Ashika Group

List of Stock Brokers Reviews:

Ashika Group is a Mumbai based full-service stockbroker with a presence in around 500 locations of India through its sub-broker and franchise offices. Established in the year 1994, Ashika Group has an employee strength of around 150 and has relatively a stronger presence in the eastern part of India.

If you want to be part of their network, here is a quick review of the Ashika Group Franchise.

Ashika Group Review

The broker claims to be among the first brokers in India to provide online trading in Mutual Fund through NSE MF Simplified module.

“Ashika Group has an active client base of 16,950 as per the latest numbers for FY 2019-20.”

With its memberships with NSE, BSE, MCX-SX, MCX, NCDEX, the full-service stockbroker allows its clients to trade and invest in the following segments:

- Equity

- Commodity Trading

- IPO

- Currency Trading

- Investment Banking

- Depository services

- Mutual funds

- Bonds

- Corporate Lending

Looking at the wide range of trading and investment products, it can be observed that Ashika Group has made sure that no matter how a client gets acquired, all of the financial needs are taken care of within the same financial umbrella.

Mr Pawan Jain, Chairman – Ashika Group

Ashika Group Trading Platforms

The full-service stockbroker outsources all of its trading platforms from third parties and has no in-house development or maintenance of these softwares. Here are the details on the different trading platforms offered:

ODIN Diet

This terminal-based software is an outsourced 3rd party software provided to the clients of Marwadi Group. ODIN Diet is a mature terminal based trading application with multiple features and reasonable performance. Here are some of the features of this application:

- Built-in features and intelligence that allows clients to look for market opportunities.

- Allows users to develop and run multiple strategies for their technical and fundamental level trades.

- This trading application is pretty exhaustive in terms of the number of features, especially for analysis.

There are a couple of concerns with the usage of out-sourced trading applications such as ODIN Diet. First, the usability of the trading application is a bit low, implying you might have some hard time in understanding some of the features and navigating across those features initially, especially if you are a beginner.

Secondly, the control of the addition of new features or facilitating of fixing bugs or issues raised by clients through comments and feedback do not get incorporated quickly. The whole process is a tad complicated and involves multiple parties before it finally happens (if it happens).

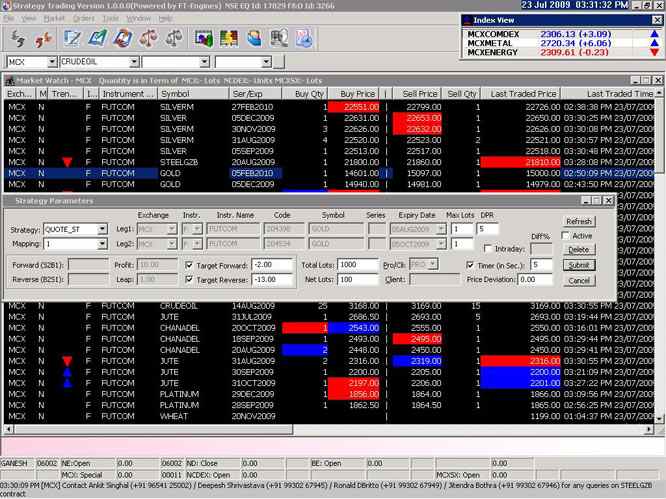

This is how the ODIN Diet dashboard looks like:

Furthermore, make sure you do ask the executive of the broker about any specific charges for the usage of the trading platform. Few stockbrokers do levy charges for using such outsourced trading platforms (as license charges).

NSE Now

NSE Now is a web-based trading solution that is also outsourced by Ashika Group. It can be accessed using any prominent browser such as Chrome, Internet Explorer, Firefox etc.

You, as a client, don’t need to download or install anything to access trading. And the best part is, this can be accessed from any device be it, a mobile, laptop, tablet or a desktop.

NSE Now is responsive in nature and takes care of the screen resolution by itself, thus, providing you optimum user experience.

