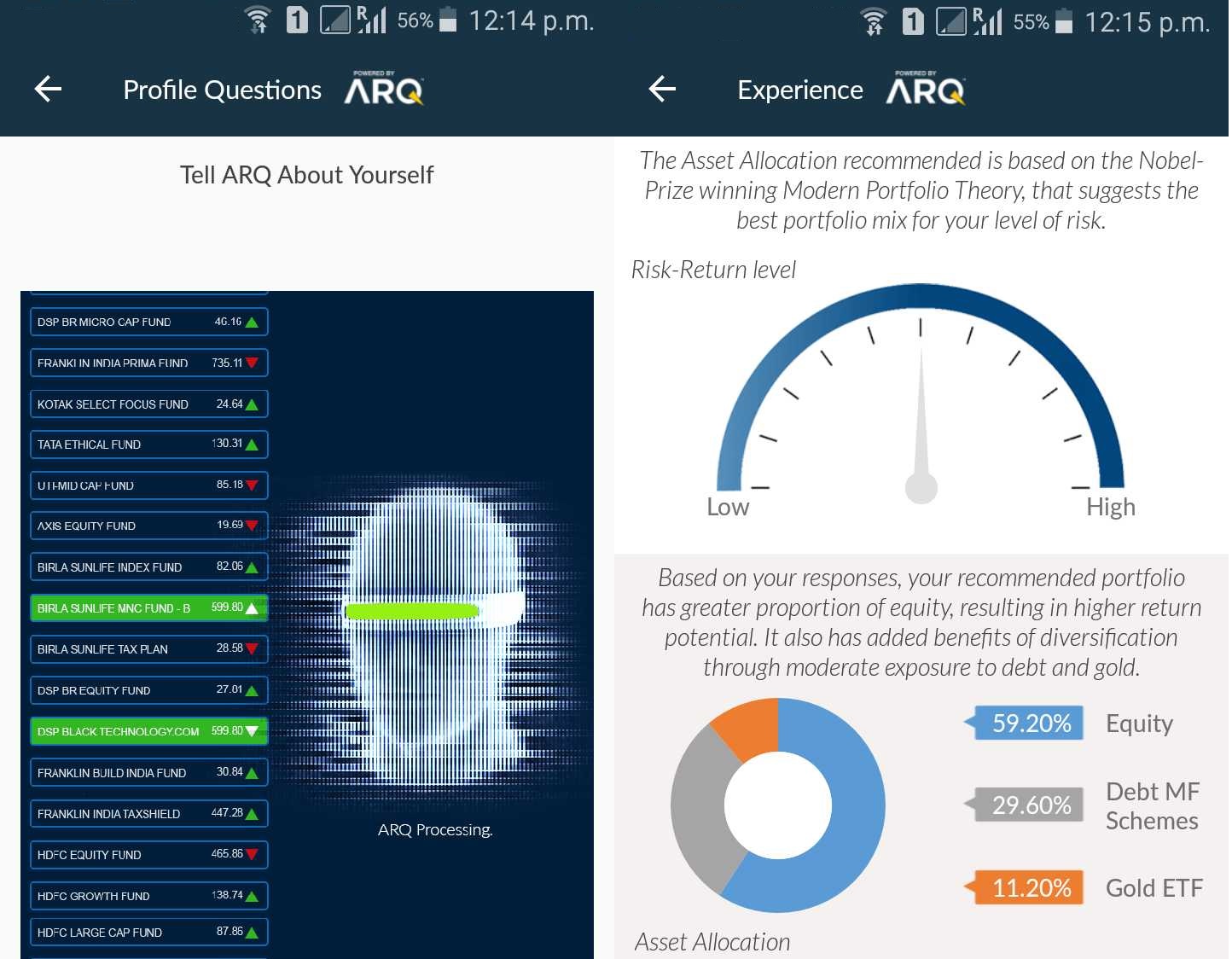

The mobile app recommends different financial products to users through Angel broking’s automated recommendations engine – ARQ.

The engine performs risk profiling for the user, suggests different financial products along with the proportion of the user’s investment in each of these segments.

