Arihant Capital

List of Stock Brokers Reviews:

Arihant Capital is a full-service stockbroker based out of Mumbai that was incorporated back in 1992. This stockbroker has a presence in around 110 cities of the country with close to 700 branches. If you are looking to set-up a stockbroking business, here is a quick look at the Arihant Capital Franchise business.

Let’s have a detailed look at the different value propositions it has to offer to its clients. Hopefully, this will help you to decide on whether to go ahead with Arihant Capital or not for your trading needs.

Arihant Capital Review

With a client base of few thousands in India, Arihant Capital has memberships running with BSE, NSE, NCDEX, MCX and MCX-SX. Arihant capital has also created a repository around trading education with tutorials for beginner clients.

“Arihant Capital has a total of 29,655 active clients for the year 2020.”

Clients can trade across the following segments using Arihant Capital services:

- Equity

- Derivative Trading

- Currency Trading

- Commodity Trading

- Depository services

- Mutual Funds

- IPO

- NRI Demat Account

Furthermore, Arihant Capital operates at an institutional level as well along with retail broking. Their in-house DP service helps them to provide a Demat account to their clients on their own rather than getting it done through a 3rd party or partnership.

Mr Ashok Kumar Jain (Chairman, Arihant Capital)

Arihant Capital Trading Platforms

Arihant Capital has developed in-house trading platforms for its clients, available across devices. Here are the details:

Arihant Capital – Invest Ease

Invest ease is a browser-based trading application from Arihant Capital. Clients can directly login into the application from any device or location. This web-based trading platform comes with the following features:

- Real-time market data available

- Multiple market watch lists provision with a customizable interface

- Interactive charts with research reports for technical analysis

- Users can transfer funds from over 25 banks

- Multiple types of orders available for execution, including – Basket, cover, spread, normal etc.

- Hotkeys for quick order execution are present

- Research reports, recommendations and tips available within the trading platform

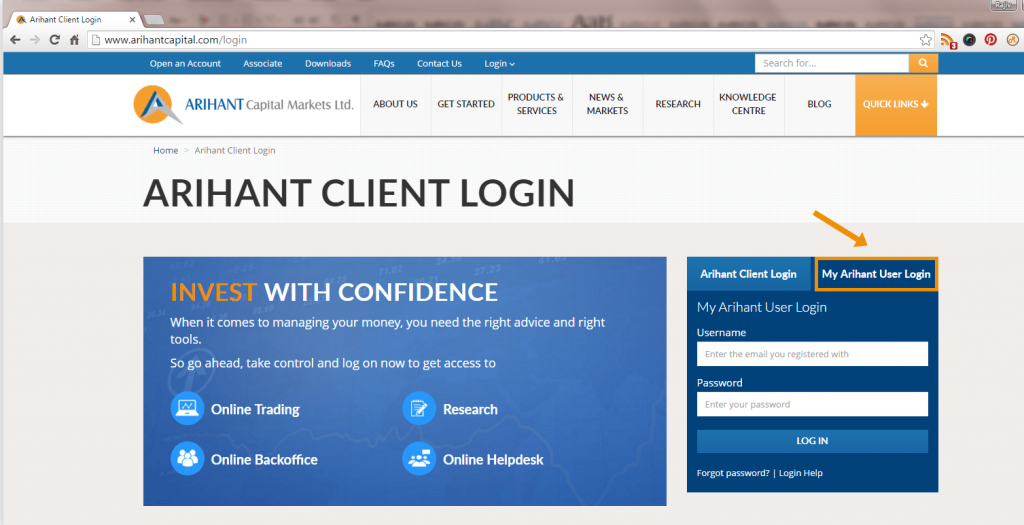

This is how the application looks like:

Ari-Trade Speed

Ari Trade Speed is a terminal-based trading platform that users can download and install on their laptops or desktops. This is primarily suitable for heavy traders who prefer high-speed trading platforms with quick tap feature executions.

Ari Trade Speed is one of those software and comes loaded with the following features:

- Clients can trade in different segments across different exchanges

- Advanced charts with multiple technical indicators

- Clients can place orders after market hours

Here is the detailed demo Ari Trade Speed trading software:

Arihant Capital – Ari Mobile App

Ari Mobile is in-house developed the mobile trading app from Arihant house. Users can trade across multiple segments and exchanges through this app, which can also be used across tablet devices as well. The mobile app comes with the following features:

- The mobile app can refresh itself based on the internet connection strength

- Multiple Market watch lists can be created and customized as per user preferences

- Users can place trades with a single tap

- Different order types and corresponding status can be viewed in a single screen

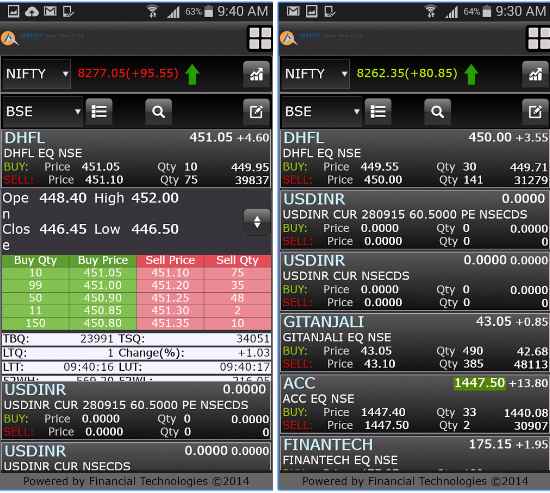

This is how the mobile app interface looks like:

Here is the Google Play Store information of the Ari Mobile App:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 52.4 MB |

| Negative Ratings Percentage | 7.7% |

| Overall Review |  |

Arihant Capital Research

Arihant Capital provides multiple types of research products segregated across different segments. Different users tend to trade and/or invest across different segments and thus the broker through its reporting structure, has segregated its products as shown:

- Equity

- Company reports

- Daily reports

- Fundamental reports

- Monthly research reports

- Result Update

- Technical

- Value Plus

- Weekly

- Commodity

- Daily reports

- Technical reports

- Weekly reports

- Currency

- Daily reports

- Monthly reports

- Technical reports

- Weekly reports

- Mutual Funds

- Fundamental reports

- Weekly reports

- Monthly reports

- IPOs

- Company reports

- Fundamental reports

- Fundamental Fixed Deposit Reports

Thus, with this clean segregation, the broker has made sure that there is no confusion among users (traders as well as investors) in terms of using the most appropriate research as and when required.

Furthermore, Arihant Capital has set up a ‘Knowledge Center’ for its visitors to understand multiple intricacies of trading and investing with modules on:

- Equity basics

- Mutual funds basics

- Technical analysis basics

- Investment webinars (outdated with the last one done in 2015)

Arihant Capital Customer Service

The full-service stockbroker provides the following communication channels as shown:

- Webform assistance

- Phone number

- Offline branches

- FAQs

Although the communication channels are decent enough, the quality of service provided by the stockbroker is below par. Be it professionalism and skill set of executives or the communication style/tone, the broker definitely lags on multiple aspects.

To start with, the support needs to have a regular schedule of training on professional customer service with a keen focus on keeping the overall discussion with the end-user as smooth as possible.

Secondly, there is a definite need to work on the turnaround time (TAT) taken by the staff for issue resolution. There must be a process for TAT monitoring and the end-user must be notified accordingly.

Arihant Capital Pricing

Clients need to pay the following charges while trading through Arihant Captial:

Arihant Capital Account Opening Charges

| Demat Account Opening Charges | ₹0 |

| Trading Account Opening Charges | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹362 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

Compared to industry standards, especially among the full-service stockbroking fraternity, the account level charges levied by Arihant Capital are pretty reasonable and nominal in nature. Otherwise generally, full-service stockbrokers charge somewhere between ₹400 to ₹800 for the account-related expense.

Arihant Capital Brokerage Charges

| Equity Delivery | 0.2% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹10 per lot |

| Currency Futures | 0.03% |

| Currency Options | ₹10 per lot |

| Commodity | 0.07% |

On the similar front, the brokerage charges offered by Arihant Capital are nominal too, as far as comparison with other full-service stockbrokers is concerned. Without a doubt, these charges are no way close to the ones levied by discount stock brokers but still, users looking for a full-service stockbroker may opt for this broker to get reasonable brokerage charges on their trades.

For instance, Arihant capital charges ₹10 brokerages for options trading, which is one of the cheapest bargains among full-service stockbrokers otherwise, there are brokers that charge ₹50 in this segment as well.

Use this Arihant Capital Brokerage Calculator for complete charges and your final profit or loss.

Arihant Capital Transaction Charges

| Transaction/Turnover Charges | |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.005% |

| Equity Options | 0.06% |

| Currency Futures | 0.005% |

| Currency Options | 0.06% |

| Commodity | 0.007% |

Unlike account-related charges or brokerage, the transaction charges levied by Arihant Capital are pretty high. In fact, these rates beat the industry percentage standards by quite a bit.

This is a concern with few stockbrokers that have set up their pricing pretty smartly. They keep their brokerage charges low to attract potential client base but then charge higher values in transaction charges, that are not prominently visible to users until when those are actually charged. Users are advised to have a detailed discussion

Arihant Capital Margin

| Equity | Upto 10 times Intraday, Upto 4 times delivery |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 3 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 3 times for Intraday |

The Margin offered by Arihant Capital is pretty average. In fact, equity intraday is the only trading segment where you can expect some decent exposure at 10 times of your trading capital. Other than that, the values offered are minuscule in nature.

It is our duty to inform you that using exposure or leverage on top of your trading capital has its own potential risks. Unless you understand its intricacies and implication, our suggestion is to better avoid it. At the same time, if you do understand the way it works, it certainly has the potential to bring much higher returns to you.

Arihant Capital Disadvantages

Here are some of the concerns of using the services of this full-service stockbroker:

- Physical presence is still less as compared to other full-service stockbrokers

- Pricing not completely clear, we’d advise you to clarify while interacting with the executive

- Customer service is below average as far as turnaround time is concerned.

