BMA Wealth Creators

List of Stock Brokers Reviews:

BMA Wealth creators is a full-service stockbroker based out of Kolkata with its corporate office in Mumbai. This broker is more than 15 years old and claims to have coverage through 42 branches and 7000 business partners or franchises across India.

BMA Wealth Creators Review

BMA Wealth has a membership with NSE, BSE, NCDEX and MCX, thus, allowing its active client base of 28,678 to trade across:

- Equity

- Derivates

- Commodity

- Mutual Funds

- Insurance

- IPO

“BMA Wealth Creators has 18,849 active clients for this year 2020.”

MRUGESH DEVASHRAYI, CEO – BMA Wealth Creators

BMA Wealth Creators Trading Platforms

BMA Wealth creators offer 3 trading platforms depending on the user device and trading frequency preference. Here are the details:

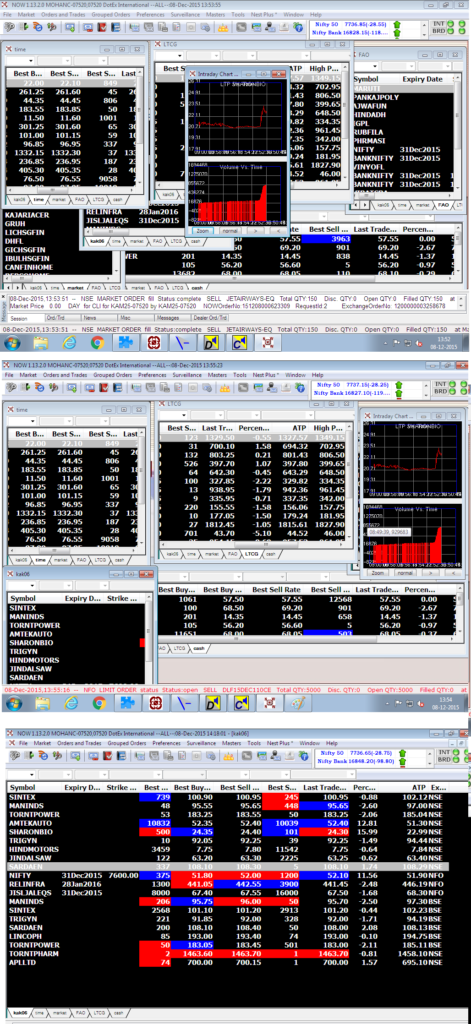

NEST Trader

NEST is the traditional trading terminal provided to BMA Wealth clients through NSE. It is a robust trading application that users can download and install on their desktops or laptops. This suits well for heavy traders who have a dedicated machine just for trading and treat trading as their primary income source.

Here are some of the features of the trading terminal software NEST:

- Market Watch

- Options calculator

- Compare Scrip

- Heatmaps

- Charts with multiple indicators

Here is how NEST looks like:

Trade On BMA

Trade on BMA is a browser-based trading terminal that can be accessed from anywhere. This trading platform has been customized for BMA wealth by Omnesys and is compatible across browsers and devices.

The application can be accessed with a valid username and password combination. Some of the features of the application are:

- Single interface for all the interfaces

- Intraday and index charts available with multiple indicators

- Portfolio management services

- Online funds transfer across multiple banks

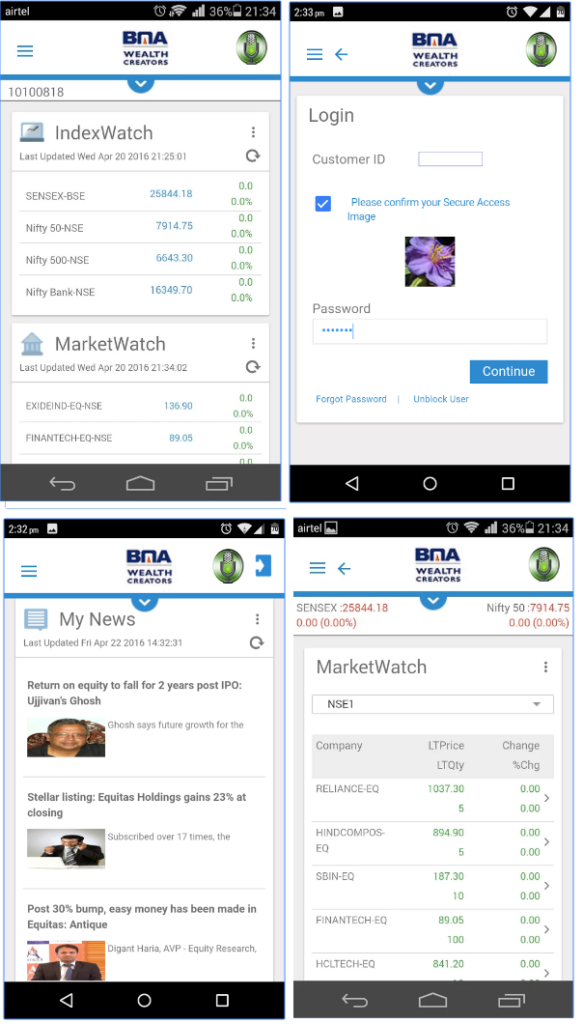

BMA mTrade

BMA mTrade is a mobile app from BMA Wealth creators that comes with the following features:

- Index watch and market watch

- Real-time quotes steaming

- Latest news and market updates

Here are some of the screenshots of the mobile app:

This is how the mobile app is rated at Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 21.5 MB |

| Negative Ratings Percentage | 11% |

| Overall Review |  |

| Update Frequency | 1.5 Years |

BMA Wealth Mobile App

This is a recent addition to the in-house trading platforms of BMA Wealth where they have introduced a new mobile trading application altogether. Seems the stockbroker launched a new product rather than working on fixing their existing mobile trading application.

Nonetheless, the features offered in this trading application include:

- Lightweight, easily installed and configured

- A limited number of features though but a well-designed application

- Okayish speed or performance

At the same time, some of the concerns raised by application users are:

- Faces crash out regularly

- Compatibility issues with few smartphones observed

- Almost no personalization allowed

This is how the application looks like:

Here are some of the stats of this application:

| Number of Installs | 10,000+ |

| Mobile App Size | 38 MB |

| Negative Ratings Percentage | 39.2% |

| Overall Review |  |

| Update Frequency | 24-26 Weeks |

BMA Wealth Creators Customer Care

The full-service stockbroker provides the following communication channels to its clients for customer support:

- Offline branches

- Toll-free number

- Email support

- Phone

This is one of the biggest concerns in the case of this full-service stockbroker. There is no track of turnaround time or quality of communication. In fact, the skillset of the support staff lacks professionalism too.

BMA Wealth certainly needs to pick up the tempo in this area, especially looking at their overall registered complaint percentage at the National Stock Exchange (NSE).

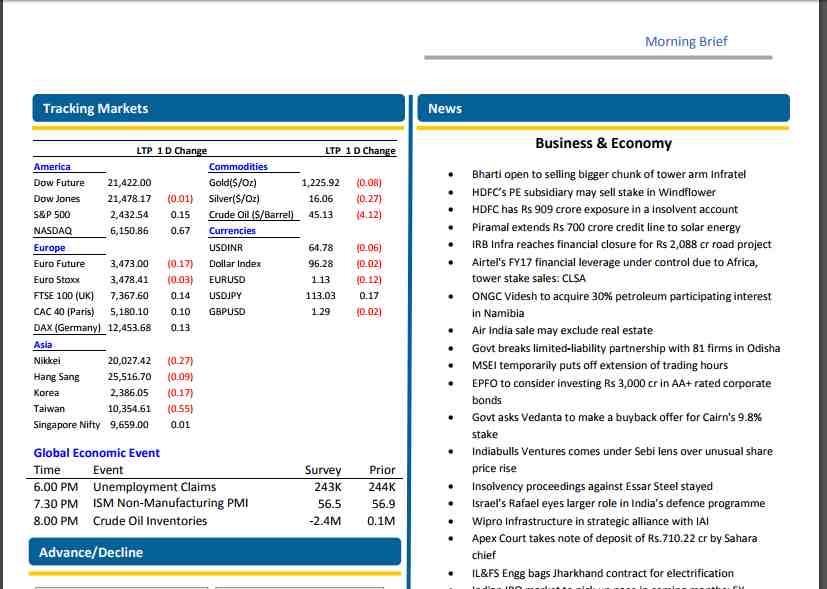

BMA Wealth Creators Research

The broker provides different types of research reports and recommendations to its clients, distributed across segments. Here is the complete segregation of reports provided to clients for reference:

- Equity

- Daily Reports

- Company Reports

- Weekly Reports

- Other Reports

- Commodity

- Daily Reports

- Company Reports

- Weekly Reports

- Other Reports

- Currency

- Daily Reports

- Company Reports

- Weekly Reports

- Other Reports

- Result Update

- Economic Update

This is how a report from BMA Wealth looks like:

However, when it comes to the accuracy of these reports, the stockbroker fails to impress with its performance. The recommendations are pretty generic in nature and fall below the industry average.

Users that are clients of BMA Wealth or are looking to be one are advised to perform their own analysis to validate the recommendations provided by the broker. Directly following the broker’s advice and executing orders based on that, is not recommended.

BMA Wealth Creators Pricing

Being a full-service stockbroker, BMA is considered relatively expensive.

BMA Wealth Creators Account Opening Charges

Here are the account opening charges that are levied to the clients of this stockbroker:

| Trading Account Opening Charges | ₹0 | ₹ | |

| Trading Account AMC (Annual Maintenance Charge) | ₹350 | ||

| Demat Account Opening Charges | ₹1000 | ||

| Demat Account AMC (Annual Maintenance Charge) | ₹0 | ||

Following the pattern of full-service stockbrokers, BMA Wealth charges pretty hefty amounts for opening a Demat account. Annual maintenance charges (AMC) are as per industry standards though.

BMA Wealth Creators Brokerage Charges

BMA Wealth creators charge reasonably fine brokerage charges. Details are given below:

| Equity Delivery | 0.3% to 0.1% depending on Margin Money |

| Equity Intraday | 0.03% to 0.01% depending on Margin Money |

| Equity Futures | 0.03% to 0.01% depending on Margin Money |

| Equity Options | ₹50 to ₹10 per lot |

| Currency Futures | 0.03% to 0.01% depending on Margin Money |

| Currency Options | ₹50 to ₹10 per lot |

| Commodity | 0.03% to 0.01% depending on Margin Money |

Use this BMA Wealth Creators Brokerage Calculator for complete charges and your profit.

The brokerage charge at BMA Wealth creators depends on the initial deposit you are putting up with the broker. Higher the initial trading account balance, lower is the brokerage you are required to pay.

Furthermore, users looking to open an account with this stockbroker are advised to negotiate the final brokerage rates as much as possible.

Once finalized, make sure to get all the negotiated rates documented or emailed from the broker to avoid any future altercations.

BMA Wealth creators Transaction Charges

Apart from account opening and brokerage charges, here are the transaction charges levied on the client:

| Transaction/Turnover Charges | |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.004% |

| Equity Options | 0.06% |

| Currency Futures | 0.004% |

| Currency Options | 0.06% |

| Commodity | 0.05% |

Transaction charges in case of BMA Wealth are relatively pricey as compared to other stockbrokers in the industry especially for Options trading and commodity.

BMA Wealth Creators Margin

Clients get the following leverage across different trading segments:

| Equity | Upto 10 times Intraday, Upto 2 times delivery @interest |

| Equity Futures | Upto 4 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 4 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 4 times for Intraday |

BMA Wealth stays around the industry average when it comes to exposure or leverage offered across segments. For people looking to use exposure must understand the implications and risks associated with it. It can be fatal to use against your trading account capital if not done appropriately.

BMA Wealth Creators Disadvantages

Here are some of the major concerns of using the services of this stockbroker:

- No innovation in trading platforms

- Recent complaints about Mobile app speed and performance, overall its a stockbroker with one of the highest registered complaint percentage.

- Even though it has been here for more than a decade, BMA Wealth creators has not created much of a brand name or a speciality of its own.

- Low-quality customer service.

“BMA Wealth Creators has received 14 complaints this year which converts to 0.06% of its active client base. This is one of the worst-performing brokers in terms of complaints percentage, especially when the industry average is just 0.01%.”