Furthermore, the app allows taking these recommendations to the next step where within the user journey of the app, you are allowed to invest your money in those products right away.

In other words, with this application, Angel Broking is offering its clients to not only get recommendations but also go ahead and actually make the move towards investing that is directly aligned with their financial goals.

For Angel Broking, apart from increasing investment revenue from their existing client base, Angel Bee has the potential to serve as a new client acquisition stream too.

It all really depends on how they actually execute it.

Angel Bee App

This platform can be used in the form of a mobile app. Although, it makes sense for Angel Broking to come up with a web application version as well.

However, as of now, the investments through Angel Bee can be done only through its mobile app.

Now, in the next section, we will have a quick look at how this mobile app works.

How Angel Bee Works?

Let’s talk about the different features Angel Bee offers to its clients and the way this application works:

- Once you login into the application, the 18 MB+ sized application downloads some of the important information including your total bank holdings, expenses, savings along with your investments and trades through your trade Angel broking account (if applicable). All this information is taken post your confirmation only.

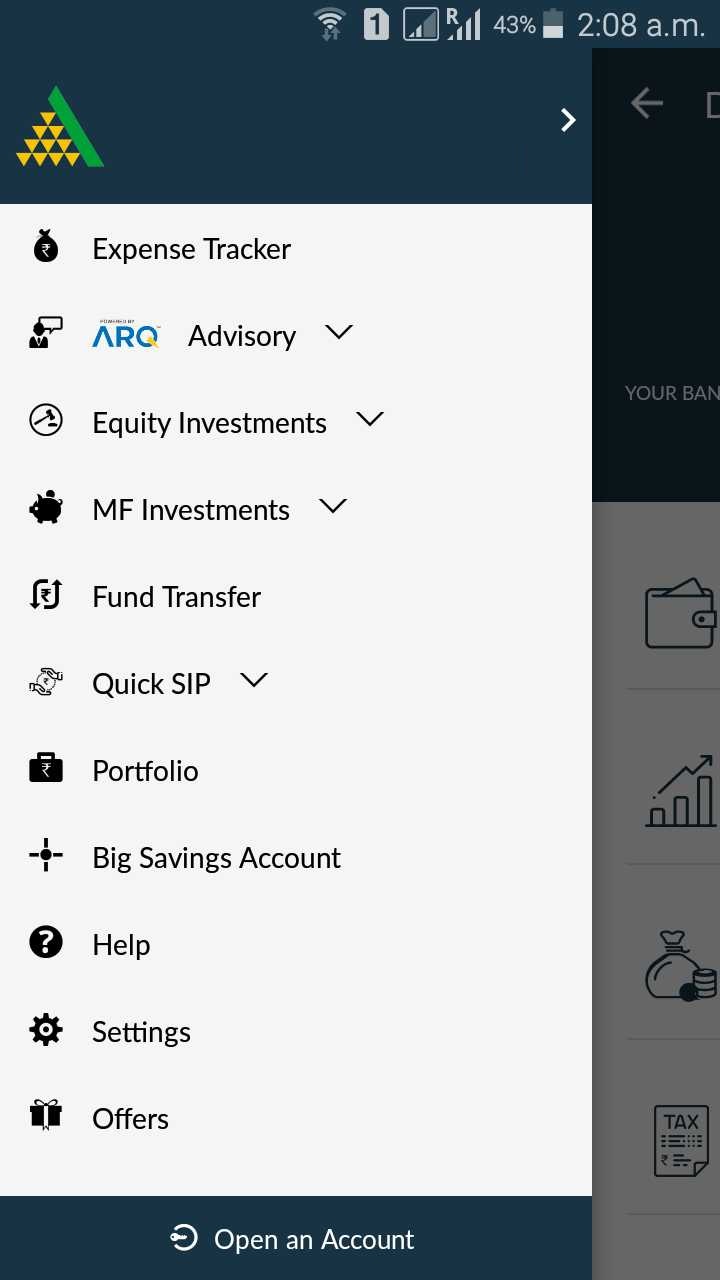

- As shown below, the following features are offered to you once you start using the application. If you are a client of Angel Broking, Angel Bee shows your positioning and holding in different products such as Equity, Mutual funds, SIPs. Furthermore, you can place your new investments as well by using the mobile app.

