Bezel Securities

List of Stock Brokers Reviews:

Established in the year 1998, Bezel Securities is a full-service stock broker based out of New Delhi. Started by a young Angad Singh Bhatia, Bezel Securities today has PAN India presence through its sub-broker and franchise network.

Bezel Securities Review

It has running memberships with NSE, BSE, MCX-SX and NCDEX and allows its clients to trade and invest in the following segments:

Angad Singh Bhatia, MD – Bezel Group

Bezel Securities Trading Platforms

Bezel Group offers NSE based NEST trading platforms like few other stock brokers. These trading softwares are available across devices:

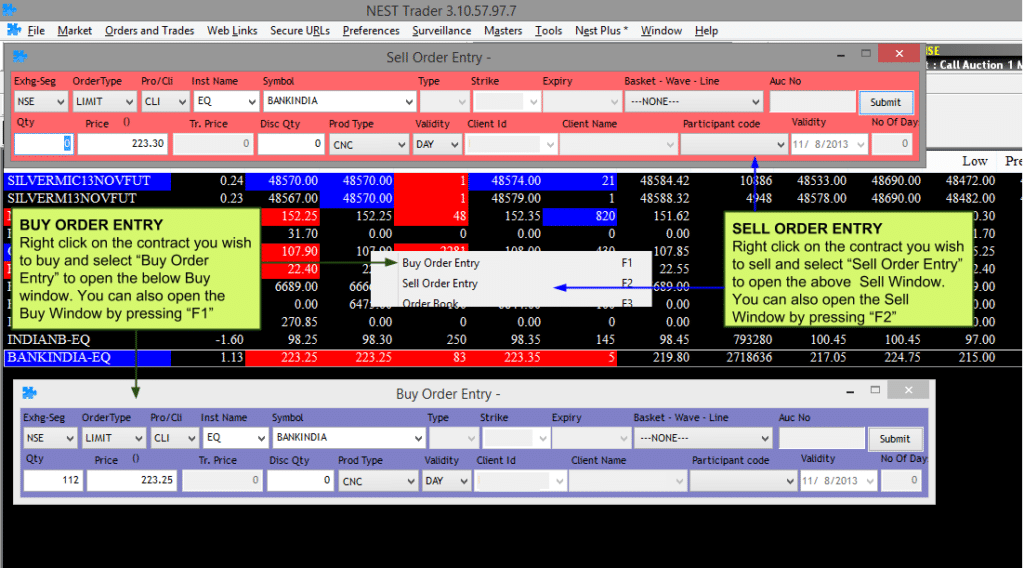

NEST Trader

NEST (Next Generation Electronic Securities Trading platform) Trader is a terminal-based trading software that needs to be downloaded and installed onto the user’s machine before carrying on with trading. There are multiple features that can be accessed using NEST, including:

- Quick order placement

- Set up market watch groups with provisional conditions

- Use an effective risk management system

- Intraday, historical and comparative charting

- Heatmaps for quick technical analysis

- Personalized alerts and notifications

This is how the software looks like:

NOW Online

NOW Online, on the other hand, is a web-based trading platform that can be accessed through any browser. The user can perform trading on this platform using any device as it is responsive in nature. At the same time, it is relatively much lighter to use as compared to a full-fledged trading platform such as NEST Trader. Some of the top features of NOW Online are:

- Place, cancel, modify or view order

- View Intraday charts

- Multiple market watch

- Online fund transfers

- Alerts and notifications based on user preferences and conditions

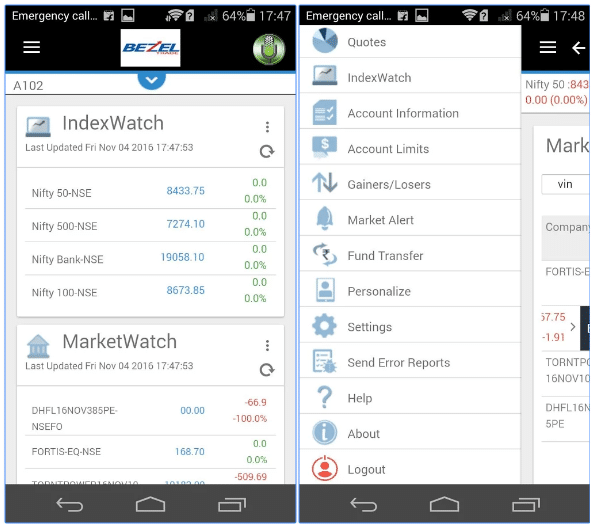

EZE Trade

EZE trader is a step taken towards in-house trading platform development by Bezel Securities. It is a mobile app that has been recently launched but has not seen much light of the day yet. With under 500 installs, the mobile trading app definitely has a long way to go.

Here are some of the stats of EZE Trade:

| Number of Installs | 100-500 |

| Mobile App Size | 41 MB |

| Negative Ratings Percentage | 0% |

| Overall Review |  |

Bezel Securities Charges

Here are the details on the pricing part of this full-service stockbroker:

Account Opening Charges

Let’s talk about the account opening and annual maintenance charges:

| Demat Account opening charges | ₹250 |

| Trading Account opening charges | ₹100 |

| Demat Account Annual Maintenance Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

Bezel Securities Brokerage Charges

There are a couple of plans offered by Bezel Securities as far as a brokerage is concerned. The user can choose either of these based on user’s preferences:

Classic Plan

A flat brokerage plan across segments with details as shown below:

| Equity Delivery | ₹19 per executed order |

| Equity Intraday | ₹19 per executed order |

| Equity Futures | ₹19 per executed order |

| Equity Options | ₹19 per executed order |

| Currency Futures | ₹19 per executed order |

| Currency Options | ₹19 per executed order |

| Commodity | ₹19 per executed order |

Super-Saver Plan

Supersaver plan offers the flexibility of paying a very low percentage of the trade value for traders and investors.

| Equity Delivery | 0.07% |

| Equity Intraday | 0.007% |

| Equity Futures | ₹7 per lot |

| Equity Options | ₹7 per lot |

| Currency Futures | ₹1 per lot |

| Currency Options | ₹1 per lot |

| Commodity | ₹7 per lot |

Bezel Securities Transaction Charges

Here are the detailed transaction charges levied by Bezel Securities:

| Equity (Cash & Delivery) | 0.0035% |

| Equity Futures | 0.0028% |

| Equity Options | 0.085% on premium |

| Currency Futures | 0.0028% |

| Currency Options | 0.085% on premium |

| Commodities: MCX | 0.003% |

| DP Transaction charge | Rs 10 /Debit Transaction |

| Dial & Trade | No Charge |

Bezel Securities Margin

You can expect the following exposure values from this stockbroker across different trading segments:

| Equity Delivery | No Leverage |

| Equity Intraday | 8 to 10 times for Intraday |

| Equity Futures | upto 2 times for intraday |

| Equity Options | upto 2 times for intraday |

| Currency Futures | No Leverage |

| Currency Options | No Leverage |

| Commodity | upto 2 times for intraday |

Disadvantages of Bezel Securities

Here are some of the concerns while using the trading services from Bezel Securities:

- Not much of a focus toward technology improvements or innovations, especially the mobile app

- Although it has been around for a while, not much of visibility seen. This generally creates less brand trust among prospective clients.

Advantages of Bezel Securities

At the same time, these are some of the merits of this stockbroker:

- Decent customer service

- Flexible brokerage plans with pretty low brokerage rates

- Regular tips and recommendations

Interested to have a discussion for the Demat Account and Trading Account?

Provide your details below and we will set up a free call back for you:

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

You can read this review in Hindi as well.

More on Bezel Securities:

For more information on this full-service stockbroker, you can check the below-mentioned links:

| Bezel Securities Review | Bezel Securities Hindi Review |

| Bezel Securities Transaction Charges | Bezel Securities Brokerage Calculator |

Video Review; Video Review; |