Here are some of the features of NSE Now:

- Lightweight application

- Multiple charting types with technical indicators

- Different order types allowed

- Easy fund transfers

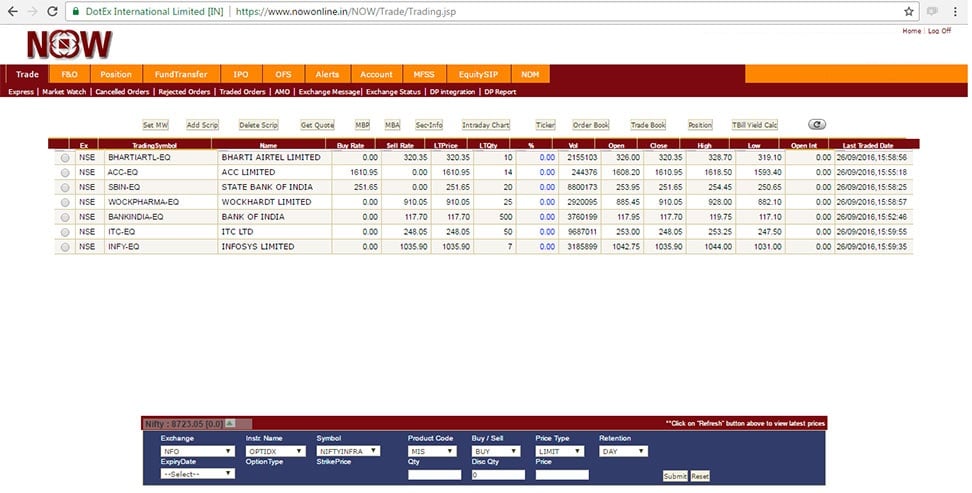

Here is the look and feel of NSE Now application:

Since 1st July 2017, few stockbrokers have started charging ₹350 per month per segment for the usage of NSE Now. Thus, again for this trading platform as well, make sure to have a discussion with the executive to understand such costs involved.

Now Mobile App

NOW Mobile app is software from NSE which is outsourced to stockbrokers such as Ashika Group. The mobile app is pretty exhaustive in terms of the number of features and will allow you to trade across multiple segments. Here are some of the features of this mobile app:

- Market Watch

- Technical/fundamental analysis through charting functionality

- IPO investment

- Top market movers/losers

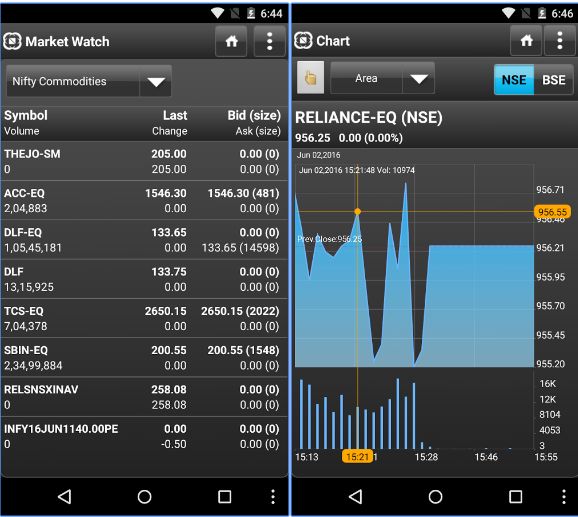

This is how the app looks like:

However, there are few concerns observed in this application, including:

- Bland UI and user experience

- Low update frequency cycle

- Performance/speed issues, especially in smaller cities

This is how the mobile app from NSE is rated at Google Play Store:

Ashika Group Customer Service

The full-service stockbroker provides the following communication channels to its clients:

- Offline branches

- Email support

- Toll-free number

- Phone number

- Webform

When it comes to user acquisition (before you become a client of Ashika Group), the support team works very patiently with the users in order to bring you onboard. However post-acquisition, customer support quality sees a little dip. Nonetheless, the overall customer support stays at better than average level.

Thus, you can keep reasonable expectations from the broker when it comes to Customer Support, especially when it comes to the turnaround time.

“With Ashika Group, you can transfer funds to/from your trading account through 32 prominent banks of India.”

Ashika Group Research

Ashika Group, being a full-service stockbroker, provides you with all sorts of research reports, recommendations and tips. The broker claims to use a few sophisticated research softwares such as Capitaline Plus & Bloomberg to go along with paid subscriptions to sectoral websites for quick research and tips for clients.

Clients of Ashika Group are provided with research reports and tips on a regular basis through SMS and email modes of communication.