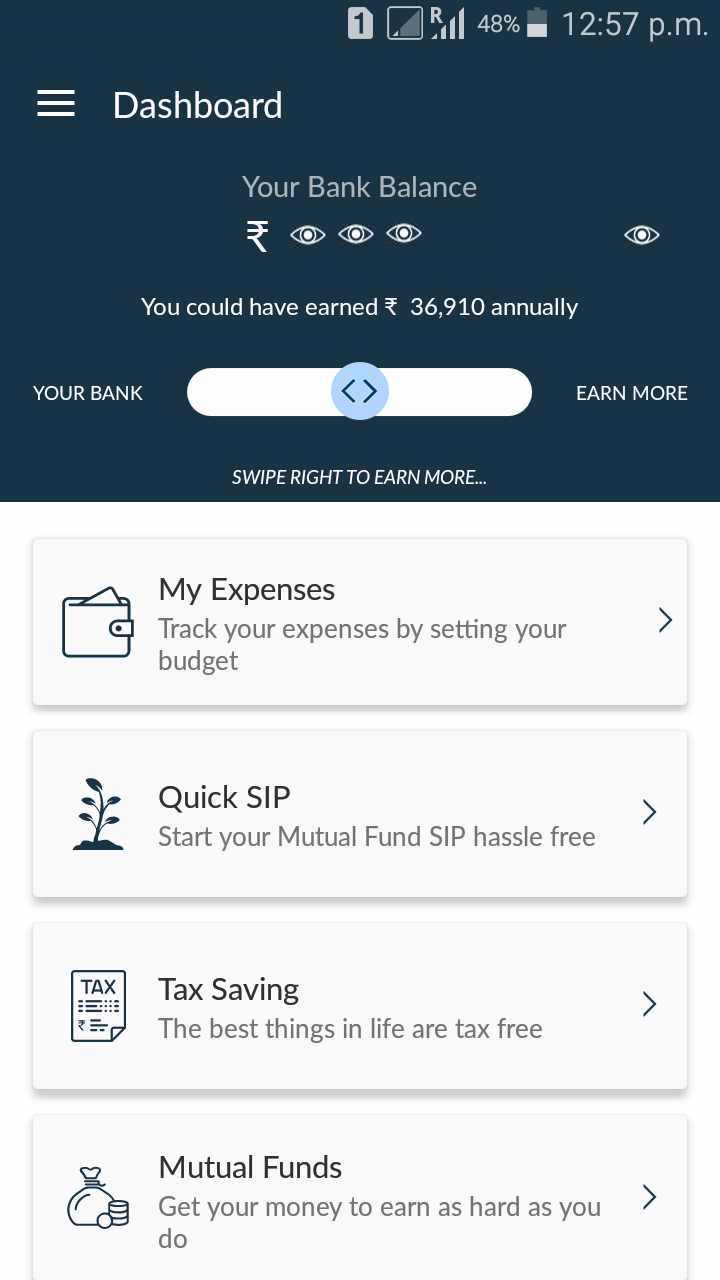

- This is the dashboard screen from where you can navigate across expense tracker, mutual fund investments, quick SIP tracker, tax savings tab etc. The details about the bank balance and corresponding investment are taken from your actual bank accounts post confirmation from you. Based on your bank balance, the app also mentions your potential monetary returns on an annual basis.

- You may choose to run the ARQ advisory engine that takes in your inputs on age, risk appetite, preferable investment products, investment time horizon etc. Based on that, the engine recommends a specific percentage of your overall investment amount towards different financial segments. You also get the option to rebalance your existing investments based on ARQ recommendations.