“Arihant Capital has received 5 complaints this financial year with a percentage of less than 0.01%, one of the lowest in the industry.”

Arihant Capital Advantages

At the same time, you will get the following benefits if you go ahead with Arihant Capital:

- Reasonable pricing even though it is a full-service stockbroker

- An array of trading platforms across devices

- Full range of financial classes for clients to invest and trade

- Knowledge centre for fresh entrants and beginners to understand the basics of trading

- Multiple channels available for customer issue resolution

Conclusion

“Arihant Capital is one of the oldest names in the full-service stockbroking space and provides decent research to go along with low pricing (account opening, maintenance, brokerage) but still, the broker has not been able to create a positioning for itself. That is one aspect the broker needs to work on.

Otherwise, Arihant is a value for money stockbroker and certainly will provide your decent services across the board.”

Looking to open a Demat Account?

Feel free to fill in your details in the form below and we will arrange a Free call back for you!

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

Arihant Capital Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB 010705532 |

| NSE | INB 230783938 |

| MSEI | INE260783938 |

| NSDL | IN-DP-127-2015 |

| CDSL | DP ID-43000 |

| SEBI | MB INM 000011070 |

| MCX | 10525 |

| NCDEX | 00080 |

| Registered Address | #1011 Solitaire Corporate Park, Andheri Ghatkopar Link Road, Chakala, Andheri (E), Mumbai - 4000093 |

The details can be verified from the corresponding websites of the exchanges.

Arihant Capital FAQs:

Here are some of the most frequently asked questions about Arihant Capital:

Is Arihant Capital a reliable stockbroker? Can I trust it?

The full-service stockbroker has been around for around 25 years and that is a good enough time to gain user trust across any industry. Arihant capital although is certainly a reliable stockbroker but the growth momentum it has seen has been fairly low and slow over the years.

The biggest reason for that is the broker has not taken any leadership initiative in the industry in any area whatsoever. For this, the broker has not been able to create a brand of its own in such a long time span.

Yes, without a doubt, you can trust Arihant capital but then you can find other trustable names too with much better growth potential.

Is Arihant Capital suitable for beginners or small investors?

Yes, Arihant Capital can certainly be used by beginners or small investors at the initial level for handholding on research and trading education to go along with reasonable pricing and a wide range of trading platforms. One thing that might not work for beginner traders is the “lazy” customer service provided by the broker.

In other words, beginners can certainly use it’s certainly, with a pinch of salt.

What are the account opening charges at Arihant Capital?

There are no account opening charges levied by Arihant Capital, neither for the Demat account nor for the trading account. However, you will be required to pay ₹362 as AMC or Annual Maintenance Charges every year, which again is in the nominal range.

What are the brokerage charges at Arihant Capital?

The brokerage charges levied by Arihant Capital are reasonable too. For instance, it charges you 0.2% for Equity Delivery trades which basically means ₹200 brokerages for each ₹1,00,000 worth of trade. Although discount stock brokers charge even lower brokerage charges within full-service stockbroking space, 0.2% is certainly one of the lowest.

Even further, if you are looking to negotiate the brokerage charges – that can be done while you discuss the account opening procedure with the executive of the broker.

How is the mobile trading app of Arihant Capital? Is it recommended?

Arihant Capital provides one of the weakest mobile trading apps in the industry. In fact, the quality of trading platforms is one big grey area when it comes to Arihant Capital.

The biggest concern with the mobile app is its update frequency cycle. In fact, the app has not seen any update for around 2 years, with the last one done in December 2015.

To put things into perspective, stockbrokers that have a much better focus on technology (especially discount stock brokers) update their mobile app at least once in 3-4 weeks while Arihant clients saw last update way back in 2015.

As far as recommending this particular mobile app is concerned, it’s a BIG NO! In fact, you might actually lose some money if you trade through this outdated and low performance-based mobile trading app.

How can I close my Demat account at Arihant Capital?

Closing your Demat account is not as simple as opening one. To close your Demat account you need to complete few formalities such as paying off all the dues that are leftover, submit back all the unused DIS slips, provide the share transfer form if you want to transfer your shares to some other Demat account and so on.

To understand the complete process of closing your Demat account, you can refer to link on How to Close Demat Account.

What is the quality of the research and recommendations provided by Arihant Capital?

Arihant Capital provides regular tips and recommendations through its fundamental and technical research to its clients. These recommendations are provided by email, SMS and within the trading platforms. As far as the accuracy of the research is concerned, it comes better than the industry benchmarks and users can certainly trust these tips, especially the ones provided at the fundamental (or long-term) level.

For complete details, you can refer to the ‘Arihant Capital Research’ section above.

You can check out the complete comparisons of Arihant Capital Vs Other Stockbrokers here:

More on Arihant Capital

If you wish to learn more about this full-service stockbroker, here are a few links for your reference:

Arihant Capital Review  |

Arihant Capital Brokerage Calculator  |

| Arihant Capital Transaction Charges |

Arihant Capital Comparisons  |

Arihant Capital Hindi Review  |

| Arihant Capital Franchise |