This is how the full-service stockbroker has segregated its overall research for its clients:

- Equity

- Daily Morning Report

- Technical and Derivative report

- Fundamental report

- Weekly Insight Report

- Special report

- Equity tracker report

- Commodity

- Commodity Research report

- Commodity call tracker

- Weekly commodity report

- Commodity short-term call tracker

- Currency

- Currency call tracker

Now, all the above reports are provided at different frequency level and are designed and developed for different types of traders and investors. Thus, in a way, Ashika Group has kept it pretty clean and uncluttered to avoid any potential confusions among users regarding what kind of reports make more sense to them.

The accuracy of these reports and recommendations, however, is around average and users are advised to perform their own parallel analysis to validate the understandings provided in these reports.

This is how a sample report from Ashika Group looks like:

Ashika Group Pricing

Pricing, being one of the most important factors in finalizing a stockbroker, requires a close look and understanding to make sure the broker is value-for-money for you.

Since the Ashika group is a full-service stockbroker, they will charge you a percentage based brokerage. This percentage is applied to your trade value and corresponding brokerage charges are calculated.

Make sure you understand the language of the executives when the brokerage gets discussed. Generally, the executives of full-service stockbrokers suggest that their brokerage is 30 Paisa, 50 Paisa etc., which in other words, implies 0.30% or 0.50% of your trade value.

It has been observed that users start believing that the brokerage is literally 30 or 50 paisa, which clearly is not the case.

Nonetheless, here are the details of pricing in case of Ashika Group:

Ashika Group Account Opening Charges

The account opening process, both at demat and trading account level, does not require you to make any payment whatsoever. However, there are different plans in place when it comes to the maintenance of these accounts with the broker. Here are the details:

Ashika Group Brokerage

Comparing with other full-service stockbrokers in India, Ashika Group stands at an around average level when it comes to brokerage charges. It is not expensive or cheap, however, it is certainly open to negotiation depending on your initial deposit. Thus, you are advised to have a detailed negotiation discussion with the executive before opening your account with the broker.

Here are the brokerage details:

Use this Ashika Group Brokerage Calculator for complete charges and your profit.

Ashika Group Transaction Charges

Apart from the brokerage or account-related charges, you are supposed to pay transaction charges over your trades. Transaction charges, like brokerage charges, are percentage-based across segments. Here are the details for Ashika Group:

Other than the above-mentioned charges, here are details on some other charges levied by Ashika Group at different levels:

- Inter-depository charges – ₹10 to ₹45

- Dematerialization – ₹2 per certificate + ₹50 courier charges

- Pledge Creation – 0.02% of the value (minimum ₹50)

- Pledge Closure – 0.02% of the value (minimum ₹50)

- Transaction charges – ₹20 for an extra statement

Ashika Group Margin

Ashika Group is known to provide much exposure to its clients. Here are the details:

As displayed above, you will get pretty low exposure values across segments from Ashika Group. Nonetheless, if exposure is not one of your top criteria, then you can ignore this aspect. At the same time, we would like to mention that exposure or leverage is a risky concept and must only be used if you understand the risks and intricacies associated with it.

Ashika Group Disadvantages

Here are some of the concerns if you open your account with this stockbroker:

- No inclination towards in-house technology and trading platforms development

- Average quality research across trading segments

- Low exposure offered

Ashika Group Advantages

At the same time, here are some of the positives as well:

- Reasonable pricing from full-service broking context

- Free Demat and Trading Accounts with multiple plans of AMC

- Wide range of trading and investment products

- An old name in the Indian stock broking space

Conclusion

Ashika Group is an average stockbroker overall with average quality research, tips, service, brokerage charges and so on. Furthermore, its an old brand name in the industry so certainly brings in some sort of trust factor along with it.

Yes, you will get value for money service from the broker but you have to keep your expectations low when you are looking for quick turnaround time for your problem, 100% reliable research reports and recommendations etc.

If you can negotiate with the broker onto even lower brokerage charges (somewhere around 0.1% for delivery, 0.01% for intraday), then yes it makes sense to go ahead with it (assuming you are looking to opt for a full-service stockbroker only.

Are You looking to open an account?

Provide your details in the form below and we will set up a callback for you right away:

Ashika Group Membership Information

Here are the details on different memberships the full-service stockbroker has taken up:

More on Ashika Group:

If you wish to learn more about this full-service stockbroker, here are a few reference articles for you:

I think this is among the most significant info for me.

And i’m glad reading your article. But want to remark on few general things, The site style is wonderful, the articles is really excellent : D.

Good job, cheers