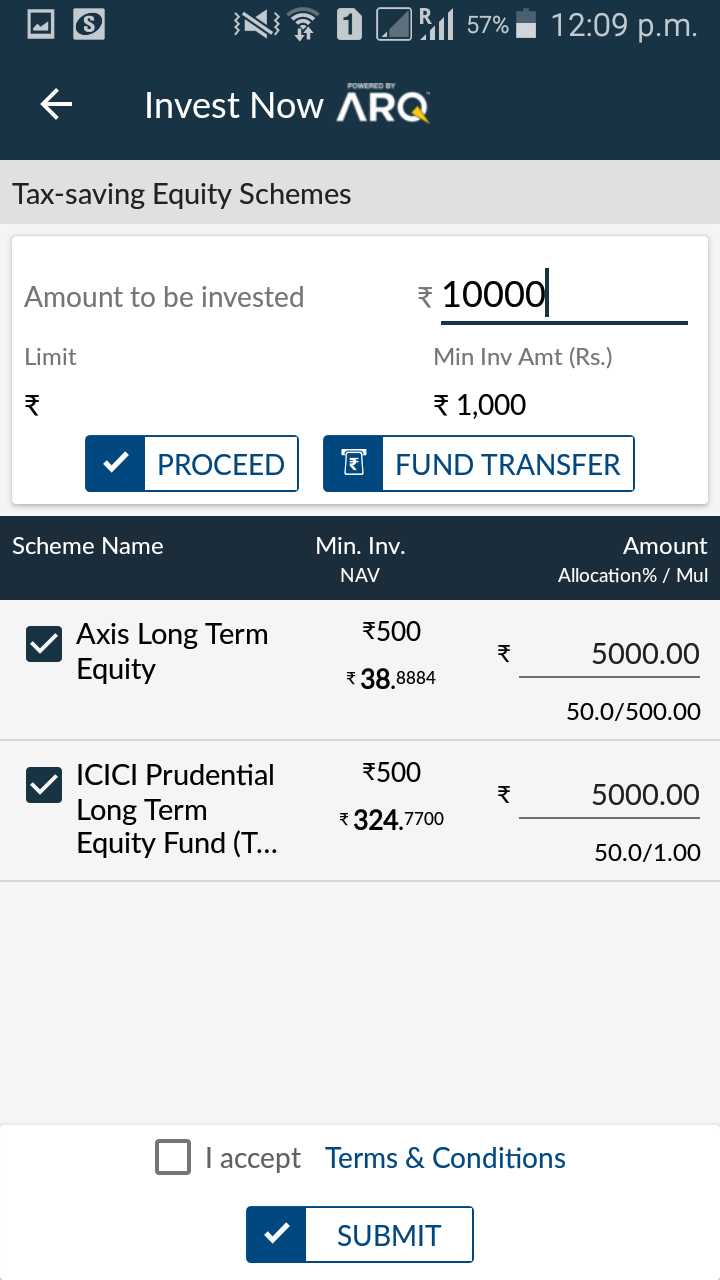

- If you choose to follow the advice provided by ARQ, you can then take the next step and invest in specific equity stocks, MFs and SIPs recommended. For that, you just need to enter the amount to be invested, choose the investment product and transfer funds. Once you do that and orders get executed, these financial products become part of your portfolio and those details get reflected in the Portfolio section.

