Best 3 in 1 Demat Account

Looking to open a 3 in 1 Demat Account and that is why you’d definitely want to know which is the best demat account in 3 in 1 category available out there.

So when you think to open NSE account this becomes even more important to know since there is a huge range of stockbrokers available and it can be really easy to get confused with whatever each broker has to say.

Let’s figure out answers to all such confusions in this review here.

Also, to know more you can read Demat Account Types.

3 in 1 Demat Account Review

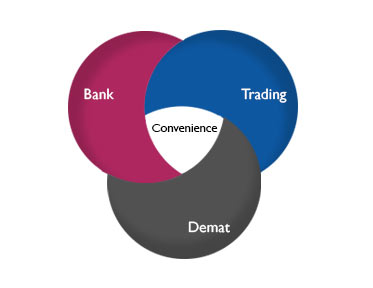

Before we dive into the best 3 in 1 Demat account in India, let’s try to understand what exactly do we mean by a 3 in 1 account. When you open a Demat account with a stockbroker to trade across financial segments such as Equity, Currency Trading, Commodity Trading, Derivative Trading, etc. you also open a trading account along.

To reap the benefit of commodity trade, you can opt for opening NCDEX Account.

A trading account allows you to trade across these mentioned segments while a Demat account is like a safe locker where you keep your purchased stocks from the stock market. Such a provision of a Demat plus trading account can be provided by any stockbroker – be it a full service or a discount broker.

One main crunch when you trade is managing your funds in your account. When you trade on a regular basis, there is a consistent need of:

- Money Deposits

- Immediate Transfers during opportunity situations

- Recurring payments

In case you have your bank account with a banking service and you are trading through a full service or a discount broker, you always have to make sure there are a reasonable amount of funds available in your account. Otherwise, you will to regularly keep transferring funds and in case, your trading account gets short of funds, your trading sees a hiccup.

This is where a 3 in 1 demat account comes into the picture that allows you to trade without any of the concerns mentioned above. Some of the Demat Account features are:

- No hassle of money transfers between accounts

- An integrated financial solution with minimal paperwork

- Savings account remains as the normal bank account without any impact

- Suits well for beginners since some of the formalities during trading might be overwhelming

At the same time, some of the concerns with 3 in 1 Demat account are:

- Trading through a bank generally costs higher as compared to conventional stockbrokers

- Specialist full-service stockbrokers stay marginally ahead in terms of market research or intraday tips

Best 3 in 1 Demat Account in India

With quite a few options in banking services in India, selecting a specialist bank that helps you to manage both bankings as well as trading needs can be a tough task. Here we are listing some of the leading banks in India that have proven that their trading abilities to their clients in the past. This review is based on:

- Stock market Expertise

- Customer service

- Bank History

- Brokerage charges

- Trading Platforms

Some of the best 3 in 1 Demat account in India (in no particular order) are:

ICICI Direct

With the ICICI 3 in 1 Account, a client can trade across:

- Equity

- Mutual Funds

- Derivatives

- IPOs

With the savings account of ICICI bank, clients get access to more than 3000 ICICI bank branches along with 10,000 ATMs across the country.

Here are the 3 in 1 demat account opening charges of ICICI Bank:

| ICICI Direct Account Opening Charges | |

| Demat Account Opening Charges | NIL |

You can check out a detailed review of ICICI Direct as well. You can get a free call back from ICICI by clicking the button below and providing your details.

HDFC Securities

HDFC Bank has a client base of close to 2 million when it comes to Demat accounts across the country along with a presence in more than 3500 locations. This is a huge plus for a bank that has wide coverage with its branches and franchise locations.

As far as trading is concerned, HDFC securities are known for its top-class trading platforms and customer service. Below listed are the 3 in 1 Demat account opening charges of HDFC Securities:

| HDFC Securities Account Opening Charges | HDFC Securities Account Opening Charges | HDFC Securities Demat Account Opening Charges |

| Account Opening Charges | Default Plan | NIL |

| Classic Plan | ₹750 | |

| Preferred Plan | NIL | |

| Imperia Plan | NIL |

You can check out a detailed review of HDFC Securities as well. You can get a free call back from HDFC by clicking the button below and providing your details.

Zerodha

Yes, you heard it right. Zerodha, even though is a discount broker, has started offering a 3 in 1 Demat account to its clients. Although this 3 in 1 Zerodha Demat account is in partnership with IDFC bank, the overall value you can get from such an account is definitely transferred to the trader.

You will need to open a new bank account as well, but it will happen along with the Demat account opening with Zerodha and is not a separate process.

Also, it offers a quick and easy process for account closure.

Here is a quick video if you want to know more about it:

You can read this review in Hindi as well.

Kotak Securities

Kotak Securities provides the following benefits to its trading client:

- Kotak Securities academy for educational trading content for beginner and intermediate users

- Notifications through email and SMS so that clients never miss out on potential opportunities

- In-house developed innovative trading platforms such as Keat Pro X

- Aftermarket hours orders allowed

Below listed are the 3 in 1 Demat account opening charges:

| Kotak Account Opening Charges | Kotak Demat Account Opening Charges |

| Account Opening Charges | NIL |

You can check out a detailed review of Kotak Securities as well. You can get a free call back from Kotak Securities by clicking the button below and providing your details.

There are multiple other banks that provide a provision of 3 in 1 Demat account, however, their major focus lies in their banking and other related financial services.

We, at A Digital Blogger, suggest you have a detailed discussion with each of these and other preferred banks. You should put out any concerns or any specific preferences you might have during such discussions.

Most of the time, terms and charges are open to negotiation and it’s up to you as an individual till what level you can take negotiation to. Always remember, there is huge cut-throat competition out there to acquire a customer like yourself. Make sure to take due advantage of that aspect.

Happy Trading!

Still, do you have more questions to get clarified? Why don’t you send your details and we will arrange a Free call back for you!