BMA Wealth Creators Advantages

On the other side, here are some of the merits of this stockbroker:

- Okayish brokerage charges as compared to other full-service brokers (can still be negotiated)

- Reasonable presence across different parts of the country

Conclusion

“BMA Wealth is one of the rare stock brokers that is complete non-recommendable. There are so many concerns with the broker and the biggest of all those concerns is that the broker itself seems to be paying no heed to all these issues.

Be it the mobile app performance, quality of service, the performance of research, pricing etc, the broker miserably fails to attract with any USP.

Thus, users are advised to use their own discretion when it comes to selecting this particular stockbroker for their trading but we, at A Digital Blogger, strongly feel that the broker as of now has way too many issues to fix.”

Looking to open a Demat Account?

Enter Your details below and get a Free call back right away.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

BMA Wealth Creators Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB011233138 |

| NSE | INB231233132 |

| MCX | 28055 |

| NCDEX | 00523 |

| Registered Address | BMA Wealth Creators, India Bulls Finance Center,1402- C, Tower 2,14th Floor Senapati Bapat Marg, Elphistone Road (W) Mumbai- 400013 |

The details can be verified from the corresponding websites of the exchanges.

BMA Wealth Creators FAQs:

Here are some of the most prominent and frequently asked questions about BMA Wealth Creators:

Is BMA Wealth a trustable stockbroker? Is it reliable?

Although the full-service stockbroker has been around for around 15 years, it has not been able to create positioning of its own in this time span. Be it the trading platforms, customer service or research, the broker has not been able to make its mark in any of these aspects.

As far as the trust factor is concerned, the broker has received registered complaints from 0.52% of its clients, which is huge as compared to the industry average of 0.06%.

Thus, as of now, the broker cannot be termed as a reliable or a trustable stockbroker.

What the account opening charges at BMA Wealth Creators?

The full-service stockbroker charges INR 1000 for opening the Demat account and another ₹350 for maintaining your trading account with the broker. These values are pretty expensive as per industry benchmarks that are in the range of ₹300 to ₹600 overall.

How are the brokerage charges levied by BMA Wealth Creators?

The broker charges a specific percentage of the trade value depending on the trading segment. For instance, if you are trading in equity delivery, you will be charged 0.3% of your trade value. Assuming you trade for a sum of ₹1,00,000, then your brokerage for that particular trade will be ₹300.

At the same time, looking at the service quality provided, it cannot be called a Value-for-money broker.

What trading and investment products are available at BMA Wealth Creators?

Clients having a trading account with BMA Wealth can trade and invest in Equity, Derivates, Commodity, Mutual Funds, Insurance and IPOs. Thus, you can trade across different products as per your requirements.

What is the quality of research provided by BMA Wealth Creators?

Below average. Be it the accuracy of tips or performance of research reports, the full-service stockbroker fails to provide high converting recommendations and tips to its clients.

Is the customer service offered by BMA Wealth Creators good?

The broker offers a limited number of communication channels and has a pretty low-quality service mechanism with no track of turnaround time. Furthermore, the quality of resolution provided is pretty generic in nature.

BMA Wealth Creators Branches

The full-service stockbroker has a presence in a few locations across different parts of India as displayed below:

| States/City | |||

| Andhra Pradesh | Vizag | Vijayawada | Rajahmundry |

| Assam | Guwahati | Hyderabad | |

| Bihar | Patna | ||

| Delhi/NCR | New Delhi | Delhi | |

| Gujarat | Ahmedabad | Surat | Vadodara |

| Jharkhand | Ranchi | ||

| Karnataka | Bangalore | ||

| Madhya Pradesh | Bhopal | ||

| Maharashtra | Nashik | Pune | Mumbai |

| Kolhapur | |||

| Orissa | Cuttack | ||

| Punjab | Ludhiana | Amritsar | Chandigarh |

| Tamil Nadu | Chennai | Coimbatore | |

| Uttar Pradesh | Varanasi | Lucknow | |

| West Bengal | Medinipur | Kolkata | |

| Silguri | Durgapur |

More on BMA Wealth Creators:

If you wish to know more about BMA Wealth Creators, here are a few reference links for you:

You can read this review in Hindi as well.

I enjoy the report

Thanks for the great guide