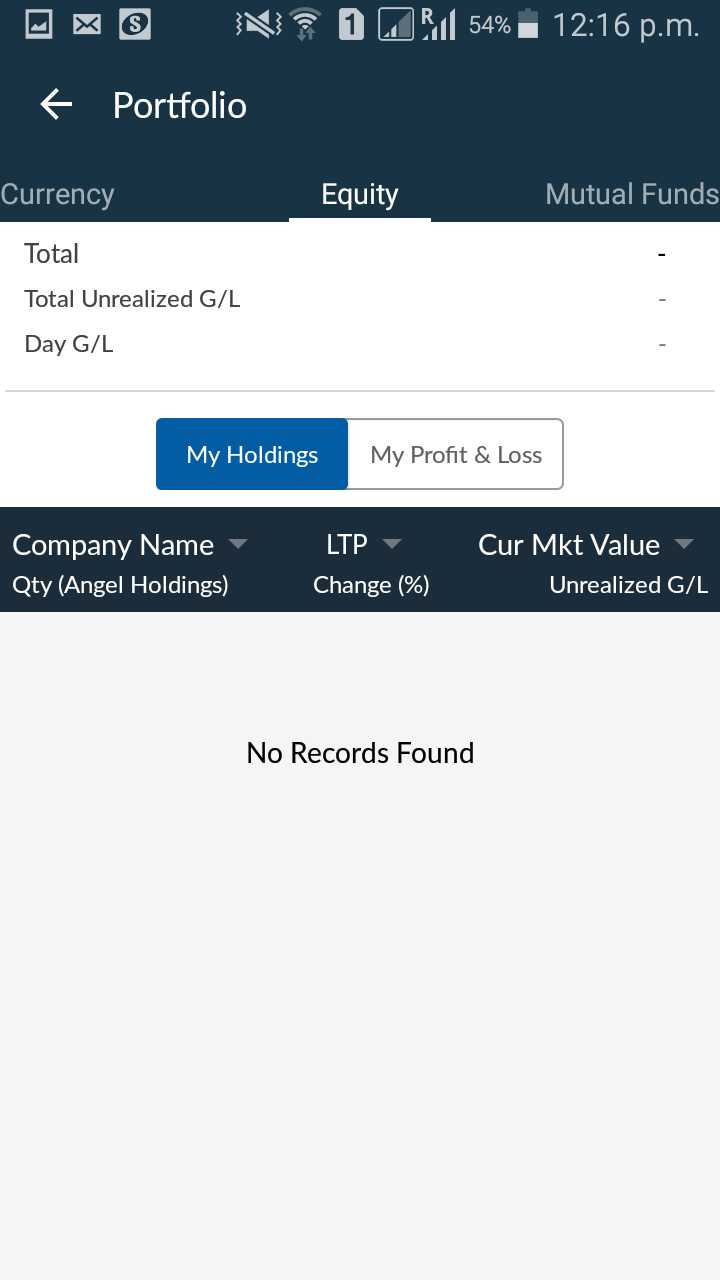

- This is the screen where your holdings and respective profit/loss will be reflected once you have made the investments. There is clean segregation of your investments among different investment products. The one shown below will display Equity-based investments only.

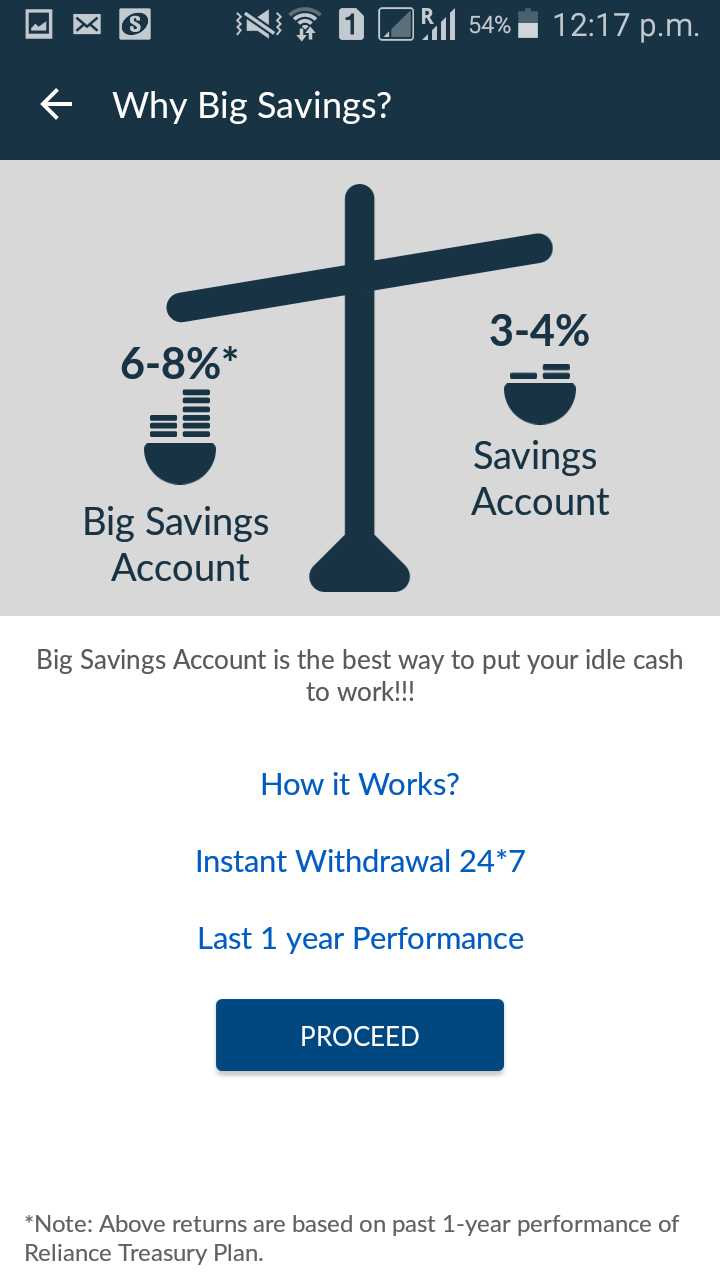

- Angel Bee also allows you to open up a Big Savings account through the mobile app itself. The full-service broker, Angel Broking claims that this type of account can potentially offer double the returns as compared to a normal savings account. To open up this account, you need to provide some basic documentation. You may as well use the callback feature to get a detailed understanding as well.

- The app allows you to invest among the following mutual fund options:

- L&T Mutual Fund

- Kotak Mutual Fund

- SBI Mutual Fund

- Aditya Birla Sun Life Mutual Fund

- Reliance Mutual Fund

- IDFC Mutual Fund

- Axis Mutual Fund

- ICICI Prudential Mutual Fund

- HDFC Mutual Fund

- Invesco Mutual Fund

- UTI Mutual Fund

Here are some of the stats about Angel Bee from Google Play Store:

| Number of Installs | 500,000+ |

| Mobile App Size | 18 MB (Android), 67.4 MB (iOS) |

| Negative Ratings Percentage | 17% |

| Overall Review |  |

| Update Frequency | 3-4 weeks |

| Android Version | 4.2 and up |

| iOS Version |

In case you are looking to get in touch with Angel Bee customer care, then you can directly contact Angel Broking Customer Care or let us know by filling the form in this screen below.

Angel Bee Charges

The investment app does not levy any charge whatsoever to its clients for mutual fund investments.

Thus, either we talk about the account opening or maintenance charges or the commissions when you buy or sell mutual funds, there are no payments that need to be made to Angel Bee.

The app is completely free to use and it is one of the top unique selling propositions of this stockbroker.

Angel Bee Login

In order to login to the app, you just need to download and install the Angel Bee onto your Android or iOS mobile phone.

Once installed, you will be directed to the home page of the app where you can put in your credentials and login to the app.

If you are logging in for the first time, you will be asked to use either your Gmail or your account id. Then you’d need to put up your phone number and the OTP received.

Once these details are validated, you will successfully be logged into the app and then you can start using it for your mutual fund investments.

Angel Bee Customer Care

The Angel Bee Customer care team is different from the Angel Broking Customer care team.

If you want to get in touch for your mutual fund investments, you can use the following contact details and get your concerns resolved:

| Contact Method | Details |

| Phone | 022-50515151 022-44114411 |

| support@angelbee.in |

Is Angel Bee Safe?

This is one of the basic questions that come up, especially from beginner level investors and rightly so!

Simply because you are going to just trust the platform and place your investments through it.

Well, the answer to that is yes, Angel Bee definitely seems to be safer as it comes from the house of Angel Broking which in itself has been around for a while.

In order to validate the details, it is suggested that you verify the membership details of this investment house from the respective regulatory bodies’ websites.

Some of those regulatory bodies include SEBI, NSE, MCX, BSE, MSEI, CDSL, NCDEX.

For more information, you can also check this detailed review on Is Angel Broking Safe?

Angel Bee Disadvantages

Here are some of the concerns about using the Angel Bee mobile app:

- The app is available only for Android users; iOS platform app not released yet.

- Limited financial product options are available. The user cannot invest in segments such as Commodity, Currency, upcoming IPOs etc.

- Although it is relatively new the application is a tad bulky at a size of >18 MB and can be optimized in terms of size. iOS version is even worse at a size of 67.4MB which needs to be fixed as well.

Angel Bee Advantages

At the same time, let’s talk about some of the positives as this mobile app:

- The app is sleekly designed and most of the content pieces are clearly positioned. So even if you are a beginner or a non-client of Angel broking, you will not have a tough time understanding different features available in the app.

- Angel Bee provides a comprehensive view of your account savings, expenditures, potential gains etc in such a way that you are able to easily understand your overall spending pattern and corresponding investment opportunities.

- Useful for people who are risk savvy and need assistance in mutual fund investments. Thus, clients of Angel Broking now have a technology-based platform from where they can carry out their mutual fund investments.

- In-app notifications make your life and you are informed through an alert based on the set conditions.

Looking to have a discussion with the executive of Angel Broking for complete understanding?

Just provide details in the form below and we will set up a callback for you:

Post this call, there are 2 ways to get started.

- If you have an Aadhar card, then the account opening process can be completed in a few minutes.

- Otherwise, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

For more information, you can check this detailed review of documents required for demat account.

Once you are done with this, your account gets opened within 2-3 business days.

Angel Bee FAQs

Here are some of the frequently asked questions (FAQs) about Angel Bee:

What are the different fund types available for investment in Angel Bee?

There are multiple types of funds that you can choose to invest in using this mobile app. Some of those funds include Debt Schemes, ELSS schemes, Equity Schemes, Balanced Schemes.

What are the charges I need to pay for using Angel Bee?

The Angel Broking Charges in case of mutual fund investments are ZERO.

You are not required to pay anything to the broker if you are doing mutual funds investments through this app.

The bigger question then becomes – how does Angel bee make money then? As per the broker claims, it makes money through the AMC (Asset Management Companies) as a commission.

Will I get free advisory for mutual fund investments in this mobile app?

Yes, this mobile app provides free mutual fund investment recommendations based on the preferences you set.

These preferences include your risk appetite, investment capital, lock-in period, expected returns and so on. The app also uses ARQ – an Automated Recommendations Engine by Angel Broking to provide automated recommendations with no human error.

What documents do I need to get started with mutual fund investments using Angel Bee?

In case you are interested to get started with Angel Bee, you need to provide the following documentation:

- Aadhar Card

- Cancelled Cheque of your bank account

- PAN Card

Do I need to maintain any minimum balance in my Angel Bee Account?

There is no need to maintain any minimum balance if you are investing in mutual funds using this mobile app.

What are the Annual Maintenance Charges (AMC) charged by Angel Bee?

There are no annual maintenance charges levied for mutual fund investments through Angel Bee, at least as of now. The app is free for investments and as said above, the broker makes money from the asset management companies.

How can I withdraw money from this app? Can I do that at any time?

As per the withdrawal policy set by the broker, you can withdraw as much as ₹50,000 or 90% of the total value in your account, whichever is lower in a day.

If you want to withdraw more amount than that, then you can do that on the next working day.

Is my investment secure if I do that using Angel Bee?

Angel Bee is an initiative towards online mutual fund investments from the house of Angel Broking, a full-service stockbroker who has been around for more than 30 years in the Indian Stockbroking space.

So, yea Angel Bee is trustable in nature for your investments.

More on Angel Broking:

Here are some related articles on Angel Broking for your reference:

Dear Angel Bee,

I am an NRI British Citizen with OCI status. Myself and my husband spend 6 months in UK and 6 months in Bangalore, India. We both have PAN and AADHAAR and KYC compliant. I am 67 and my husband 79 years old.

We have NRE bank account in our joint names with my name as SECOND holder.

Please advise :

Regarding best way to invest our spare cash in Indian Mutual Funds instead of holding funds in NRE savings/fixed deposit bank accounts.

We would like to hold our MFs in joint names either or survivor basis – if not in my sole name only. As our NRE account is in joint names (with my name second) will I be able to have investments in my sole name? All our investment will be from our Indian bank NRE joint account and on repatriable basis only. Do we need to apply to each fund separately to each AMC with FACTA etc ?

Our Uk phone number is +44 020 86428698 (Apr to Sep) and Indian phone 91 8884555008 (Oct to Mar)